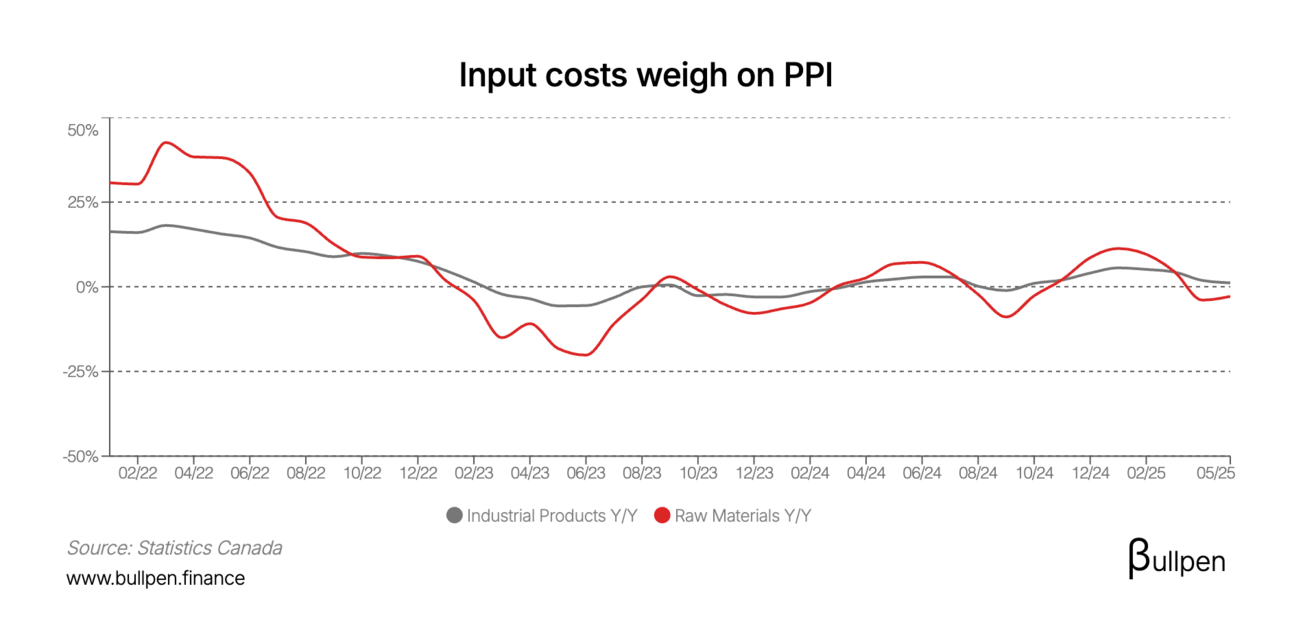

Industrial product prices in May fell 0.5% (+1.2% Y/Y), the second straight monthly decline and well below analyst forecasts for no change versus April. Input costs regressed 0.4% (-2.8% Y/Y), the third straight monthly drop.

The PPI weakness was driven by lumber and energy products, which fell ~6% and ~2% in May, respectively. Oil has been the key anchor to raw materials costs, falling another ~5% in May.

The recent geopolitical dust-up could swing the pendulum in the opposite direction, lifting input costs and, in turn, industrial product prices in the near-term.