|

TSX

1D %

YTD %

|

25,897.48

0.80%

4.01%

|

|

|

TSXV

1D %

YTD %

|

667.45

1.34%

8.12%

|

|

|

S&P 500

1D %

YTD %

|

5,916.93

0.41%

0.82%

|

|

|

NASDAQ

1D %

YTD %

|

19,112.32

0.18%

0.87%

|

|

|

US 10Y

1D

YTD

|

4.435

10 bps

14 bps

|

|

|

DJIA

1D %

YTD %

|

42,322.75

0.65%

0.16%

|

|

|

CA 10Y

1D

YTD

|

3.170

9 bps

6 bps

|

|

|

CAD/USD

1D %

YTD %

|

0.716

0.13%

2.99%

|

|

Non-residential activity weighs on building permits

Housing starts jump on big multi-unit activity

Residential REITs: is the trade changing?

Nearing the end of the HBC saga

A truck load of insider transactions

SCR up on $2.8B asset sale, ATRL jumps on nuclear activity

Fund managers say the gold trade is the most crowded

Soft building permits due to non-residential

Building permit values for March fell 4.1% M/M, below analyst estimates for a 1.2% drop on the back of ~15% lower institutional and commercial permitting, which more than offset 2% gains in residential activity.

The residential improvement was driven by a 6% jump in multi-unit permitting, with a huge rebound in activity in Vancouver. Encouraging to see given the recent challenges in BC, though Ontario continues to struggle to add new supply.

Housing starts jump on multi-unit activity

The rebound in multi-unit permitting carried through to housing starts, which came in at 279K for April, blowing by estimates of 228K and up 30% M/M thanks to a jump in multi-unit starts.

While Vancouver bucked the negative YTD trend with a 6% Y/Y increase, the provincial divergence largely continued, with strength in Quebec and Alberta offsetting weakness in Ontario.

