|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Long-term job loss mirrors 1998

Chip makers owe 15% on China sales

Tourmaline founder makes a big buy

Leon’s rises on 20% dividend bump

U.S. dental sinks teeth into SLF’s Q2

HOT OFF THE PRESS

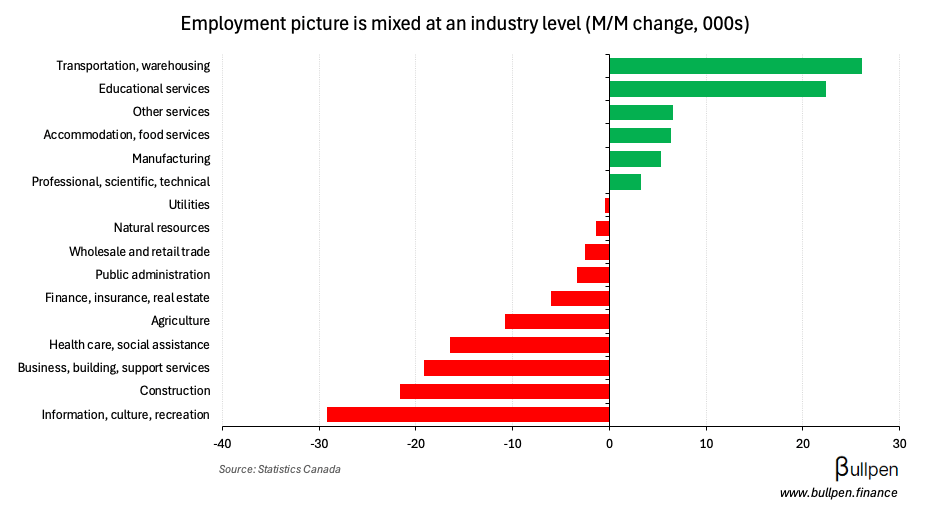

Long-term job loss revisits 1998 highs

The unemployment rate held steady at 6.9% in July, beating estimates for an increase to 7%…

… despite a big miss on the change in employment, with 51K full-time jobs lost…

… across a number of industries including information, construction, management services, and health care.

The reason this employment miss didn’t ding the unemployment rate was a drop in workforce participation to 65.2%. Down only slightly Y/Y, the decrease isn’t ringing any alarm bells…

… but it’s likely a symptom of the highest structural unemployment we’ve seen since 1998 (excluding the pandemic), with nearly a quarter of unemployed people having been so for more than 27 weeks.

FUNNY BUSINESS

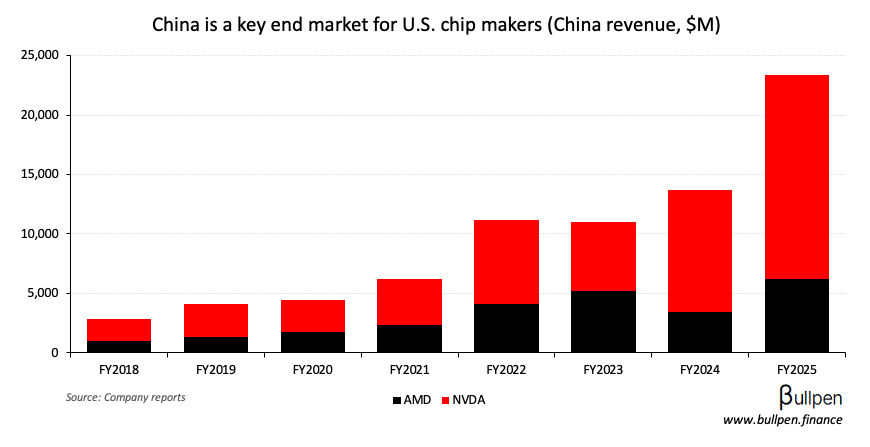

It looks like America’s biggest chip makers have access to the Chinese market again, so long as 15% of revenue from the region is paid to Uncle Sam.

