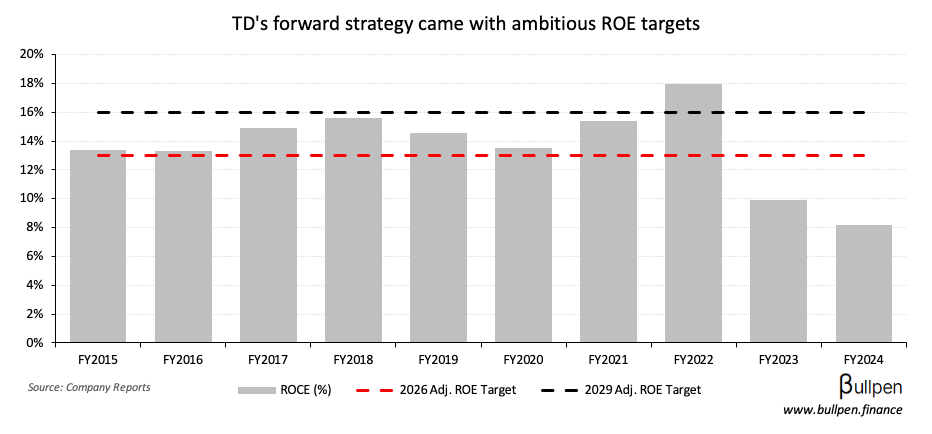

TD Bank (TD) hosted a lengthy (200 page deck!) investor day centered around its go-forward strategy under new CEO Raymond Chun, who’s focused on restoring near-term ROE and expanding medium-term returns beyond prior year levels.

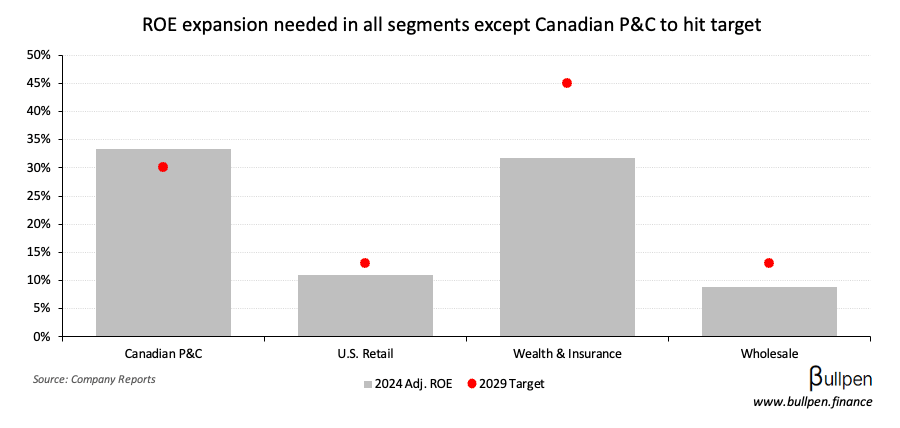

At the segment level, the 16% 2029 target will require improvement in all business lines except for Canadian P&C…

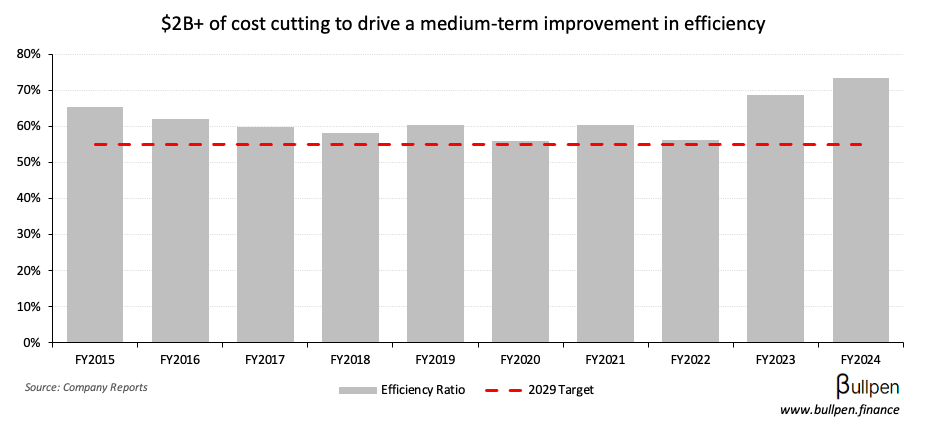

… which will be carried largely by cost-cutting initiatives - with the bank eyeing over $2B of fat to trim in order to reach a mid-50s efficiency ratio.

