|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Shopify locks arms with OpenAI

TD’s new strategy to drive ROE

Canadian lumber takes another blow

Gatekeeper rises on new contract

Stella-Jones jumps on acquisition

HOT OFF THE PRESS

Shopify locks arms with OpenAI

Shopify (SHOP) gained 6% after announcing its partnership with OpenAI, enabling merchants to sell directly through ChatGPT conversations - a move that’s likely to increase GMV…

… if the introduction of in-chat shopping is well received by its 700M users. Importantly, enterprise prospects are likely to take notice of Shopify’s AI leadership - which could accelerate already strong growth…

… and payments penetration, which has flattened out in recent quarters but could improve - given it would likely be the default for in-chat transactions.

With retail sales data showing ~6% total e-commerce penetration, Shopify has a lot more runway than people think.

TD’s go-forward strategy to drive ROE

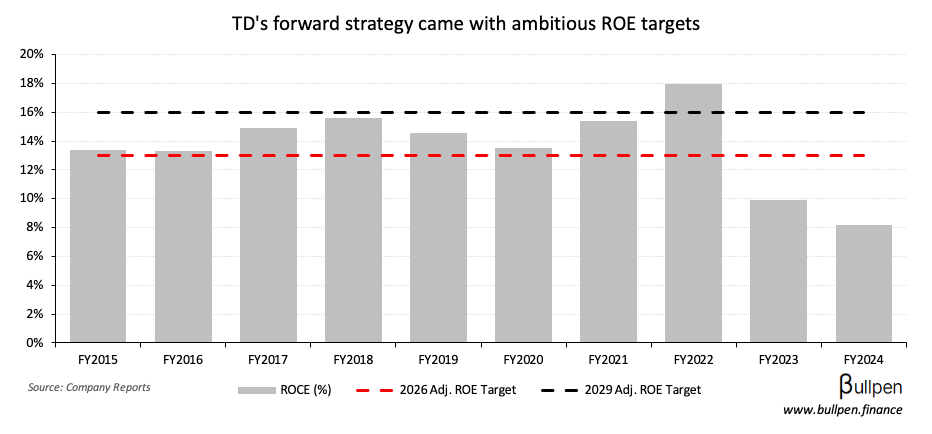

TD Bank (TD) hosted a lengthy (200 page deck!) investor day centered around its go-forward strategy under new CEO Raymond Chun, who’s focused on restoring near-term ROE and expanding medium-term returns beyond prior year levels.

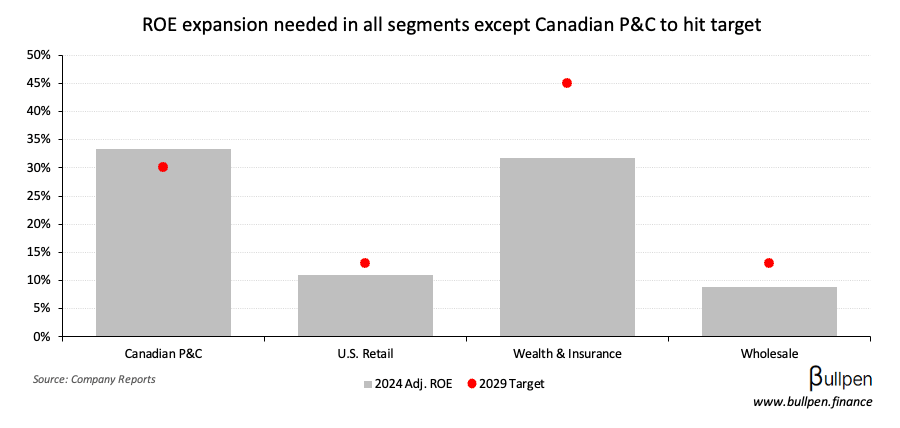

At the segment level, the 16% 2029 target will require improvement in all business lines except for Canadian P&C…

