|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Job vacancies break pandemic lows

Onex & AIG buy Convex for $7B

MDA & SpaceX lock horns

Aecon & Spin Master pop on Q3

Boyd’s $1.3B deal & U.S. IPO

HOT OFF THE PRESS

Job vacancies break pandemic lows

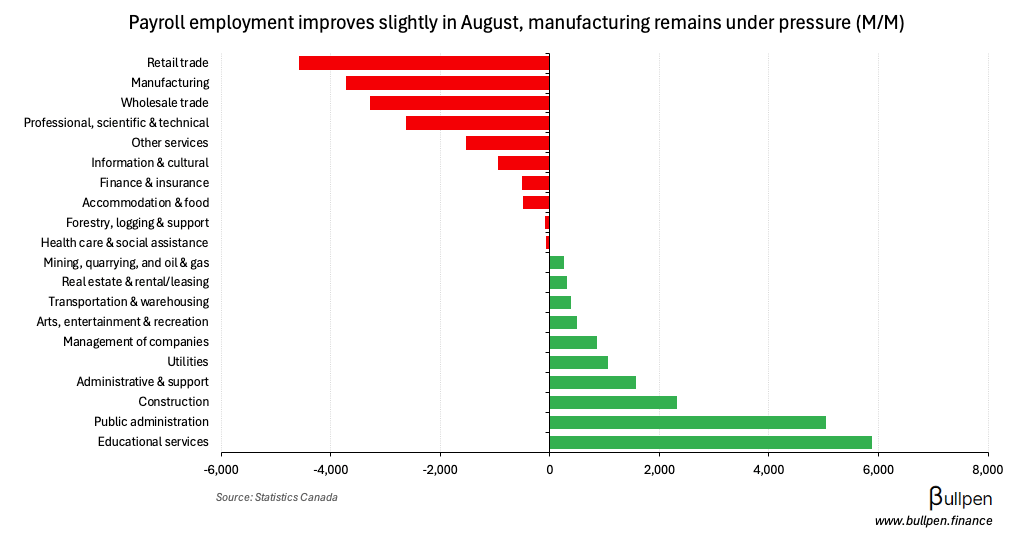

Payroll employment inched higher in August, with gains in education and public administration offsetting continued volatility in retail trade and manufacturing.

