|

TSX

1D %

YTD %

|

27,036.16

0.0%

8.6%

|

|

|

TSXV

1D %

YTD %

|

755.22

0.2%

22.3%

|

|

|

S&P 500

1D %

YTD %

|

6,279.35

0.8%

7.0%

|

|

|

NASDAQ

1D %

YTD %

|

20,601.10

1.0%

6.9%

|

|

|

US 10Y

1D

YTD

|

4.35

7 bps

22 bps

|

|

|

DJIA

1D %

YTD %

|

44,828.53

0.8%

5.8%

|

|

|

CA 10Y

1D

YTD

|

3.36

2 bps

14 bps

|

|

|

CAD/USD

1D %

YTD %

|

0.735

0.2%

5.7%

|

|

Trade deals turn defense to offense

Market volumes recover in June

H&R could be the next REIT to go

Elon to form a third political party

TIXT jumps on potential for higher bid

Trade deals spark offensive rotation

Wednesday’s deal between the U.S. and Vietnam gave us a preview of how the Canadian market might react to a wave of trade agreements - with investors rotating within sectors from defensive names to more economically sensitive companies.

With Trump’s 90-day pause on tariffs ending July 9th, this week feels binary. If deals get over the line, expect more aggressive positioning. If the week underwhelms, expect more defensive positioning and pause extensions. Regardless, expect volatility.

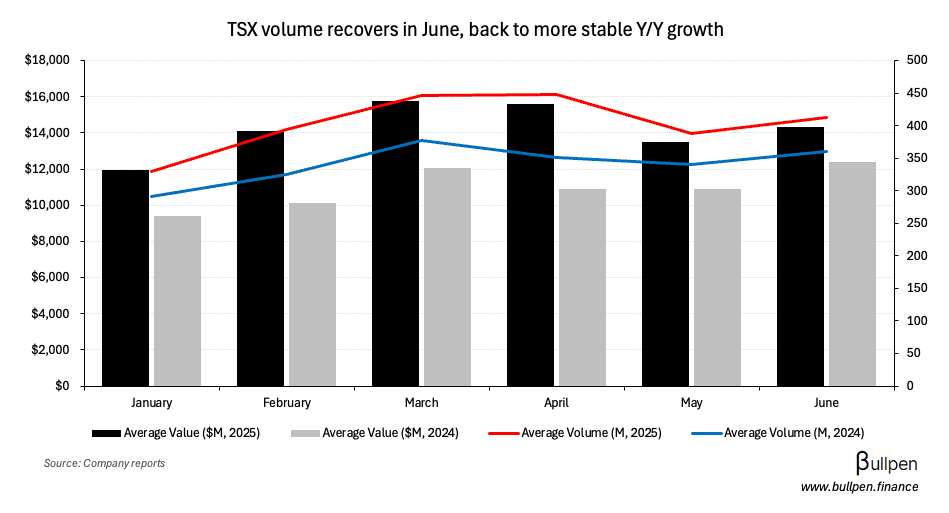

Volumes recover from classic May lull

Both volume and value traded in June recovered from what’s typically a slow May, with TSX volumes up 6% M/M and 15% Y/Y - normalizing versus April’s near-30% Y/Y jump driven by liberation day volatility.

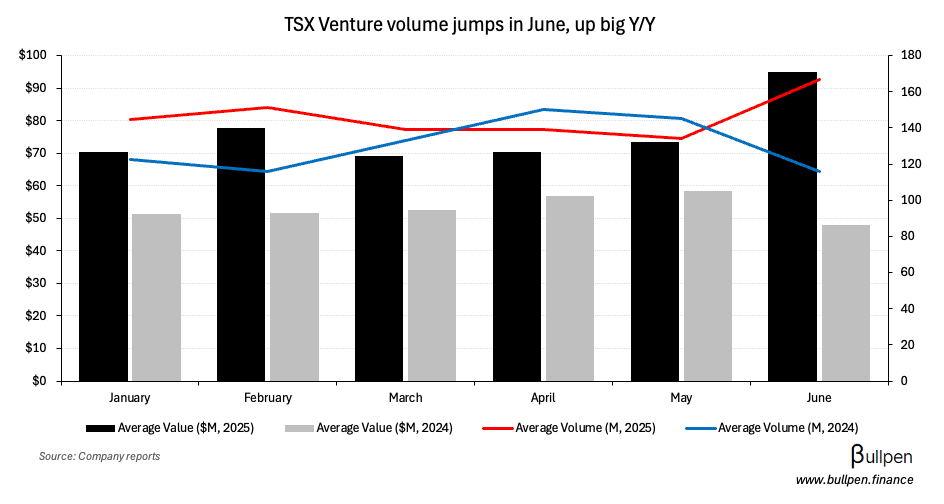

The venture exchange was particularly hot, with volumes up 24% M/M and 44% Y/Y - indicating Canadian small caps are getting some love. With increased liquidity and the TSXV up 22% YTD…

… we could see more equity financings soon. TMX Group (X) would welcome that, given activity on this exchange has been muted for years.

