|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Inflation beats on gas and food

Metals & meat drive fourth PPI gain

MEG deal hangs in the balance

Martinrea follows Linamar’s lead

Big insider selling at Zedcor

HOT OFF THE PRESS

Inflation beats on gas and food

Headline inflation of 2.4% beat estimates for September, gaining 0.1% over the August print…

… thanks to an easy Y/Y comp in gasoline, which should be short lived if oil prices hold.

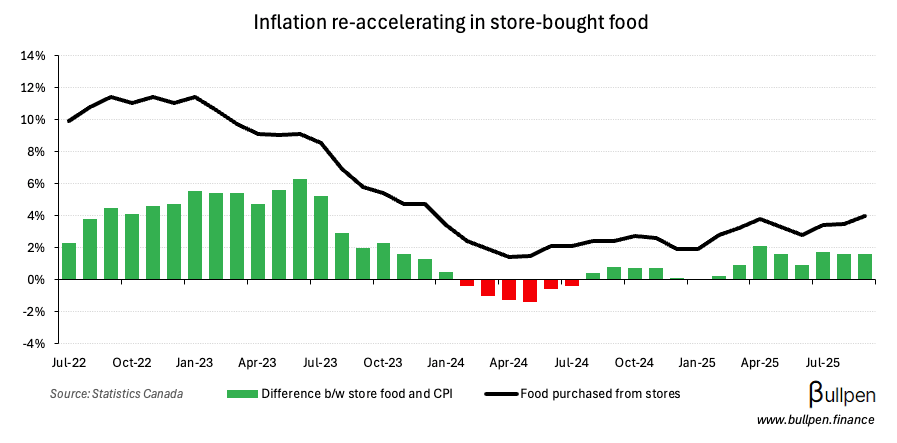

That dynamic helped reverse deflation in transportation, while the same inflationary trends continued - with food inflation accelerating M/M to nearly 4%…

… driven by prices at the counter, which posted their largest increase since 2023.

Rent costs accelerated too, gaining 5% Y/Y on pricing strength in most key provinces - supporting supply additions.

Metals & meat drive fourth PPI gain

Industrial product prices rose 0.8% in September, the fourth straight sequential gain thanks to metals, petroleum and meat...

… which posted its tenth month of price inflation in a row.

Similar dynamics played out in raw materials, with a near-10% gain in precious metals that offset continued weakness in crude and crop products…

… which have gotten a haircut for four straight months, bringing price levels down to where they were a year ago.

FUNNY BUSINESS

After a series of offers for MEG Energy (MEG) from Strathcona (SCR) and Cenovus (CVE), this deal seemed all but over… but MEG pushing its vote date out a week casts doubt over whether it will close at all.

At 63% in favour of CVE’s “final” offer, MEG needs to find and swing another ~4% before the end of October… let’s see if it gets over the finish line.

