|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Non-U.S. exports hit new high

Ivey PMI tops estimates

Telus hires advisors for health unit

Zedcor has an Amazon problem

Defense names run on budget hopes

HOT OFF THE PRESS

Record non-U.S. trade

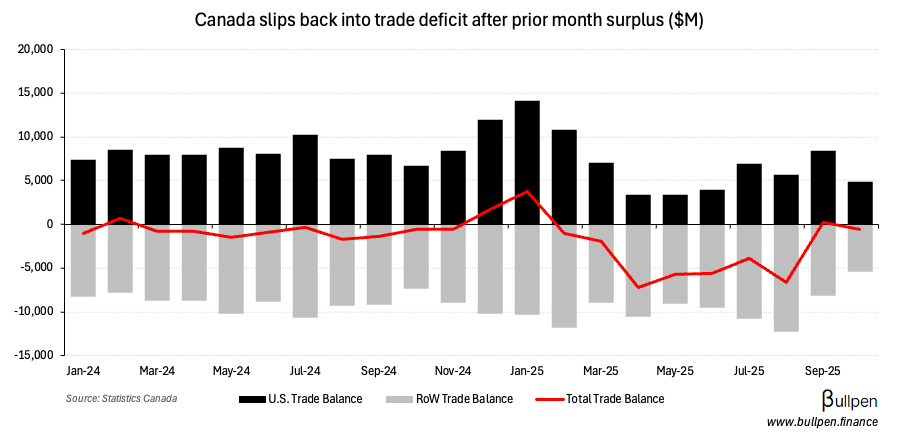

October’s ~$580M trade deficit came in better than expectations of $1.4B, reversing from last month’s print…

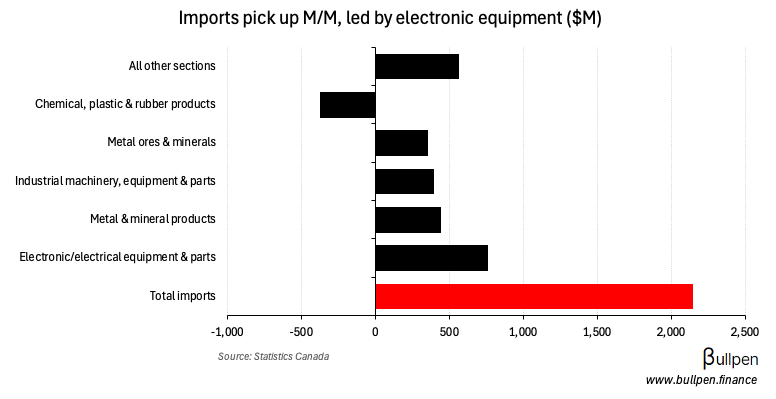

… driven by a >3% gain in imports that was broad-based, but led by electronics…

… computers and computer peripherals in particular, which jumped 32% M/M on increased shipments from Ireland.