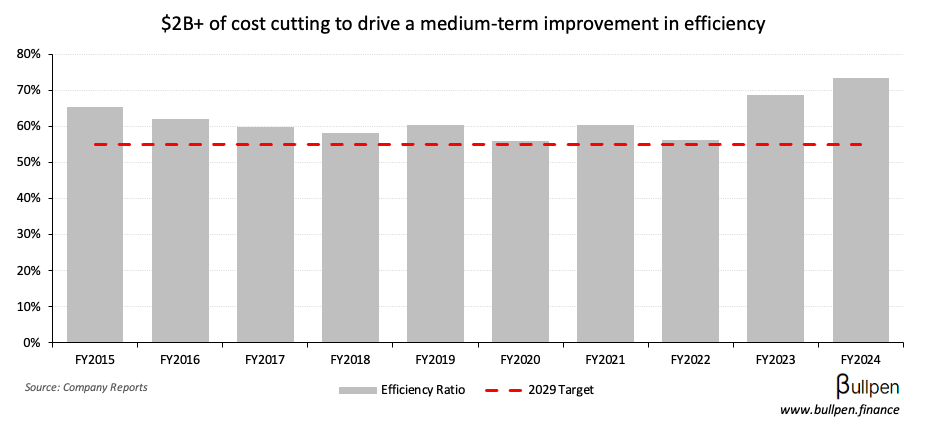

… which will be carried largely by cost-cutting initiatives - with the bank eyeing over $2B of fat to trim in order to reach a mid-50s efficiency ratio.

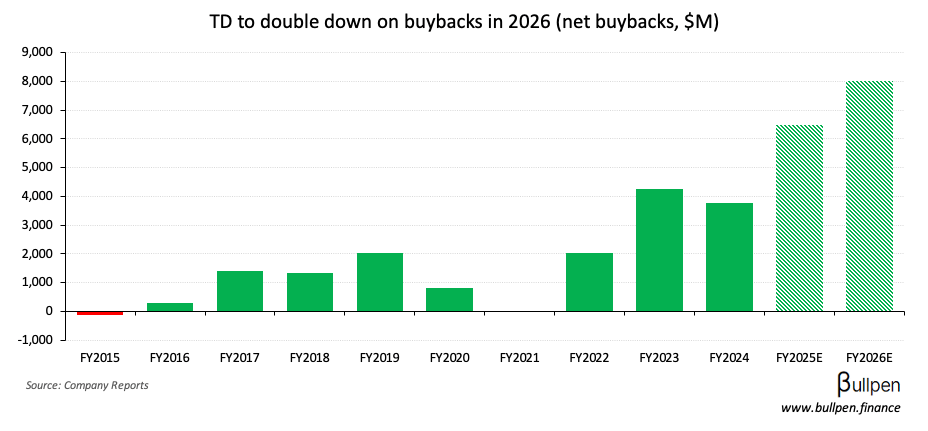

Buybacks will continue to play an important role as well, with the bank ready to launch a $6-7B program next year after the current $8B NCIB is fully tapped.

