|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Here’s what we have on tap for you in this Morning Meeting:

The best trade war cheat sheet we’ve seen

Looking at the market and this earnings season from a bird’s eye view

Results from our channel checks at HBC aren’t pretty

After a few tough years, the setup for higher lumber prices is in place

NFI shares pop 20% on a great Q4 and 2025 outlook

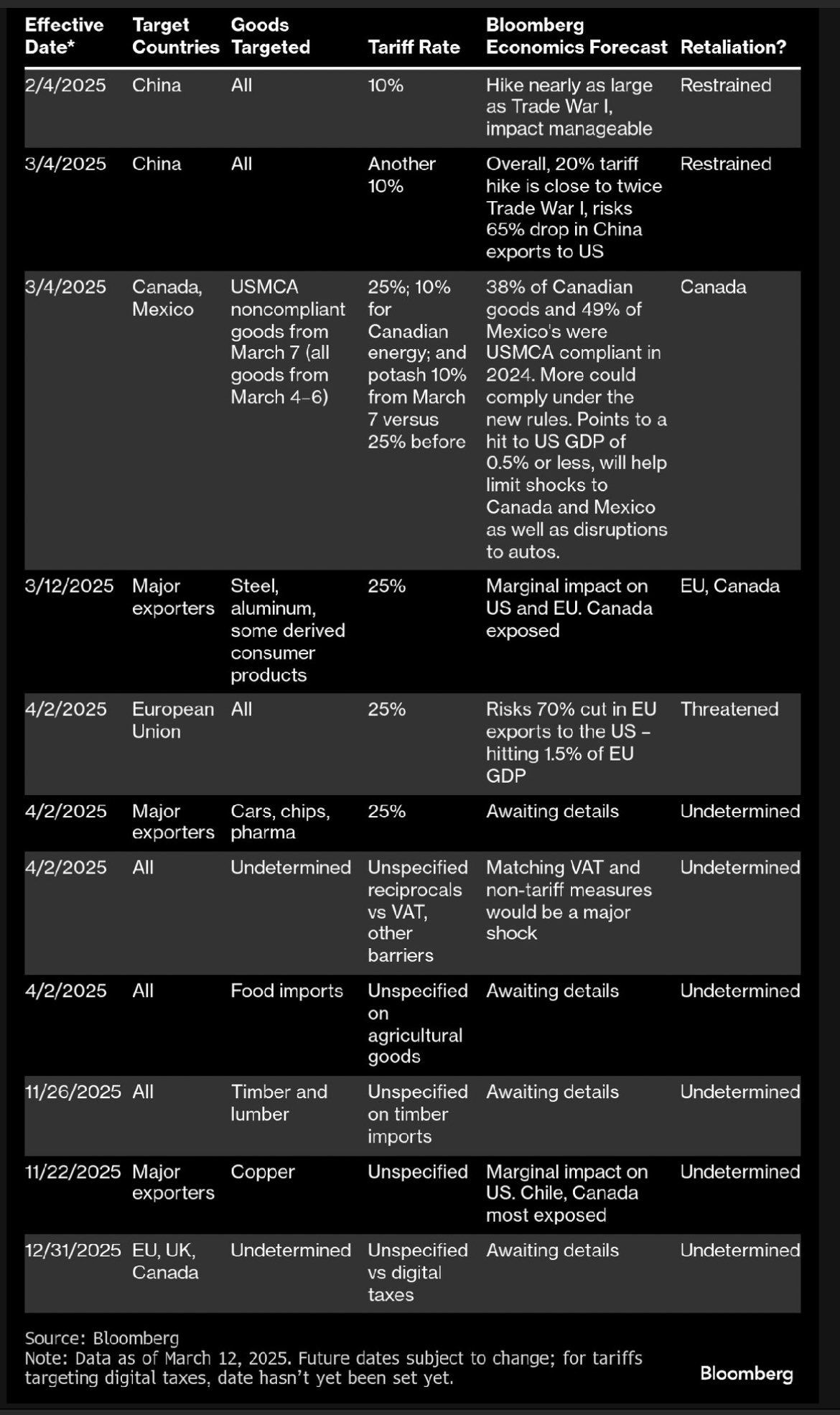

TRADE WAR MONITOR

We finally got a quiet period in trade talks, so instead of updates on the latest, here’s the best cheat sheet we’ve found on where things stand currently (courtesy of Bloomberg):

Our framework for navigating the trade war: https://www.bullpen.finance/content/51