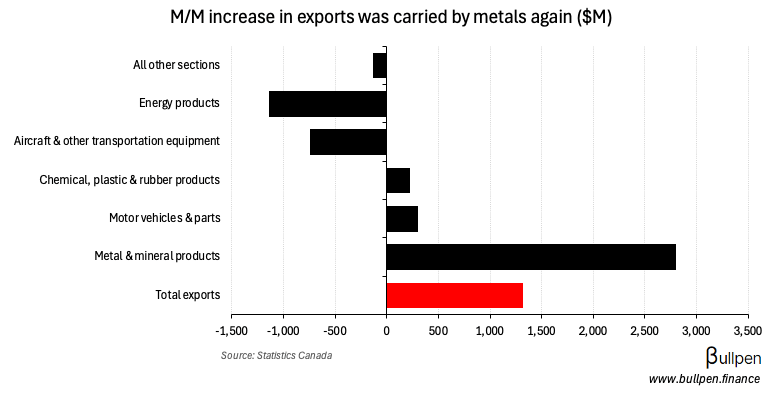

Exports increased to a lesser degree, adding ~2% M/M…

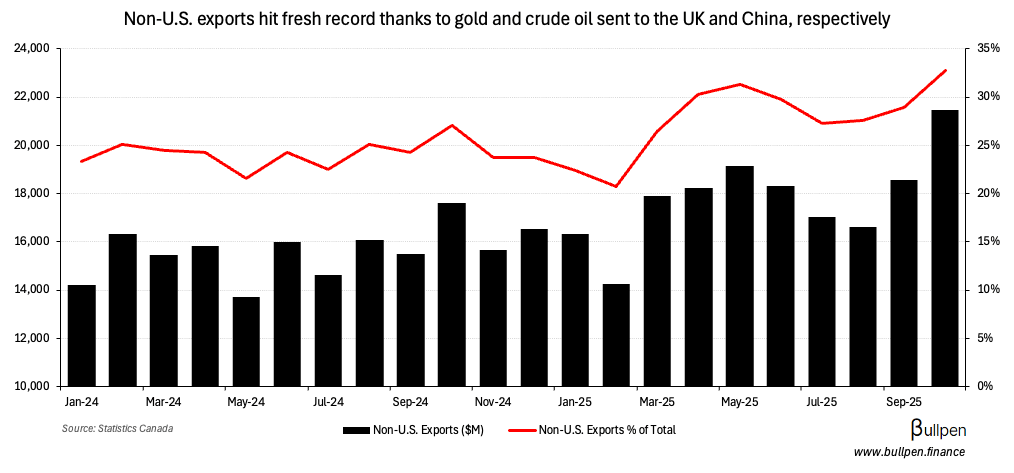

… driven almost entirely by precious metals, which posted a second sequential gain of more than 25% - leading to a fresh record in export value…

… and contributing to record non-U.S. exports, which now account for a third of total activity versus a quarter through 2024.

Ivey PMI tops estimates

The Ivey PMI came in better than expected at 51.9, indicating purchasing activity expanded relative to last month…

… likely driven by inventory replenishing, with balances contracting meaningfully despite a decline in deliveries.

The employment index improved too, more than offsetting November’s pullback - a signal that manufacturing employment could be up in today’s jobs print.

ON OUR RADAR

Flagging Telus (T), who has engaged TD and Jefferies as advisors in the monetization strategy of its health unit, which continues to grow the top-line while leaning out its cost structure.

Along with its insider buying PR earlier this week, the news is clearly aimed at easing investor concerns over leverage and dividend sustainability…

… so the setup to sell looks less opportunistic than its digital unit monetization in 2021. Despite that, private capital will line up at the right price - which should land well above where Telus currently trades.

With management looking for ~$2B…

We would bring in a partner that would easily, in this scenario, bring in $1-3 billion if that was the case.

… a deal could be within GTCR’s wheelhouse, given they just took dentalcorp private at $2.2B and helped fund Telus’ Workplace Options deal in May.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