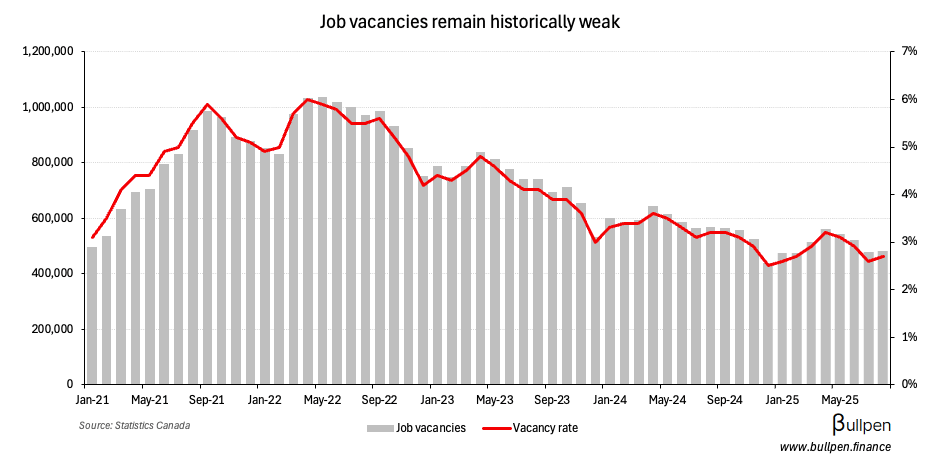

At the country level, job vacancies recovered slightly…

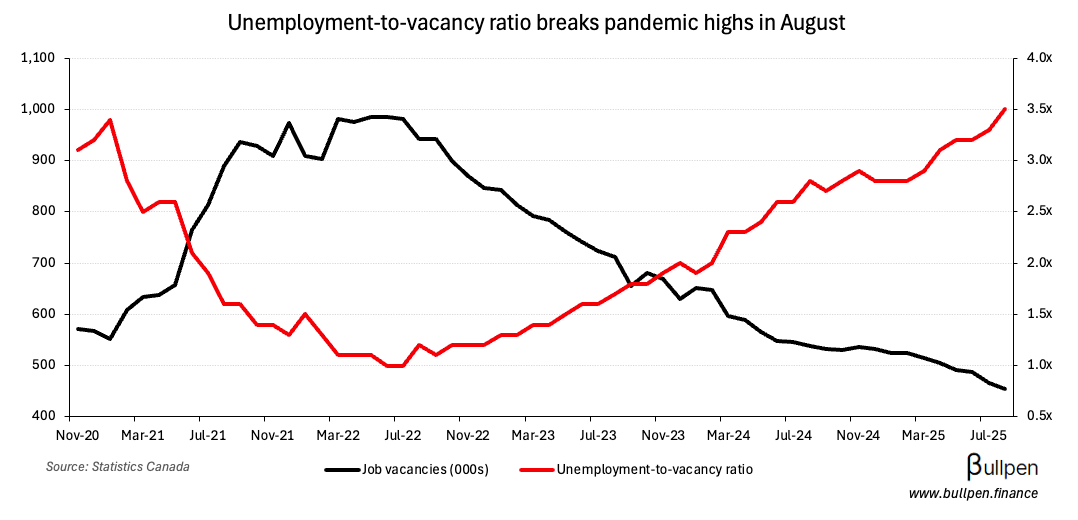

… entirely driven by the territories. Excluding them (in-line with the Labour Force Survey), vacancies fell to an 8-year low - pushing the number of job seekers per available seat past pandemic highs to 3.5.

