|

TSX

1D %

YTD %

|

26,615.75

0.4%

6.9%

|

|

|

TSXV

1D %

YTD %

|

721.79

0.0%

16.9%

|

|

|

S&P 500

1D %

YTD %

|

6,045.26

0.4%

3.0%

|

|

|

NASDAQ

1D %

YTD %

|

19,662.48

0.2%

2.0%

|

|

|

US 10Y

1D

YTD

|

4.37

6 bps

21 bps

|

|

|

DJIA

1D %

YTD %

|

42,967.62

0.2%

1.4%

|

|

|

CA 10Y

1D

YTD

|

3.33

2 bps

10 bps

|

|

|

CAD/USD

1D %

YTD %

|

0.735

0.5%

5.7%

|

|

Israel strikes Iran’s nuclear footprint

Building permits miss big

Telus offers $550M to re-absorb digital unit

The Pentagon Pizza Report

TransAlta jumps 9% on upgrade

Geopolitical tensions rise as Israel strikes Iran

The geopolitical backdrop just got scarier, with Israel striking Iran’s capital and declaring a state of emergency ahead of a counter-attack. This is sure to be the driving force in markets near-term… expect volatility (VIX):

Futures are ugly, gold has a bid, and crude oil surged more than 10% on the news given Iran accounts for 4% of global output.

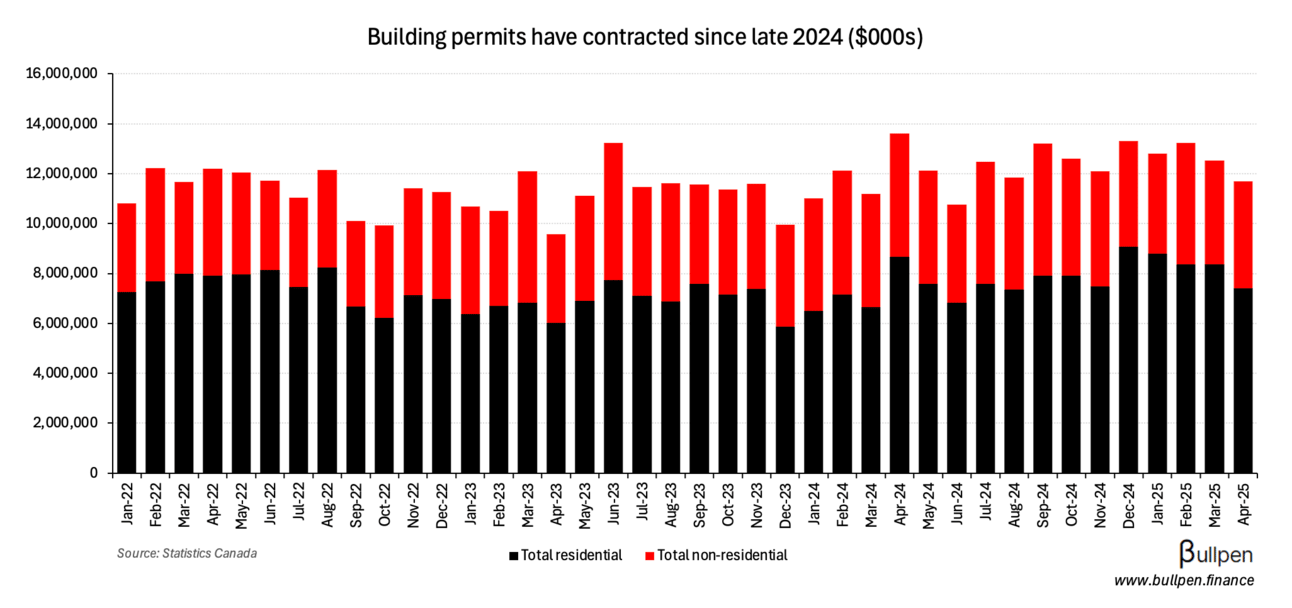

Building permits fall on multi-unit weakness

Wednesday’s building permit data disappointed, falling 6.6% M/M versus expectations for a 2.2% increase. The Y/Y figure is uglier - down 16% - though I’d note last April was a pretty tough comp.

The second sequential drop was largely driven by multi-unit activity, which fell more than 15% due to weakness in Vancouver and dragged total residential permitting down nearly 12%.

Non-residential activity showed resilience, gaining 3% on strong commercial and industrial activity in Ontario (up ~21%), partly offset by weakness in BC.

Telus looks to swallow digital unit for $550M

After spinning it off in a frothy 2021 IPO market, Telus (T) is looking to re-absorb Telus International (TIXT) for a skinny 15% premium - in a $550M deal that looks accretive on an EBITDA basis.

