|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Ivey PMI misses expectations

Nutrien weighs $2.5B phosphate sale

goeasy slides 17% on Q3

Lightspeed jumps 16% on turnaround

HOT OFF THE PRESS

Ivey PMI misses

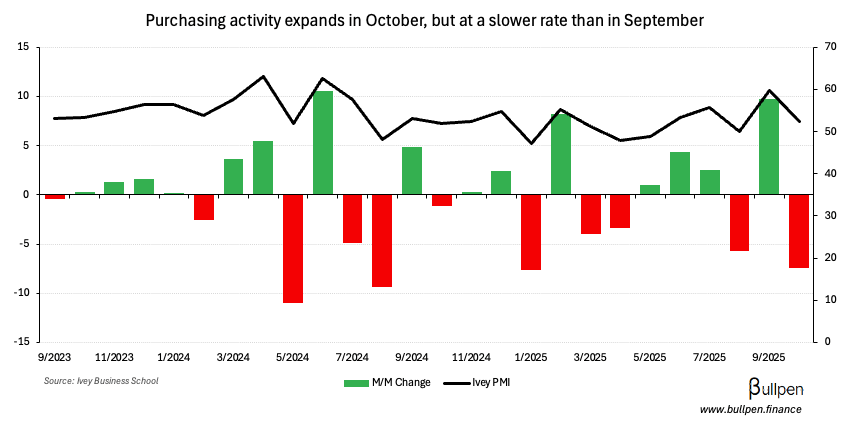

The Ivey PMI came in worse than expectations at 52.4, indicating purchasing activity is expanding at a slower rate than last month…

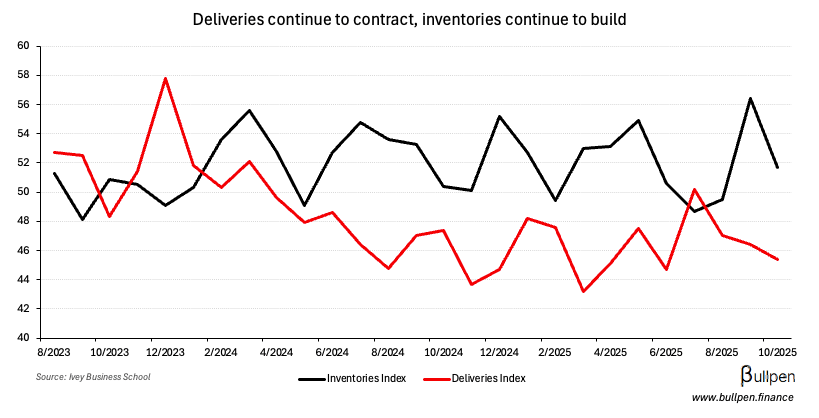

… likely driven by a continued slowdown in deliveries, which pushed inventories higher for the second month in a row.

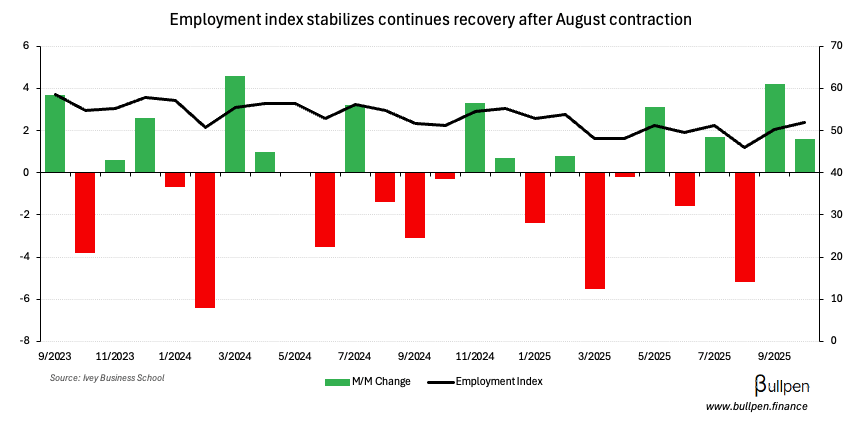

The employment index was the bright spot, expanding again in October - a signal that manufacturing employment could be up again in today’s jobs print.

