|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Maple Leaf Foods spins out pork unit

Open Text continues non-core sales

The pipeline tug of war begins

BRP runs ahead of investor day

HOT OFF THE PRESS

Maple Leaf Foods spins out pork unit

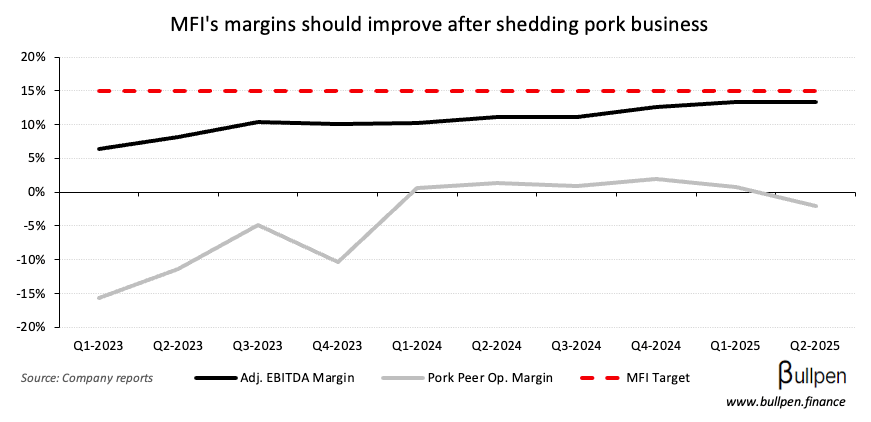

Maple Leaf Foods (MFI) has completed the spin-out of its pork business, Canada Packers (CPKR) - a move investors expect will drive margin expansion…

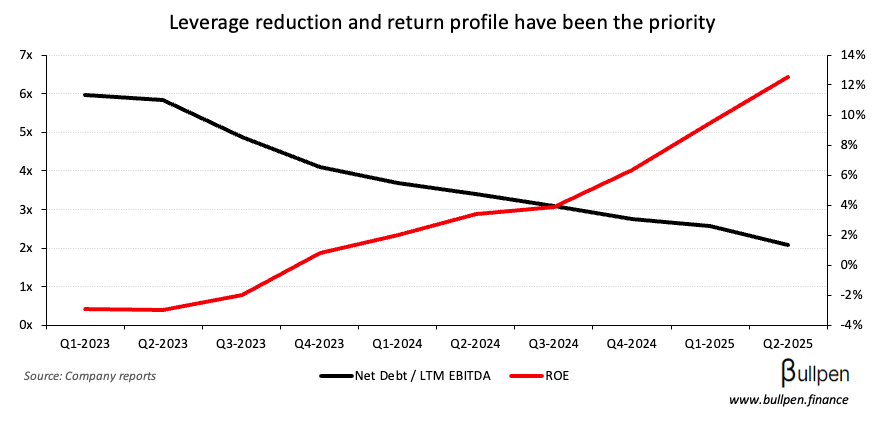

… and further leverage reduction, which should support continued improvement in MFI’s return profile.