The deal isn’t all that surprising, given Telus already owns nearly 60% of TIXT and accounts for a quarter of its revenue.

The offer values the IT business at just over $1B - not much higher than the ~$900M paid to it annually from Telus and small enough to not impact the leverage profile.

With TIXT shares closing above the offer, the market expects a competing bid or a sweetener - but if Telus can get this over the line it’s a near-term win. The long-term implications are muddier, as investors are unlikely to forget the 90% drawdown that preceded this transaction…

… which could impact the price tag on future spin offs, Telus Health in particular.

The U.S. has denied any involvement in the latest escalation in the Middle East, though an X account tracking pizza shops near the Pentagon suggests they were made aware at some point…

… there really is a place for everything on the internet (25K followers and growing).

| Insider |

Company |

Value |

| Andrew Thorne |

Cameco (CCO) |

$317K |

| Warren Raczynski |

Canadian Natural (CNQ) |

$359K |

| Calvin Bast |

Canadian Natural (CNQ) |

$314K |

| Joan Sproul |

FirstService (FSV) |

$727K |

| Brian Lawson |

Brookfield (BN) |

$5.4M |

| Eric Martel |

Bombardier (BBD) |

$4.5M |

| Timothy Haldane |

Orla Mining (OLA) |

$271K |

| Timothy Carstens |

Energy Fuels (EFR) |

$1.1M |

| Ajay Virmani |

TD Bank (TD) |

$210K |

| Paulo de Brito |

Aura Minerals (ORA) |

$3.1M |

|

Telus Int. (TIXT)

1D %

YTD %

|

4.97

22.7%

12.0%

|

|

|

Transat (TRZ)

1D %

YTD %

|

2.48

11.4%

27.2%

|

|

|

Major Drilling (MDI)

1D %

YTD %

|

9.76

13.8%

18.9%

|

|

|

Healwell (AIDX)

1D %

YTD %

|

1.28

7.3%

39.3%

|

|

|

TransAlta (TA)

1D %

YTD %

|

15.51

8.5%

23.7%

|

|

|

Lightspeed (LSPD)

1D %

YTD %

|

15.67

5.0%

28.5%

|

|

TransAlta ran ~9% on an upgrade from Jefferies, citing “higher for longer” power prices in Alberta, where the company has a lot of merchant exposure (no contract, they receive spot pricing and hedge against that).

YESTERDAY’S EARNINGS

| Company |

Actual |

Consensus |

| 🇨🇦 Alithya Group (ALYA) |

0.12 |

0.05 |

| 🇨🇦 Transat (TRZ) |

-0.58 |

-0.89 |

| 🇺🇸 Adobe Systems (ADBE) |

5.06 |

4.97 |

TODAY’S EARNINGS

| Company |

Time |

Consensus |

| 🇨🇦 Roots (ROOT) |

AM |

-0.19 |

YESTERDAY’S ECONOMIC RELEASES

| Release |

Actual |

Consensus |

| 🇺🇸 PPI M/M |

0.1% |

0.2% |

| 🇺🇸 Core PPI M/M |

0.1% |

0.3% |

| 🇺🇸 Jobless Claims |

248K |

240K |

| 🇺🇸 Continuing Claims |

1,956K |

1,910K |

TODAY’S ECONOMIC RELEASES

| Release |

Time |

Consensus |

| 🇨🇦 Capacity Utilization |

8:30AM |

79.8% |

| 🇨🇦 Mftg. Sales M/M |

8:30AM |

-2.0% |

| 🇨🇦 Wholesale Sales M/M |

8:30AM |

-0.9% |

| 🇺🇸 Consumer Sentiment |

10:00AM |

53.5 |

|

WTI Crude

1D %

YTD %

|

68.14

0.0%

5.1%

|

|

|

Gold

1D %

YTD %

|

3,388.27

1.0%

29.1%

|

|

|

Nat Gas

1D %

YTD %

|

3.53

0.8%

1.8%

|

|

|

Silver

1D %

YTD %

|

36.36

0.3%

25.9%

|

|

|

Lumber

1D %

YTD %

|

618.49

1.3%

12.3%

|

|

|

Copper

1D %

YTD %

|

4.83

0.5%

21.3%

|

|

|

Soybean

1D %

YTD %

|

1,042.22

0.8%

4.3%

|

|

|

Aluminum

1D %

YTD %

|

2,521.70

0.2%

1.4%

|

|

|

Corn

1D %

YTD %

|

438.34

0.4%

4.3%

|

|

|

Wheat

1D %

YTD %

|

526.36

1.5%

4.6%

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.