|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Manufacturing sales to fall ~1%

H&R REIT unloads $1.5B of assets

BRP runs on new product launch

ATD continues momentum in Q2

HOT OFF THE PRESS

Manufacturing sales to fall in October

We got preliminary estimates for October’s manufacturing sales Monday, which are tracking 1.1% lower M/M after the transportation-led beat in September…

… driving expectations for a small 0.1% decline in wholesale sales.

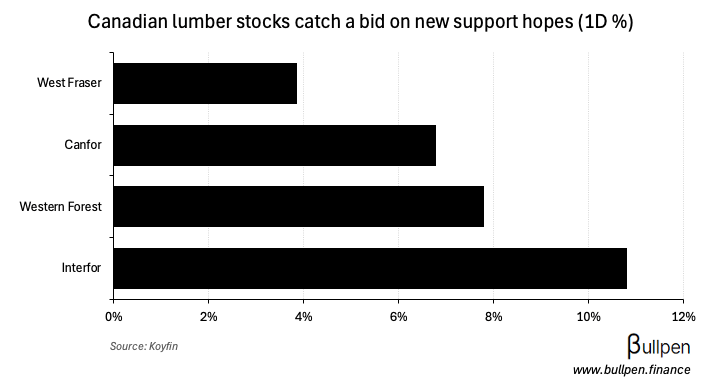

The weaker manufacturing results look to be driven in part by weaker wood product sales, as higher lumber duties rock exports and drive industry-wide production curtailments…

… prompting Carney to signal more supportive measures would be announced soon. That gave the Canadian producers a strong bid yesterday…

… which will likely be contingent on that support coming quickly.

H&R unloads $1.5B of assets

H&R REIT stuck to its word, executing $1.5B of asset sales across the retail and office portfolio. Once closed, residential and industrial exposure will climb above 80% of fair value…

… which has more headroom still, with negotiations underway on two more Canadian office properties and management indicating its desire to accelerate its resi/industrial transformation (will be needed to reach its $2.6B target).

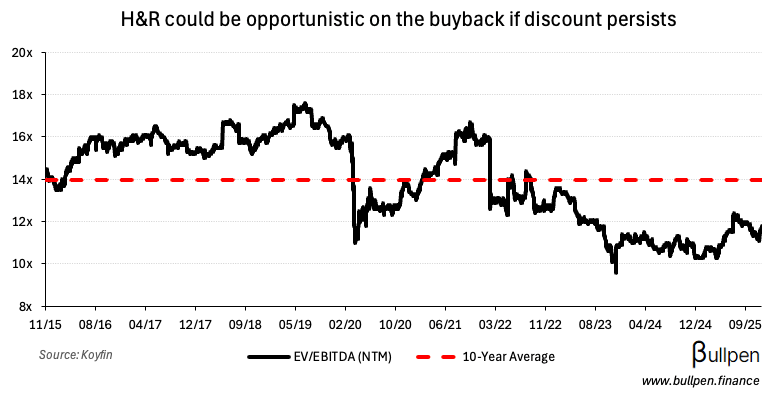

H&R plans to wipe out debt with the $1.1B in cash proceeds post-close, bringing leverage down to 8.7x - below its target ceiling of 9x…

… which gives it some room for share repurchases, with the company applying for a $200M NCIB in the near future.

FUNNY BUSINESS

With U.S. thanksgiving around the corner, it should be a quiet week…

… before bank earnings breathe some life into markets ahead of everyone’s ski trips and travel plans. Given the back half of December is like thanksgiving on steroids, we’ll likely pack it in for the year and gear up for a busy 2026.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

