|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Trump signals progress is being made on trade negotiations with Canada

M/M GDP growth was strong, but is unlikely to continue in the coming months

We like Poilievre’s proposed capital gains tax deferral

Recapping Canadian tech earnings season

A Canadian tech CEO just sold $75M in stock

Trump is threatening Russia and Iran, oil prices could move higher

TRADE WAR MONITOR

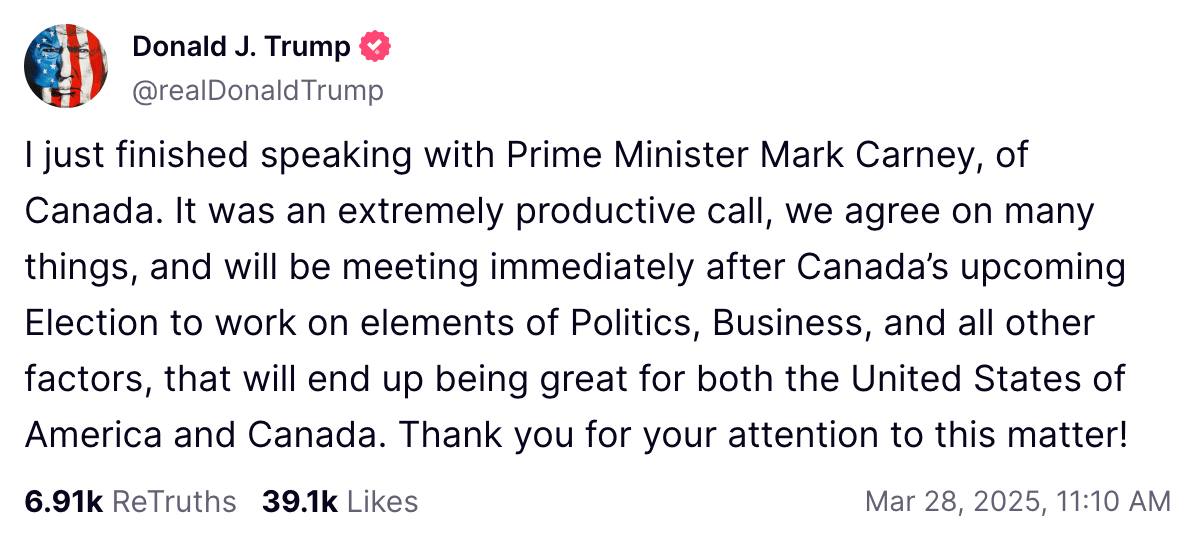

We have movement on the trade front:

Between the absence of 51st state commentary and governor references, it’s clear Trump is in dealmaking mode as we highlighted in our initial piece on auto tariffs.

We think that’s an important anchor… both parties are incentivized to figure this out. When the media would have you believe the sky is falling, remember that this is a negotiation, and deals tend to be struck somewhere in the middle of the extremes.

For now though, expect that April 2nd brings new U.S. tariffs and a Canadian response.

Our framework for navigating the trade war: https://www.bullpen.finance/content/51