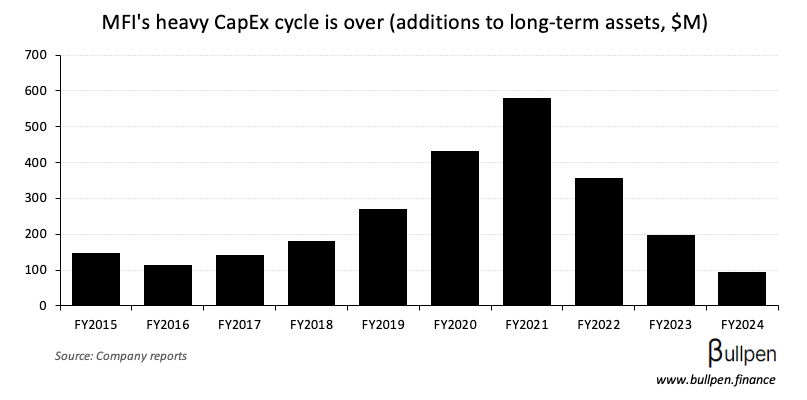

With its heavy CapEx cycle now over…

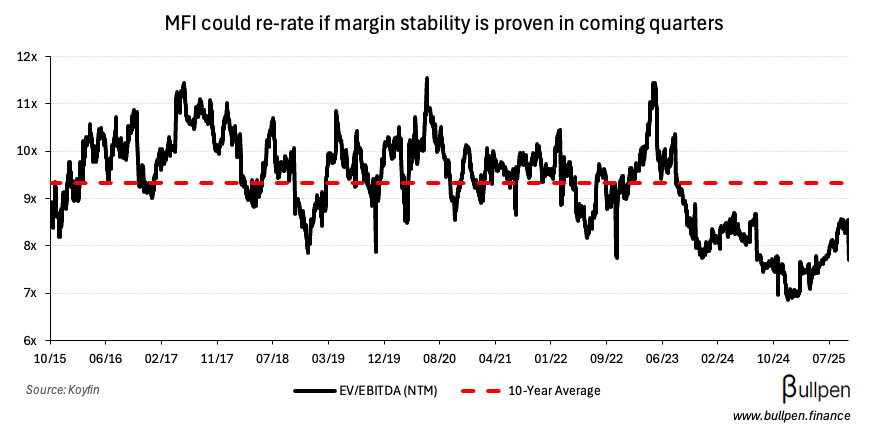

… proof of execution and the stability coming from this pork carve-out could drive a multiple re-rate for MFI.

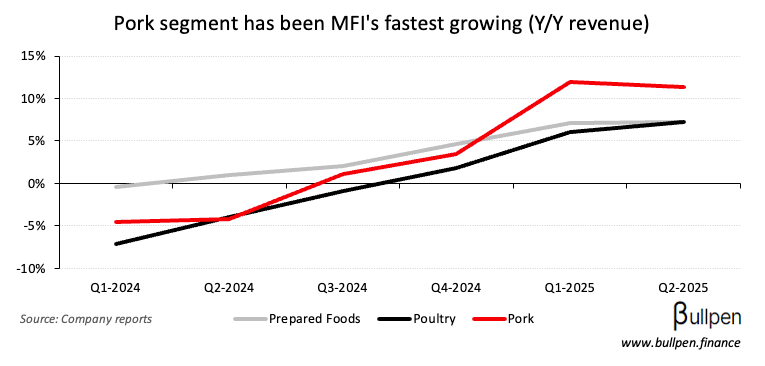

If nothing else, the separation was opportunistic - with Canada Packers being Maple Leaf’s fastest growing segment…

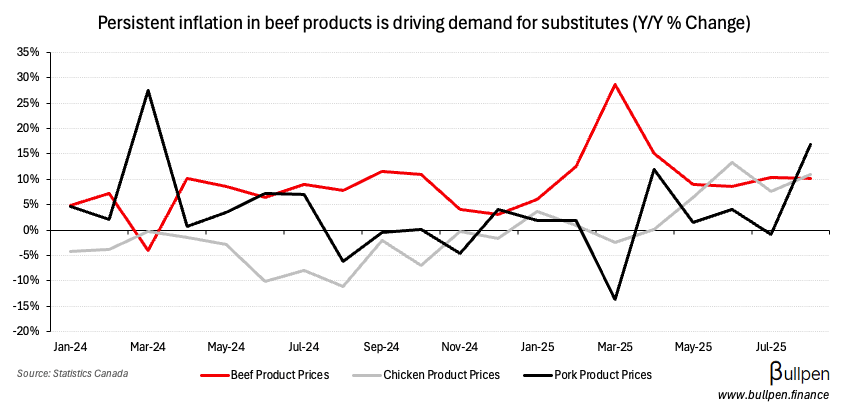

… driven by persistent inflation in beef, which has shifted demand to substitutes like pork…

