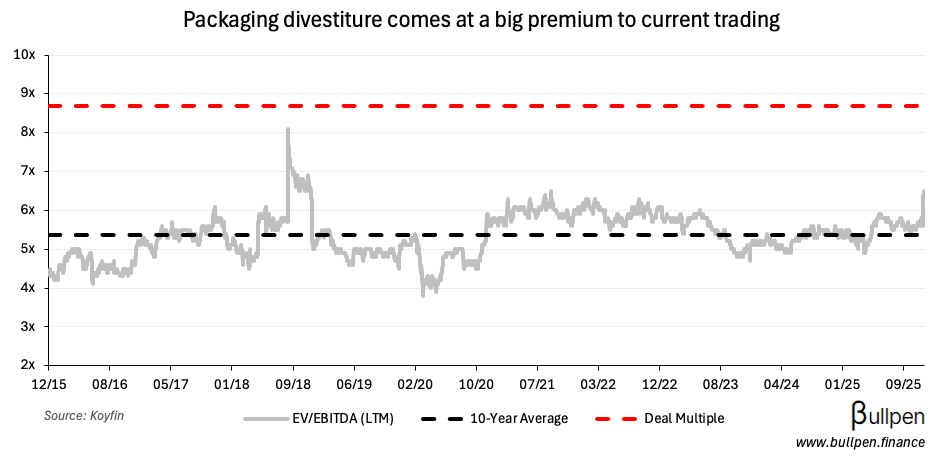

Transcontinental (TCL-A) jumped 20% on the back of its announced $2.2B packaging unit divestiture, a price tag that translates to ~9x LTM EBITDA - well above where the stock has traded historically…

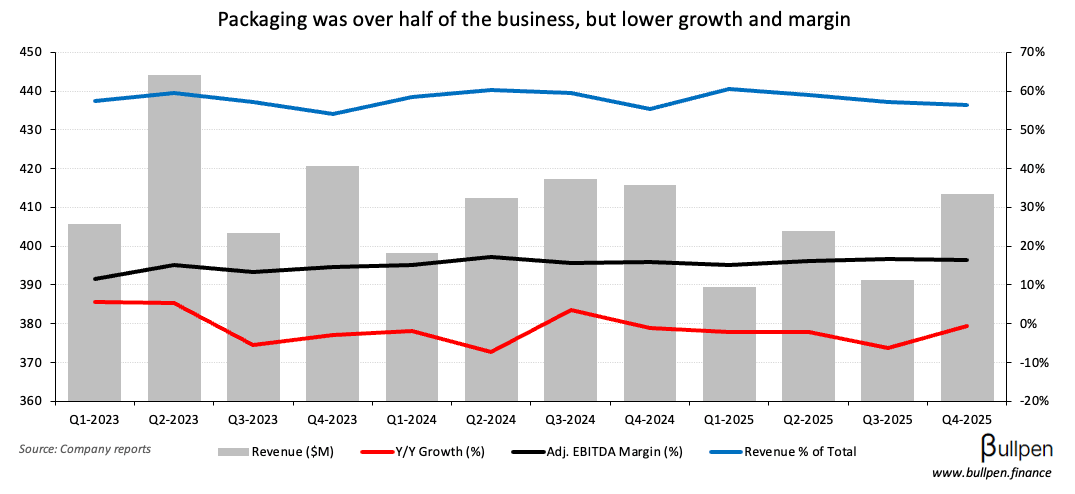

… which limited its ability to grow accretively through M&A. Organic growth has been sluggish too, making now as good a time as any to take the off-ramp at a premium.

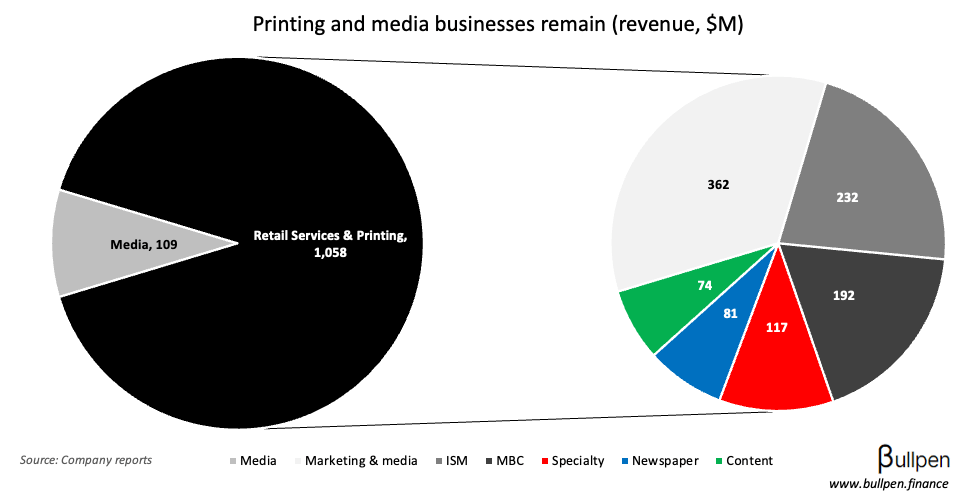

Post-close, management plans to make a $20/sh cash distribution and tighten its focus on the printing and media businesses - citing a healthy M&A pipeline...

… that it believes can close at 4-5X EBITDA. Those numbers make sense on the back of the napkin, so we could see more deals like its Middleton Group acquisition soon.