HOT OFF THE PRESS

GDP notches highest monthly gain since April

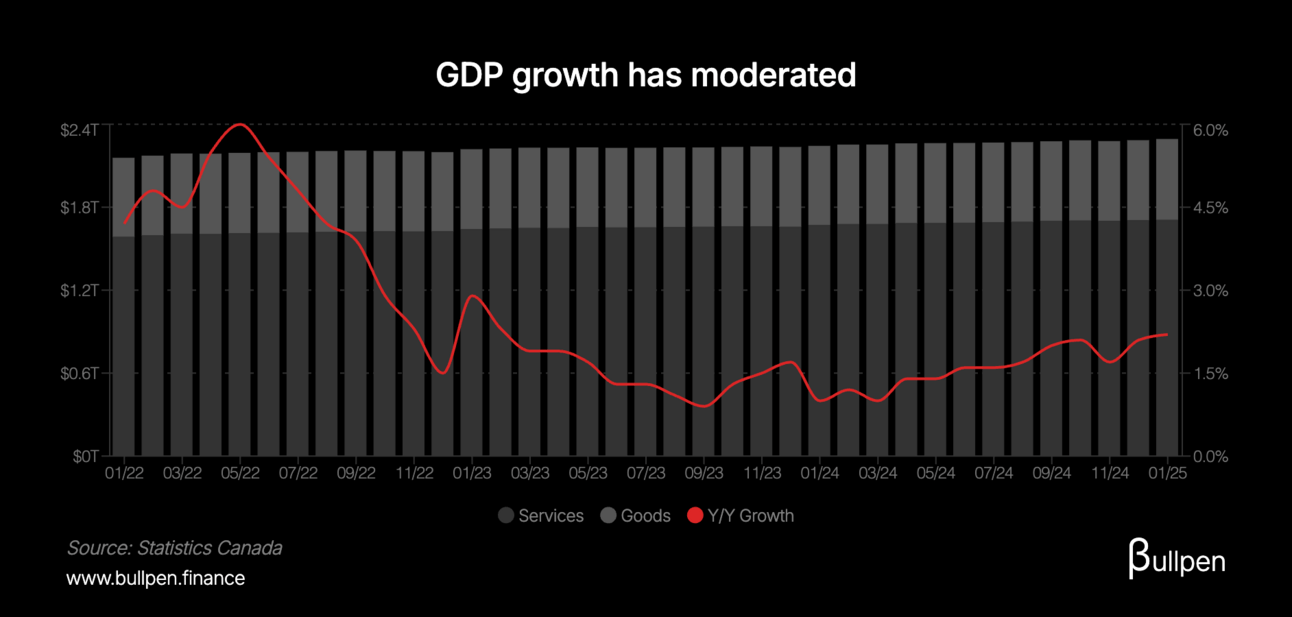

We got GDP data to close out last week, which jumped 0.4% M/M in January (up 2.2% Y/Y), ahead of December’s 0.3% gain and consensus estimates at 0.3%.