HOT OFF THE PRESS

Factor performance provides useful context

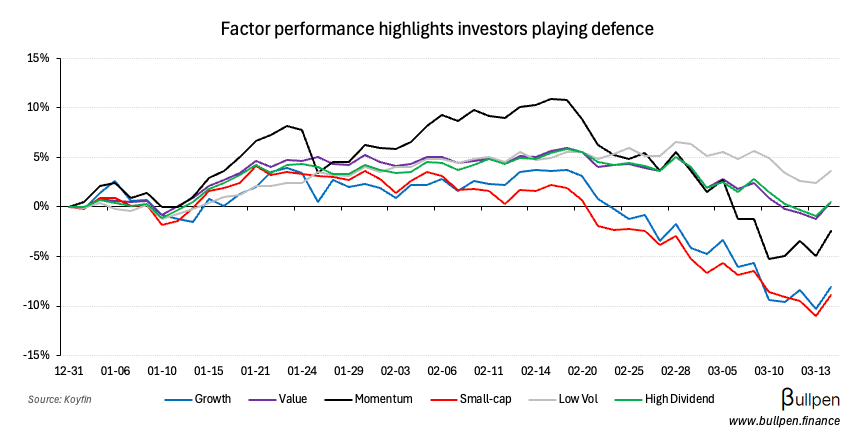

We ended off last week on a positive note, with a sizeable rally in the TSX on modest volumes.

U.S. markets ran a bit harder on Friday, but are still underperforming Canada YTD due to higher tech exposure.

Looking deeper into U.S. market dynamics, it’s clear defensive factors are in favour - with value, low volatility, and high dividend the only positive performers in 2025.

Small cap and growth names have taken it on the chin, making now as good a time as any to pick your spots. A turn in sentiment could drive a rotation back into factors with more torque.

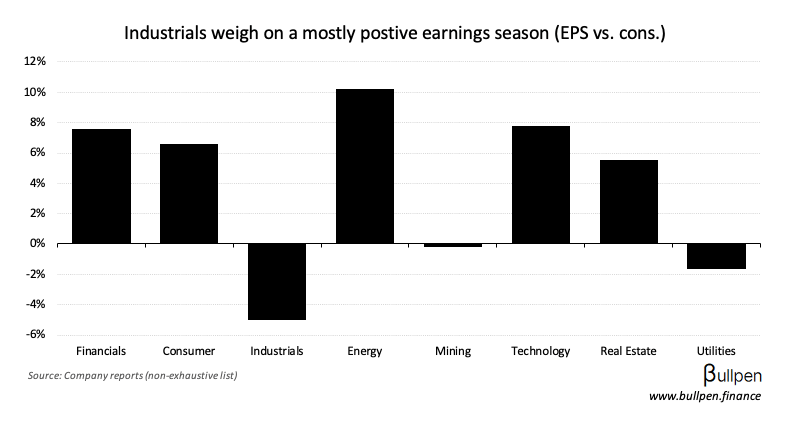

With earnings done, recaps are coming

Earnings season is entering the rear-view mirror for most, but not us - because recap season is coming.

What that means for you? In each edition of The Morning Meeting for the next little while, you can expect an earnings breakdown of a particular sector, similar to the one we did on banks a couple of weeks ago.

We’ll look into results verus street estimates…

… figure out what the main drivers were for each company…

… and dig into the corporate outlook, backing it up with commentary from management.

These recaps should help you understand what happened this quarter, and what could be coming in the next few. If that sounds good to you, let us know which sector you’d like to see first!

FUNNY BUSINESS

We dove into the HBC bankruptcy situation a week ago, highlighting the company’s intentional move upmarket and south of the border as the real death blow to the Canadian business.

Well, we decided to do some channel checks to see what things were like on the ground and lemme tell ya… not pretty.

I’m talking clearance on basically every aisle (at least the ones that aren’t empty), escalators that are out of service, and holes in the ceiling. Wherever you had the odds pegged that HBC is going to vacate retail locations… take them higher.

HBC when the next lease payment is due

Oh yeah, forgot to add - there are birds flying around in stores now…

… who knows how they got in - maybe through one of the many holes HBC’s cash was leaking from?

We may never know, but one thing’s for sure… RioCan execs didn’t have a petting zoo in mind when getting the market hyped on mixed-use real estate.

