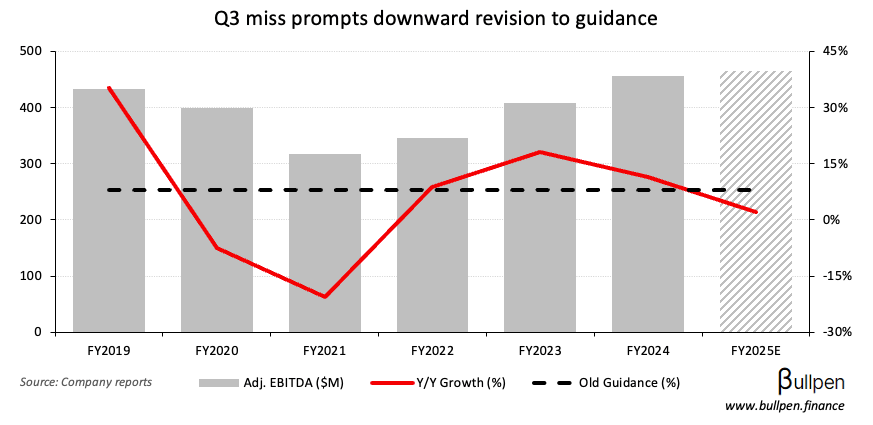

Superior Plus (SPB) fell over 20% on its Q3 results, which missed big on EBITDA and prompted management to reduce its full-year guide to 2% growth from 8%…

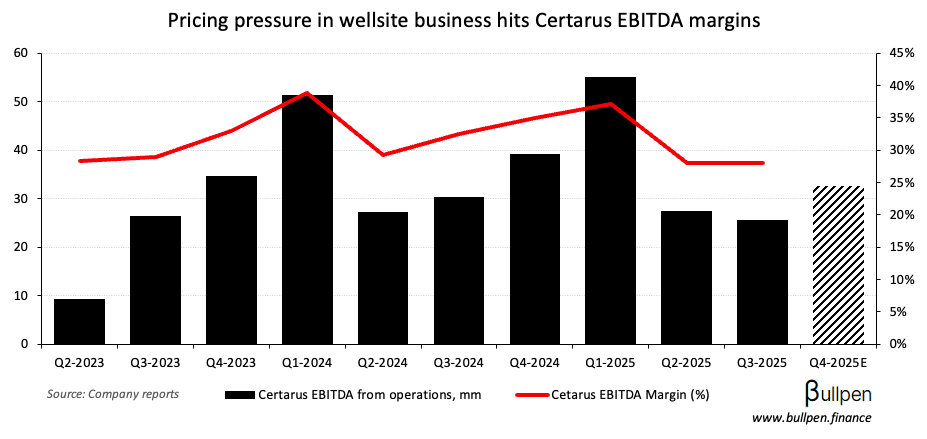

… due in large part to its Certarus business - which is facing intense competition and lower wellsite pricing in compressed natural gas.

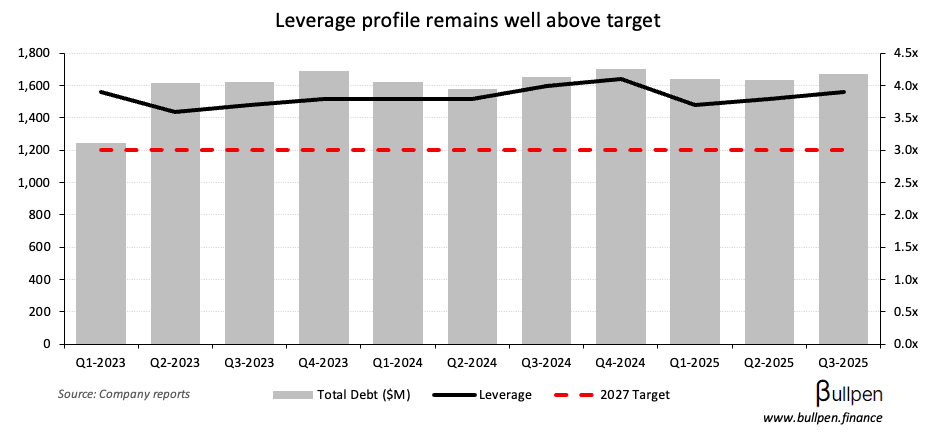

The softer EBITDA outlook pushes SPB’s leverage reduction plans to the right, with management expecting to end the year around 4x - a full turn above its 2027 target.

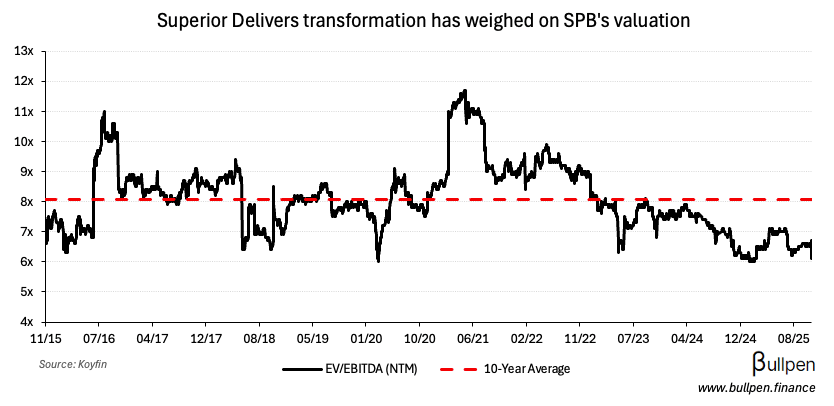

It also pushes out the expected EBITDA boost from the company’s “Superior Delivers” initiative, which has weighed on shares since it was announced alongside a dividend cut last year.

Bottom line: transformations aren’t easy, but trading at a trough multiple… it’s tough to imagine the floor isn’t near.