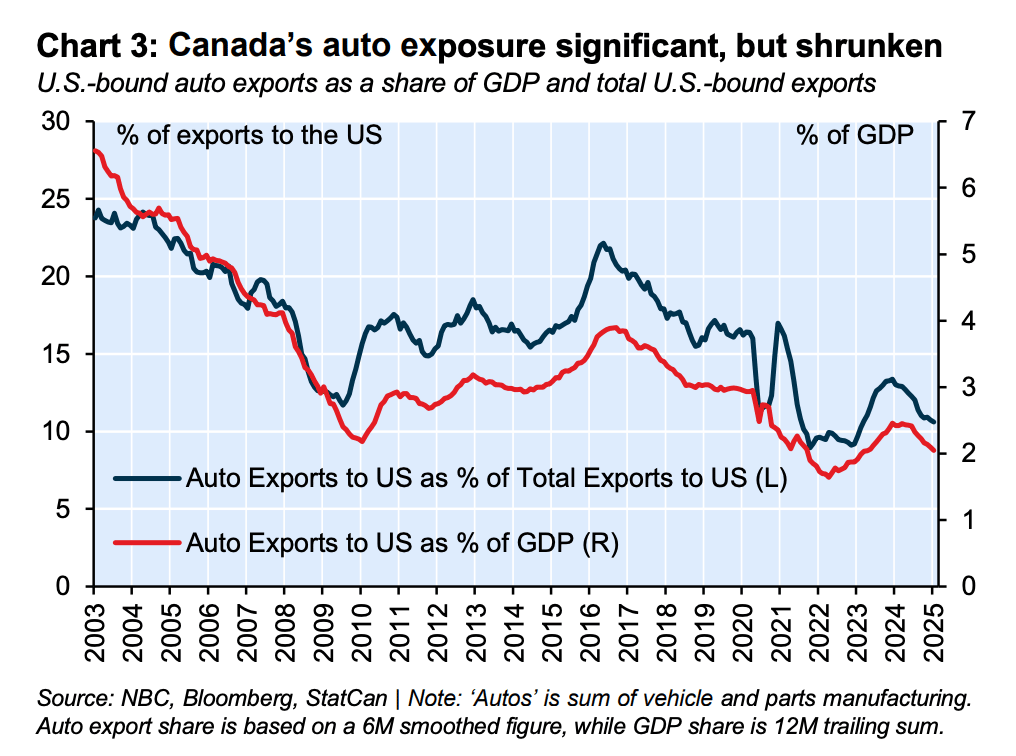

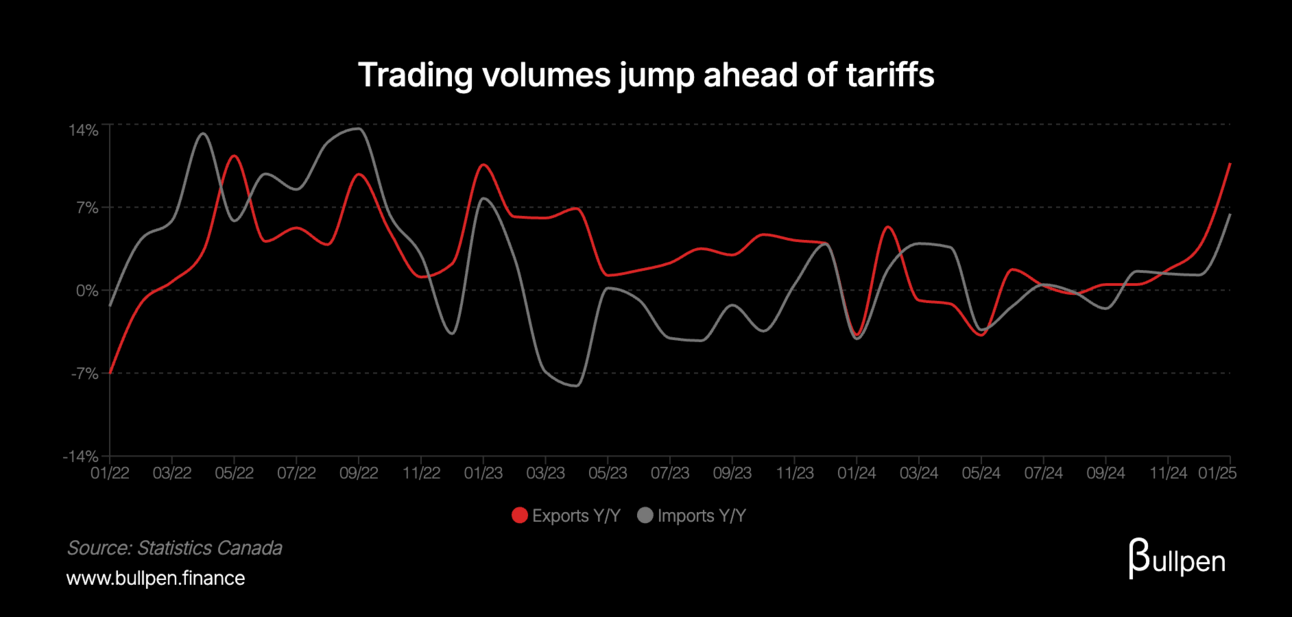

Goods producing industries notched their highest monthly gain in more than 3 years at 1.1%, giving us another data point in support of a pre-tariff pull forward.

The preliminary forecast for February is flat M/M and we could see more pressure through March and April, as the first full months of no tax holiday and tariff implementation bite into consumer demand.

Pierre doubles down on domestic investment

Poilievre continues to take aim at keeping capital in Canada, with a proposed capital gains tax deferral on personal and corporate profits reinvested in Canada from July 1st through 2026.

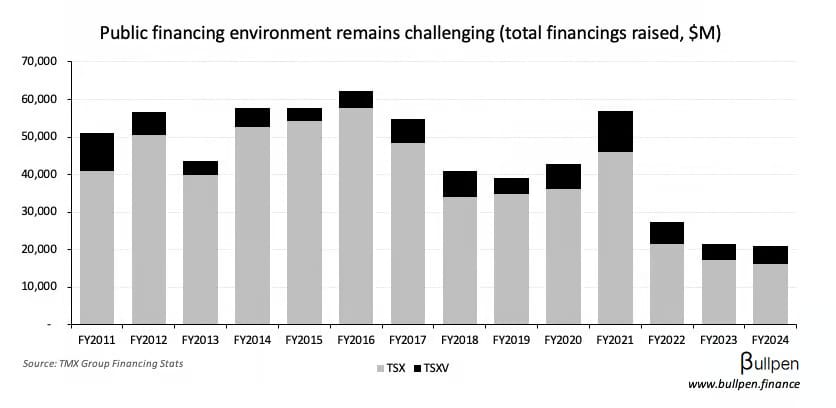

The proposal could have a much bigger impact on domestic flows than the ~$5B annually from Pierre’s TFSA top-up plan and the timing is interesting, with Canadian companies opting for asset sales to offset a challenging financing backdrop.