With the Chinese volume NVDA and AMD did in their last fiscal year, the export tax would bring in roughly $3.5B per year (reality is lower as it’s linked to specific AI chips)…

… but I’m more interested in whether this is the start of a broad shift by the administration to target goods leaving the country rather than those coming in.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Mehmet Yilmaz | Eldorado (ELD) | $525K |

| John Roberts | Agnico (AEM) | $363K |

| Jean Robitaille | Agnico (AEM) | $2.4M |

| Rebecca Finley | Colliers (CIGI) | $2.2M |

| Stephen Kerrigan | Kinross (K) | $260K |

| Katherine Patrick | ATCO (ACO) | $1.0M |

| Kasra Nejatian | Shopify (SHOP) | $12.3M |

| Hendrikus Eijbergen | Topicus (TOI) | $114K |

| Mike Cuddy | Toromont (TIH) | $713K |

| Patrick Mongeau | Savaria (SIS) | $174K |

| Sylvain Aubry | Savaria (SIS) | $279K |

| Michael Konnert | Vizsla (VZLA) | $1.4M |

| Laura Dottori-Attanasio | Element Fleet (EFN) | $1.0M |

| Denis Ricard | iA Financial (IAG) | $281K |

| Laura Dottori-Attanasio | Element Fleet (EFN) | $1.0M |

| Mark Thompson | Nutrien (NTR) | $153K |

| Chris Seasons | Suncor (SU) | $146K |

| Meyer Orbach | GO REIT (GO-U) | $3.9M |

| Joshua Gotlib | GO REIT (GO-U) | $390K |

| Mike Rose | Tourmaline (TOU) | $6.9M |

Flagging the buying at GO REIT, which follows some weakness in shares (down 15%) after the IPO a couple weeks ago.

