|

|

||||

|

|

||||

|

|

||||

|

|

HOT OFF THE PRESS

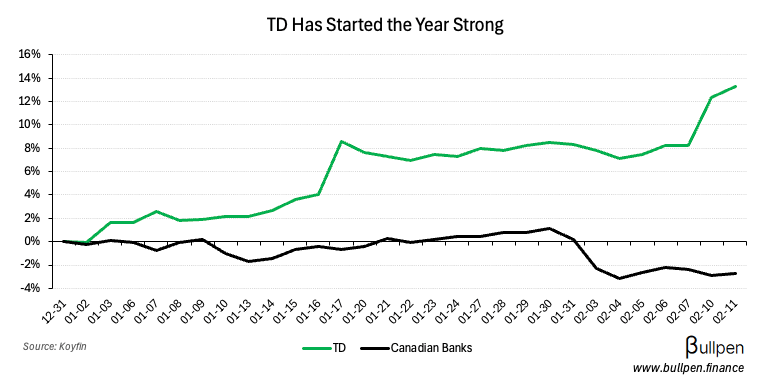

TD came out with more well-received news earlier in the week, divesting its 10.1% equity stake in Schwab (SCHW) in a secondary transaction, netting the company $20B.

Shares ran another 5% following the announcement, widening the performance gap between TD and its peers to start the year.

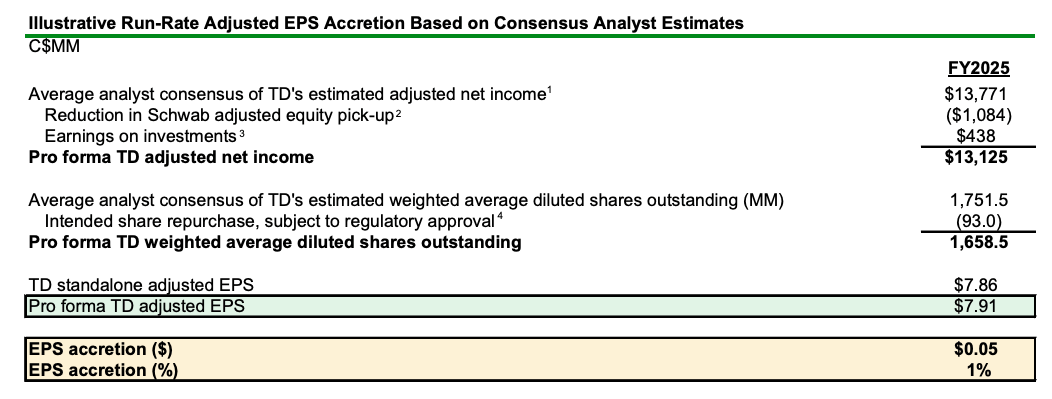

We’re not overly excited by the pop higher though. It falls roughly in-line with a ~5% share buyback TD plans to allocate $8B of the proceeds towards, making the transaction slightly accretive on paper.

Source: Company Reports

But with $12B left over, the question now becomes: how can TD allocate the remaining proceeds effectively, given the asset cap in the U.S. retail business?

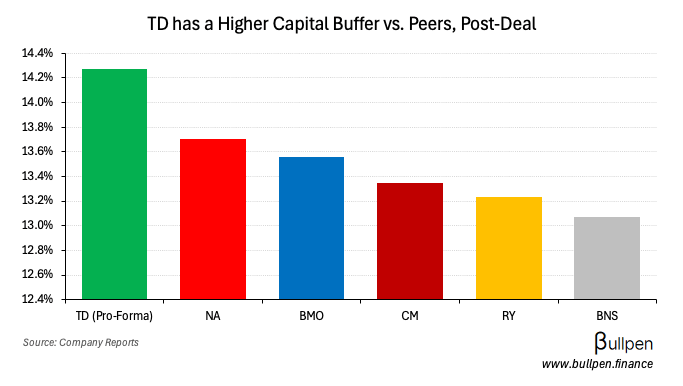

Net of buybacks, management expects its pro-forma CET1 ratio to sit at roughly 14.3%, well above Canadian peers.

In a challenging economic period where loan loss expectations are high, the capital buffer could be viewed positively by the market. In the current environment, it looks like a drag on returns.

The obvious thought on capital deployment would be M&A, which management doesn’t seem interested in doing anytime soon (sorry Laurentian, you’ll have to wait).