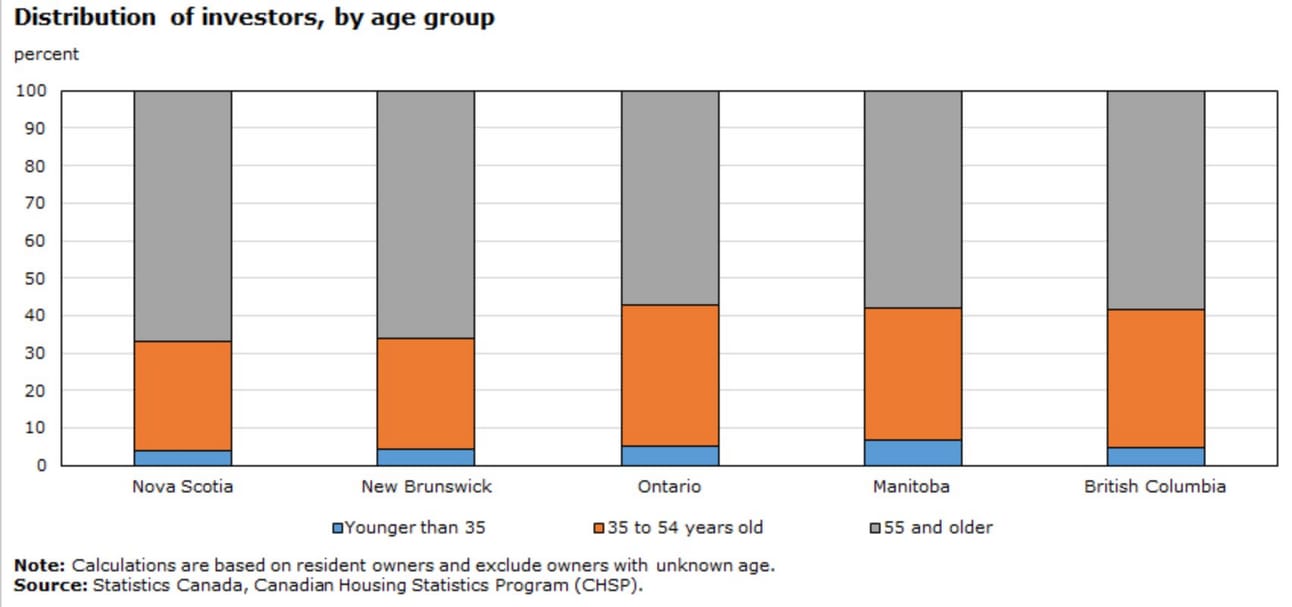

It could also free up housing supply held by the 55+ demographic, who would be able to roll the capital gains from real estate into a lower risk investment to support them in retirement.