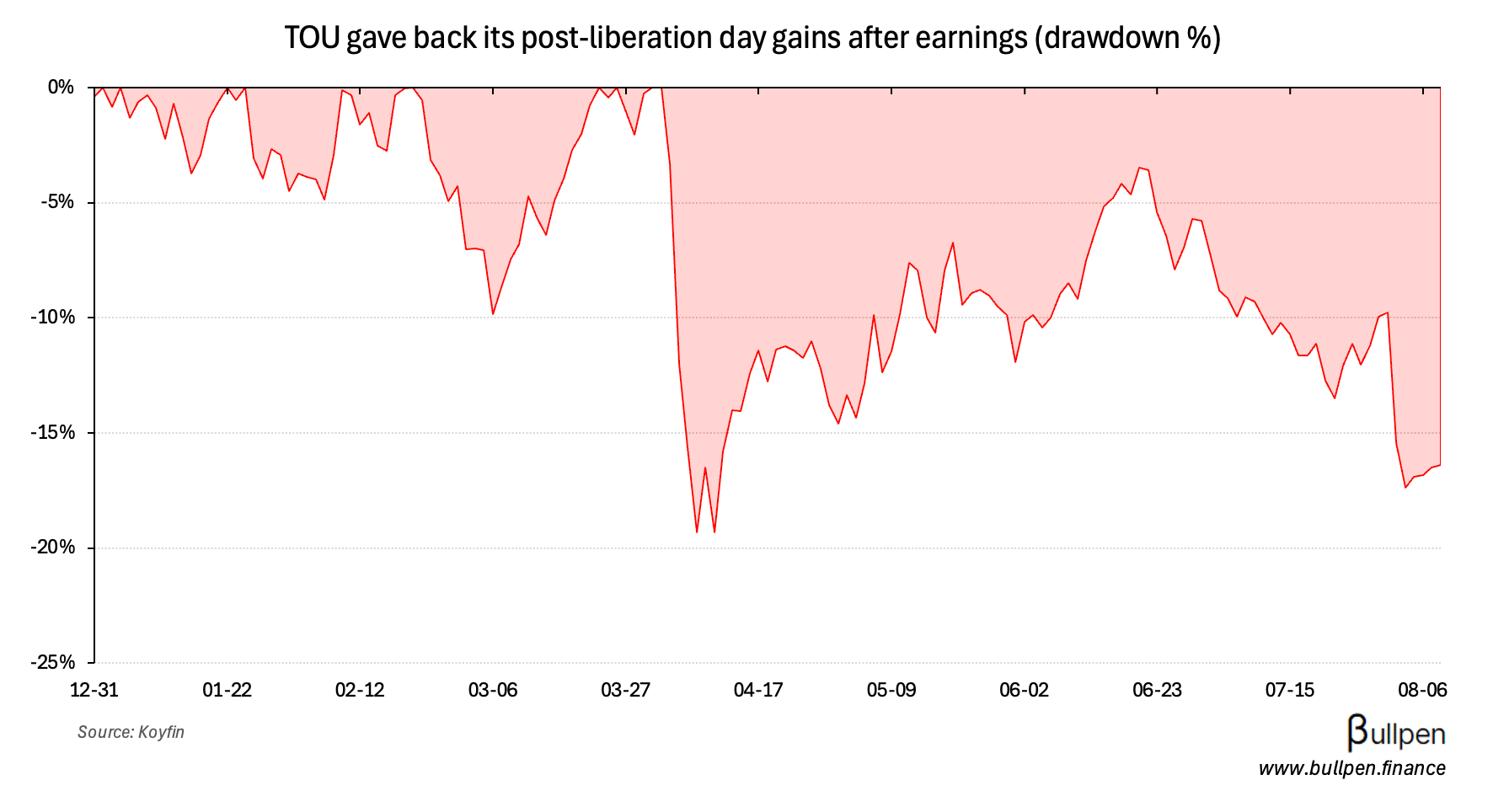

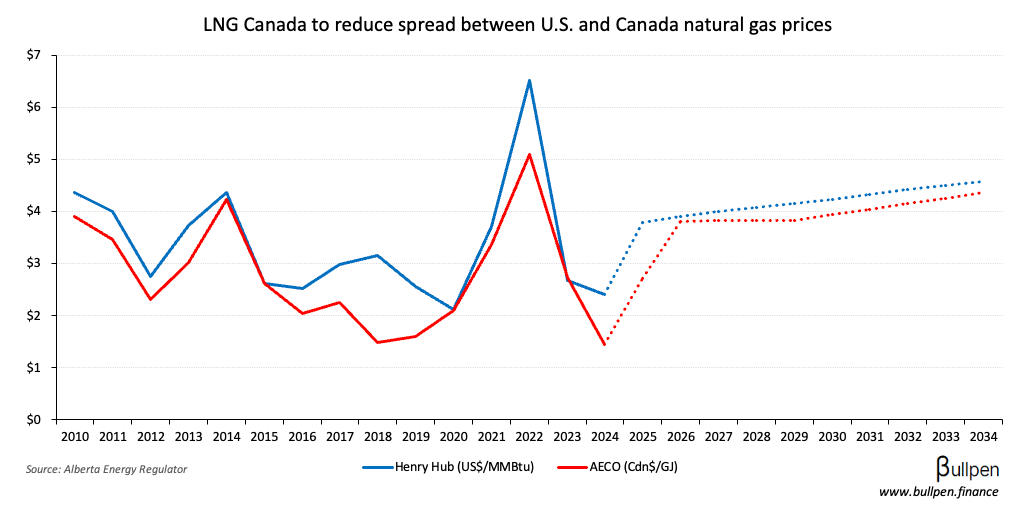

The Tourmaline (TOU) buying is also interesting, as Mike (founder & CEO) has been steadily adding shares in recent years in ~$300K chunks - so this $6.9M buy is well above his normal size and comes after a ~10% post-earnings drawdown.

The sell-off was likely guidance-driven, as management pointed to lower full-year production due to weakness in gas pricing and an increased CapEx plan linked to its $290M acquisition of Groundbirch from Strathcona.

With LNG Canada ramping up through the beginning of 2026, next year could bring a more constructive pricing environment - Mr. Rose is likely counting on it.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