H&R could be the next REIT to go

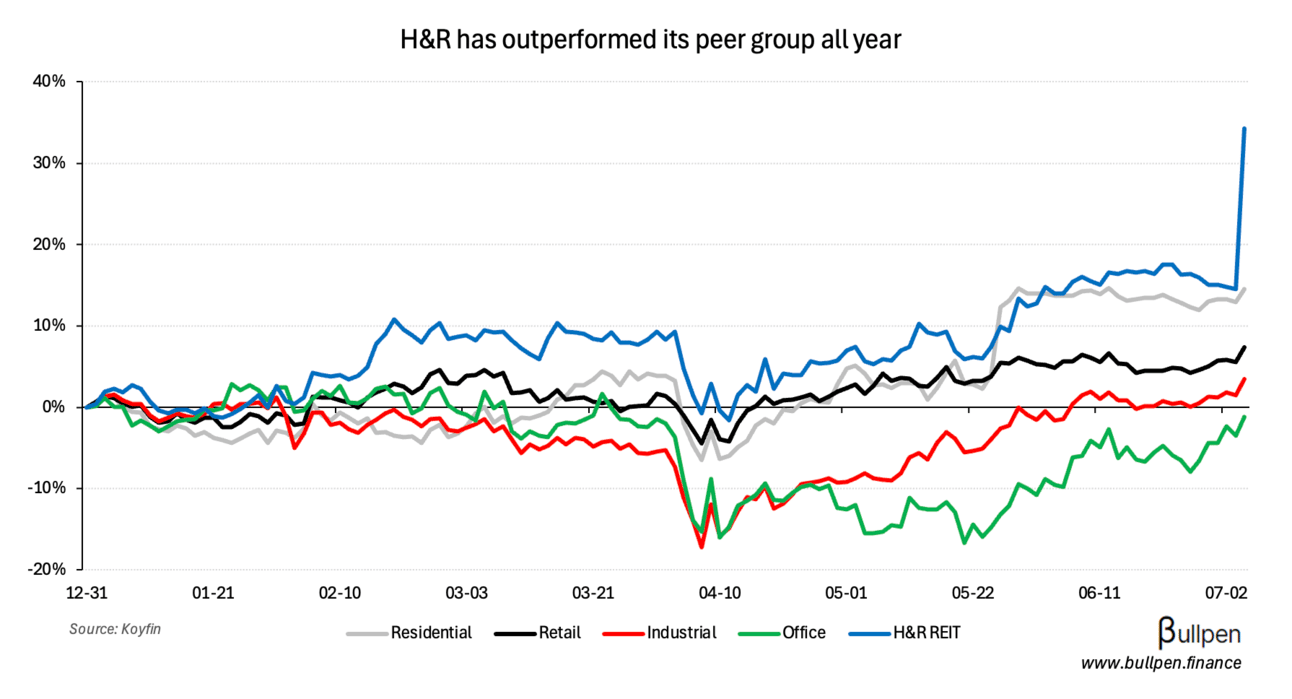

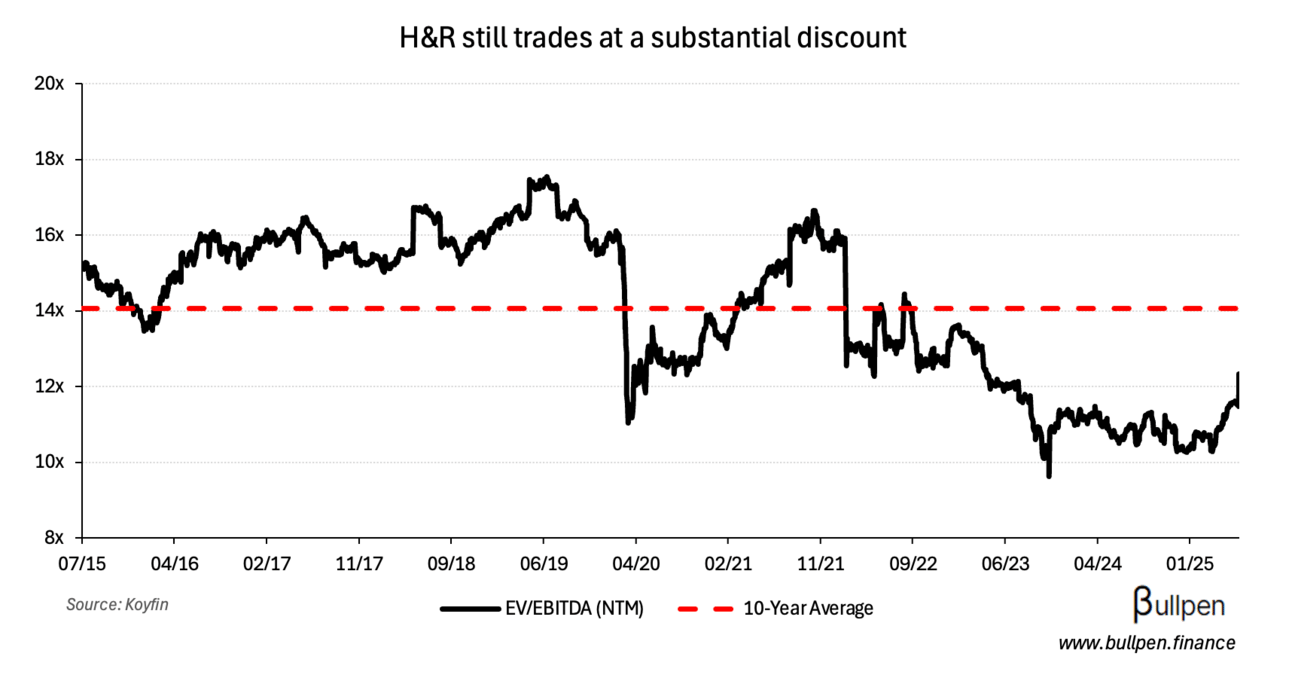

Just a month after the $2B take-private bid for InterRent it looks like H&R REIT (HR-U) could be next, with the stock up 17% after management confirmed the company has received several offers.