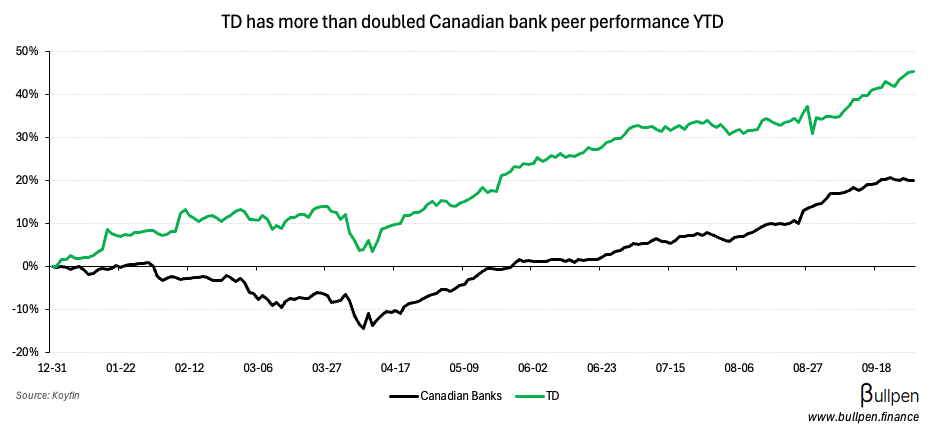

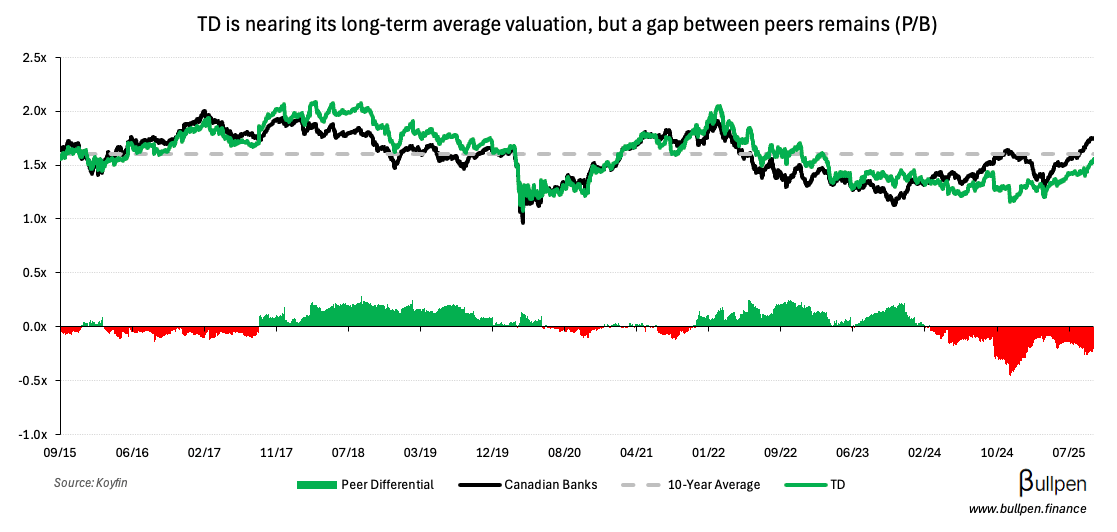

With TD’s YTD returns more than double its Canadian banking peers, the easy money has likely been made…

… but execution towards its medium-term targets could drive a continued bid, with the stock still trading at a small discount on a book value basis.

FUNNY BUSINESS

Trump upped tariffs on imported lumber another 10% in response to Carney’s $1.2B of support for the industry, applying leverage on a weak spot he can use in the upcoming USMCA negotiations.

It’s been a tough year for the group, whose YTD underperformance worsened earlier in the month after the U.S. administration’s final duty rates were announced…

… resulting in production cuts from both Interfor and Western Forest Products that should contribute to continued weakness in the industry here at home.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Gatekeeper Systems (GSI) jumped 11% on a ~$9M school bus video and subscriptions contract, its largest ever in the segment.

Up nearly 300% YTD, the company’s recent success is a reflection of the push for safety on public transit - and with Transport Canada requiring perimeter visibility systems on all buses by late 2027, the theme has staying power.

Stella-Jones (SJ) was up 4% on the back of its $140M acquisition of Brooks Manufacturing, a firm specializing in the production of distribution crossarms and transmission framing components. The deal grows SJ’s utility segment…

… and its U.S. footprint…

… which should benefit from a looming grid refresh and huge power demand from data centers. Stella could be an interesting “enabling infrastructure” play - but it’s not priced like one yet.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Mindy Gilbert | GFL Env. (GFL) | $945K |

| Elizabeth Grahek | GFL Env. (GFL) | $943K |

| Luke Pelosi | GFL Env. (GFL) | $2.4M |

| Charles Jeannes | Orla (OLA) | $945K |

| Joseph Lusardi | Curaleaf (CURA) | $423K |

| Jeff Hoffmeister | Shopify (SHOP) | $275K |

| Jessica Hertz | Shopify (SHOP) | $260K |

| Harley Finkelstein | Shopify (SHOP) | $240K |

| Craig Nelsen | OceanaGold (OGC) | $619K |

| Edwin McLaughlin | Nexus (NXR) | $465K |

| Mike Rose | Tourmaline (TOU) | $606K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 Nike (NKE) | 0.49 | 0.27 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 NovaGold (NG) | AM | -0.05 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 JOLTs Job Openings | 7.2M | 7.2M |

| 🇺🇸 CB Consumer Confidence | 94 | 96 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 S&P Mftg. PMI | 9:30AM | - |

| 🇺🇸 ADP Employment Change | 8:15AM | 50K |

| 🇺🇸 ISM Mftg. PMI | 10:00AM | 49 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.