And doing any sort of an M&A at this point would distract us from both the AML remediation, but also as we get into the strategic review we are seeing opportunities here within Canada and also within our wholesale business… so that’s where the focus will be as we go forward on the strategic review.

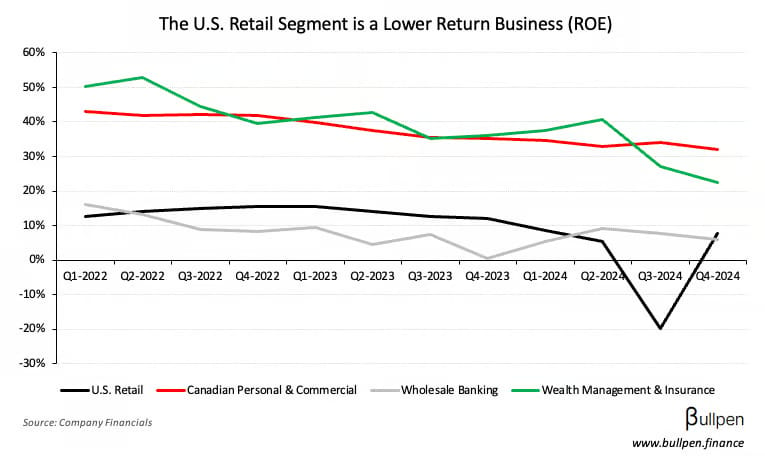

The focus appears to be on organic growth, with management highlighting the investment bank and Canadian P&C business as compelling opportunities.

And certainly, one of the opportunities that we see is that we’ve got an undersized investment bank and opportunities to invest and grow it now that we have a fully integrated wholesale bank.

As we stated previously, returns in the wholesale business haven’t exactly been pretty, and growing rapidly in the Canadian P&C segment should be challenging.

Until we get clarity on TD’s ability to do what it says it can do - redirect U.S. retail growth investment at attractive returns in its other segments - we’d be cautious, as outlined in our note from 3 weeks ago:

If the above link won’t work, try this: https://www.bullpen.finance/content/14

Increasing our coverage, starting with macro

Let me start by saying we have a lot in store for you this year, as we ramp up content volume, grow the team, and significantly increase our coverage of the Canadian market.

We’re stoked with all the positive feedback we’ve gotten to date, but honestly, the way we view our current state of affairs is that this is the worst things are ever going to be.

