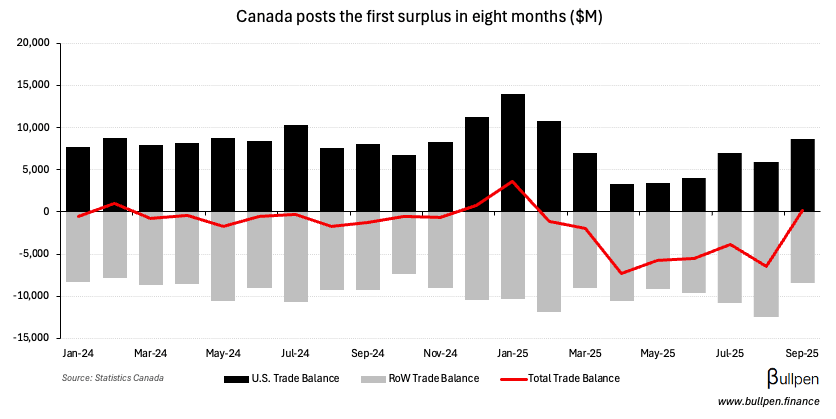

September’s ~$150M trade surplus was the first in eight months, tracking ahead of expectations for a $4.5B deficit and improving versus August’s $6.4B…

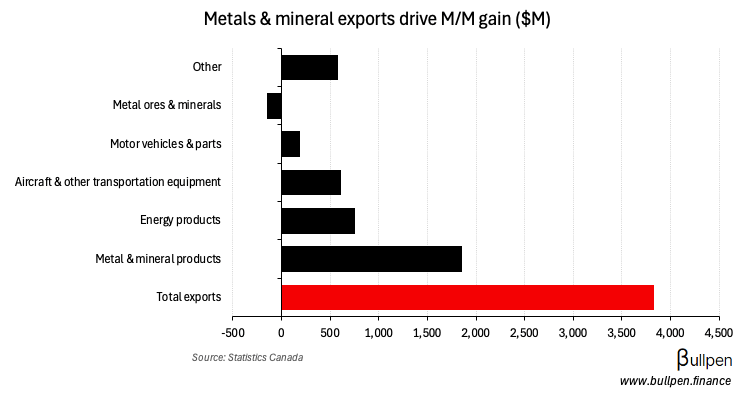

… largely due to metals and minerals (gold, silver, platinum, etc.), which carried exports to a 6% M/M gain…

… and imports to a 4% decline, with the help of a broad-based 6% drop in consumer goods.

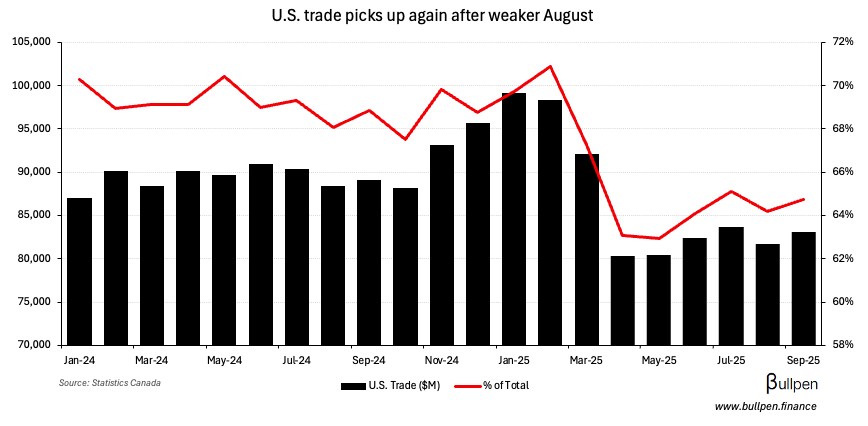

While the print was pretty one-sided, U.S. activity rebounded after a sluggish August - which will be needed to keep total trade balanced going forward ($8.6B surplus is the largest since February).