ON OUR RADAR

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

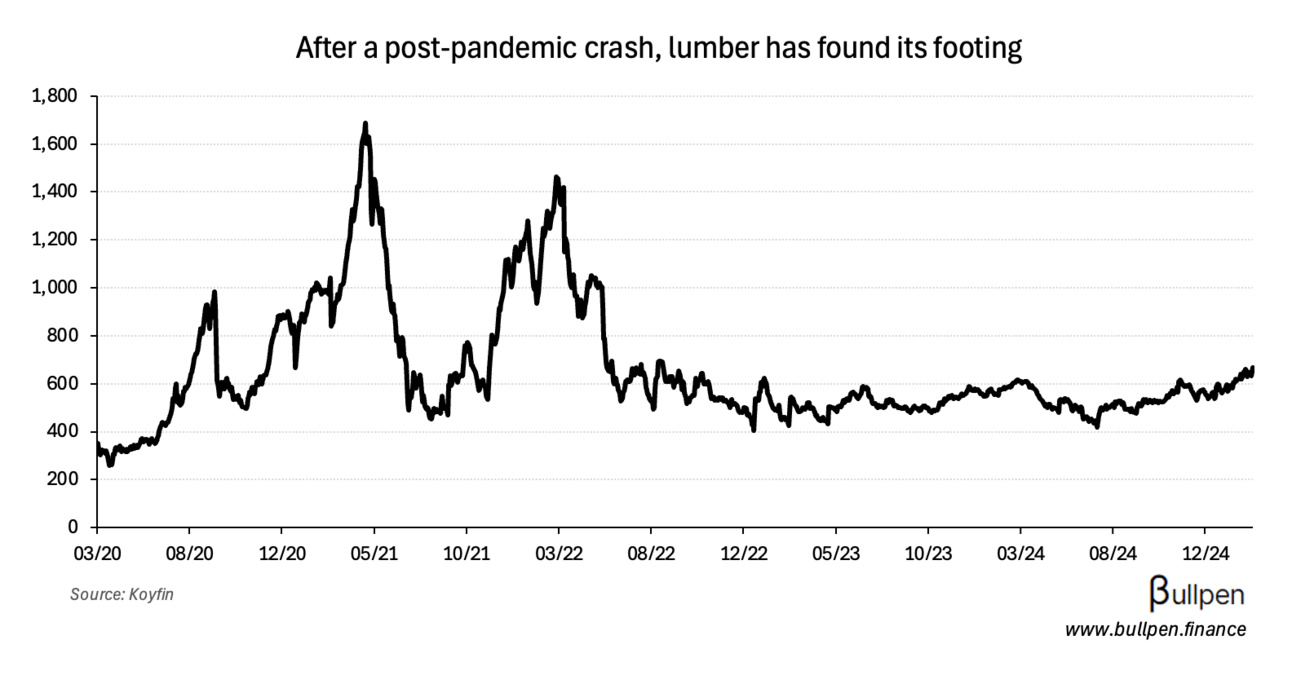

Lumber extended its large YTD move Friday, finishing the session up 5%. The backdrop looks supportive of higher prices, with U.S. import duties potentially rising again this year, even without considering the potential for a broad-based 25% tariff.

The supply side of the picture is supportive of lumber prices too, with a number of sawmill closures, curtailments, and environmental factors leading to expectations of a Y/Y decline in capacity in 2025.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

NFI Group (NFI) finished Friday up more than 20%, recouping nearly all of its YTD losses on a strong Q4 and 2025 outlook. On the quarter, revenue came in light but EPS of $0.11 crushed the street at $0.04. The company showed record backlog of nearly $13B (>15K units), which supported a 2025 revenue and adj. EBITDA guide of $3.8-4.2B and $320-360M, respectively.

On tariffs, NFI appears confident in its ability to pass through increased costs over time, and its supply chain disruptions continue to trend lower.

Source: company reports

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Mark Stainthorpe | Canadian Natural (CNQ) | $3.2M |

| Scott Stauth | Canadian Natural (CNQ) | $1.1M |

| Linda Southern-Heathcott | Atco Ltd. (ACO) | $2.4M |

| Margaret Southern | Atco Ltd. (ACO) | $2.4M |

| Nancy Southern | Atco Ltd. (ACO) | $2.4M |

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 illumin (ILLM) | 922K | 500K |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 K92 Mining (KNT) | AM | 0.30 |

| 🇨🇦 Greenfirst (GFP) | PM | - |

| 🇨🇦 Quarterhill (QTRH) | AM | 2.8M |

| 🇨🇦 Greenfire (GFR) | PM | 0.35 |

| 🇨🇦 Lithium Argentina (LAAC) | PM | -9.3M |

| 🇨🇦 Info Sources (ISC) | PM | 0.55 |

| 🇨🇦 High Tide (HITI) | PM | 500K |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales M/M | 1.7% | 2.0% |

| 🇨🇦 Wholesale Sales M/M | 1.7% | 2.0% |

| 🇨🇦 Vehicle Sales M/M | 122K | - |

| 🇺🇸 Consumer Sentiment | 57.9 | 63.1 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Housing Starts | 7:15AM | 248.5K |

| 🇺🇸 Retail Sales M/M | 7:30AM | 0.7% |

| 🇺🇸 Business Inventories M/M | 9:00AM | 0.3% |

| 🇺🇸 Housing Market Index | 9:00AM | 43 |