|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

U.S. strikes Iran, oil isn’t buying it

Input/output PPI continues fall

New home prices inch lower

Retail trade lifted by vehicle sales

The Rob Ford documentary

Strathcona responds to MEG

HOT OFF THE PRESS

U.S. strikes Iran, oil isn’t buying it

By now you’re likely aware the U.S. green-lit the bombing of three Iranian nuclear sites over the weekend. The Iranian Parliament then voted to close the Hormuz Strait, resulting in headlines calling for >$100 oil despite no change in sea traffic.

Oil futures haven’t moved much either because Parliament doesn’t have the final say - the National Security Council does - and they have no incentive to close it, given most oil flowing through the strait is heading for China, not the U.S.

The O&G sector accounts for roughly a quarter of Iran’s GDP and a third of its government revenue. Should they choose to limit the flow of it, the only nuke in Iran will be an economic one. Let’s see what happens.

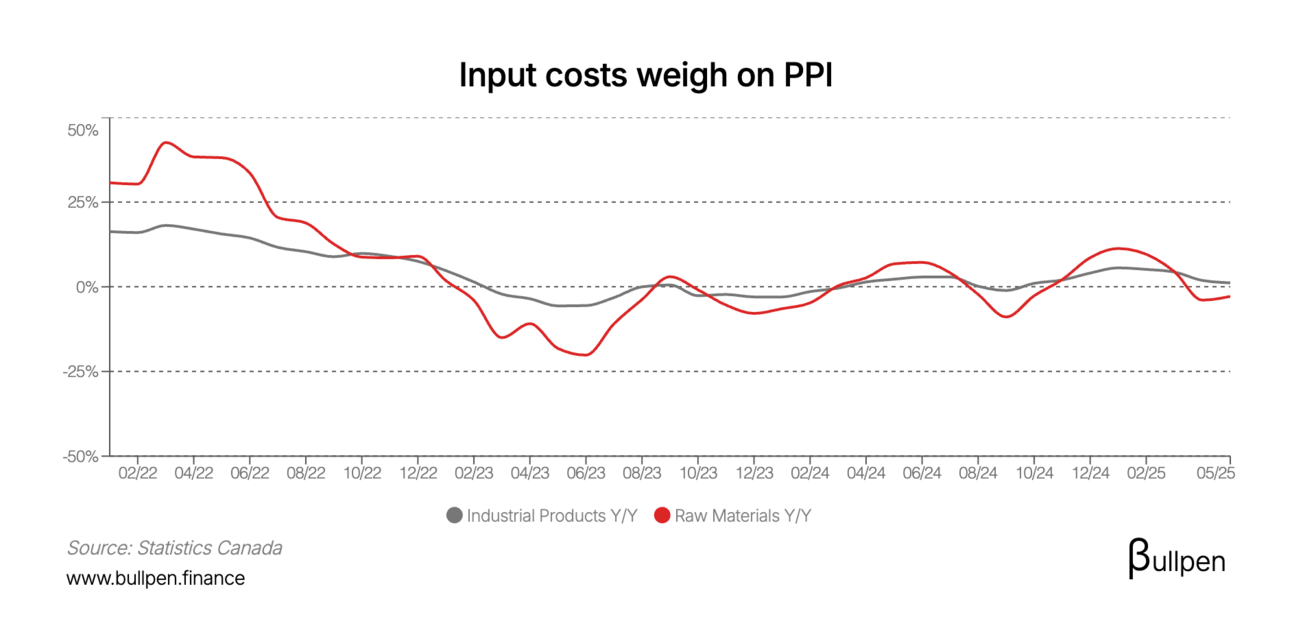

Oil has been a key lever in input/output PPI

Industrial product prices in May fell 0.5% (+1.2% Y/Y), the second straight monthly decline and well below analyst forecasts for no change. Input costs shed another 0.4% (-2.8% Y/Y), the third straight monthly drop.

The PPI weakness was driven by lumber and energy products, which fell ~6% and ~2% in May, respectively. Oil has been the key anchor to raw materials costs, falling another ~5% in May.

This geopolitical dust-up could swing the pendulum in the opposite direction though, lifting input costs and, in turn, industrial product prices.