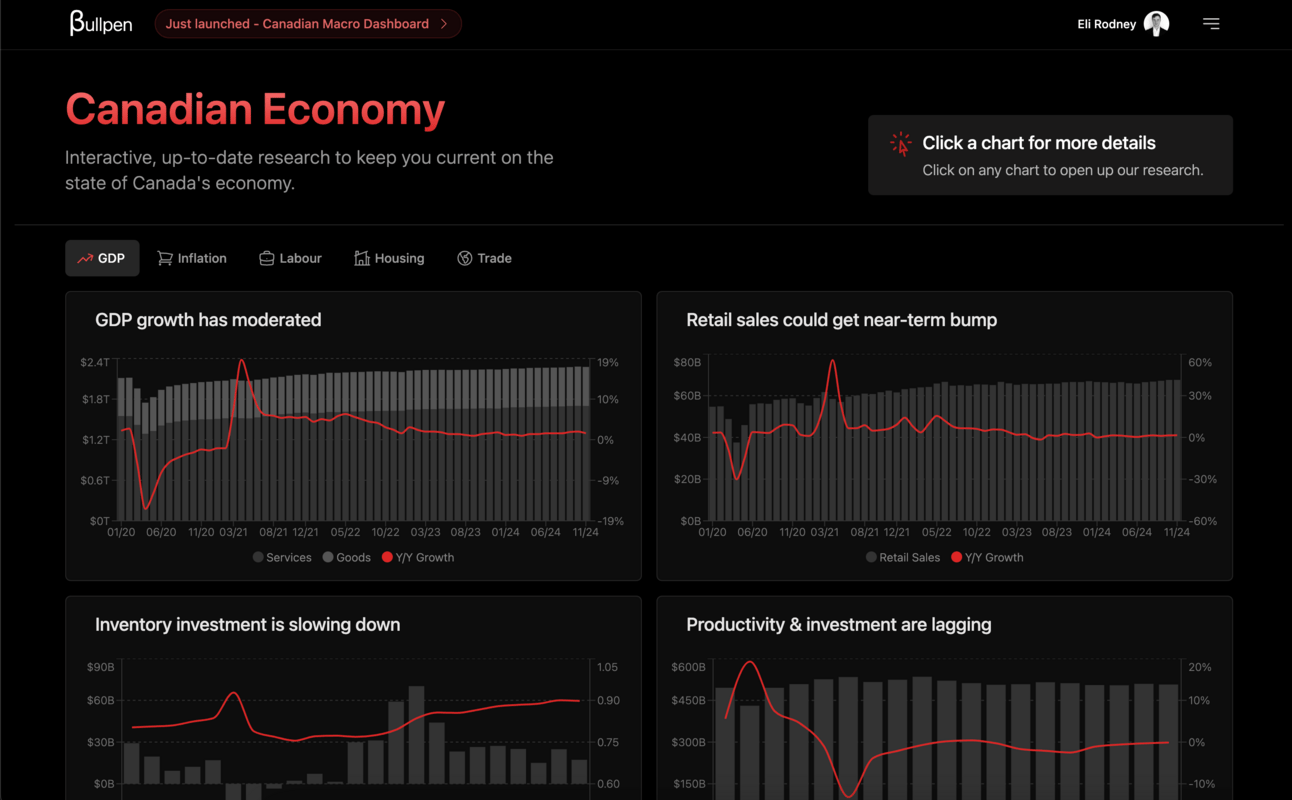

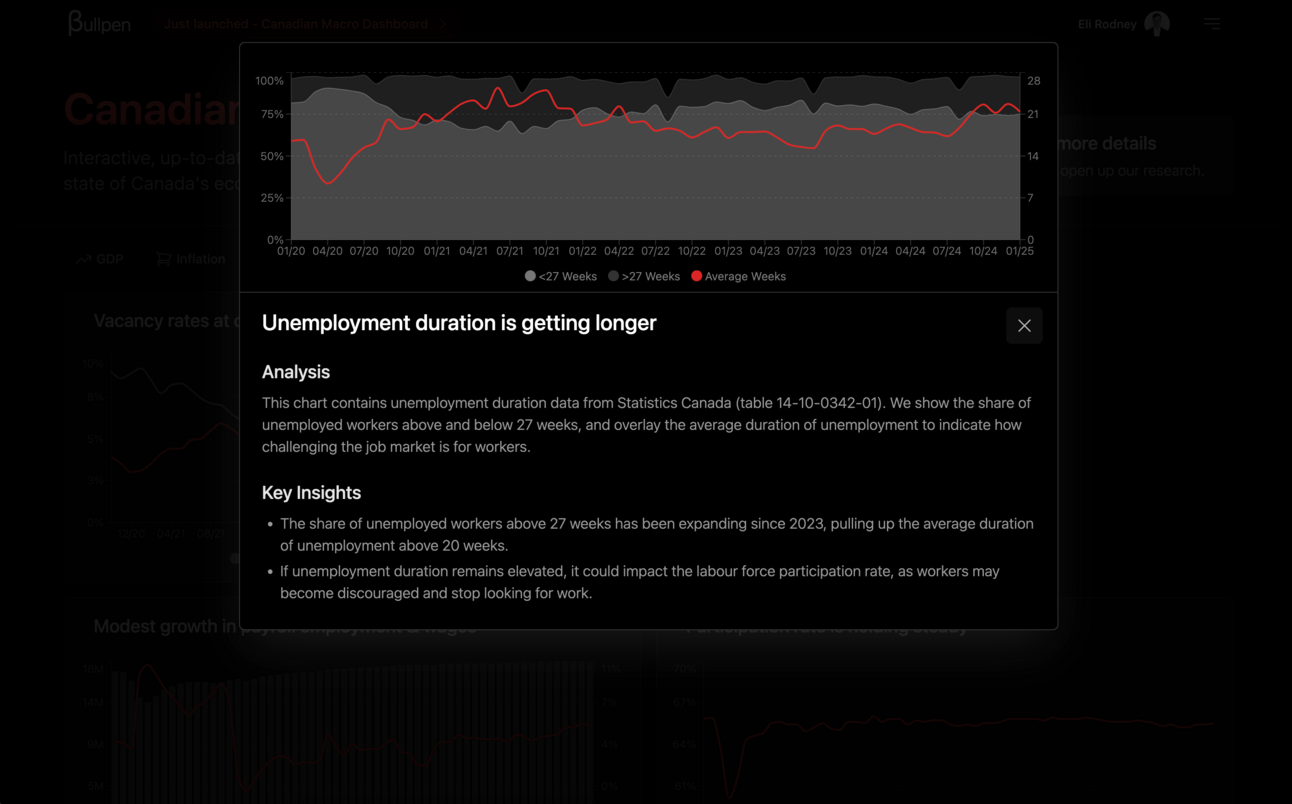

To kick things off, we’ve just launched the first version of our Canadian Macro research dashboard.

The reasoning behind this one was pretty simple: Canadian investors (really all Canadians) need a trustworthy place to get a quick pulse check on the economy, and StatCan is god awful to use.

In a nutshell, we categorize Canada’s economy into buckets, and surface only the most important data points to follow in each category.

We’re a research company, not a software company. You can click on any chart you find interesting to get our underlying thoughts on the data you’re looking at.

We keep the research and the data current, so this can be a reference you can come back to monthly as new economic data is released.

As I said before, this is the first version of the macro dashboard. If we’re getting good feedback on it, you can expect a lot of future improvements including more macro categories, more analysis in each category, and increased functionality like update alerts.

It’s live now and works well on either desktop or mobile, so go check it out.

If you like it, share it with colleagues and friends. Lots more to come! 🤝

FUNNY BUSINESS

ON OUR RADAR

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Coveo (CVO) jumped 25% on the back of strong earnings and forward guidance released on Monday. Of particular interest was the growth in its Gen AI customer base, up 36% sequentially. Not a bad setup, with $119M in cash and no debt!

Parkland (PKI) shares moved 13% higher on the back of a favourable court ruling that will allow Simpson Oil, a ~20% owner of PKI, to have more voting power and influence on the company’s strategy and governance.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Edmund Murphy (President) | Great-West (GWO) | $1.4M |

