|

|

||||

|

|

||||

|

|

||||

|

|

TRADE WAR MONITOR

The potential impact of this trade war makes it the single biggest factor in markets today. Until that’s no longer the case, we’re going to keep you updated in this dedicated section of The Morning Meeting.

Trump announced a one-month tariff exemption on Canadian automobiles, auto parts, and goods covered under the USMCA trade pact (38% of Canadian exports) - Canada’s tariffs remain in place

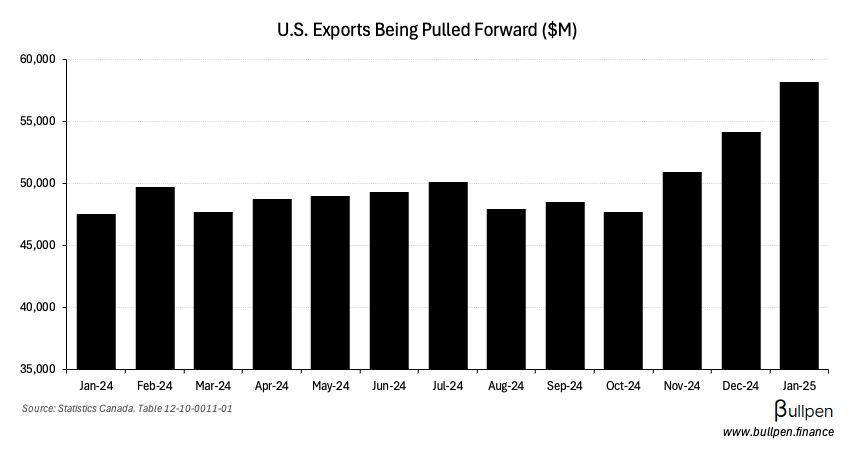

Canadian trade data was released, with a ~$4B trade surplus driven by the pull forward of auto parts, energy, and consumer goods by the U.S. ahead of tariffs

Our framework for navigating the trade war: https://www.bullpen.finance/content/51

HOT OFF THE PRESS

U.S. jobs cuts shock the market, more to come

U.S. jobs cuts came in at 170K for February, the highest level since July of 2020, with over 60K government cuts due to Musk’s DOGE initiative (we recently highlighted this as a risk to American GDP growth).

We’ll get more labour market context before the bell today with payroll, unemployment, and participation rate data coming out in Canada and the U.S.

In Canada, expectations are for unemployment to inch back up to 6.7% from 6.6% in January, driven by a tight job market and uncertain economic backdrop.

Here we go again: PKI initiates strategic review

Parkland (PKI) put up a dud of a quarter, missing both top and bottom-line estimates by a wide margin. The numbers didn’t matter in this one though, with the stock closing up ~6% because management said the magic words… strategic review.

We acknowledge that Parkland shares have underperformed and do not currently reflect the intrinsic value of the company. Initiating a review is appropriate at this time. Its primary intention is to explore opportunities to maximize value creation.

Translation: we’re going to see if anyone is willing to pay a big premium to take us off the market.

With investors taking a volatile ride to zero capital gains over the past 5 years, and the recent takeout of Innergex at a ~60% premium, it’s no surprise shares traded higher in yesterday’s session.

But how did we get here in the first place?