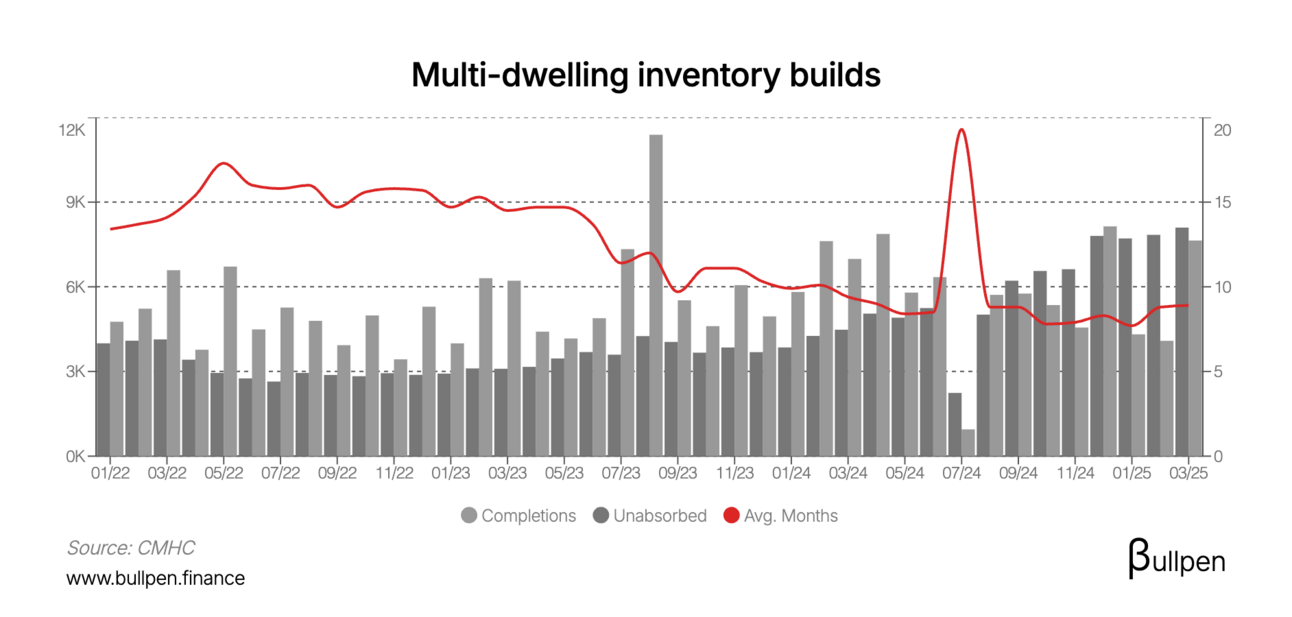

Despite some signs of a turnaround we’re staying cautious here, as continued builds in unabsorbed multi-unit inventory should tame developer appetite.

Residential REITs: is the trade changing?

All this housing market data came at the perfect time, given the residential REITs just wrapped up Q1 earnings. We’re back with a follow up to our first recap, where we highlighted regional players as the way to play, given immigration headwinds.

We dive into the trading and fundamental performance since then, before giving an update on how we’d play the sector from here. Check it out!

While there’s still a few i’s to dot and t’s to cross, this one is all but over. The way it happened still rubs us the wrong way, with all of the capital raising done in Canada before orphaning the business to get in bed with U.S. private equity… money talks!

| Insider |

Company |

Value |

| Paul Sislian |

Bombardier (BBD-B) |

$1.3M |

| J.C. Gallagher |

Bombardier (BBD-B) |

$1.3M |

| Robert King |

Freehold (FRU) |

$203K |

| Mike Rose |

Tourmaline (TOU) |

$318K |

| John Hooks |

PHX Energy (PHX) |

$2.4M |

| Denis Ricard |

iA Financial (IAG) |

$530K |

| Jessica Hertz |

Shopify (SHOP) |

$1.1M |

| Ian Reid |

OceanaGold (OGC) |

$146K |

| Caroline Maso |

Bombardier (BBD-B) |

$125K |

| Andre Le Bel |

OR Royalties (OR) |

$1.3M |

| Frederic Ruel |

OR Royalties (OR) |

$802K |

| Megan Paterson |

Kinaxis (KXS) |

$1.0M |

| Angel Mendez |

Kinaxis (KXS) |

$1.9M |

| Chris Fitzgerald |

Kinaxis (KXS) |

$7.5M |

| Mark Morgan |

Kinaxis (KXS) |

$1.4M |

| Robert Courteau |

Kinaxis (KXS) |

$908K |

| Anita Oliva |

TC Energy (TRP) |

$965K |

| Jennifer Cochrane |

Toromont (TIH) |

$580K |

| Mike Cuddy |

Toromont (TIH) |

$586K |

| Marc Branson |

Fortis (FTS) |

$1.4M |

| Gary Edelstein |

Propel (PRL) |

$360K |

| Gary Edelstein |

Propel (PRL) |

$342K |

| Tim Ferwerda |

Finning (FTT) |

$216K |

| Kevin Parkes |

Finning (FTT) |

$290K |

| Kieran Holm |

Finning (FTT) |

$395K |

| Jacques Goulet |

Sun Life (SLF) |

$2.3M |

| Michael Spencer |

OR Royalties (OR) |

$562K |

| Aimee DeCamillo |

Manulife (MFC) |

$300K |

|

Strathcona (SCR)

1D %

YTD %

|

30.92

13.97%

1.87%

|

|

|

Baytex (BTE)

1D %

YTD %

|

2.33

8.27%

37.03%

|

|

|

AtkinsRealis (ATRL)

1D %

YTD %

|

84.25

10.93%

10.48%

|

|

|

Mattr (MATR)

1D %

YTD %

|

10.36

7.83%

18.04%

|

|

|

MDA Space (MDA)

1D %

YTD %

|

25.80

7.72%

12.63%

|

|

|

Valeura (VLE)

1D %

YTD %

|

7.34

6.62%

1.10%

|

|

AtkinsRealis (ATRL) was up big on its Q1 results, beating earnings estimates by nearly 20% and showing huge backlog gains in its nuclear segment. The backlog growth prompted a $300M bump to ATRL’s nuclear revenue guidance of $1.7-2.0B. The nuclear theme isn’t going anywhere anytime soon.