ON OUR RADAR

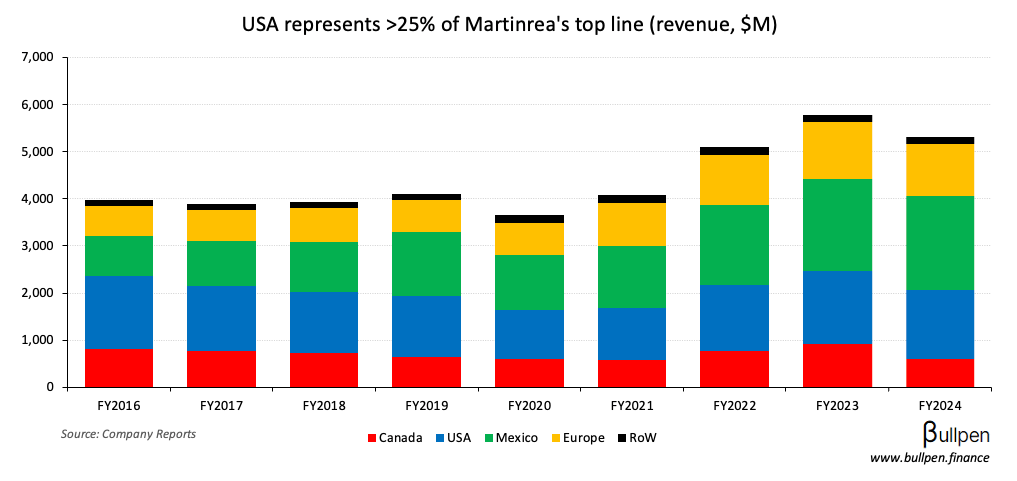

Just 10 days after Linamar’s $300M acquisition, Martinrea (MRE) joined the party - buying the assets of Lyseon North America and growing its U.S. footprint.

With auto tariffs and supply chain challenges weighing on smaller players, the deal lines up well with recent management commentary…

One of the realities, particularly when we have tougher times like we do now is customers like us looking. They might have a troubled supplier situation and say, you could really help us out if you do this.

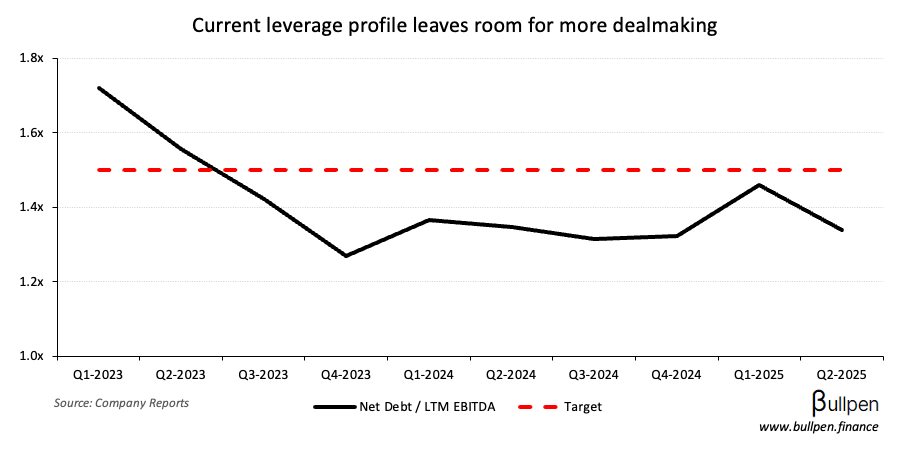

… and given leverage remains comfortably under target, like Linamar - there’s probably more activity on the way.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Phillip Williams | IsoEnergy (ISO) | $319K |