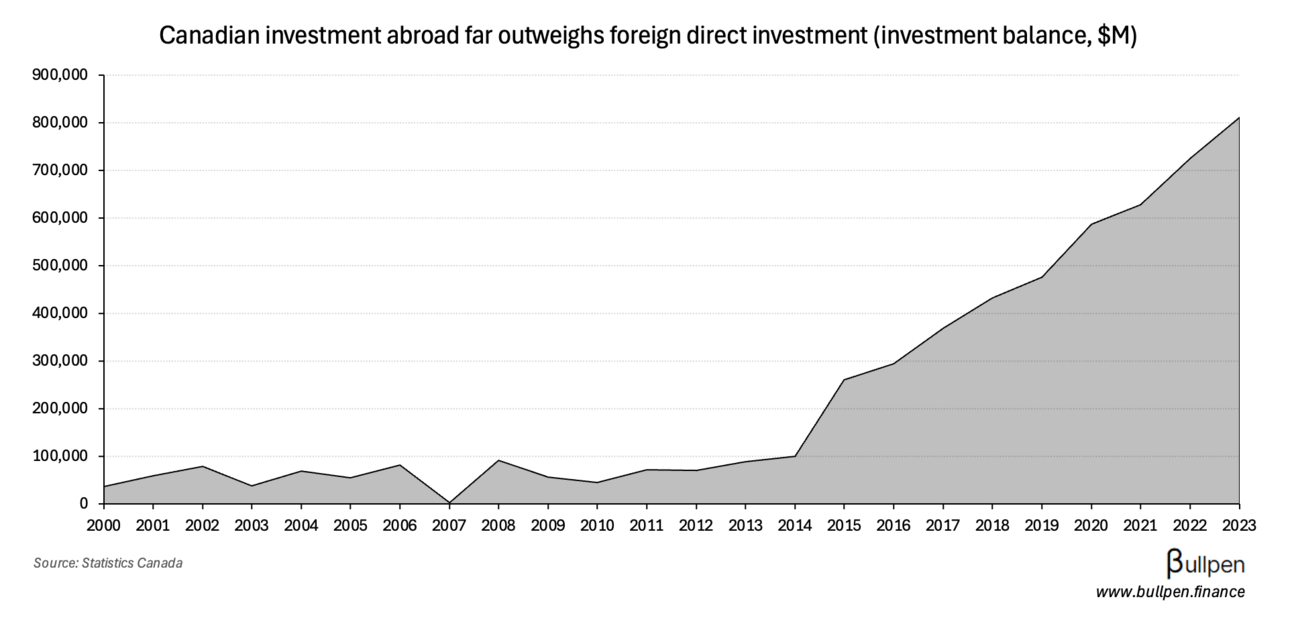

Perhaps most importantly, it could encourage repatriation of Canadian capital invested abroad, which has accelerated over the last decade.

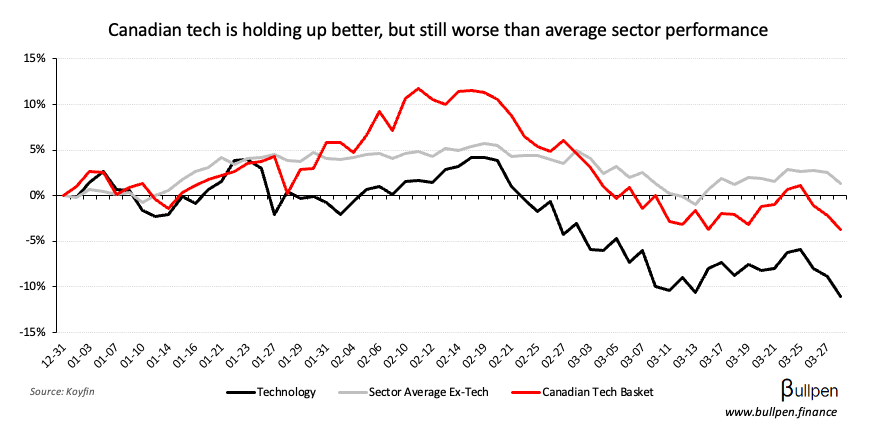

Tech earnings recap: solid quarter all around

We’re back with another earnings recap, this time diving into results out of the Canadian tech universe. Check it out!

If the above link doesn’t work, try this: https://www.bullpen.finance/content/74

FUNNY BUSINESS

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Vitalhub (VHI) was up big on the back of a strong Q4, beating street estimates on both the top and bottom line. VHI has more than tripled since the end of 2023 following Shen Capital (a Canadian growth equity firm) taking a large position and board seat.

