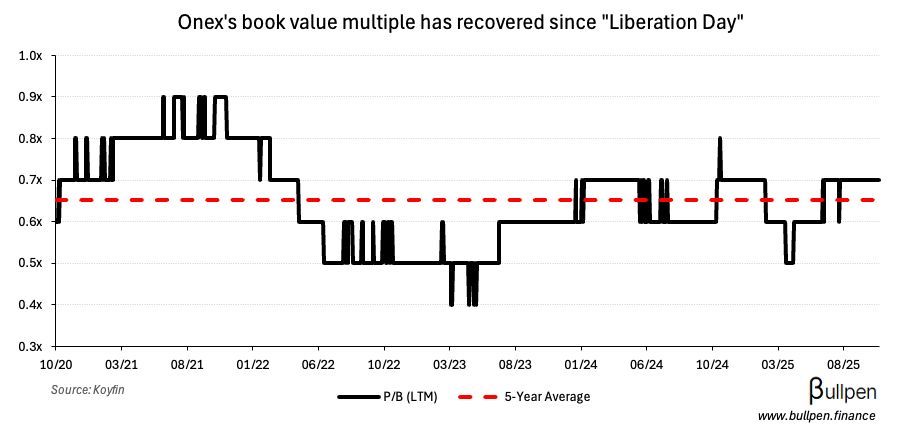

Onex Corp. (ONEX) rose 3% on the back of a transformational $7B acquisition of Convex, a specialty P&C insurer that’s been in Onex Partners’ portfolio since 2019 - giving its partners a nice exit…

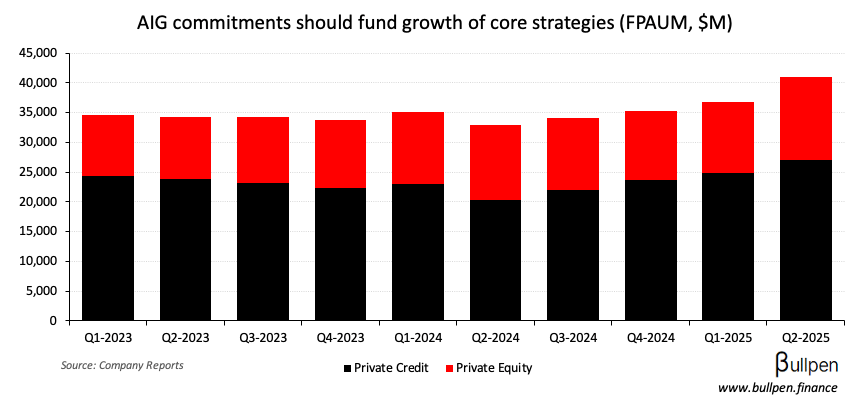

… and bringing the insurer onto the balance sheet for a permanent source of capital. It also locks down AIG as a partner - who took 35% of the deal, 9.9% of ONEX, and made $2B of capital commitments over the next three years.

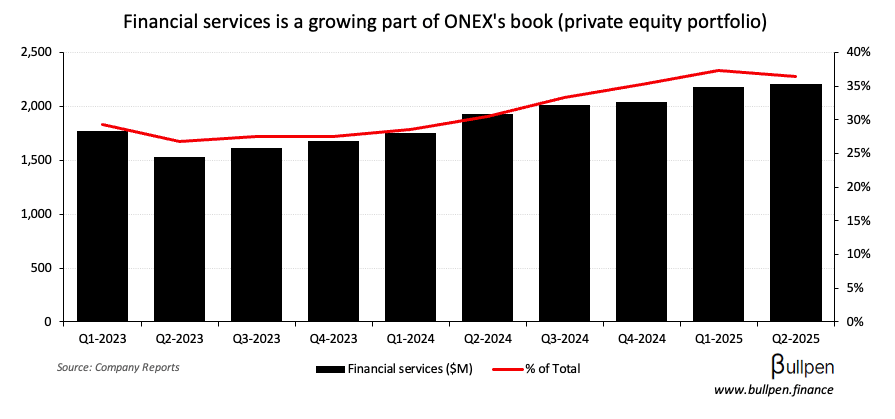

As the market prices in these changes, valuation could drift higher - given the stability that a consistent stream of insurance premiums brings.

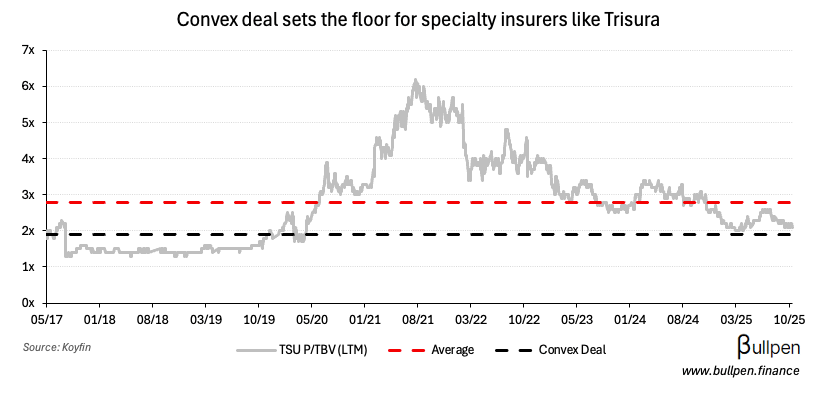

The Convex deal also sets a floor for similar specialty P&C insurers like Trisura (TSU), with the $7B price tag translating to a 1.9x multiple on tangible book value.