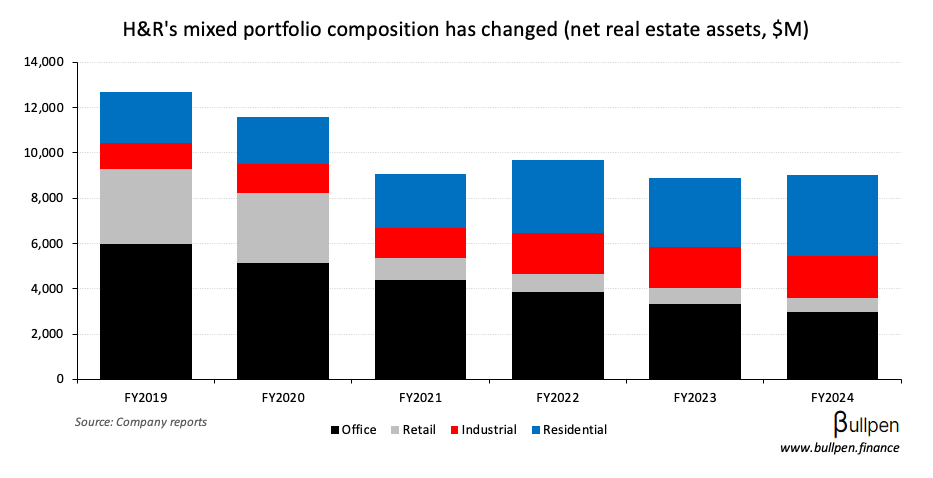

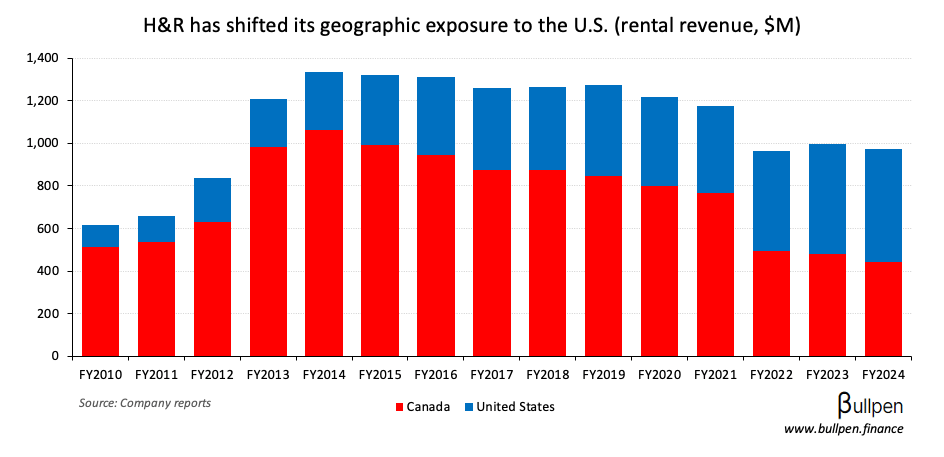

Even with Friday’s jump, H&R trades at a near-40% discount to its reported NAV of $20.62/unit, likely owing to the complexity of its portfolio - with a sizeable residential, industrial, and office footprint…

… and mixed geographic exposure.

While a buyer of the entire portfolio would want a discount, there’s still plenty of upside in a takeout scenario. A partial sell-down of the office and retail assets could also unlock value, accelerating the company’s multi-year portfolio transformation.

The ‘America Party’ strategy is clear: appeal to the political middle, win a handful of Senate seats and House districts in 50/50 regions, and become the swing vote - forcing all parties to negotiate with them.

Dozens of new parties have tried and failed to garner political influence in the past, but none were spearheaded by a man worth $400B that has a direct line to 245M daily users. Oh, and if you were wondering what the party’s stance is on immigration…

| Insider |

Company |

Value |

| Sustainable Capital |

Geodrill (GEO) |

$134K |

| Pamela Arpin |

Canadian Pacific (CP) |

$933K |

| Guido Mastropietro |

Pan American (PAAS) |

$115K |

| Anthea Bath |

Wesdome (WDO) |

$136K |

| Kyle Floyd |

Vox Royalty (VOXR) |

$648K |

| Patrick Carlson |

Kiwetinohk (KEC) |

$436K |

| Salim Manji |

Extendicare (EXE) |

$542K |