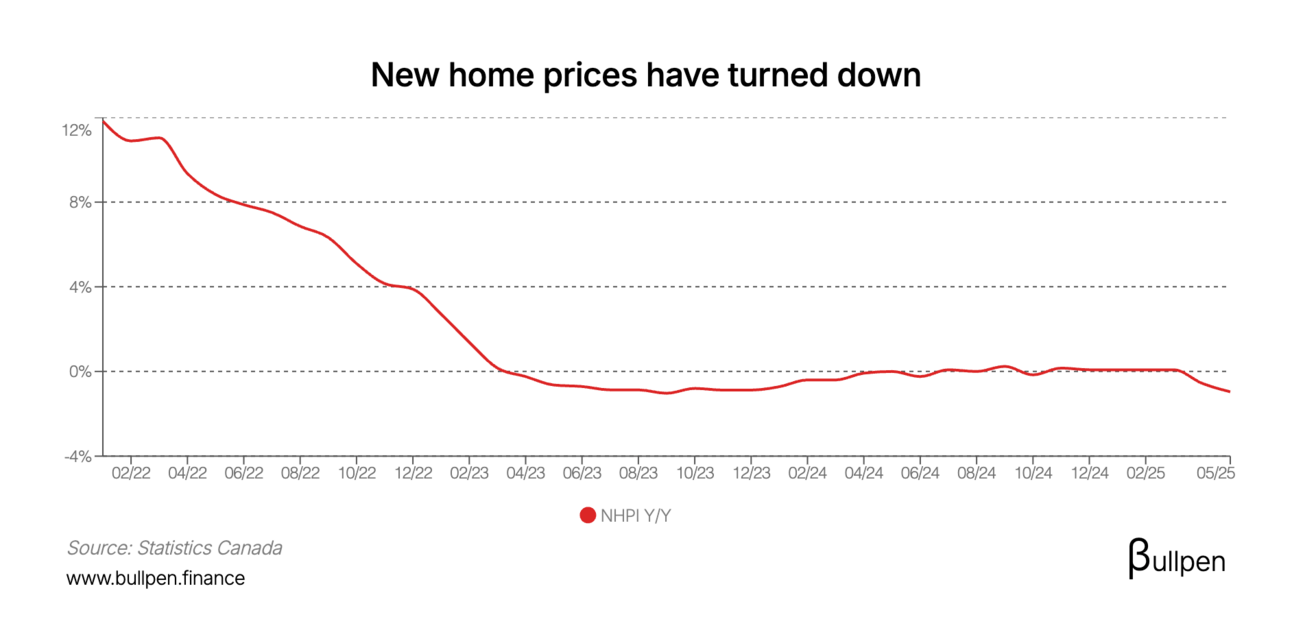

New home prices continue to slide

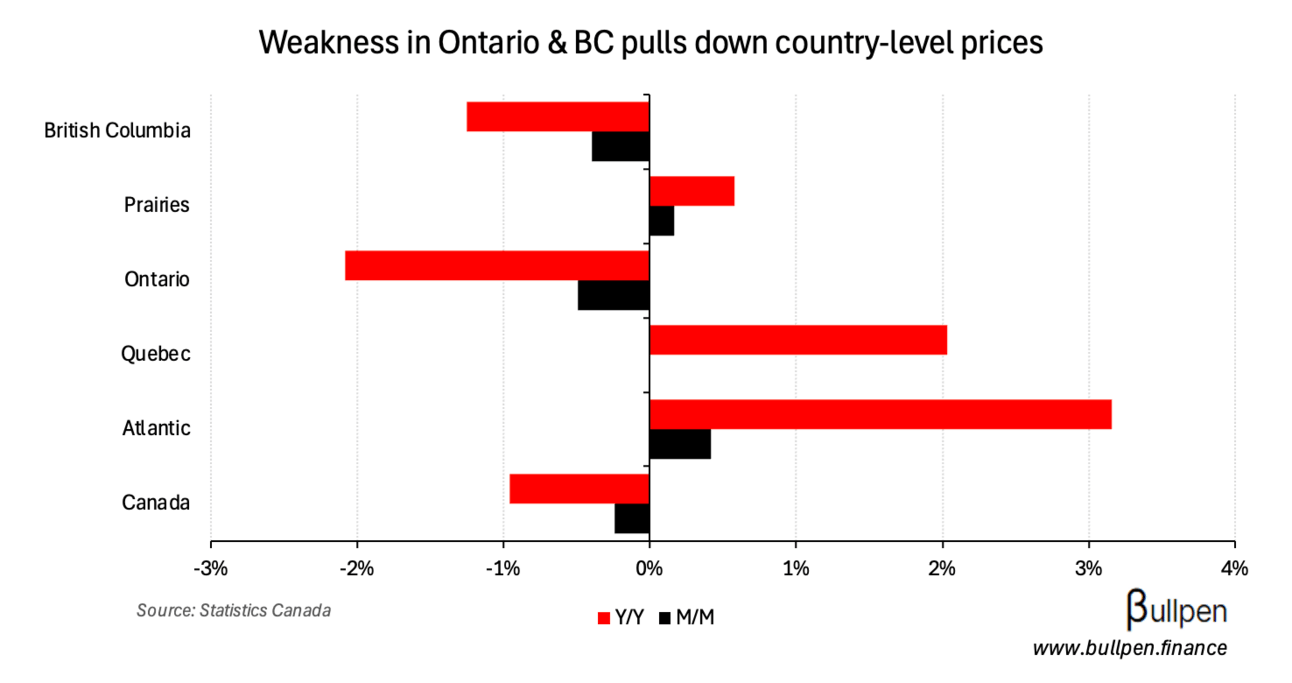

New home prices for May were released on Friday, falling 0.2% after April’s 0.4% drop (-1% Y/Y) as the real estate slowdown continues.

At a regional level: Ontario and BC struggled, prices in the prairies rebounded after three consecutive down months, and markets east of Ontario remained resilient despite broader economic challenges.

The atlantic region has held up remarkably well, with no monthly declines since 2023 - a core reason we shifted our view on the REIT trade towards Killam (KMP-U) in May.

Retail sales numbers miss estimates

Retail sales rose less than expected in April at 0.3% (+5% Y/Y), supported by a 0.5% increase in sales volumes.

Though six of nine categories showed positive growth vehicle sales were the main driver - up nearly 2%, with ex-auto retail sales falling 0.3% versus expectations for a 0.2% gain.

That looks set to reverse course in May, with early data suggesting a >1% sequential decline in retail sales as the impact of tariffs starts to bleed through.

FUNNY BUSINESS

Netflix released a documentary titled “Mayor of Mayhem” that dives into the whirlwind that was Rob Ford’s tenure as Mayor of Toronto.

In some ways he was our own version of Trump, rallying the support of groups that felt disenfranchised, challenging the mainstream media at every turn, and dropping headline-worthy quotes one after another.

In other ways he was our own version of Biden (Hunter)… but let’s not go there. The doc shows the good, the bad, and the ugly - and makes you feel for him along the way. Worth a watch!

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Hutchison | Cenovus (CVE) | $27.7M |