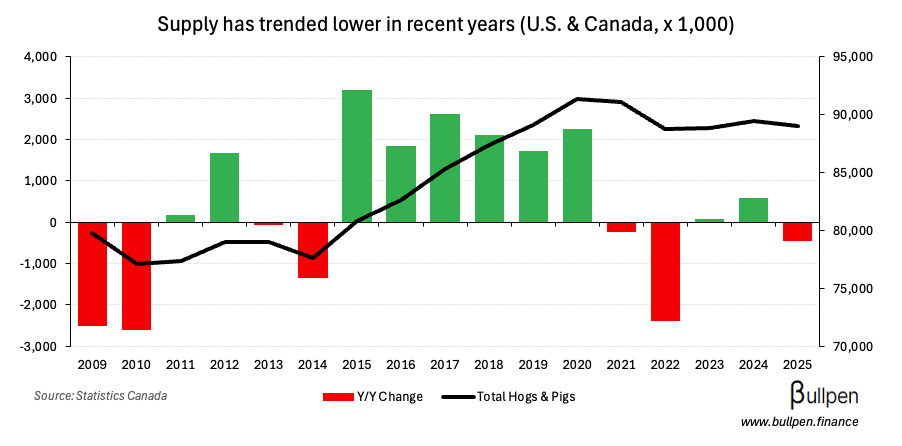

… at a time when supply hasn’t kept pace, pushing prices higher…

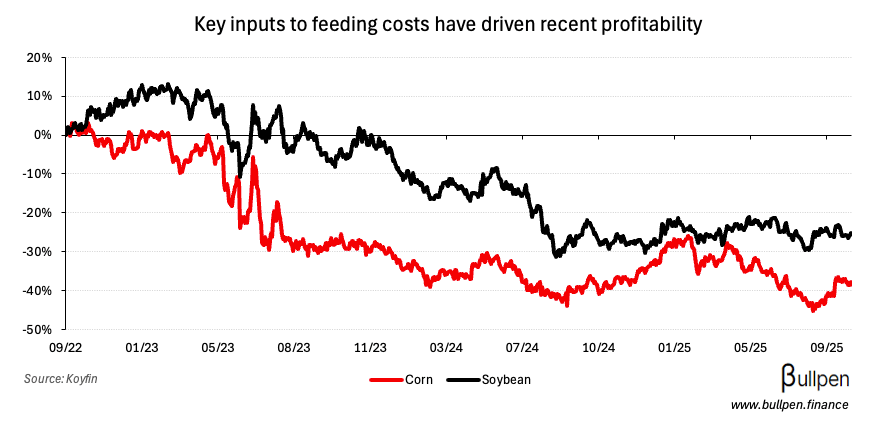

… while key feed inputs like corn and soybean have gone in the opposite direction.

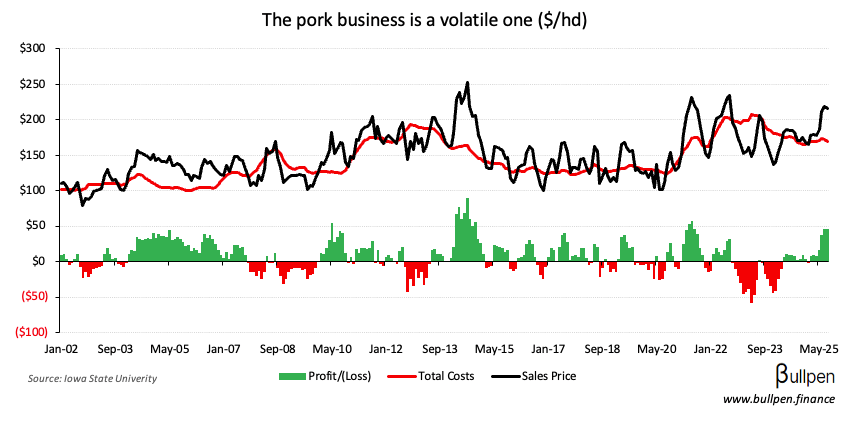

That’s driven a period of strong profitability, making it a perfect time to market a standalone entity. But as history has shown, pork is a cyclical business…

… and with shares down 12% in the first day of trading, my fingers are crossed that we don’t end up with a replay of Telus Digital. If we do, MFI could “bring home the bacon” when the cycle turns.