Onex buys Convex for $7B

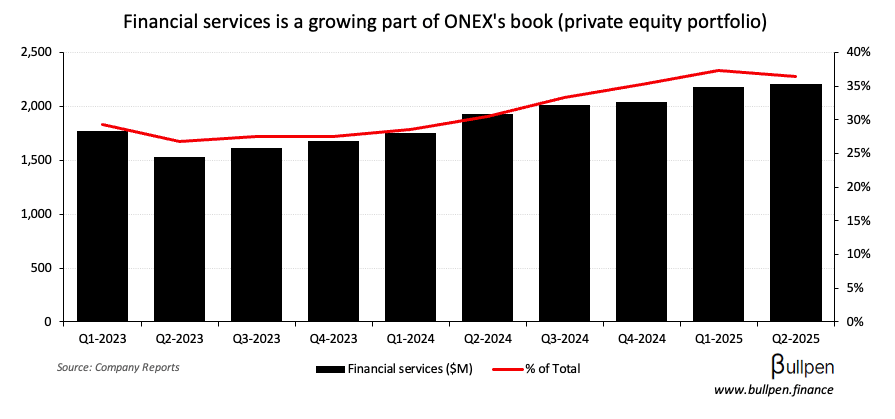

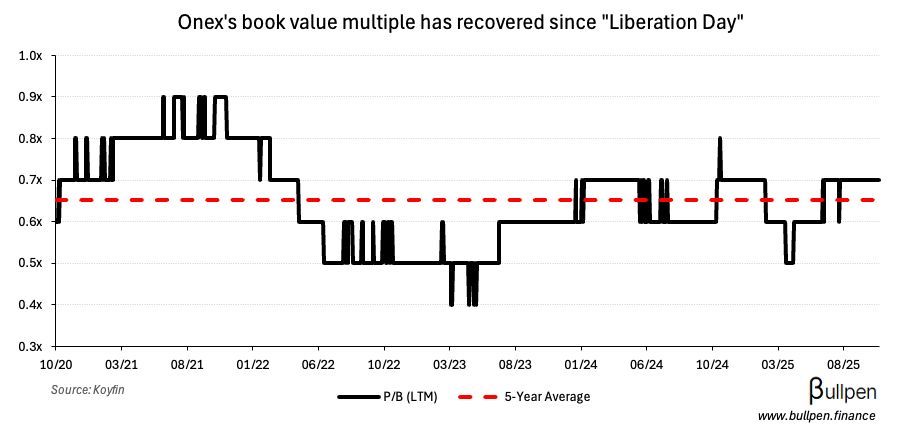

Onex Corp. (ONEX) rose 3.5% on the back of a transformational $7B acquisition of Convex, a specialty P&C insurer that’s been in Onex Partners’ portfolio since 2019 - giving its partners a nice exit…

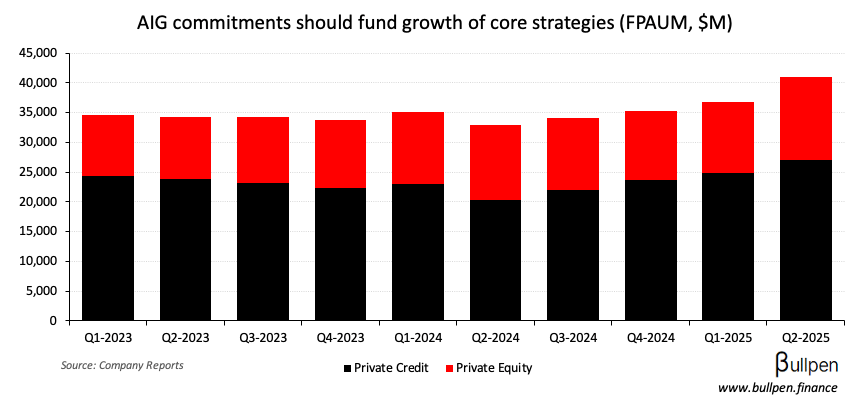

… and bringing the insurer onto the balance sheet for a permanent source of capital. It also locks down AIG as a partner - who took 35% of the deal, 9.9% of ONEX, and made $2B of capital commitments over the next three years.

As the market prices in these changes, valuation could drift higher - given the stability that a consistent stream of insurance premiums brings.

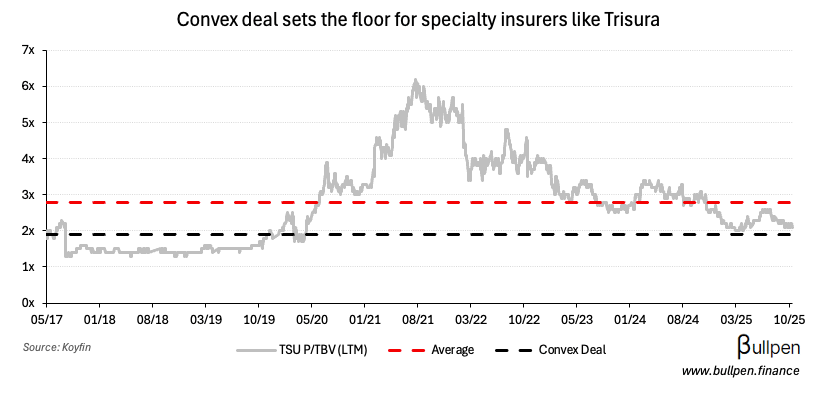

The Convex deal also sets a floor for similar specialty P&C insurers like Trisura (TSU), with the $7B price tag translating to a 1.9x multiple on tangible book value.