Nutrien explores $2.5B phosphate sale

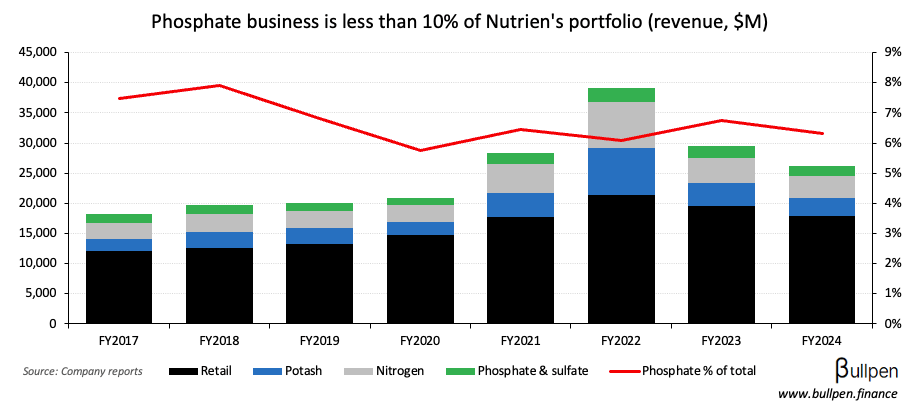

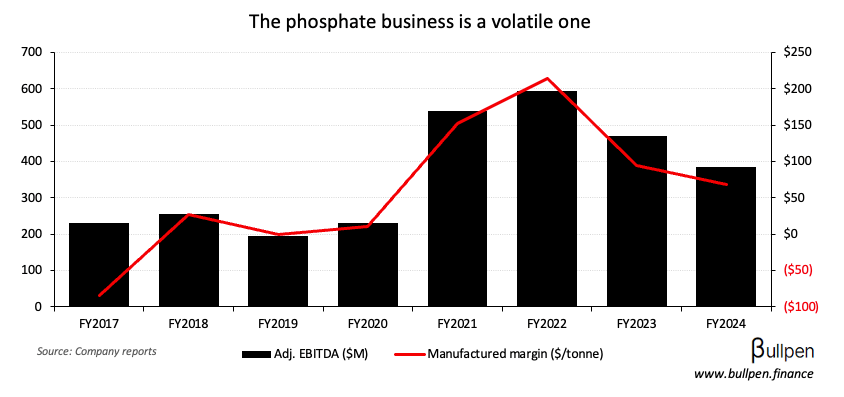

Nutrien (NTR) was up 3% on a Q3 beat but the results weren’t the story, with management running a process on its phosphate business. Given the segment is only ~6% of NTR’s top line…

… and has been historically lumpy, a sale would reduce margin volatility…

… and follow a series of streamlining initiatives including the wind down of its nitrogen ops in Trinidad and $600M Profertil sale. If a deal lines up with the 6-7x multiple NTR currently trades at…

… it would put another ~$2.5B in Nutrien’s pocket - let’s see.

FUNNY BUSINESS

With over 50 companies reporting yesterday, we’re half way through earnings season… almost there.