| Claude Genereux (EVP) | Power Corp. (POW) | $1.1M |

| Rob Laidlaw (CEO) | VerticalScope (FORA) | $1.5M |

| Antanas Guoga (CEO) | Sol Strategies (HODL) | $6.9M |

| Christos Balaskas (VP) | Eldorado (ELD) | $298K |

| Carl Colizza (CEO) | Saputo (SAP) | $248K |

| Juan Pablo Amar (President) | Finning (FTT) | $112K |

| Dan Gabbard (VP) | Metro (MRU) | $275K |

| Todd Cooper (President) | Metro (MRU) | $8.4M |

| Walter Coles Jr. (Chair) | Skeena (SKE) | $541K |

| Andrew Macritchie (CFO) | Skeena (SKE) | $940K |

| Lloyd Feldman (VP) | Stingray (RAY-A) | $345K |

| Mario Dubois (CTO) | Stingray (RAY-A) | $657K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Shopify (SHOP) | 0.44 | 0.43 |

| 🇨🇦 Cineplex (CGX) | 0.09 | 0.10 |

| 🇨🇦 Toromont (TIH) | 1.90 | 1.73 |

| 🇨🇦 NanoXplore (GRA) | -0.02 | -0.01 |

| 🇨🇦 First Quantum (FM) | 0.04 | 0.04 |

| 🇨🇦 WildBrain (WILD) | 0.02 | 0.00 |

| 🇨🇦 Intact (IFC) | 4.18 | 4.24 |

| 🇺🇸 Coca-Cola (KO) | 0.55 | 0.52 |

| 🇺🇸 S&P Global (SPGI) | 3.77 | 3.36 |

| 🇺🇸 Gilead (GILD) | 1.90 | 1.71 |

| 🇺🇸 Marriott (MAR) | 2.45 | 2.37 |

| 🇺🇸 Welltower (WELL) | 0.19 | 0.41 |

| 🇺🇸 Ecolab (ECL) | 1.81 | 1.81 |

| 🇺🇸 Carrier Global (CARR) | 0.54 | 0.49 |

| 🇺🇸 AIG (AIG) | 1.30 | 1.28 |

Shopify (SHOP) reported small beats on both sales ($2.81B vs. $2.73B) and FCF ($611M vs. $586M), resulting in a rule of 40 of 43% (revenue growth + FCF margin), an improvement from last quarter. Its guide was strong, expecting sales of $2.32B and FCF margin in the mid-teens, in-line with street estimates. Trading was volatile after the print, with shares selling off 5-6% in the morning before rallying to finish +3% at the close. We’ve been diving deep on SHOP and look forward to sharing our in-depth research with you soon!