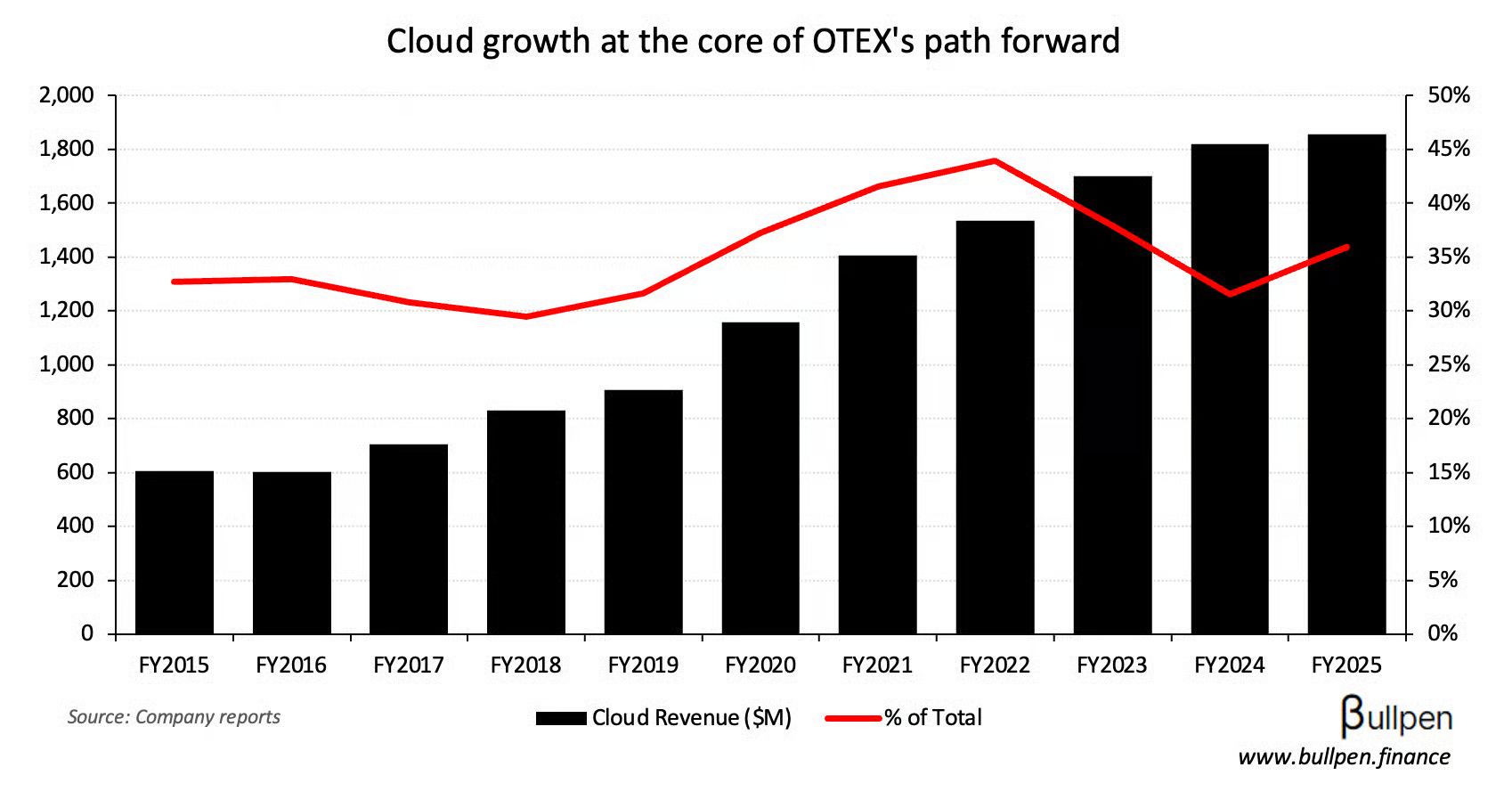

Open Text sells non-core unit for $163M

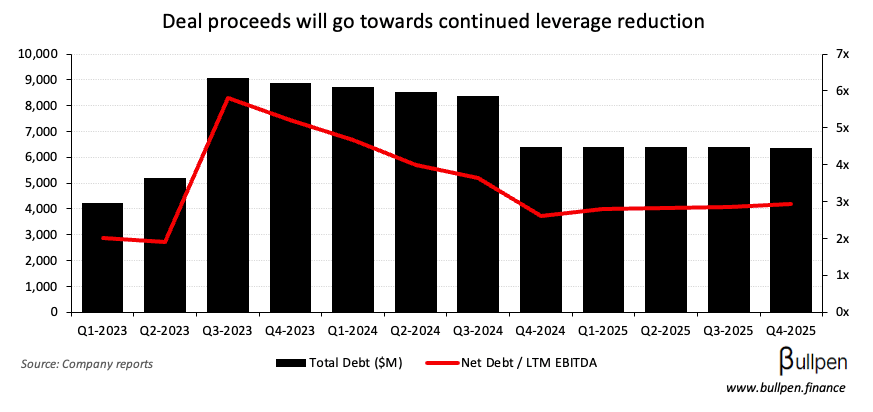

Open Text (OTEX) announced another non-core divestiture, selling eDOCS to NetDocuments for $163M. The deal sheds $30M in revenue (sub-1%) and tightens the focus on its cloud business…

… and financial position, with the proceeds earmarked for leverage reduction.