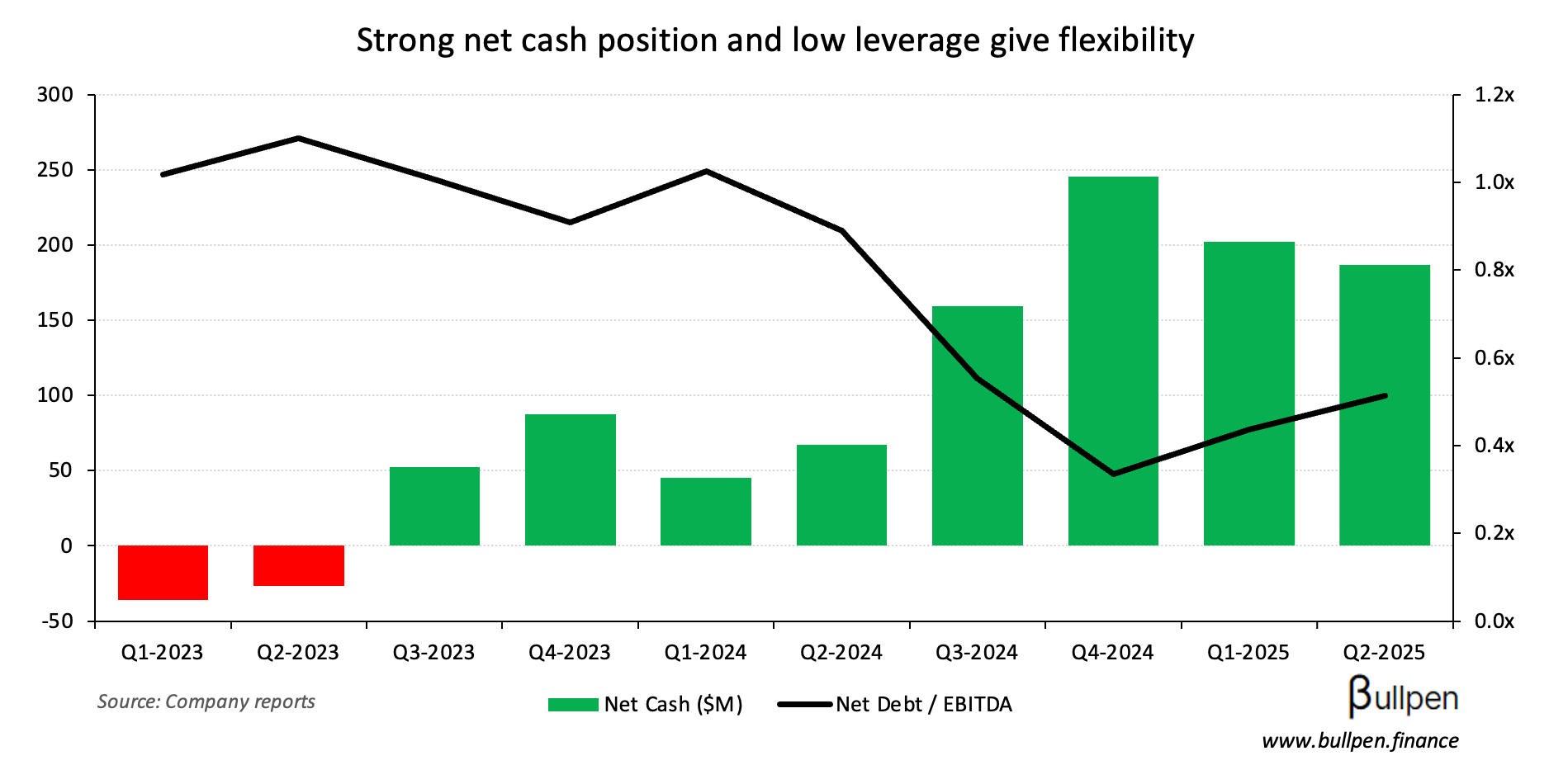

Leon’s Furniture (LNF) got a 6% lift on earnings, which came in well ahead of expectations on the back of continued same-store sales growth - thanks to a stronger inventory position and improved furniture sales.

Management increased the dividend by 20%, supported by a sub-40% payout ratio and a net cash position of nearly $200M…

… which should grow if the company does a real estate carve out - taking a page out of the Empire, Loblaw, and Canadian Tire playbook.