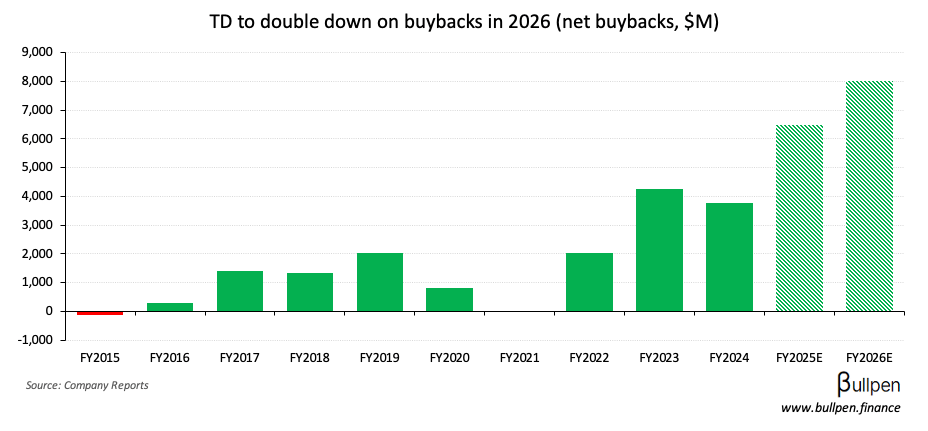

Buybacks will continue to play an important role as well, with the bank ready to launch a $6-7B program next year after the current $8B NCIB is fully tapped.

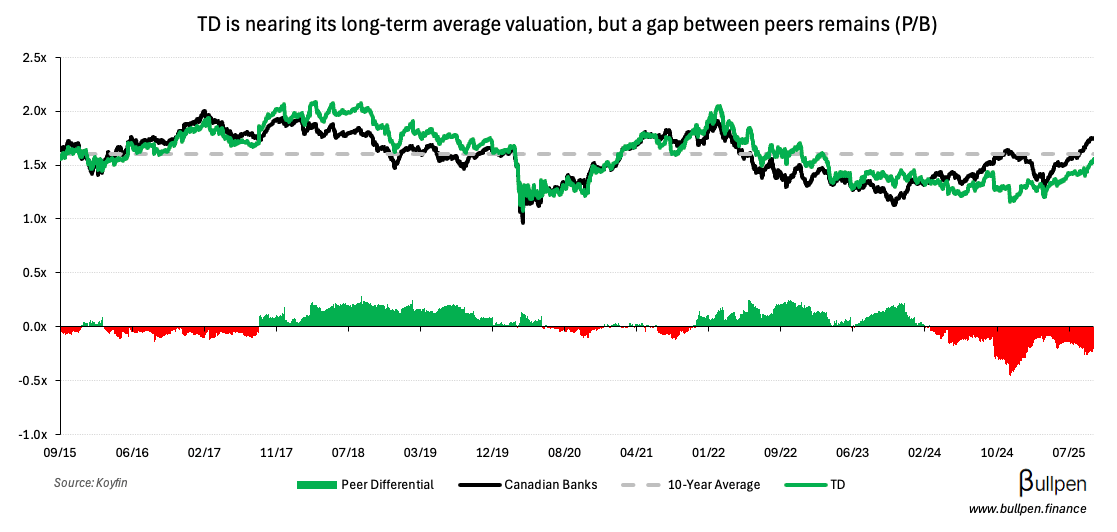

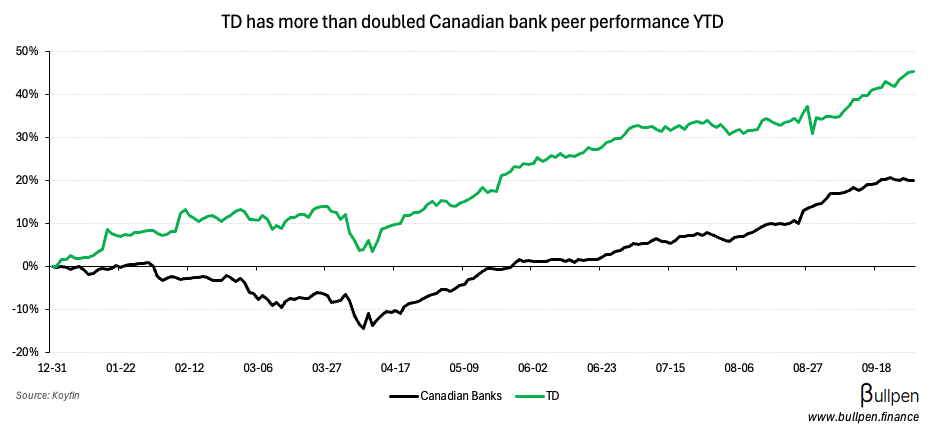

With TD’s YTD returns more than double its Canadian banking peers, the easy money has likely been made…

… but execution towards its medium-term targets could drive a continued bid, with the stock still trading at a small discount on a book value basis.