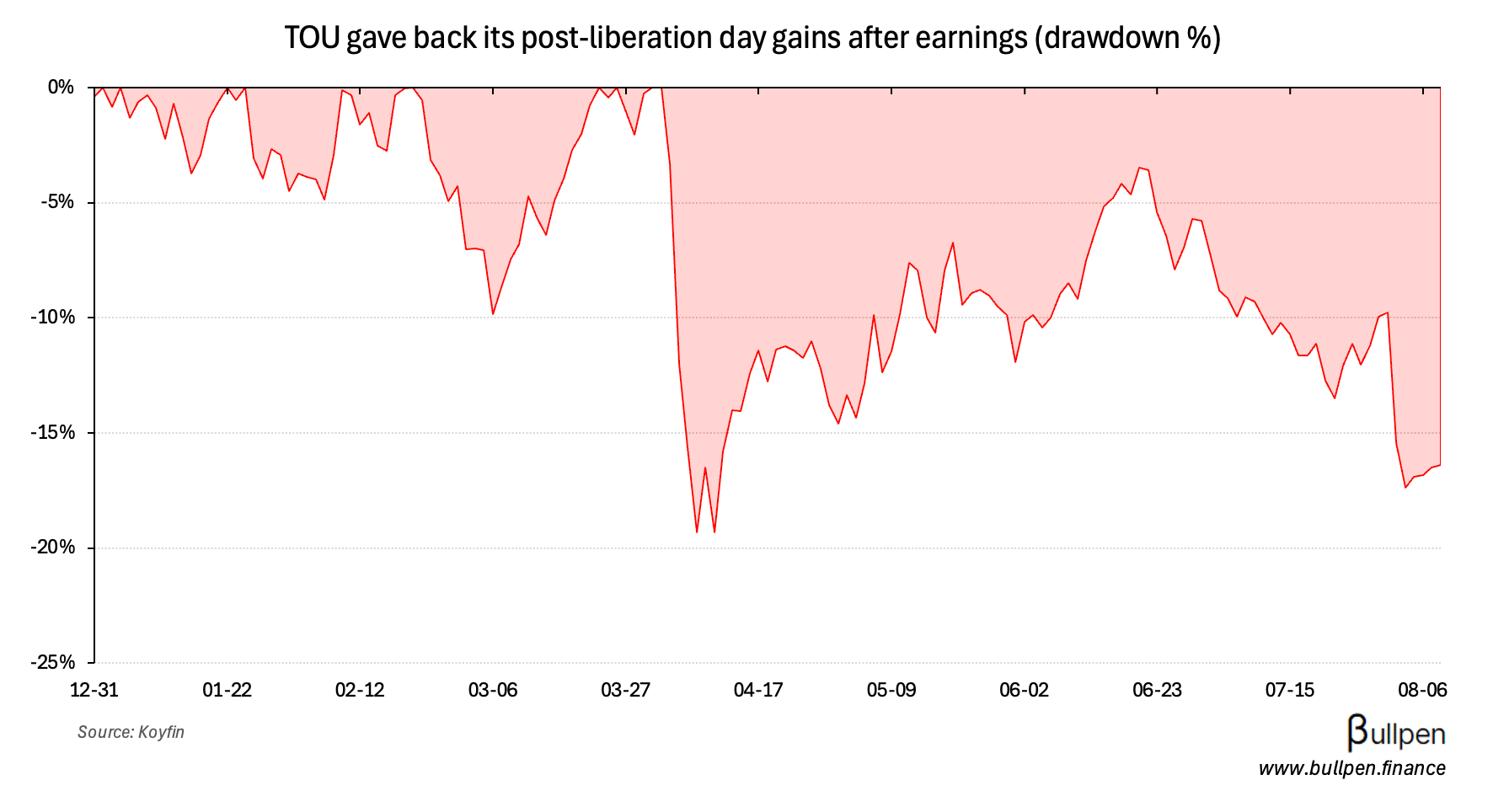

Mike Rose (founder & CEO) of Tourmaline (TOU) has been steadily adding shares in recent years in $100-500K chunks - but he pulled the trigger on a $6.9M buy Friday, following a ~10% post-earnings drawdown in shares.

The sell-off was guidance-driven, as management pointed to lower full-year production due to weakness in gas pricing and an increased CapEx plan linked to its $290M acquisition of Groundbirch from Strathcona.

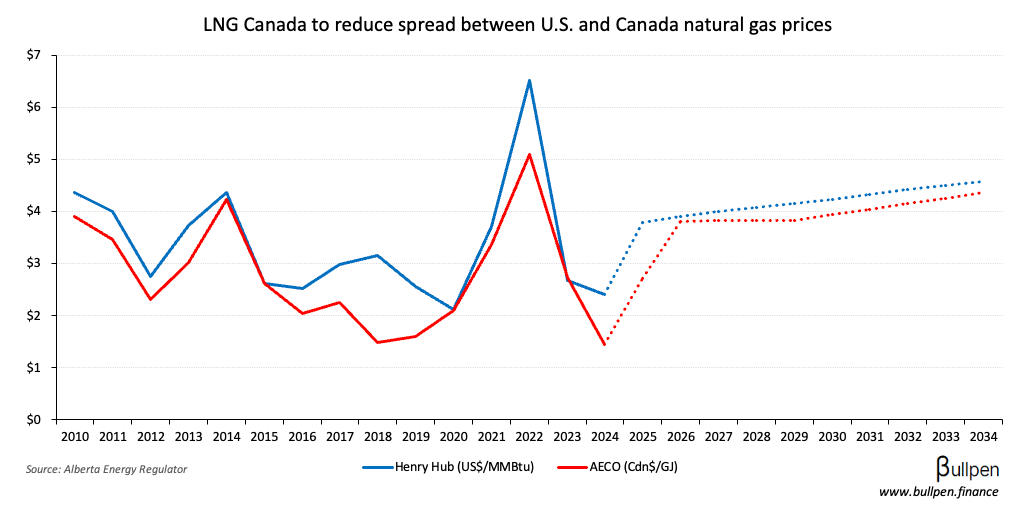

With LNG Canada ramping up through the beginning of 2026, next year could bring a more constructive pricing environment - Mr. Rose is likely counting on it.