FUNNY BUSINESS

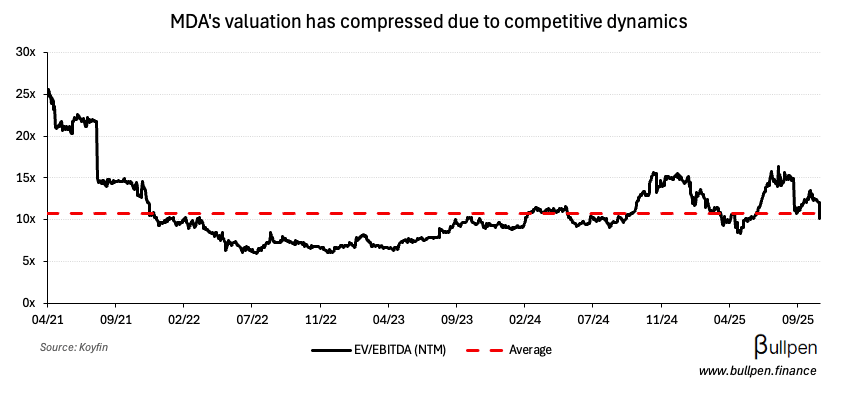

MDA Space (MDA) was down 16% on rumours that SpaceX was sniffing around Globalstar’s sales process, less than two months after it bought EchoStar’s spectrum licenses…

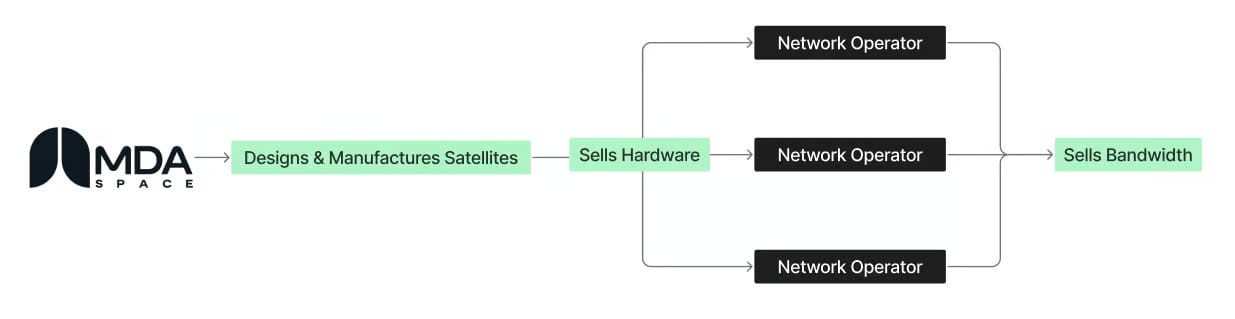

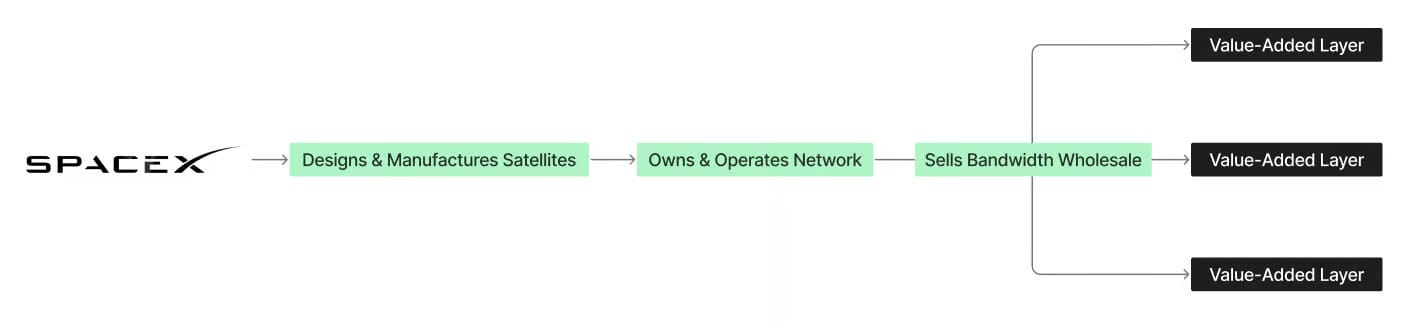

… knocking ~$2B out of the backlog. Given MDA signed a $1.1B deal with Globalstar earlier in the year, more of the order book is at risk. Recall that MDA manufactures satellites for network operators…

… while SpaceX is vertically integrated, manufacturing and operating its own satellite network.

