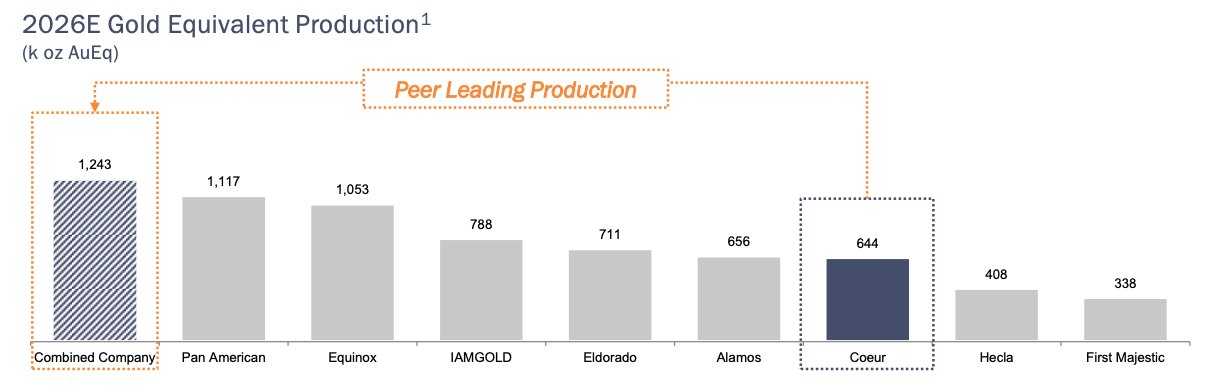

Another Canadian miner is in play, with Coeur (CDE) proposing a $7B all-stock deal for New Gold (NGD) - positioning the combined company as a North American leader in precious metals production…

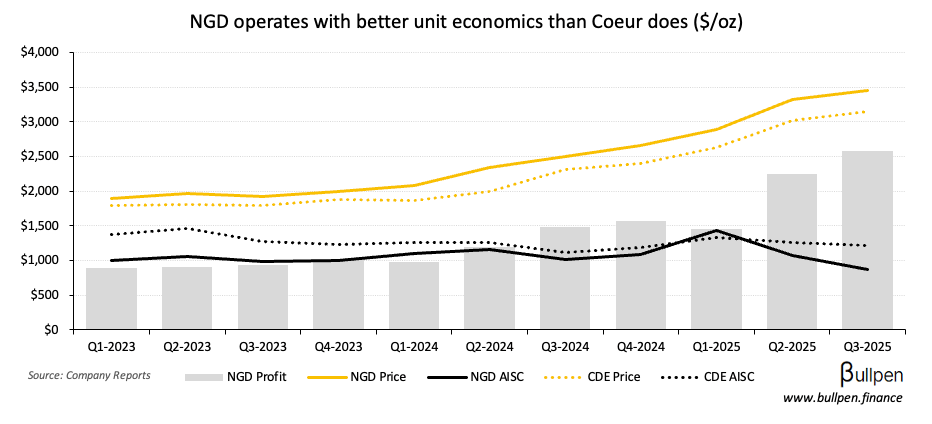

… and one with better economics, given NGD’s low cost production profile and leverage to gold prices.

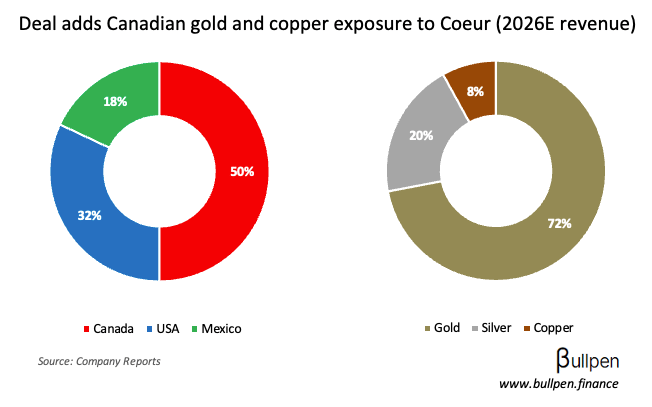

Coeur also gets some copper exposure with the deal, which could be a regulatory hurdle if the $75B Teck/Anglo merger is any indication…

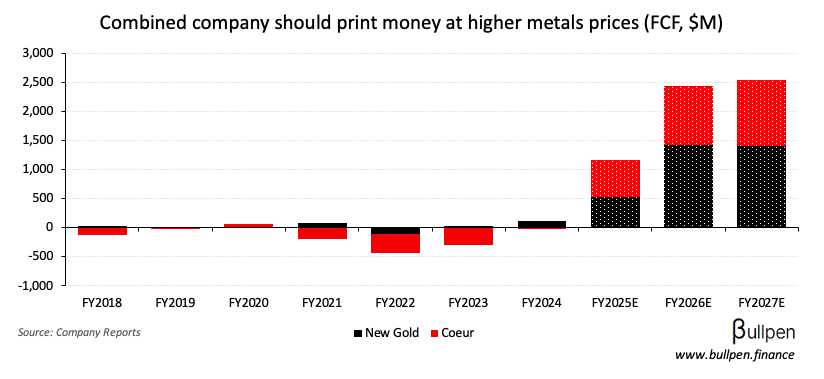

… but management appears committed to Canada, indicating it will pursue a TSX listing and ramp up investment in the acquired assets. There’s a lot of cash waiting on the other side of an Investment Canada approval…

… which could drive a re-rate, given the better trading liquidity and index inclusion opportunities that come with being an American company.