Aya Gold & Silver (AYA) went the other way on earnings, missing big on revenue and EBITDA and reversing its YTD gains, while the sector continues to rally.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Jack Lundin | Lundin Mining (LUN) | $485K |

| Michael Shea | Kelt (KEL) | $1.1M |

| Geoffrey Burns | Triple Flag (TFPM) | $8.2M |

| John MacKenzie | Capstone (CS) | $4.4M |

| Robert Orr | Power Corp. (POW) | $11.1M |

| Jean Robitaille | Agnico Eagle (AEM) | $11.1M |

| Jean Robitaille | Orla Mining (OLA) | $4.0M |

| Gary Brown | Wheaton (WPM) | $949K |

| Mark Leonard | Constellation (CSU) | $75.0M |

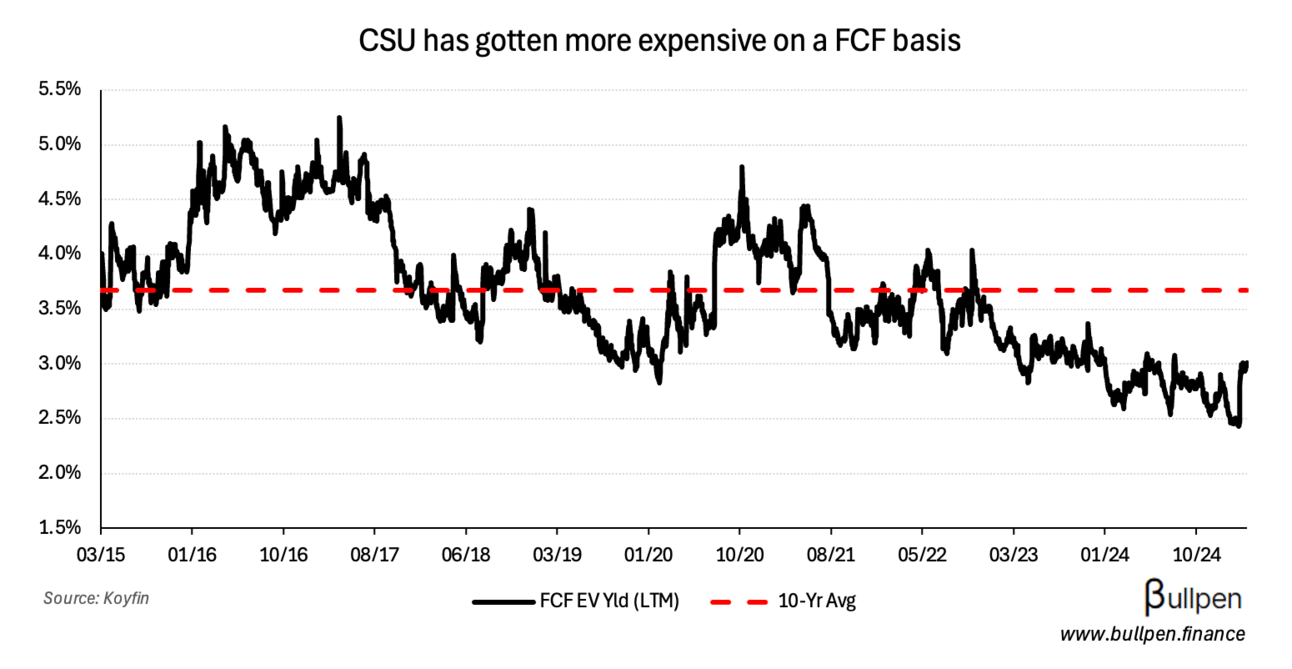

Flagging the Mark Leonard sale here for $75M, as it’s the first big insider sale at Constellation (CSU) this year and one of only a handful of sales by the founder.

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 G Mining (GMIN) | 0.53 | 0.23 |

| 🇨🇦 Aimia (AIM) | 17M | 10M |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Westport Fuel (WPRT) | AM | -0.28 |

| 🇨🇦 Pizza Pizza (PZA) | PM | 0.25 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | 0.4% | 0.3% |

| 🇺🇸 Core Price Index M/M | 0.4% | 0.3% |

| 🇺🇸 Personal Income M/M | 0.8% | 0.4% |

| 🇺🇸 Personal Spending M/M | 0.4% | 0.5% |

| 🇺🇸 Consumer Sentiment | 57.0 | 57.9 |

| 🇺🇸 PCE Price Index M/M | 0.3% | 0.3% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Chicago PMI | 8:45AM | 45.4 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Watch for oil this week, as Trump threatens Russia with oil tariffs and Iran with bombing.