|

TSX

1D %

YTD %

|

28,615.62

0.2%

14.9%

|

|

|

TSXV

1D %

YTD %

|

845.20

1.9%

36.9%

|

|

|

S&P 500

1D %

YTD %

|

6,415.54

0.7%

9.3%

|

|

|

NASDAQ

1D %

YTD %

|

21,279.63

0.8%

10.4%

|

|

|

US 10Y

1D

YTD

|

4.26

3 bps

28 bps

|

|

|

DJIA

1D %

YTD %

|

45,295.81

0.6%

6.9%

|

|

|

CA 10Y

1D

YTD

|

3.44

7 bps

22 bps

|

|

|

CAD/USD

1D %

YTD %

|

0.725

0.3%

4.3%

|

|

Breaking down the ugly GDP print

TIXT gets a higher ~$740M bid

BRP jumps 20% on strong Q2

ATD beats but U.S. growth is weak

A breakdown of the ugly GDP print

Friday’s GDP print came up short of estimates, falling 0.1% versus expectations for a gain of similar magnitude - the third straight sequential decline…

… resulting in a 0.4% Q/Q drawdown that was anchored almost entirely by a slowdown in exports - as the first full quarter of tariff impacts hit overall trade activity and front-running in Q1 made for a tough comp.

At the industry level, manufacturing was the primary laggard…

… as tariffs magnified the longer-term structural challenges facing the industry - with activity down nearly 10% from 2022 highs.

Despite the weak GDP print, final domestic demand recovered in Q2 - rising 0.9%…

… on the back of a 1.1% gain in per capita consumption…

… which offset a small decrease in fixed capital formation - as general business uncertainty slows down investment decision making.

Whether that dynamic can last remains to be seen, as Q2’s growth in consumption outstripped growth in disposable income - eating into household savings.

With kids heading back to school this week, expect corporate activity to pick up…

| Insider |

Company |

Value |

| Yousriya Loza |

G Mining (GMIN) |

$2.1M |

| James Dendle |

Triple Flag (TFPM) |

$1.1M |

| Grant Angwin |

Andean (APM) |

$143K |

| Scott Parsons |

Alamos (AGI) |

$419K |

| Barton Demosky |

Bombardier (BBD) |

$400K |

| Steven Douglas |

Saputo (SAP) |

$1.0M |

| J.P. Lachance |

Peyto (PEY) |

$459K |

| David Kelly |

Kinaxis (KXS) |

$304K |

| Conrad Mandala |

Kinaxis (KXS) |

$182K |

| Vasile Ticala |

Kinaxis (KXS) |

$182K |

| Gilbert Palter |

Sagicor (SFC) |

$120K |

|

Andean (APM)

1D %

YTD %

|

6.90

18.4%

516.1%

|

|

|

Canopy (WEED)

1D %

YTD %

|

2.04

17.4%

48.2%

|

|

|

Telust Int. (TIXT)

1D %

YTD %

|

6.18

16.2%

9.4%

|

|

|

Dye & Durham (DND)

1D %

YTD %

|

11.06

5.4%

37.1%

|

|

|

BRP Inc. (DOO)

1D %

YTD %

|

91.89

6.3%

25.5%

|

|

|

5N Plus (VNP)

1D %

YTD %

|

14.36

4.4%

94.6%

|

|

With the new price being more consistent with peer valuations and Telus (T) already representing a quarter of TIXT’s top line, this one looks to be a done deal.

BRP Inc. (DOO) continued its post-earnings run, up 6% yesterday and 16% since Friday’s beat - which came with a 2026 guide that sits well above the street and points to a continued re-acceleration of revenue.

Expected tariff impacts are creeping higher at $90M - above the original $60-70M, but manageable at <10% of EBITDA thanks to USMCA compliance.

Despite that, the outlook is for margin improvement - thanks to much healthier dealer inventory levels which are down 20% Y/Y…

… putting the company in position to push new product through the channel at better economics.