| Jose Moreno | Avino (ASM) | $548K |

| Michael Konnert | Vizsla (VZLA) | $2.4M |

| Dean Swanberg | Zedcor (ZDC) | $5.9M |

| Keith Neumeyer | First Majestic (FR) | $104K |

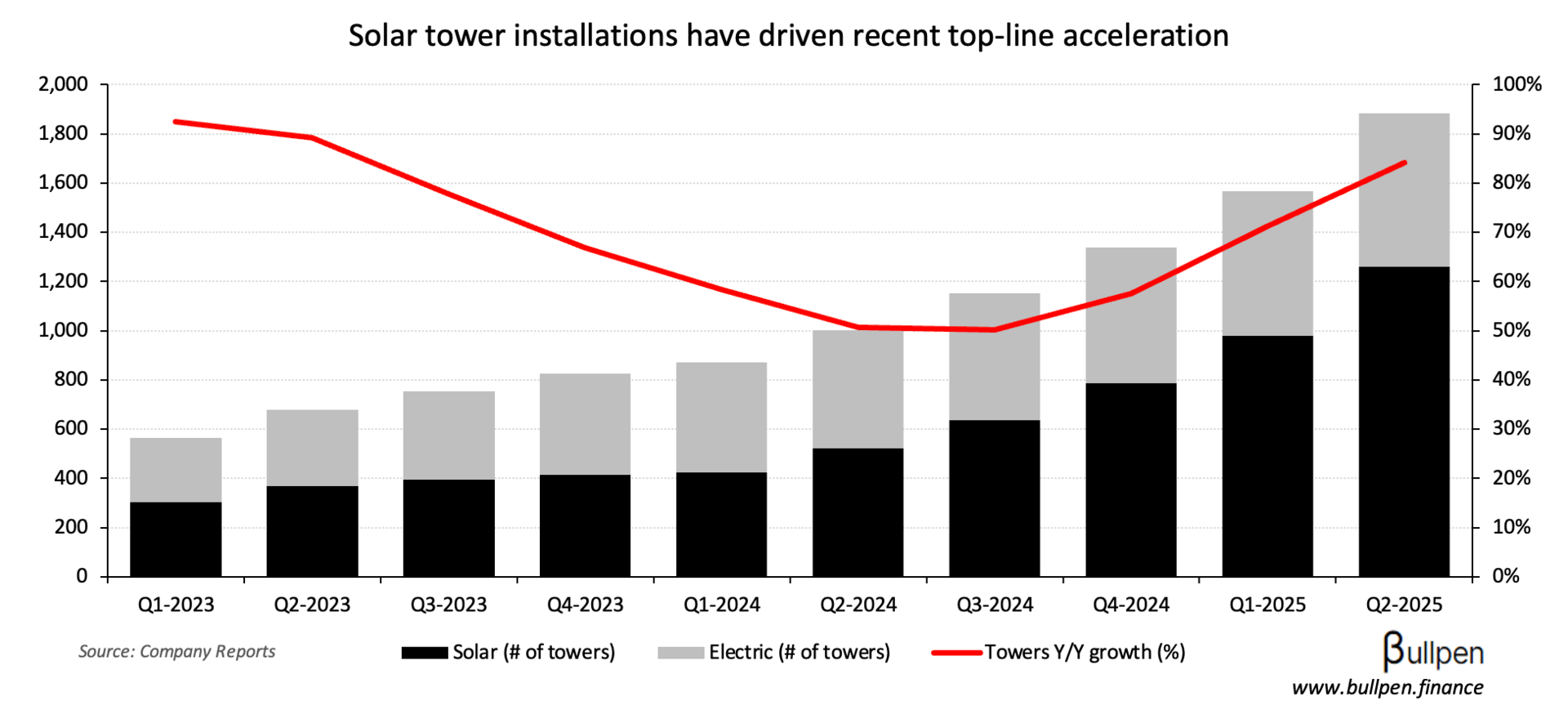

Flagging the selling at Zedcor (ZDC), which is one of very few from Dean and the largest on record by a mile. It follows a near 10x run since the start of 2023, with revenue doubling and margins expanding…

… thanks to a rapid acceleration in solar-powered surveillance tower deployments.