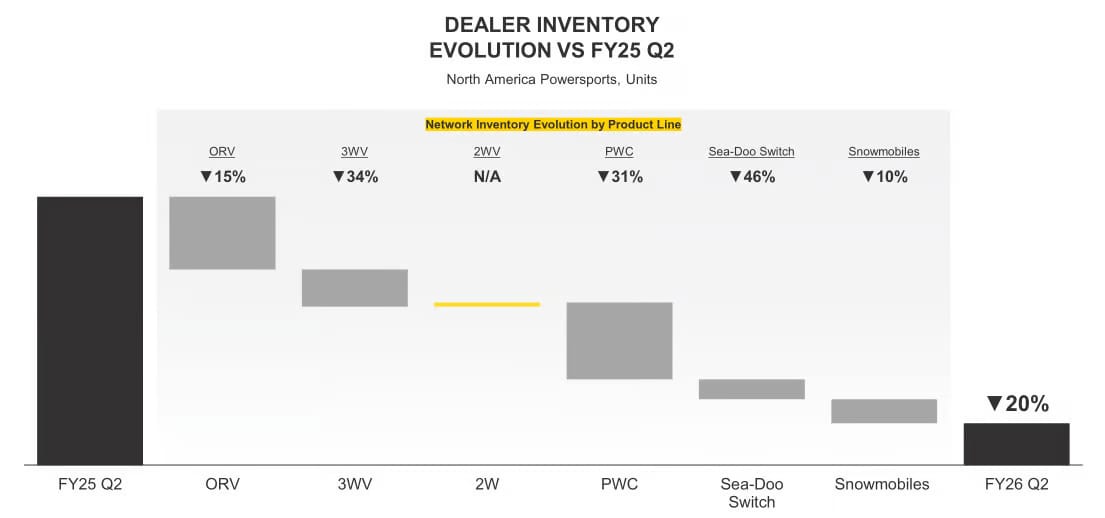

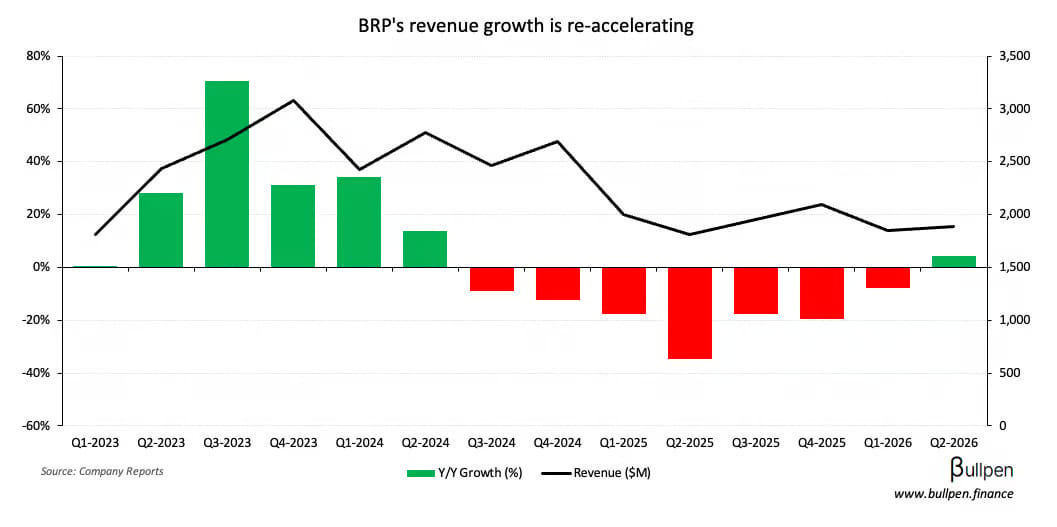

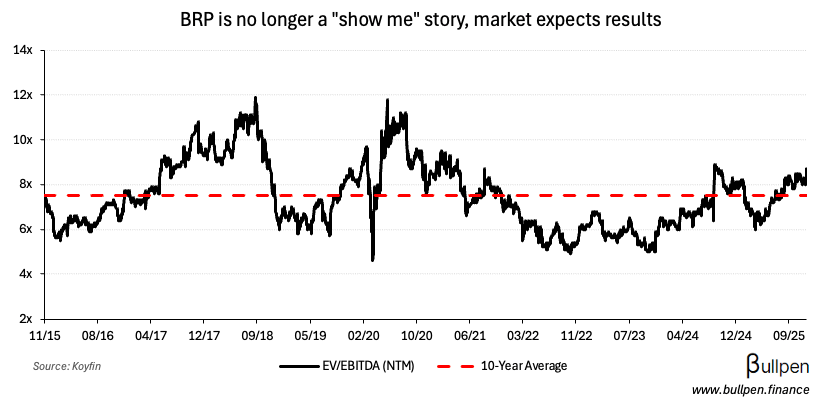

BRP Inc. (DOO) got an 8% lift yesterday on the back of a new product launch that it’s touting as the most affordable HVAC-equipped side-by-side in the industry. Alongside Q2 results, we highlighted healthy inventory levels…

… that would enable the company to push new product through at better margins, driving a re-acceleration of revenue.

Well now they’re doing it, and the market has woken up to the fact that this isn’t a “show me” story anymore.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Todd Burdick | Peyto (PEY) | $1.7M |

| Lee Curran | Peyto (PEY) | $623K |

| Michael Collens | Peyto (PEY) | $285K |

| Paolo Bravi | Metro (MRU) | $1.1M |

| Alain Tadros | Metro (MRU) | $291K |

| Denis Ricard | iA Financial (IAG) | $562K |

| Brian McGill | Zedcor (ZDC) | $450K |

| Dennis Higgs | Energy Fuels (EFR) | $490K |

| Ian Fillinger | Interfor (IFP) | $177K |

| Nauman Toor | Tidewater (TWM) | $218K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Couche-Tard (ATD) | 0.78 | 0.74 |

| 🇺🇸 Dell (DELL) | 2.59 | 2.48 |

| 🇺🇸 Autodesk (ADSK) | 2.67 | 2.50 |

| 🇺🇸 Workday (WDAY) | 2.32 | 2.17 |

Alimentation Couche-Tard (ATD) posted a solid Q2, beating estimates on the back of continued momentum in same-store sales growth that management expects can hold through the balance of the year.

As for the excess capital after its failed Seven & i bid, ATD hammered the buyback…

… which should remain a part of its capital allocation plan alongside M&A, with a pipeline of opportunities of all sizes across its geographic footprint.

We are active with files in all three of our large geographies… both smaller and larger files out there today. We’re engaged, and we continue to see quite a bit of deal flow.

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Calian Group (CGY) | AM | 1.07 |

| 🇺🇸 Deere & Co (DE) | AM | 3.81 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Wholesale M/M Prel. | -0.1% | - |

| 🇺🇸 PPI M/M | 0.3% | 0.3% |

| 🇺🇸 Retail Sales M/M | 0.2% | 0.4% |

| 🇺🇸 Consumer Confidence | 88.7 | 93.4 |

| 🇺🇸 Biz Inventories M/M | 0.0% | 0.1% |

| 🇺🇸 Pending Home Sales M/M | 1.9% | 0.5% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Durable Goods M/M | 9:30AM | 0.3% |

| 🇺🇸 Jobless Claims | 9:30AM | 225K |

| 🇺🇸 Chicago PMI | 10:45AM | 44.3 |

Was this forwarded to you? Join 3,500+ investors reading The Morning Meeting by clicking the button below.