ON OUR RADAR

Stella-Jones, Centerra, Bell & Magna announce NCIB

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

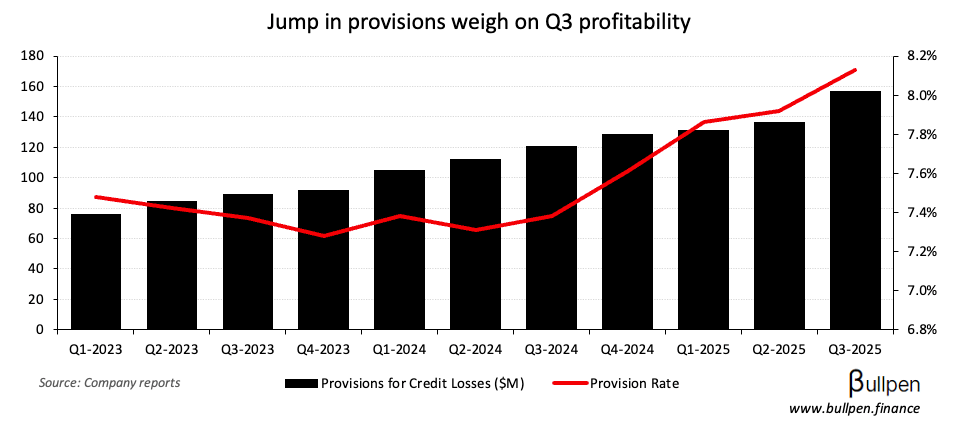

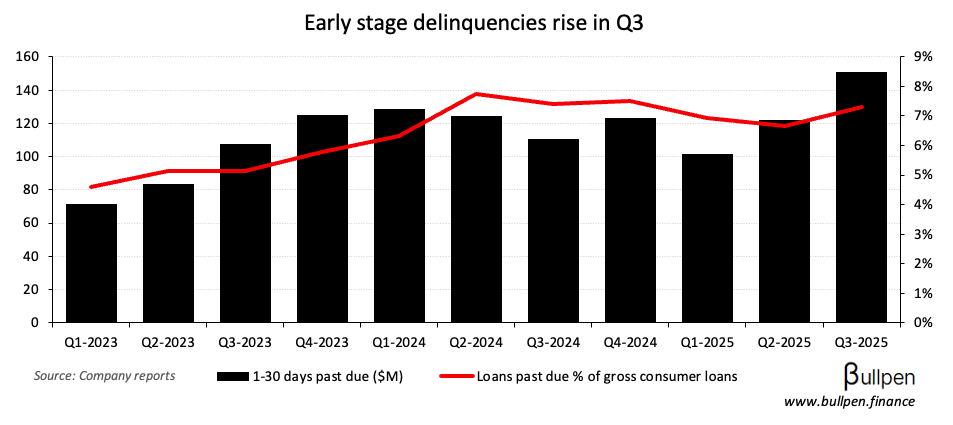

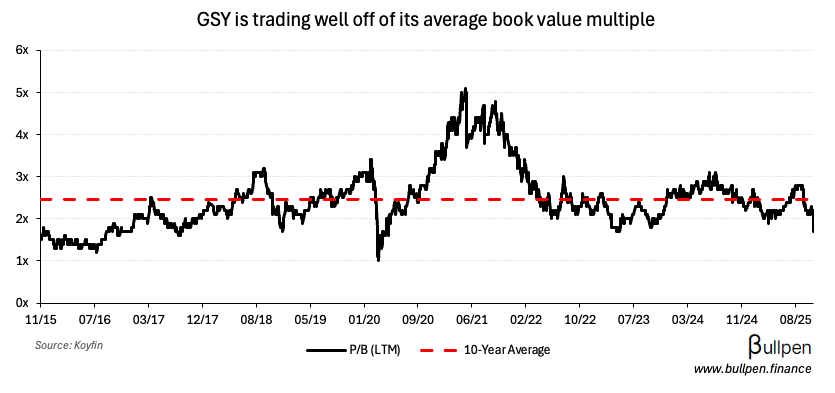

goeasy (GSY) extended its post-short report drawdown to over 35% following Q3 results, which beat on the top line but missed big on earnings - driven by increased provisioning activity...

… to cushion against some negative credit migration in the quarter.

Management indicated the tougher credit backdrop should persist, as unemployment remains elevated and economic growth slows…

… we can continue to expect to see elevated delinquency levels while we work to assist our customers during these periods of uncertainty…

… which naturally shows up in subprime loan books first. With that and some general unease following a series of auto lending blowups, investors will likely wait for evidence of a turnaround before coming back to GSY.