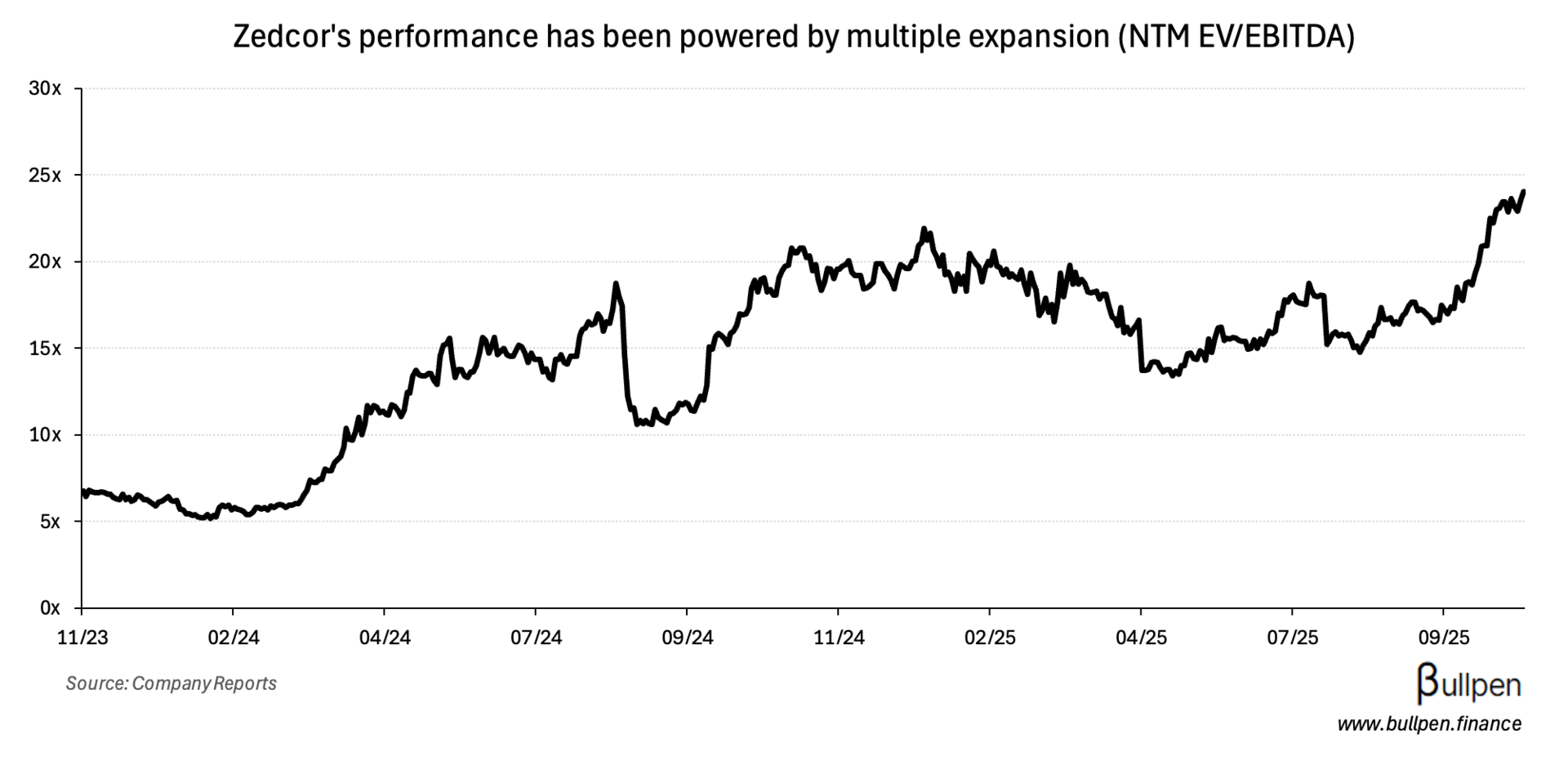

While there’s been some serious fundamental improvement in the business, much of ZDC’s run has been powered by multiple expansion…

… and with security names running hot, it could prove an opportune time to take some chips off the table.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 Netflix (NFLX) | 5.87 | 6.97 |

| 🇺🇸 General Electric (GE) | 1.66 | 1.47 |

| 🇺🇸 Coca-Cola (KO) | 0.82 | 0.78 |

| 🇺🇸 Philip Morris (PM) | 2.24 | 2.10 |

| 🇺🇸 Raytheon (RTX) | 1.70 | 1.41 |

| 🇺🇸 Lockheed (LMT) | 6.95 | 6.35 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Mullen (MTL) | AM | 0.36 |

| 🇨🇦 Whitecap (WCP) | PM | 0.23 |

| 🇨🇦 West Fraser (WFG) | PM | -1.52 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Inflation M/M | 0.1% | -0.1% |

| 🇨🇦 Inflation Y/Y | 2.4% | 2.3% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.