|

TSX

1D %

YTD %

|

26,342.29

0.1%

5.8%

|

|

|

TSXV

1D %

YTD %

|

718.27

0.2%

16.3%

|

|

|

S&P 500

1D %

YTD %

|

5,939.30

0.5%

1.2%

|

|

|

NASDAQ

1D %

YTD %

|

19,298.45

0.8%

0.1%

|

|

|

US 10Y

1D

YTD

|

4.39

3 bps

18 bps

|

|

|

DJIA

1D %

YTD %

|

42,319.74

0.3%

0.2%

|

|

|

CA 10Y

1D

YTD

|

3.26

2 bps

3 bps

|

|

|

CAD/USD

1D %

YTD %

|

0.731

0.0%

5.1%

|

|

Trade deficit hits record $7B

Vermilion sheds second non-core package

Pet Valu gets the monkey off its back

Transat does $400M debt magic trick

Trade deficit hits record-breaking $7B

Well, we got history-making trade data yesterday as tariffs stalled out the flow of goods between Canada and the U.S., driving a $7B deficit - the largest on record.

If you’re looking to get under the hood of the headline number, we published a bite that’s light on words and heavy on charts. Check it out!

If you want the takeaway, not the details, here it is in one chart:

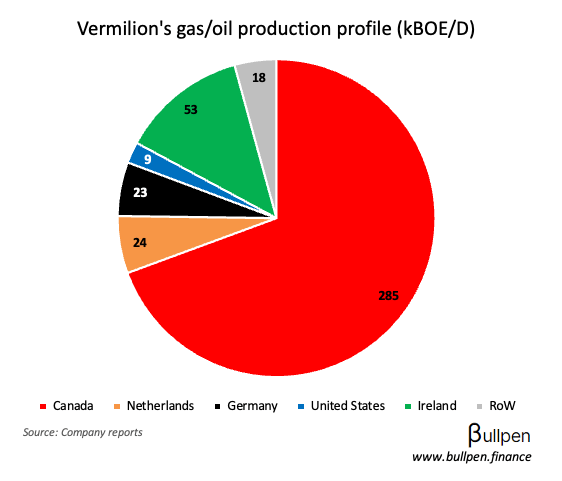

Vermilion sheds second non-core asset

Vermilion (VET) was up 4% after divesting its U.S. footprint for $120M. The transaction follows the sale of its Manitoba and Saskatchewan assets for $415M two weeks prior, as the company focuses on its core Western Canada/Europe footprint.

Pet Valu gets the monkey off its back

With the overhang on the stock from a large seller now gone and a more diversified shareholder base, PET’s multiple could continue to expand - reversing at least part of the contraction that has weighed on performance since it re-listed.

On Wednesday, we suggested the gloves could come off between the most powerful man and the richest man in America… it didn’t take long.

❝

The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon’s Governmental Subsidies and Contracts. I was always surprised that Biden didn’t do it!

Donald Trump - Truth Social

❝

Time to drop the really big bomb: Donald Trump is in the Epstein files. That is the real reason they have not been made public. Have a nice day, DJT!

Elon Musk - X

Next time you’re triple-checking an email to make sure it’s mistake-free and reads well, remember that we’re all living in a deeply unserious world… it’s all the WWE.

| Insider |

Company |

Value |

| Jean Robitaille |

Agnico (AEM) |

$2.0M |

| Ammar Al-Joundi |

Agnico (AEM) |

$3.4M |

| Scott Thon |

Aecon (ARE) |

$202K |

| Duncan Card |

OR Royalties (OR) |

$368K |

| Chris Goodridge |

VerticalScope (FORA) |

$100K |

| Ana Cabral |

Sigma Lithium (SGML) |

$4.8M |

| Kenneth Dedeluk |

Comp. Modelling (CMG) |

$141K |

| Mehmet Yilmaz |

Eldorado (ELD) |

$2.8M |

| Stephen Smith |

EQB Inc. (EQB) |

$3.2M |

| Giuseppe Tassone |

ATS Corp. (ATS) |

$218K |

| John Hooks |

PHX Energy (PHX) |

$811K |

| Norman MacDonald |

G Mining (GMIN) |

$1.1M |

|

Transat (TRZ)