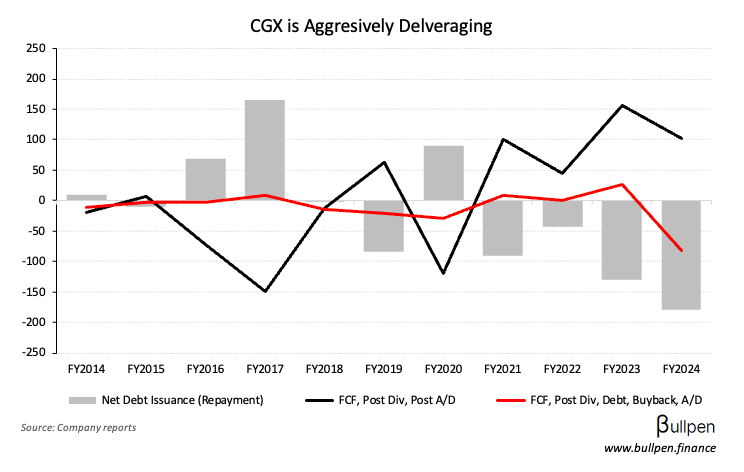

Cineplex (CGX) reported solid Y/Y improvements but sold off on missed expectations. Despite structural headwinds to the business, the company has been able to grow FCF, which it’s used to wipe out some of the debt it took on from COVID. It’s also started to ramp up buybacks, repurchasing 620K shares(~1% of the float).

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Brookfield A.M. (BAM) | AM | 0.39 |

| 🇨🇦 Slate Grocery (SGR-U) | AM | - |

| 🇨🇦 Barrick (GOLD) | AM | 0.41 |

| 🇨🇦 First Capital (FCR-U) | AM | - |

| 🇨🇦 Kinross (K) | PM | 0.25 |

| 🇨🇦 Russel Metals (RUS) | PM | 0.50 |

| 🇨🇦 European REIT (ERE-U) | PM | - |

| 🇨🇦 Killam (KMP-U) | PM | - |

| 🇨🇦 Corby Spirit (CSW-A) | PM | - |

| 🇨🇦 H&R REIT (HR) | PM | - |

| 🇨🇦 Sun Life (SLF) | PM | 1.78 |

| 🇨🇦 Waste Connections (WCN) | PM | 1.19 |

| 🇨🇦 Choice REIT (CHP-U) | PM | - |

| 🇨🇦 West Fraser (WFG) | PM | 0.31 |

| 🇨🇦 Acadian Timber (ADN) | PM | 0.12 |

| 🇨🇦 SmartCentres REIT (SLF) | PM | - |

| 🇨🇦 Morguard REIT (SLF) | PM | - |

| 🇺🇸 Cisco (CSCO) | PM | 0.91 |

| 🇺🇸 Equinix (EQIX) | PM | 2.75 |

| 🇺🇸 CME (CME) | PM | 2.48 |

| 🇺🇸 CVS Health (CVS) | PM | 1.00 |

| 🇺🇸 Dominion (D) | PM | 0.62 |

| 🇺🇸 Exelon (EXC) | PM | 0.60 |

| 🇺🇸 Kraft Heinz (KHC) | PM | 0.78 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | 11.0% | 1.7% |

| 🇺🇸 Business Optimism | 102.8 | 104.6 |

Building permits came in strong for December, climbing 11% M/M with strength in residential permitting (up 21% M/M) carrying weaker non-residential permitting (down 6% M/M). Within residential, multi-unit continues its strength, up 33% M/M, with Ontario and BC showing some much needed signs of life.

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Core Inflation M/M | 8:30AM | 0.3% |

| 🇺🇸 Core Inflation Y/Y | 8:30AM | 3.1% |

| 🇺🇸 Inflation M/M | 8:30AM | 0.3% |

| 🇺🇸 Inflation Y/Y | 8:30AM | 2.9% |