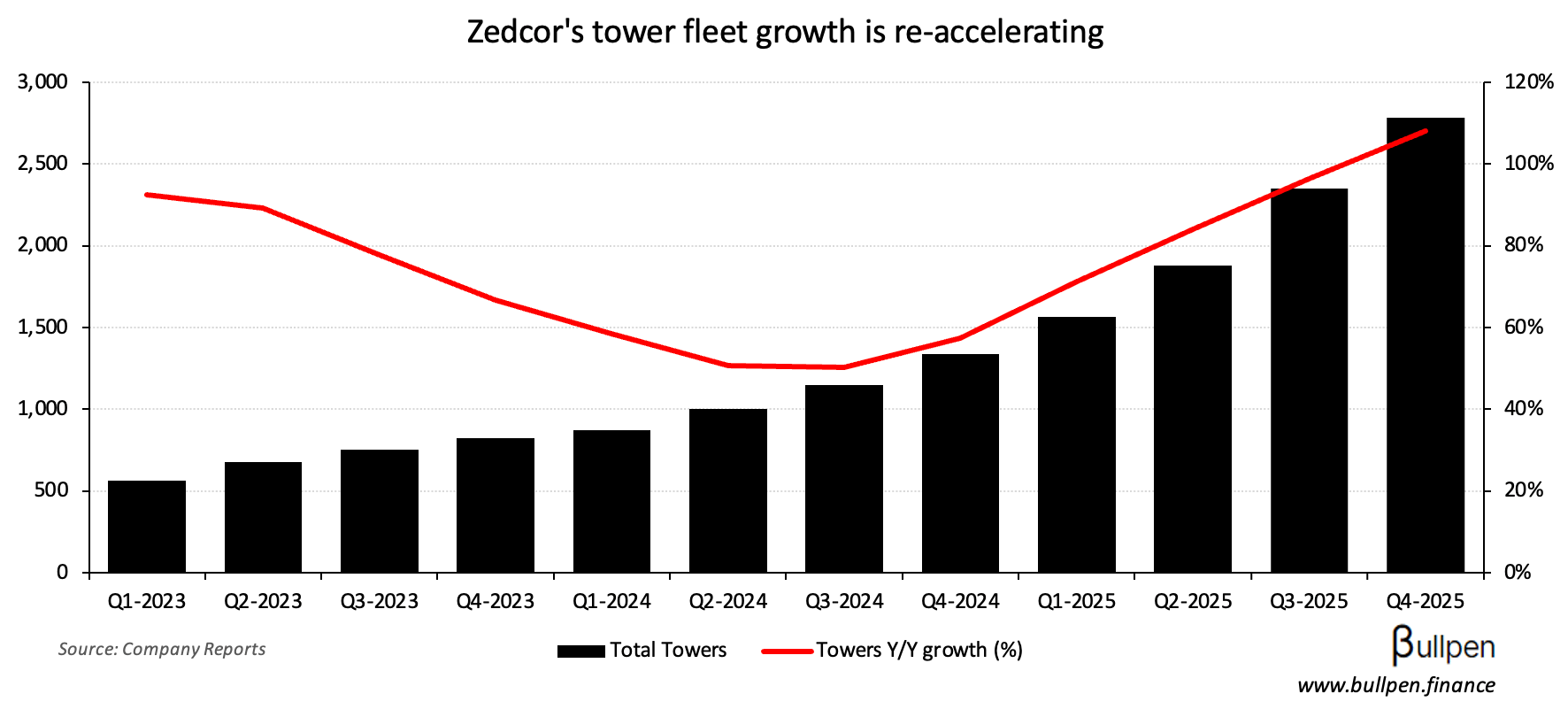

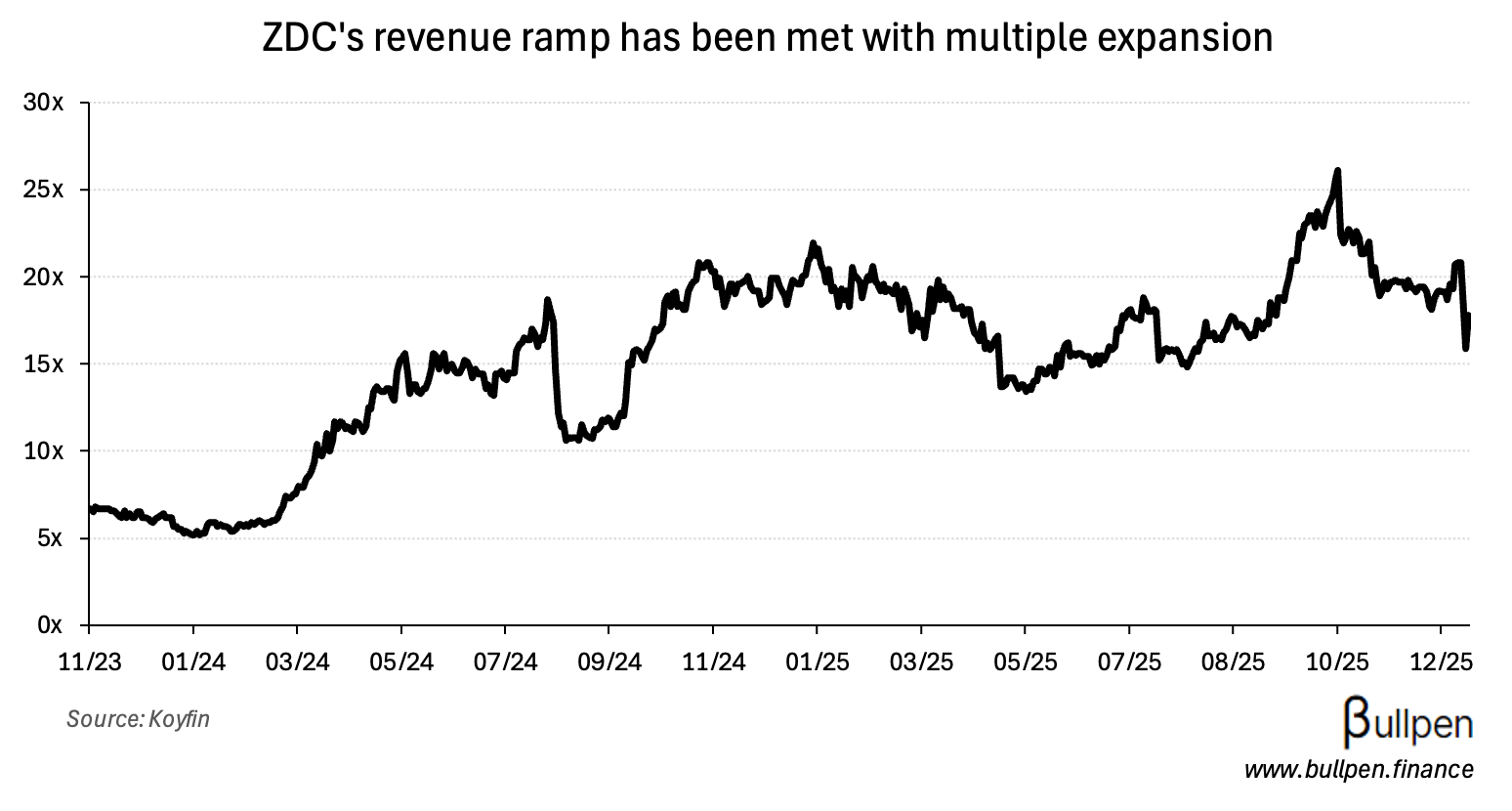

Zedcor (ZDC) has had a volatile week, shedding ~25% before yesterday’s 12% recovery. It stems from news that Amazon is entering the market via Ring with the launch of a $5,000 surveillance trailer. It’s a lower cost, less complete solution…

… but when you trade at 20x forward EBITDA, any negative news can take some air out of the multiple. While the business is performing well today, Amazon might represent a longer term threat analogous to that of SpaceX to MDA Space.

If the value isn’t in the security towers themselves, but in the handling of what they pick up (routing to police/security/company) - the network sitting on top of the hardware would be where the moat (and the premium multiple) should be.

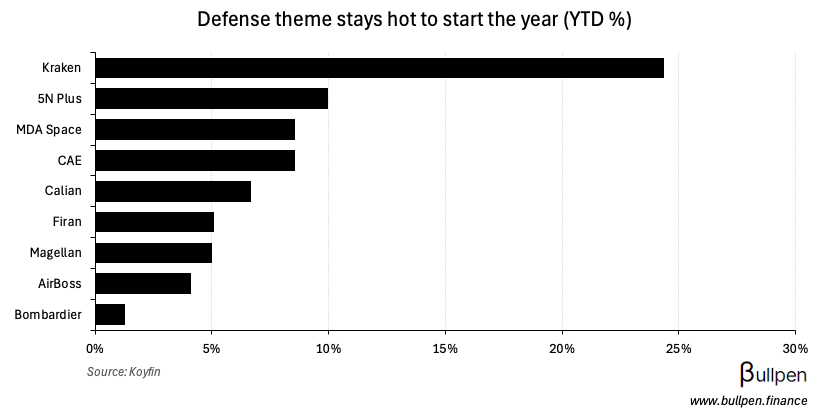

Kraken Robotics (PNG) and other Canadian defense names have started 2026 strong given the geopolitical backdrop and Trump’s call for a higher defense budget…

… let’s see if we get a repeat of 2025 for the theme.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| John Burzynski | Aya Gold & Silver (AYA) | $308K |

| Hratch Panossian | CIBC (CM) | $1.6M |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Aritzia (ATZ) | 1.10 | 0.89 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Trade Balance | -0.6B | -1.4B |

| 🇺🇸 Trade Balance | -29.4B | -58.9B |

| 🇺🇸 Jobless Claims | 208K | 210K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 8:30AM | 6.6% |

| 🇨🇦 Employment Change | 8:30AM | -5K |

| 🇺🇸 Housing Starts | 8:30AM | 1.33M |

| 🇺🇸 Non Farm Payrolls | 8:30AM | 60K |

| 🇺🇸 Unemployment Rate | 8:30AM | 4.5% |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.