YESTERDAY’S EARNINGS

| Company |

Actual |

Consensus |

| 🇨🇦 Couche-Tard (ATD) |

0.78 |

0.76 |

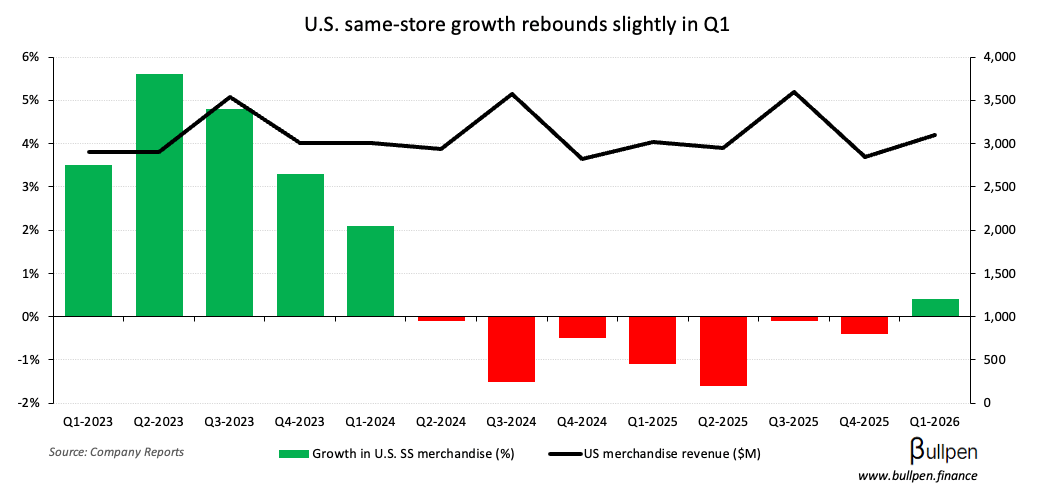

Alimentation Couche-Tard (ATD) beat estimates last night on better cost control, but let’s see how things shake out in today’s trading. The market may be focused on U.S. growth, which remains weak.

TODAY’S EARNINGS

| Company |

Time |

Consensus |

| 🇨🇦 Descartes (DSG) |

PM |

0.52 |

| 🇺🇸 Salesforce (CRM) |

PM |

2.78 |

YESTERDAY’S ECONOMIC RELEASES

| Release |

Actual |

Consensus |

| 🇨🇦 S&P Mftg. PMI |

48.3 |

- |

| 🇺🇸 ISM Mftg. PMI |

48.7 |

49.0 |

TODAY’S ECONOMIC RELEASES

| Release |

Time |

Consensus |

| 🇨🇦 Labour Productivity Q/Q |

8:30AM |

0.2% |

| 🇺🇸 JOLTs Openings |

10:00AM |

7.4M |

| 🇺🇸 Factory Orders M/M |

10:00AM |

-1.4% |

|

WTI Crude

1D %

YTD %

|

65.58

1.5%

8.7%

|

|

|

Gold

1D %

YTD %

|

3,537.06

1.7%

34.8%

|

|

|

Nat Gas

1D %

YTD %

|

3.01

0.8%

16.5%

|

|

|

Silver

1D %

YTD %

|

40.92

0.5%

41.7%

|

|

|

Lumber

1D %

YTD %

|

527.57

5.1%

4.2%

|

|

|

Copper

1D %

YTD %

|

4.57

1.2%

14.7%

|

|

|

Soybean

1D %

YTD %

|

1,024.70

1.0%

2.5%

|

|

|

Aluminum

1D %

YTD %

|

2,621.25

0.2%

2.5%

|

|

|

Corn

1D %

YTD %

|

402.80

1.3%

12.1%

|

|

|

Wheat

1D %

YTD %

|

512.26

2.0%

7.1%

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.