Weeks after the EV deal with China, Carney’s replacing the stick with a carrot - dropping the EV mandate in favour of a $2.3B pool for rebates…

… which could stimulate activity in the industry, alongside $3B from the strategic response fund and $1.5B directed to the country’s EV charging network. Linamar (LNR) looks best-positioned on a relative basis…

… given its large exposure to parts sales in Canada. That split has likely driven some of the outperformance versus peers…

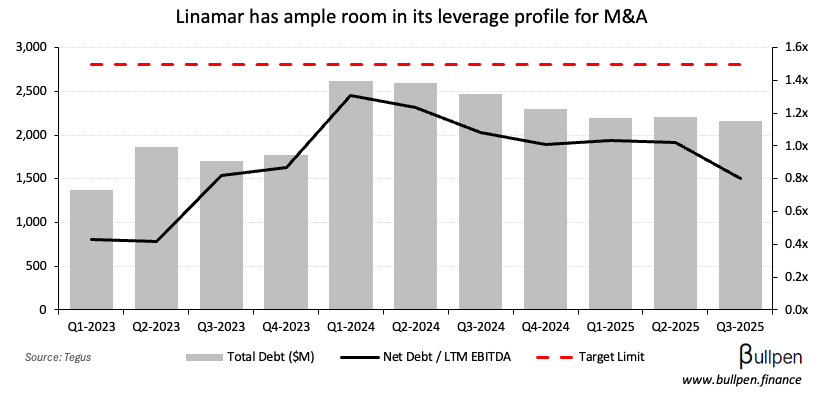

… as has tuck-in M&A, which should continue given the company’s modest leverage profile and stress among smaller, less liquid players.

Should they be able to come out of the industry slowdown bigger and stronger, there’s re-rate potential - with the stock trading below its long-term average valuation.