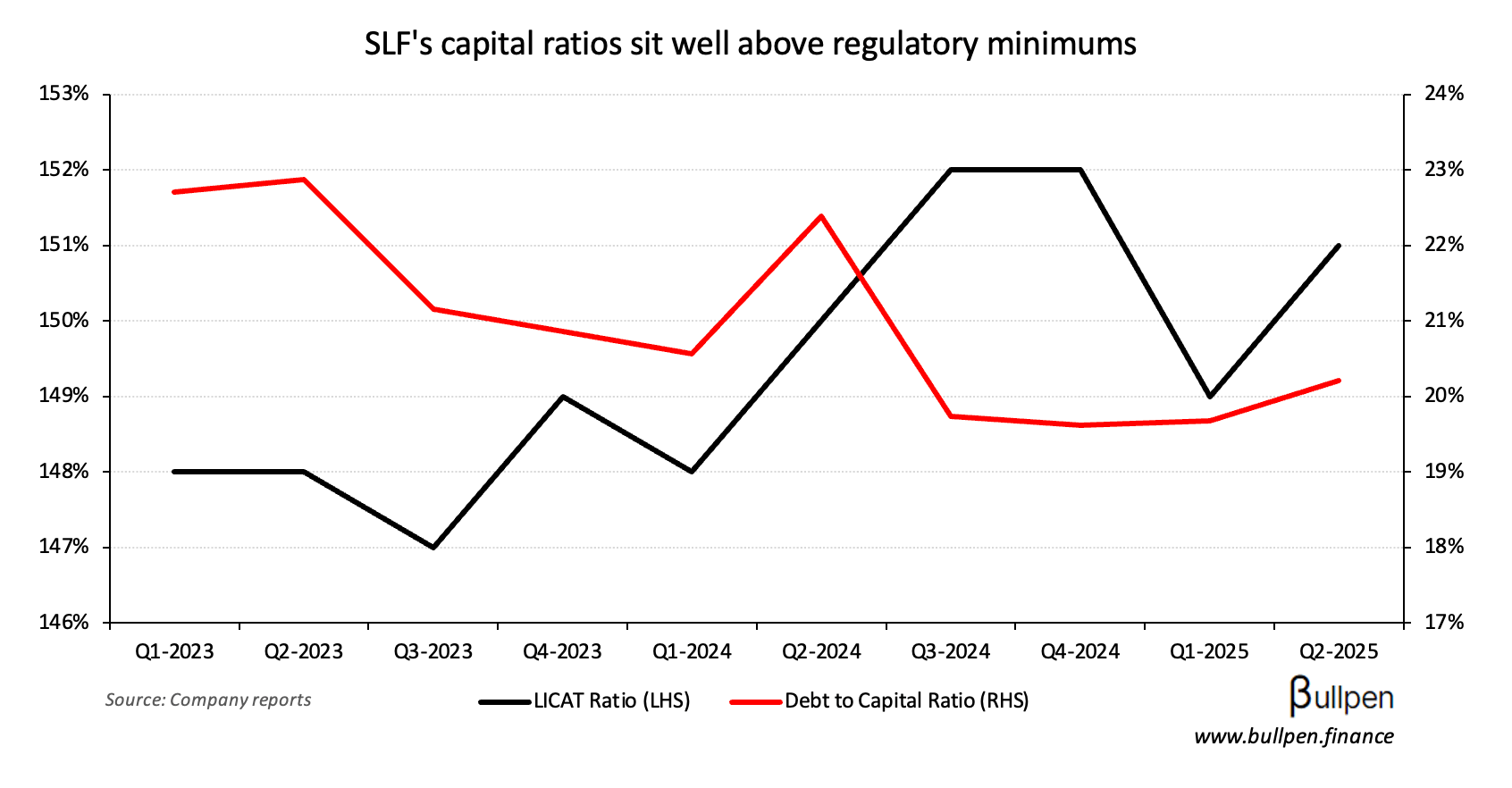

Sun Life Financial (SLF) fell 8% on a post-Q2 downgrade, driven by a weaker outlook for its U.S. dental business - with management dropping its earnings guide below $100M for the year and pulling its $250M target for 2029.

So in light of the near-term uncertainties that I referenced in my opening remarks, particularly around Medicaid and the repricing, we’re having to reforecast our earnings outlook for the business.

The segment headwinds were felt on three fronts: a $60M impairment charge linked to the early termination of a contract, slower repricing of rates by state authorities, and higher claims activity as people front-run a potential loss in coverage.

With >$3B of intangibles & goodwill linked to SLF’s $3.1B DentaQuest acquisition, investors are likely worried that continued challenges will result in a write-down. But with SLF shedding $4B in market cap on Friday…

… trading at a discount on forward earnings, and having a pretty strong capital cushion, there’s likely upside if the company can mitigate these near-term headwinds - considering U.S. dental accounts for <5% of earnings.

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Docebo (DCBO) | 0.29 | 0.22 |

| 🇨🇦 Emera (EMA) | 0.79 | 0.65 |

| 🇨🇦 Algonquin (AQN) | 0.04 | 0.04 |

| 🇨🇦 dentalcorp (DNTL) | 0.15 | 0.16 |

| 🇨🇦 Boralex (BLX) | -0.09 | 0.07 |

| 🇨🇦 Constellation (CSU) | 805M | 755M |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 K92 Mining (KNT) | AM | 0.21 |

| 🇨🇦 Franco-Nevada (FNV) | AM | 1.12 |

| 🇨🇦 Geodrill (GEO) | AM | 0.04 |

| 🇨🇦 Ballard (BLDP) | AM | -0.09 |

| 🇨🇦 Barrick (ABX) | AM | 0.46 |

| 🇨🇦 Exchange Income (EIF) | PM | 0.89 |

| 🇨🇦 Altius Minerals (ALS) | PM | 0.04 |

| 🇨🇦 Orla Mining (OLA) | PM | 0.20 |

| 🇨🇦 Westport (WPRT) | PM | -0.15 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 6.9% | 7.0% |

| 🇨🇦 Employment Change | -41K | 13.5K |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.