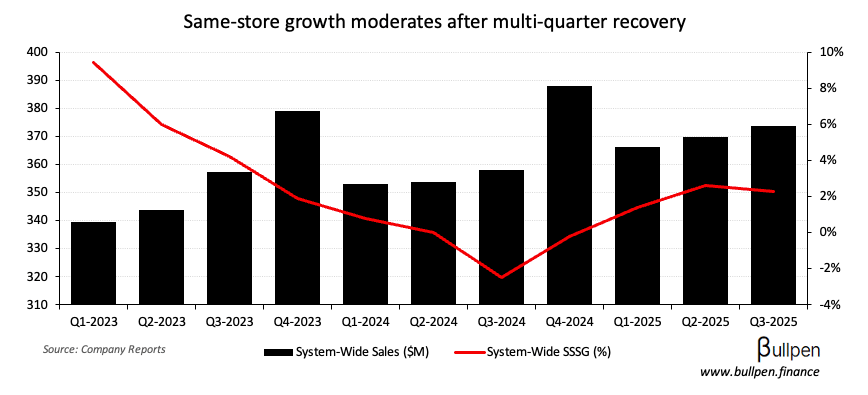

Pet Valu (PET) lost 16% after reporting a Q3 miss, driven by a slowdown in same-store sales growth…

… which prompted the company to tighten its full-year guide towards the bottom half of its previous targets ($1.18B of revenue, ~$260M of EBITDA).

The 2026 outlook was the nail in the coffin, with management’s skepticism around an industry recovery likely to drive downward estimates revisions…

… we think industry growth will remain below its long-term mid-single-digit run rate through next year.

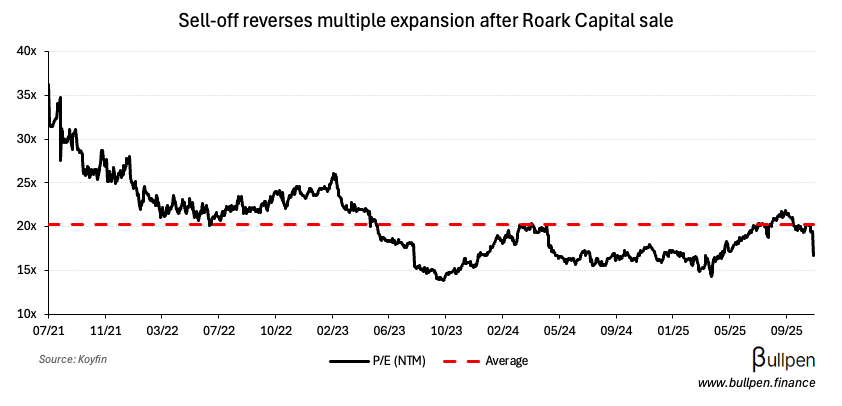

… and keep investors sidelined until they have line of sight to a rebound. With shares giving back gains following Roark Capital’s exit in June, this one could chop sideways for a while.