|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Trade deficit hits $15B YTD

Trican kicks off OFS consolidation

Rogers ups its stake in MLSE

Adam Waterous to turn up the heat at Stampede

Cargojet jumps 8% on Amazon deal

HOT OFF THE PRESS

Trade deficit hits $15B YTD

The trade picture for May shaped up as expected, with the fourth straight monthly deficit of $5.9B improving slightly versus April’s record $7.6B…

… thanks to continued momentum in gold exports (up 30% M/M)…

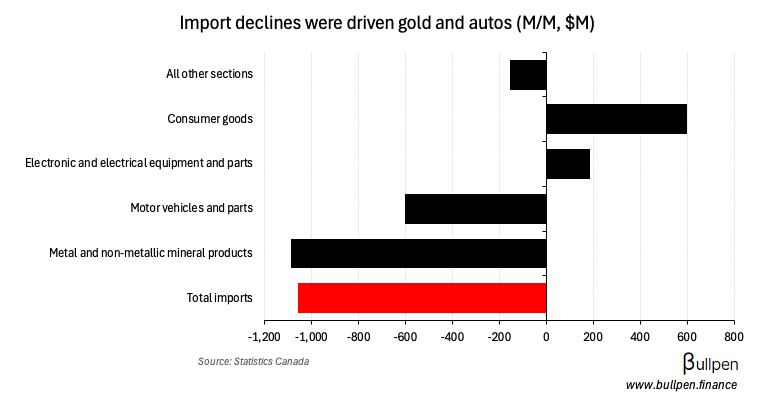

… and a slowdown in gold and vehicle imports (down 40% and 10%, respectively).

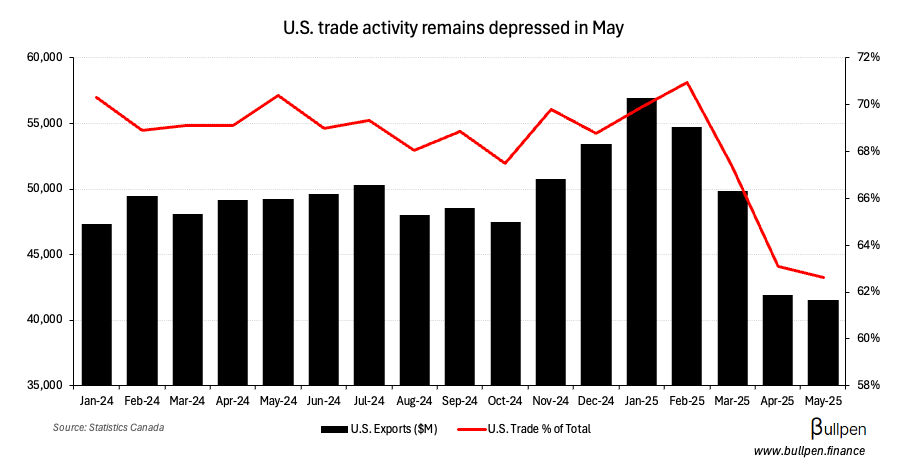

The U.S. trade situation is weighing on exports south of the border, which posted their fourth straight M/M drop as did America’s share of total trade with Canada (down from nearly 70% in 2024 to 63% today)…

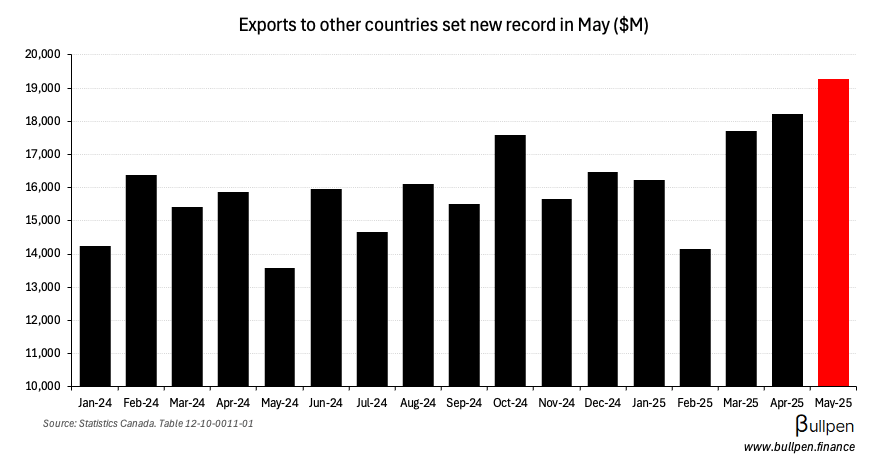

… but non-U.S. exports are picking up the slack, with May’s $19B breaking last month’s record driven mainly by increased activity in the UK. Carney’s relationships appear to be paying off.