YESTERDAY’S EARNINGS

| Company |

Actual |

Consensus |

| 🇨🇦 AtkinsRealis (ATRL) |

0.63 |

0.53 |

| 🇨🇦 Bragg Gaming (BRAG) |

4.1M |

4.3M |

| 🇨🇦 Keyera (KEY) |

0.57 |

0.52 |

| 🇨🇦 Nexus REIT (NXR-U) |

29.8M |

29.8M |

| 🇨🇦 Calfrac (CFW) |

0.11 |

0.09 |

| 🇨🇦 Vecima (VCM) |

0.02 |

0.09 |

| 🇨🇦 Dynacor (DNG) |

7.0M |

6.0M |

| 🇨🇦 InterRent (IIP-U) |

40.5M |

38.1M |

| 🇨🇦 Cdn. Net REIT (NET-U) |

4.8M |

4.5M |

| 🇺🇸 Walmart (WMT) |

0.61 |

0.58 |

| 🇺🇸 Deere & Co (DE) |

6.64 |

5.62 |

| 🇺🇸 Applied Materials (AMAT) |

2.39 |

2.31 |

No big earnings releases today… enjoy your long weekend!

YESTERDAY’S ECONOMIC RELEASES

| Release |

Actual |

Consensus |

| 🇨🇦 Housing Starts |

278.6K |

227.5K |

| 🇨🇦 Mftg. Sales M/M |

-1.4% |

-1.9% |

| 🇨🇦 Wholesale Sales M/M |

0.2% |

-0.3% |

| 🇺🇸 PPI M/M |

-0.5% |

0.2% |

| 🇺🇸 Core PPI M/M |

-0.4% |

0.3% |

| 🇺🇸 Retail Sales M/M |

0.1% |

0.0% |

| 🇺🇸 Jobless Claims |

229K |

229K |

| 🇺🇸 Continuing Claims |

1,881K |

1,890K |

| 🇺🇸 NY Mftg. Index |

-9.2 |

-10.0 |

| 🇺🇸 Philly Mftg. Index |

-4 |

-11 |

| 🇺🇸 Ind. Production M/M |

0.0% |

0.2% |

| 🇺🇸 Capacity Utilization |

77.7% |

77.8% |

| 🇺🇸 Mftg. Production M/M |

-0.4% |

-0.2% |

| 🇺🇸 Biz Inventories M/M |

0.1% |

0.2% |

| 🇺🇸 NAHB Housing Index |

34 |

40 |

TODAY’S ECONOMIC RELEASES

| Release |

Time |

Consensus |

| 🇨🇦 Foreign Security Buys |

8:30AM |

5.2B |

| 🇺🇸 Building Permits |

8:30AM |

1.45M |

| 🇺🇸 Housing Starts |

8:30AM |

1.37M |

| 🇺🇸 Export Prices M/M |

8:30AM |

-0.5% |

| 🇺🇸 Import Prices M/M |

8:30AM |

-0.4% |

| 🇺🇸 Consumer Sentiment |

10:00AM |

53.4 |

|

WTI Crude

1D %

YTD %

|

61.82

2.11%

13.89%

|

|

|

Gold

1D %

YTD %

|

3,231.87

1.44%

23.15%

|

|

|

Nat Gas

1D %

YTD %

|

3.34

4.36%

7.24%

|

|

|

Silver

1D %

YTD %

|

32.57

1.10%

12.77%

|

|

|

Lumber

1D %

YTD %

|

602.62

8.47%

9.46%

|

|

|

Copper

1D %

YTD %

|

4.65

0.92%

16.71%

|

|

|

Soybean

1D %

YTD %

|

1,052.83

2.31%

5.34%

|

|

|

Aluminum

1D %

YTD %

|

2,500.60

0.90%

2.19%

|

|

|

Corn

1D %

YTD %

|

448.19

0.60%

2.15%

|

|

|

Wheat

1D %

YTD %

|

532.24

1.43%

3.49%

|

|

Worth flagging the below from BofA’s fund manager survey… let’s see if gold can keep the rally going.