1D %

YTD %

|

1.92

16.4%

1.5%

|

|

|

Telus Int. (TIXT)

1D %

YTD %

|

3.63

13.2%

35.8%

|

|

|

Fortuna (FVI)

1D %

YTD %

|

10.11

9.7%

63.9%

|

|

|

Descartes (DSG)

1D %

YTD %

|

138.95

12.1%

15.0%

|

|

|

Ivanhoe (IVN)

1D %

YTD %

|

11.50

8.2%

32.6%

|

|

|

G Mining (GMIN)

1D %

YTD %

|

20.13

5.7%

86.4%

|

|

Transat (TRZ) jumped 16% on the back of what’s being called a “favourable debt restructuring”. What that translates to in reality is nearly $400M of debt that the Federal government is making disappear… well isn’t that nice.

YESTERDAY’S EARNINGS

| Company |

Actual |

Consensus |

| 🇨🇦 Saputo (SAP) |

0.30 |

0.34 |

| 🇨🇦 Enghouse (ENGH) |

0.26 |

0.37 |

| 🇨🇦 Xtract One (XTRA) |

-2.3M |

-1.1M |

| 🇺🇸 Broadcom (AVGO) |

1.58 |

1.57 |

YESTERDAY’S ECONOMIC RELEASES

| Release |

Actual |

Consensus |

| 🇨🇦 Trade Balance |

-$7.1B |

-$1.5B |

| 🇨🇦 Exports |

$60.4B |

- |

| 🇨🇦 Imports |

$67.6B |

- |

| 🇨🇦 Ivey PMI |

48.9 |

48.3 |

| 🇺🇸 Trade Balance |

$62B |

-$94B |

| 🇺🇸 Jobless Claims |

247K |

235K |

| 🇺🇸 Continuing Claims |

1,904K |

1,910K |

| 🇺🇸 Nonfarm Productivity Q/Q |

-1.5% |

-0.8% |

| 🇺🇸 Labour Costs Q/Q |

6.6% |

5.7% |

TODAY’S ECONOMIC RELEASES

| Release |

Time |

Consensus |

| 🇨🇦 Unemployment |

8:30AM |

7.0% |

| 🇨🇦 Employment Change |

8:30AM |

-15K |

| 🇨🇦 FT Change |

8:30AM |

- |

| 🇨🇦 PT Change |

8:30AM |

- |

| 🇨🇦 Participation Rate |

8:30AM |

- |

| 🇨🇦 Hourly Wages Y/Y |

8:30AM |

- |

| 🇺🇸 Non Farm Payrolls |

8:30AM |

130K |

| 🇺🇸 Unemployment |

8:30AM |

4.2% |

| 🇺🇸 Hourly Wage Y/Y |

8:30AM |

3.7% |

| 🇺🇸 Participation Rate |

8:30AM |

- |

|

WTI Crude

1D %

YTD %

|

63.35

0.8%

11.8%

|

|

|

Gold

1D %

YTD %

|

3,356.57

0.5%

27.9%

|

|

|

Nat Gas

1D %

YTD %

|

3.67

1.2%

2.0%

|

|

|

Silver

1D %

YTD %

|

35.69

3.5%

23.6%

|

|

|

Lumber

1D %

YTD %

|

606.57

2.5%

10.2%

|

|

|

Copper

1D %

YTD %

|

4.90

0.5%

23.0%

|

|

|

Soybean

1D %

YTD %

|

1,050.26

0.5%

5.1%

|

|

|

Aluminum

1D %

YTD %

|

2,479.20

0.4%

3.0%

|

|

|

Corn

1D %

YTD %

|

437.82

0.2%

4.4%

|

|

|

Wheat

1D %

YTD %

|

544.99

0.3%

1.2%

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.