Trican kicks off energy services consolidation

As we highlighted in early May, low oil prices are driving consolidation - this time in energy services, with Trican Well Service (TCW) taking out Iron Horse for $230M and jumping 14% in yesterday’s session.

At under 3x EBITDA the deal screens well on a multiple basis, with TCW management expecting double digit accretion and a 150 bps improvement in FCF conversion, but it represents more than just value arbitrage…

… as the company gains access to markets outside of its geographic footprint, presenting a longer term opportunity for organic growth.

Our market share in the Montney and Duvernay is very high. But as a result, we’ve somewhat neglected some of the oilier parts of the basin to the East. And our market share is very low there. We’re going to leverage off Iron Horse’s infrastructure and customer relationships to grow that business.

With $77M of cash used in the deal (remainder funded by TCW stock), Trican will remain underlevered at 0.5x - allowing the company to reward shareholders with a 10% dividend increase and continued share buybacks.

Consolidation in the space may not be over either, with the total price tag on this one approaching the market cap of names like STEP Energy Services (STEP) and Calfrac Well Services (CFW).

Rogers inches closer to MLSE spin-off

Rogers (RCI) got a 7% lift on Wednesday with news that its acquisition of Bell’s 37.5% stake in MLSE had closed, bringing its total ownership to 75%.

Clearly, the market has warmed up to the sports media angle since punishing RCI for the $11B price tag on the extension of its NHL rights. I dive into what changed, and what’s coming in the full piece below.

If the above link doesn’t work, try this: https://www.bullpen.finance/content/185

FUNNY BUSINESS

Stampede is formally kicking off tomorrow and it looks like Adam Waterous of Strathcona (SCR) is going to take full advantage of the attention it brings, as he joins Amber Kanwar at the event to discuss his ongoing takeout bid for MEG Energy.

We got an update on the campaign mid-week, with SCR highlighting MEG’s board has declined to speak with them in the nine weeks since the original offer. Let’s see if the media pressure can get their attention.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Vernon Disney | CES Energy (CEU) | $159K |

| Kenneth Zinger | CES Energy (CEU) | $212K |

| John Cormier | Orla Mining (OLA) | $325K |

| Noah Buchman | Propel (PRL) | $1.0M |

| Kevin McCreadie | AGF Mgmt (AGF) | $833K |

| Thomas Uhr | BRP Inc. (DOO) | $367K |

| Russell Hallbauer | Taseko (TKO) | $172K |

| John Cooney | Leon's (LNF) | $110K |

| Matthew Andrews | Pan American (PAAS) | $151K |

| Mike Rose | Tourmaline (TOU) | $319K |

| Alexander Verge | Journey (JOY) | $387K |

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Flagging Cargojet (CJT) here, up 8% following the extension of its agreement with Amazon, which pushes contract visibility out until 2029 at the earliest, in-line with agreements the company has with other strategic partners.

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Trade Balance | -5.9B | -5.9B |

| 🇨🇦 Exports | 60.8B | - |

| 🇨🇦 Imports | 66.7B | - |

| 🇺🇸 Non Farm Payrolls | 147K | 110K |

| 🇺🇸 Unemployment Rate | 4.1% | 4.3% |

| 🇺🇸 Hourly Earnings M/M | 0.2% | 0.3% |

| 🇺🇸 Trade Balance | -71.5B | -71.0B |

| 🇺🇸 Jobless Claims | 233K | 240K |

| 🇺🇸 Continuing Claims | 1,964K | 1,960K |

| 🇺🇸 S&P Composite PMI | 52.9 | 52.8 |

| 🇺🇸 S&P Services PMI | 52.9 | 53.1 |

| 🇺🇸 ISM Services PMI | 50.8 | 50.5 |

| 🇺🇸 Factory Orders M/M | 8.2% | 8.2% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 S&P Composite PMI | 9:30AM | - |

| 🇨🇦 S&P Services PMI | 9:30AM | - |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.