|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Canadian tech is hitting the buyback

Gibson closes $400M pipeline deal

Allied Properties hits a liquidity wall

Air Canada/Transat stop Cuba flights

ARC insiders load up after drawdown

HOT OFF THE PRESS

Canadian tech is stepping into the market

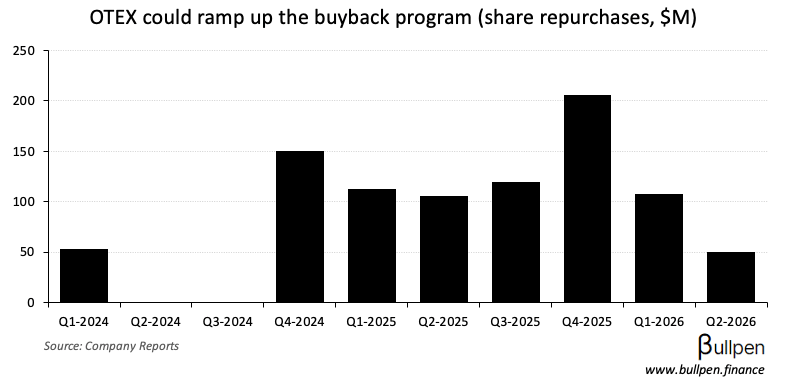

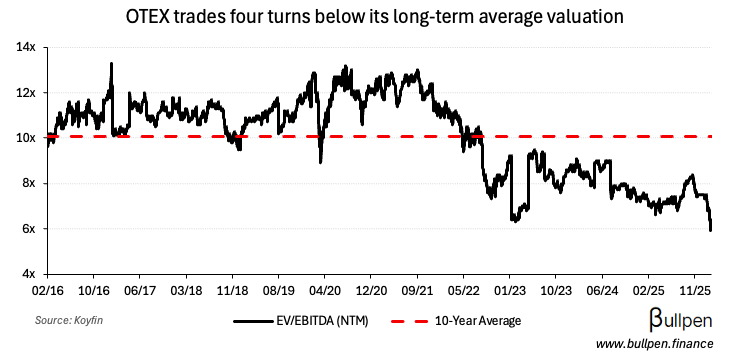

Open Text (OTEX) was up 3% after adding another $200M to its buyback program…

… to capitalize on the recent AI-linked selling. It underscores management’s conviction in the turnaround plan…

… and follows a similar announcement from Kinaxis (KXS) last week, which could be a sign of things to come - given the entire industry has traded off massively…

… and is generating cash, with next-to-no debt burden to service.

Gibson buys Hardisty pipeline for $400M

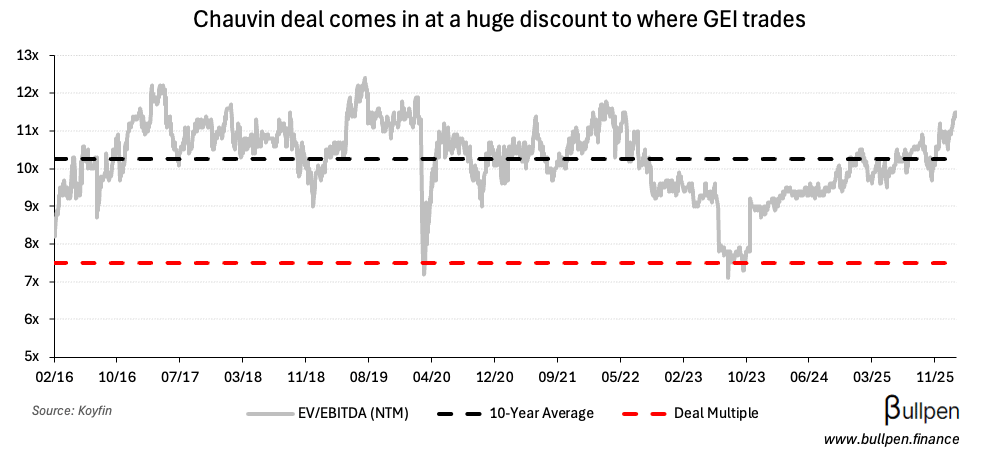

After the bell Gibson Energy (GEI) announced a $400M pipeline acquisition, adding 30K bpd of capacity to its Hardisty network. With take-or-pay agreements covering 90% of revenue (50% of volumes)…

… project economics should be relatively stable over the medium term. At 7.5x NTM EBITDA, management’s mid-single-digit accretion target passes the smell test…

… enabling it to fund half of the deal with equity. The headline multiple could even prove conservative, with a potential $50M, 50% expansion project being evaluated.

ON OUR RADAR

Allied Properties (AP-UN) should be ugly today after announcing a $500M equity raise near the lows, with proceeds used to help repay $600M of notes due today…

… in what’s effectively forced dilution - as the fundamentals of its core portfolio remain challenging. Given the weak bid for office…

… the company is also marketing its two big residential assets in hopes of raising another $500M through divestitures. Let’s see.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Transat (TRZ) fell 4% after suspending flights to Cuba until April 30th, a similar reaction to Air Canada (AC) shares after its announcement the previous day. While immaterial to AC…

… Transat is more exposed to the country (10-15% of winter capacity), which could result in negative estimates revisions if it can’t reallocate the lost routes.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Mark Eaton | K92 Mining (KNT) | $1.1M |

| Michael Culbert | ARC Resources (ARX) | $348K |

| Jonathan Wright | ARC Resources (ARX) | $1.0M |

| Terry Anderson | ARC Resources (ARX) | $114K |

Flagging the buying at ARC Resources (ARX), which comes after its ~10% sell-off on production concerns. Exactly what you want to see from management.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Rockpoint (RGSI) | 116M | 93M |

| 🇨🇦 Toromont (TIH) | 1.92 | 1.89 |

| 🇨🇦 DPM Metals (DPM) | 0.77 | 0.76 |

| 🇨🇦 First Quantum (FM) | 0.01 | 0.07 |

| 🇨🇦 Andrew Peller (ADW) | 0.17 | 0.19 |

| 🇨🇦 Stingray (RAY) | 0.38 | 0.37 |

| 🇨🇦 Finning (FTT) | 1.00 | 1.06 |

| 🇨🇦 Intact (IFC) | 5.89 | 4.69 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Shopify (SHOP) | AM | 0.51 |

| 🇨🇦 Cineplex (CGX) | AM | 0.18 |

| 🇨🇦 Birchcliff (BIR) | PM | 0.09 |

| 🇨🇦 GFL Env. (GFL) | PM | 0.19 |

| 🇨🇦 Manulife (MFC) | PM | 1.06 |

| 🇨🇦 Great-West (GWO) | PM | 1.29 |

| 🇨🇦 West Fraser (WFG) | PM | -2.41 |

| 🇨🇦 Sun Life (SLF) | PM | 1.87 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 Retail Sales M/M | 0.0% | 0.4% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | 8:30AM | 5% |

| 🇺🇸 Non Farm Payrolls | 8:30AM | 70K |

| 🇺🇸 Unemployment Rate | 8:30AM | 4.4% |

Was this forwarded to you? Join 7,000+ investors reading The Morning Meeting by clicking the button below.