Flagging the Kiwetinohk buying here, as it continues to be all positive from insiders. Patrick’s buy comes after the stock gained nearly 30% since the start of June.

|

H&R (HR-U)

1D %

YTD %

|

12.46

17.2%

34.3%

|

|

|

Alithya (ALYA)

1D %

YTD %

|

2.28

7.3%

54.1%

|

|

|

Telus Int. (TIXT)

1D %

YTD %

|

5.37

5.9%

5.0%

|

|

|

NGEx Minerals (NGEX)

1D %

YTD %

|

15.35

4.4%

14.5%

|

|

|

StorageVault (SVI)

1D %

YTD %

|

4.21

4.7%

6.9%

|

|

|

Southern Cross (SXGC)

1D %

YTD %

|

5.92

4.5%

69.6%

|

|

When the transaction was announced a month ago, I noted the market was expecting a higher price tag - that’s looking more likely today.

FRIDAY’S ECONOMIC RELEASES

| Release |

Actual |

Consensus |

| 🇨🇦 S&P Composite PMI |

44.0 |

- |

| 🇨🇦 S&P Services PMI |

44.3 |

- |

TODAY’S ECONOMIC RELEASES

| Release |

Time |

Consensus |

| 🇺🇸 3-Month Bill Auction |

11:30AM |

- |

| 🇺🇸 6-Month Bill Auction |

11:30AM |

- |

|

WTI Crude

1D %

YTD %

|

67.16

0.4%

6.5%

|

|

|

Gold

1D %

YTD %

|

3,328.70

0.9%

26.8%

|

|

|

Nat Gas

1D %

YTD %

|

3.40

2.4%

5.5%

|

|

|

Silver

1D %

YTD %

|

36.85

0.8%

27.6%

|

|

|

Lumber

1D %

YTD %

|

610.64

0.7%

10.9%

|

|

|

Copper

1D %

YTD %

|

5.09

1.1%

27.9%

|

|

|

Soybean

1D %

YTD %

|

1,054.81

0.4%

5.5%

|

|

|

Aluminum

1D %

YTD %

|

2,595.65

0.5%

1.5%

|

|

|

Corn

1D %

YTD %

|

431.98

0.6%

5.7%

|

|

|

Wheat

1D %

YTD %

|

556.28

1.4%

0.9%

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.