The latter model presents the opportunity to roll up smaller network operators, eroding the size of MDA’s end market and driving multiple compression.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

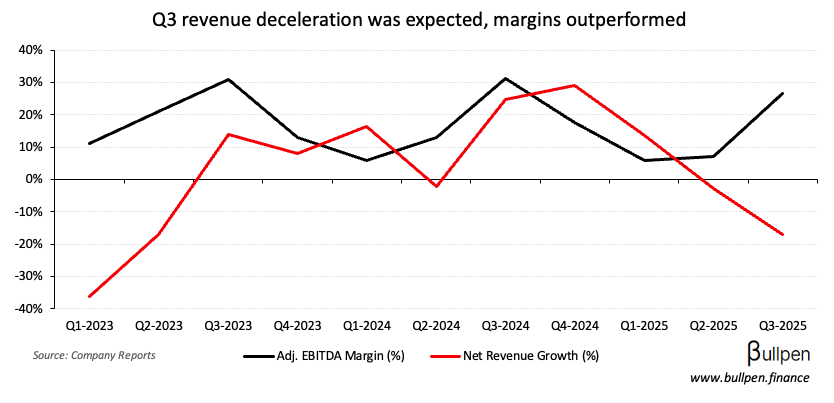

Spin Master (TOY) jumped 10% on its Q3 results, which were light on revenue but strong on margins - as the company adjusted to supply chain shocks from earlier in the year.

The top-line weakness was expected, given shipping changes that delayed revenue recognition - but with management signaling confidence in the future...

Positively, our belief is that retailers are now at a lean inventory level. So the industry should have a relatively healthy setup going into 2026.

… the bid could come back in a hurry.

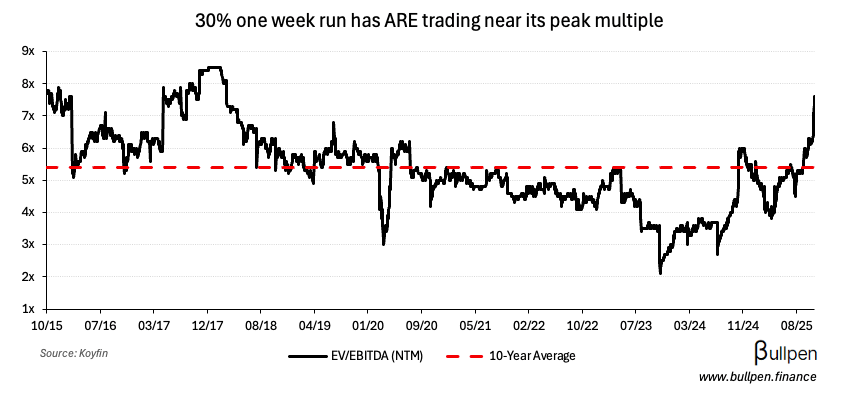

Aecon (ARE) ran another 7% on a Q3 beat, anchored by nuclear revenue which rose ~$150M Y/Y and is showing no signs of slowing down.

Between the print, its recent nuclear contract win, and Brookfield & Cameco’s $80B nuclear partnership with the U.S. government… Aecon is up 30% in the past week and trades near peak valuation.