Lightspeed (LSPD) ran 16% on its Q2 results, which beat on revenue thanks to ~2K new customer locations in its key markets.

The top line growth flowed through to margins, driving earnings past expectations…

… with the help of AI - which the company is using to drive internal efficiency.

… AI now resolves over 80% of inbound chat interactions on our flagships. This has allowed us to significantly reduce headcount in support, which is showing up in our expanded gross margins in software.

While still early in the turnaround, there’s room higher if LSPD can keep up the momentum it’s built in the past two quarters.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Paul Dubkowski | Andrew Peller (ADW) | $529K |

| Patrick O'Brien | Andrew Peller (ADW) | $256K |

| Philippe Sarfati | iA Financial (IAG) | $603K |

| Ghislain Houle | Cdn. National (CNR) | $1.0M |

| Olivier Chouc | Cdn. National (CNR) | $788K |

| Joel Couture | Toromont (TIH) | $591K |

| Louis Tetu | Coveo (CVO) | $200K |

Flagging the buying at Coveo (CVO), which follows a 25% haircut after weak guidance given with Q3 results. Good to see Louis (CEO) stepping in here to calm the market.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Bombardier (BBD) | 1.21 | 1.41 |

| 🇨🇦 Lightspeed (LSPD) | 0.16 | 0.12 |

| 🇨🇦 Canadian Tire (CTC) | 3.13 | 2.84 |

| 🇨🇦 TC Energy (TRP) | 0.77 | 0.78 |

| 🇨🇦 Canada Goose (GOOS) | -0.14 | -0.11 |

| 🇨🇦 Cascades (CAS) | 0.38 | 0.30 |

| 🇨🇦 Enerflex (EFX) | 0.59 | 0.58 |

| 🇨🇦 TransAlta (TA) | -0.02 | 0.07 |

| 🇨🇦 Quebecor (QBR) | 628M | 616M |

| 🇨🇦 Cdn. Natural (CNQ) | 0.86 | 0.81 |

| 🇨🇦 WELL Health (WELL) | 0.16 | 0.10 |

| 🇨🇦 Jamieson (JWEL) | 0.41 | 0.41 |

| 🇨🇦 NFI Group (NFI) | 0.10 | 0.10 |

| 🇨🇦 Leon's (LNF) | 0.65 | 0.62 |

| 🇨🇦 IGM Financial (IGM) | 1.26 | 1.17 |

| 🇨🇦 Saputo (SAP) | 0.48 | 0.47 |

| 🇨🇦 Lassonde (LAS-A) | 5.40 | 4.84 |

| 🇨🇦 Trisura (TSU) | 0.71 | 0.71 |

| 🇨🇦 Pembina (PPL) | 0.47 | 0.62 |

| 🇨🇦 Definity (DFY) | 1.03 | 0.78 |

| 🇨🇦 Lundin (LUG) | 0.86 | 1.07 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Emera (EMA) | AM | 0.86 |

| 🇨🇦 Brookfield Infra (BIP) | AM | 0.31 |

| 🇨🇦 Enbridge (ENB) | AM | 0.51 |

| 🇨🇦 Brookfield Asset (BAM) | AM | 0.40 |

| 🇨🇦 Algonquin (AQN) | AM | 0.06 |

| 🇨🇦 Cdn. Utilities (CU) | AM | 0.39 |

| 🇨🇦 Telus (T) | AM | 0.27 |

| 🇨🇦 Boralex (BLX) | AM | -0.20 |

| 🇨🇦 ATCO (ACO-X) | AM | 0.83 |

| 🇨🇦 Constellation (CSU) | PM | 25.6 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Ivey PMI | 52.4 | 55.2 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 9:30AM | 7.1% |

| 🇨🇦 Employment Change | 9:30AM | -2.5K |

| 🇺🇸 Consumer Sentiment | 11:00AM | 53.2 |

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.