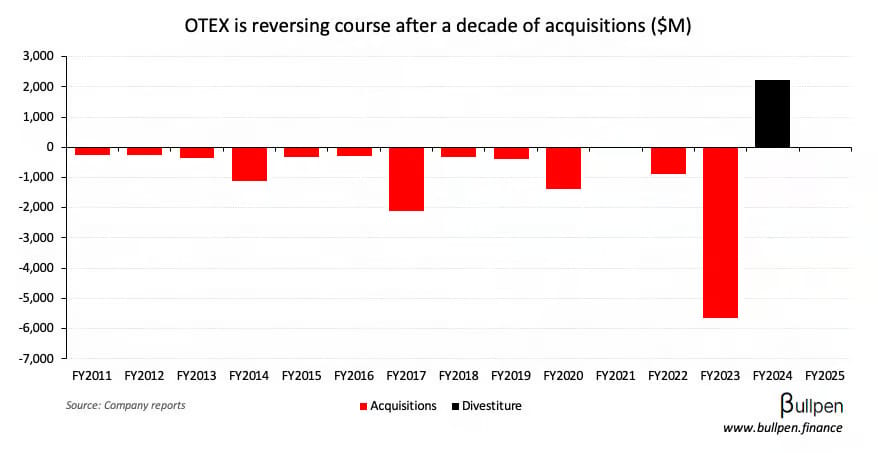

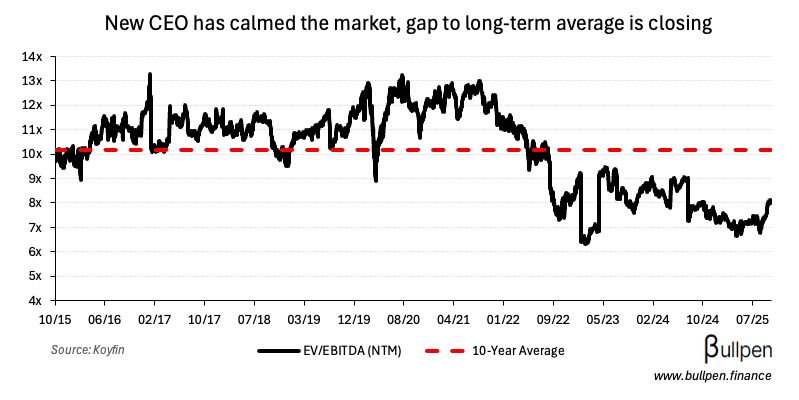

The sell-down continues the company’s shift away from the former CEO’s M&A focused growth strategy…

… a narrative the market appears to be warming up to, with the stock up nearly 30% since new leader James McGourlay took over in August.

FUNNY BUSINESS

Alberta intends to submit a pipeline proposal by May, aiming to send oil to the west coast in order to reduce U.S. market reliance. Given historical precedent, there’s no private capital behind this today…

… making it an easy target for BC, who stands firmly against changing the tanker ban. As production eventually outgrows existing capacity, a new pipeline would keep the Canadian oil discount at a minimum…

… and bring investor sentiment towards the sector back from the grave. Let’s see how it plays out.

ON OUR RADAR

There’s been a lot of small deals recently:

Some other noteworthy press releases:

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

BRP Inc. (DOO) gained 4% today after making changes to its debt stack - netting out to a $200M repayment, $265M extension, and a 50 bps interest rate reduction. The company’s new strategic plan is coming next week, likely targeting margin expansion…

… and top-line growth, which re-accelerated in Q2 for the first time in eight quarters.

Up ~20% since then and priced slightly above its long-term average, the event could dictate where it trades from here.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Ramiro Morales | Andean (APM) | $308K |

| Dominique Girard | Agnico Eagle (AEM) | $2.0M |

| David Cornhill | Imperial (IMO) | $1.6M |

| Joseph Tremblay | Taseko (TKO) | $528K |

| Kerry O'Reilly | TransAlta (TA) | $747K |

| Rod Antal | SSR Mining (SSRM) | $1.4M |

| Michael Sparks | SSR Mining (SSRM) | $200K |

| Keith Macnevin | SSR Mining (SSRM) | $455K |

| Fady Farid | SSR Mining (SSRM) | $441K |

| John Ebbett | SSR Mining (SSRM) | $319K |

| Joanne Thomopoulos | SSR Mining (SSRM) | $215K |

| Ohad Epschtein | Anaergia (ANRG) | $433K |

| Mike Rose | Tourmaline (TOU) | $302K |

ECONOMIC DATA

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Non-Farm Payrolls | 8:30AM | 50K |

| 🇺🇸 Unemployment Rate | 8:30AM | 4.3% |

| 🇺🇸 ISM Services PMI | 10:00AM | 51.7 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.