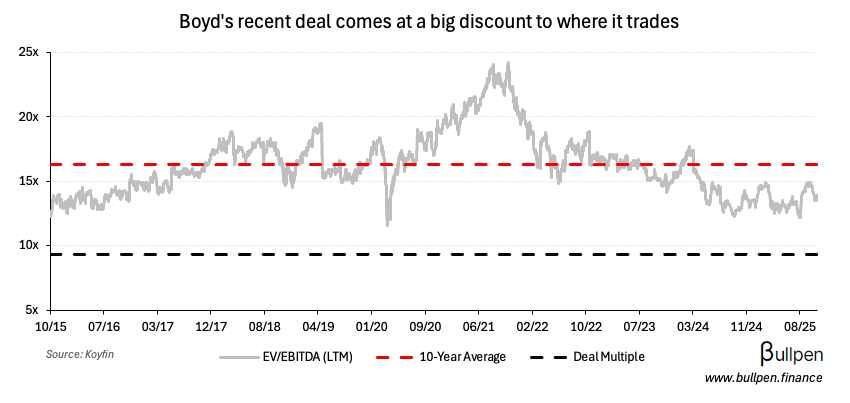

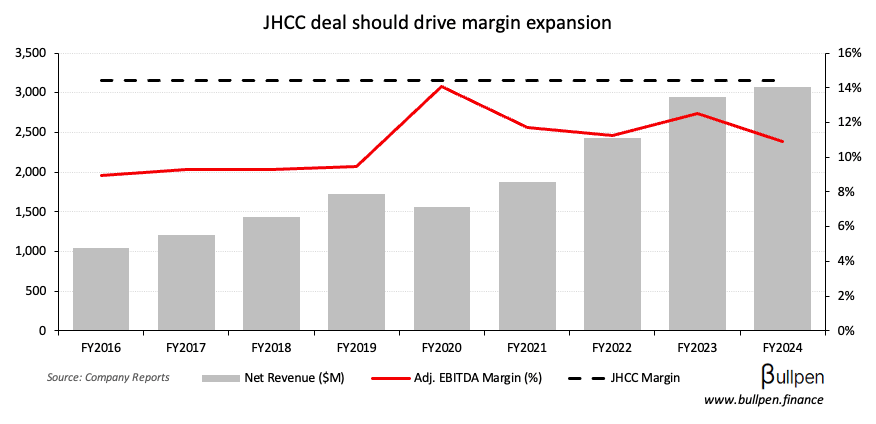

Boyd Group (BYD) had a busy day yesterday, announcing a $780M bought deal U.S. IPO and a $525M debt issuance the company is using to fund its $1.3B deal for JHCC - adding 258 U.S. locations…

… at a ~9x EBITDA multiple. Management expects to unlock $35-45M of run-rate synergies post-close…

… which should drive double-digit accretion via margin expansion.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Grant Fagerheim | Whitecap (WCP) | $106K |

| Daniel Bertram | PrairieSky (PSK) | $126K |

| Laurette Koellner | Celestica (CLS) | $2.1M |

| Marcel Teunissen | Parkland (PKI) | $401K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Spin Master (TOY) | 1.11 | 1.07 |

| 🇨🇦 Polaris (PIF) | 12.8M | 13.4M |

| 🇨🇦 Foraco (FAR) | 14.2M | 24.8M |

| 🇨🇦 Algoma (ASTL) | -1.14 | -0.98 |

| 🇨🇦 Secure (SES) | 0.00 | 0.25 |

| 🇨🇦 Methanex (MX) | 0.06 | 0.45 |

| 🇨🇦 AltaGas (ALA) | 0.04 | 0.05 |

| 🇨🇦 Coveo (CVO) | -0.05 | 0.00 |

| 🇨🇦 Capstone (CS) | 0.06 | 0.04 |

| 🇨🇦 Toromont (TIH) | 1.72 | 1.60 |

| 🇨🇦 TFI Int. (TFII) | 1.20 | 1.20 |

| 🇨🇦 Baytex (BTE) | 0.04 | 0.07 |

| 🇨🇦 Black Diamond (BDI) | 0.19 | 0.17 |

| 🇨🇦 Eldorado (ELD) | 0.41 | 0.47 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Magna (MG) | AM | 1.25 |

| 🇨🇦 Cenovus (CVE) | AM | 0.75 |

| 🇨🇦 Canadian National (CNR) | PM | 1.77 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Avg. Earnings Y/Y | 3.01% | - |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | 8:30AM | 0.0% |

| 🇺🇸 Chicago PMI | 9:45AM | 42.3 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.