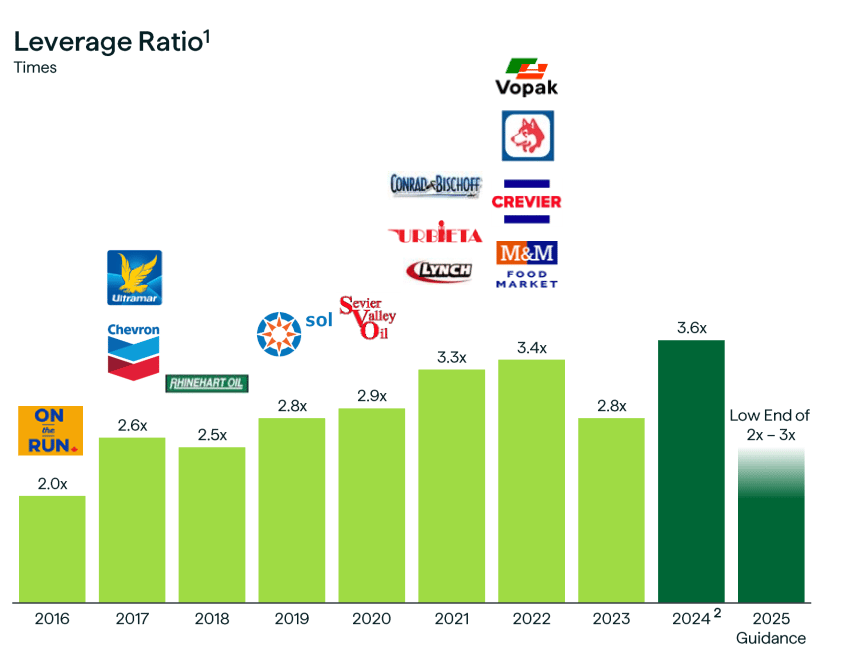

For PKI, the last decade was littered with acquisitions, spending nearly $12B between 2016 and 2022.

Leverage climbed as it executed its buy and build strategy. So did activist attention, with Engine Capital (2.5% owner) and Simpson Oil (19.8% owner) both voicing their displeasure recently.

Source: Company Reports

So will it sell?

Management is definitely incentivized, with the CEO getting 2 years of compensation in a change of control event (~$11M by our math), but the near-term setup is tough here.

We think it’s likely the government would block a deal from a U.S. buyer given trade tensions, taking the biggest pool of capital off the table.

The obvious Canadian buyer would be Couche-Tard (ATD), who could get a nice boost to geographic diversification by buying PKI, given their heavy U.S. footprint.

Problem is, ATD is already trying to make a much larger bid work for Seven & i Holdings (7-Eleven, ~$50B). Should that go through, it’s unlikely we’d see it swallow PKI whole too.

In our view, a more likely scenario would be if ATD were to scoop up some of PKI’s asset divestitures. It’s targeting >$500M this year and has a number of active processes running, with proceeds to go towards leverage reduction.

Deal or no deal, we think there’s a way shareholders can get rewarded, it just might take some time.

If the above link won’t work, try this: https://www.bullpen.finance/content/54

FUNNY BUSINESS

We have a biiiiiig announcement, no memes this time. This is serious stuff, and we are serious people.

The pirate ship just got a new crew member… everyone give a warm welcome to Buddy!

I know right? It’s unfair to have a name that good. You’re going to open every email from here on out, because how could you miss it? Buddy from Bullpen? Perfect!

Now Buddy and I have been doing equity research together since 2019, most recently at National Bank under the great Rupert Merer… so I feel uniquely qualified to give this introduction.

Despite the name, he’s not very friendly until the 3rd cup of coffee is done, 4 if it’s earnings season.

He loves markets and hates the dictionary more than anyone I know…

He chose trading…

…and he wants to be LinkedIn famous more than anything in this world, so go give his Bullpen announcement post a big like for me.

All jokes aside, with Buddy in the saddle you can expect a lot of great research from us in the near future. We’re looking forward to working for you.

ON OUR RADAR

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Aecon (ARE) shed 16% on an ugly Q4, beating on revenue but missing big on EPS. It put up $0.25 versus the street at $0.45, driven by the negative impact of fixed-price legacy contracts and the sale of its minority stake in Skyport. Outlook was solid though, so it’s possible the selling was overdone yesterday.