| John Hooks | PHX Energy (PHX) | $2.2M |

| Minda Suchan | MDA Space (MDA) | $1.2M |

| Holly Johnson | MDA Space (MDA) | $270K |

| Cassandra Quatch | Canadian Pacific (CP) | $882K |

| John Assaly | Dollarama (DOL) | $1.7M |

| Darren Gee | Peyto (PEY) | $4.1M |

| Melanie Burns | TD Bank (TD) | $611K |

| Scott Stauth | Canadian Natural (CNQ) | $7.2M |

| Paul Sislian | Bombardier (BBD) | $2.1M |

| Barton Demosky | Bombardier (BBD) | $430K |

| Shawn Beber | CIBC (CM) | $298K |

| Cindy Usprech | Propel (PRL) | $135K |

A lot of red on Friday’s insider activity… the Cenovus (CVE) transaction could raise some eyebrows, but it’s related to an agreement they made to repurchase 84% of their outstanding warrants. Cenovus has had one of the better insider boards recently, with nothing but buying since mid-2024.

ON OUR RADAR

Flagging the Strathcona (SCR) news, as the back and forth between MEG and SCR is heating up. The company released a detailed presentation addressing the reasons MEG has encouraged shareholders to decline SCR’s takeout offer. For a refresh on the story, check out the original piece below.

If the above link doesn’t work, try this: https://www.bullpen.finance/content/124

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 New Home Price M/M | -0.2% | -0.2% |

| 🇨🇦 Retail Sales M/M | 0.3% | 0.4% |

| 🇨🇦 Retail Sales Ex-Auto | -0.3% | 0.2% |

| 🇨🇦 PPI M/M | -0.5% | 0.0% |

| 🇨🇦 Raw Materials M/M | -0.4% | -0.8% |

| 🇺🇸 Philly Mftg. Index | -4 | -1 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 S&P Composite PMI | 9:45AM | - |

| 🇺🇸 S&P Mftg. PMI | 9:45AM | 51.0 |

| 🇺🇸 S&P Services PMI | 9:45AM | 52.9 |

| 🇺🇸 Existing Home Sales | 10:00AM | 3.96M |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.