Celestica (CLS) sold off another 10% alongside the broader data center basket. In an early February edition of The Morning Meeting, we flagged the >$130M of stock CLS execs had sold YTD as a reason for caution. This one might warrant a deeper dive in the future, as part of a broader AI thematic.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Michael Pilato (CEO) | Jamieson (JWEL) | $475K |

| Regan Stewart (COO) | Jamieson (JWEL) | $264K |

| Sylvian Lehoux (VP) | Eldorado (ELD) | $419K |

| Paul Ferneyhough (CFO) | Eldorado (ELD) | $255K |

| George Burns (CEO) | Eldorado (ELD) | $2.4M |

| Graham Morrison (VP) | Eldorado (ELD) | $281K |

| Colin Lindley (VP) | TC Energy (TRP) | $291K |

| James Landon (President) | ATCO (ACO) | $397K |

| Will Brennan (Board) | Altus Group (AIF) | $2.9M |

| Kuldip Sahi (CEO) | Morguard (MRC) | $3.2M |

| Domenico Pio (SVP) | Waste Conn. (WCN) | $397K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Converge (CTS) | 0.23 | 0.15 |

| 🇨🇦 Endeavour (EDV) | 0.65 | 1.23 |

| 🇨🇦 Kiwetinohk (KEC) | -0.37 | 1.11 |

| 🇨🇦 Canadian Natural (CNQ) | 0.93 | 0.95 |

| 🇨🇦 Tourmaline (TOU) | 1.69 | 1.19 |

| 🇨🇦 Parex (PXT) | -1.02 | 0.68 |

| 🇨🇦 Jushi (JUSH) | -0.07 | -0.06 |

| 🇨🇦 TerrAscend (TER) | 0.04 | 0.03 |

| 🇨🇦 Martinrea (MRE) | -0.21 | 0.28 |

| 🇨🇦 Dexterra (DXT) | 0.11 | 0.13 |

| 🇨🇦 Major Drilling (MDI) | -0.11 | -0.02 |

| 🇨🇦 Ero Copper (ERO) | 0.24 | 0.30 |

| 🇨🇦 CES Energy (CEU) | 0.18 | 0.20 |

| 🇺🇸 Broadcom (AVGO) | 1.60 | 1.51 |

| 🇺🇸 Costco (COST) | 4.02 | 4.10 |

| 🇺🇸 Kroger (KR) | 1.14 | 1.11 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 MDA Space (MDA) | AM | 0.27 |

| 🇨🇦 Algonquin (AQN) | AM | 0.09 |

| 🇨🇦 Atrium (AI) | AM | 0.23 |

| 🇨🇦 AltaGas (ALA) | AM | 0.71 |

| 🇨🇦 Total Energy (TOT) | AM | 48M |

| 🇨🇦 Black Diamond (BDI) | AM | 0.14 |

| 🇨🇦 Canfor (CFP) | AM | -0.39 |

| 🇨🇦 Artis REIT (AX-U) | AM | 39M |

| 🇨🇦 Constellation (CSU) | PM | 23.0 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Trade Balance | 3.97B | 1.30B |

| 🇨🇦 Exports | 74.5B | - |

| 🇨🇦 Imports | 70.5B | - |

| 🇨🇦 Ivey PMI | 55.3 | 50.6 |

| 🇺🇸 Job Cuts | 172K | - |

| 🇺🇸 Trade Balance | -131B | -127B |

| 🇺🇸 Exports | 270B | - |

| 🇺🇸 Imports | 401B | - |

| 🇺🇸 Jobless Claims | 221K | 235K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 8:30AM | 6.7% |

| 🇨🇦 Participation Rate | 8:30AM | - |

| 🇨🇦 Capacity Utilization | 8:30AM | 79.3 |

| 🇨🇦 Hourly Earnings Y/Y | 8:30AM | - |

| 🇺🇸 Non-Farm Payrolls | 8:30AM | 143K |

| 🇺🇸 Unemployment Rate | 8:30AM | 4% |

| 🇺🇸 Hourly Earnings Y/Y | 8:30AM | 4.1% |

| 🇺🇸 Participation Rate | 8:30AM | - |

| 🇺🇸 Fed Powell Speech | 12:30PM | - |