|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Home sales continue recovery

Manufacturing conditions stabilize

Air Canada strike impacts

Carl Icahn is out of BHC

Is Bird’s 20% sell-off overdone?

HOT OFF THE PRESS

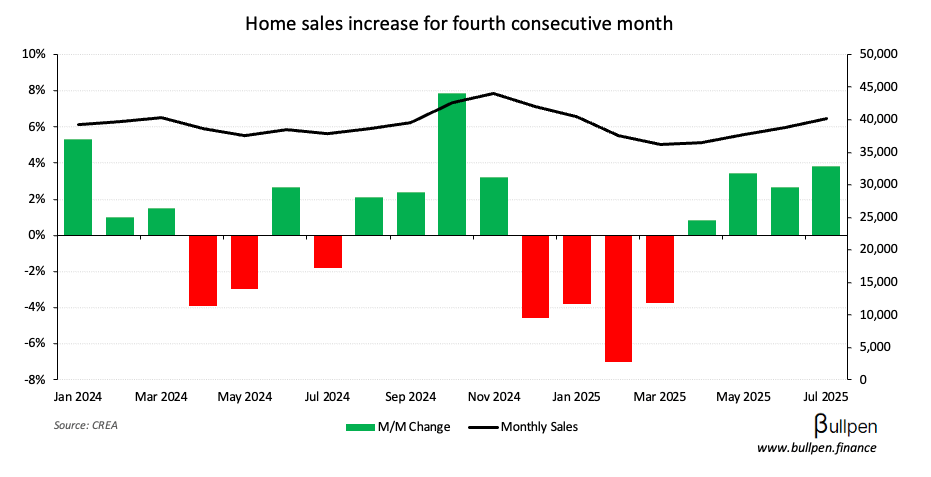

Home sales climb 11% from lows

Home sales continued their recovery in July, up roughly 4% versus June and 11% from March’s low point after four straight monthly increases…

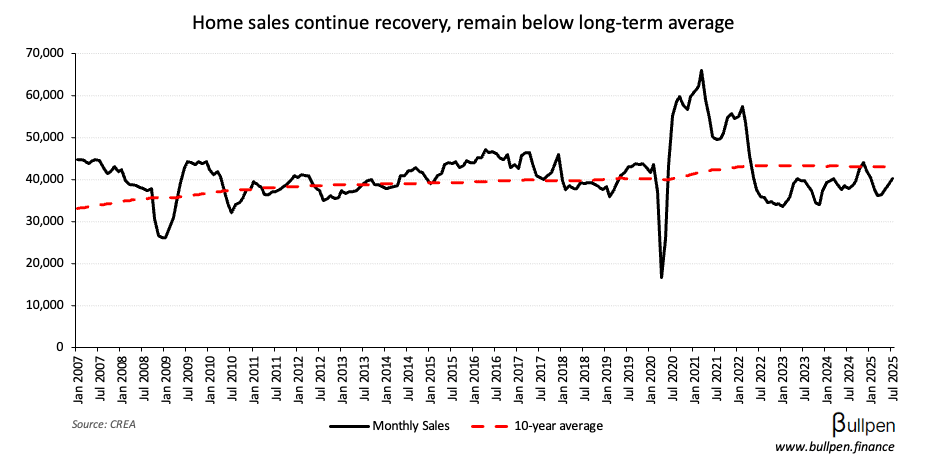

… but still below the long-term average - with overall sales activity struggling since the pandemic.

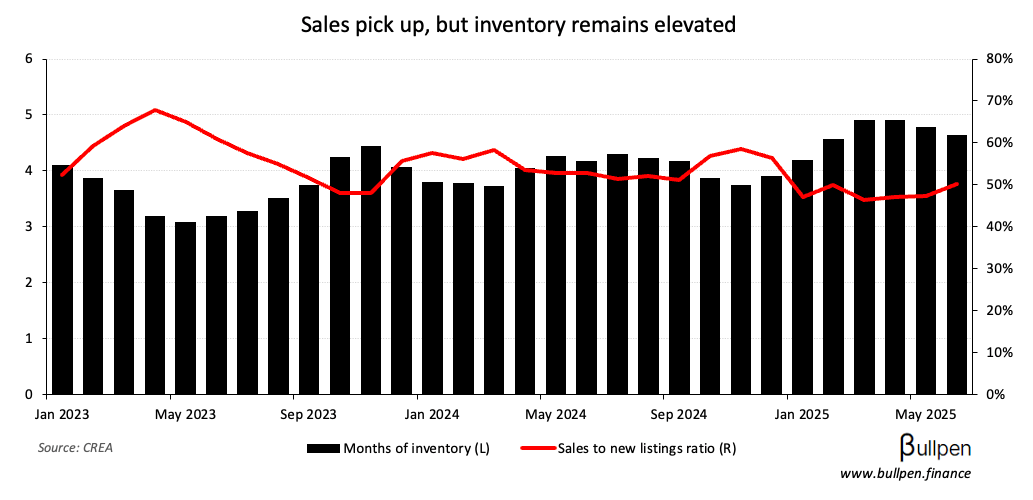

While positive, higher sales will need to chew through existing inventory before having a material impact on prices…

… which remain under pressure…

… as the gap between new listings and sales activity highlights the persistent market imbalance in recent years.

June manufacturing conditions stabilize

Manufacturing sales of ~$68B increased 0.3% M/M, coming up just shy of estimates for a 0.4% gain. June marked the first positive reading in five months - thanks to a recovery in petroleum (+12%) and food (+2.5%) sales.

Inventory levels held steady, as a 0.5% decline in raw materials offset a 0.7% jump in finished goods…

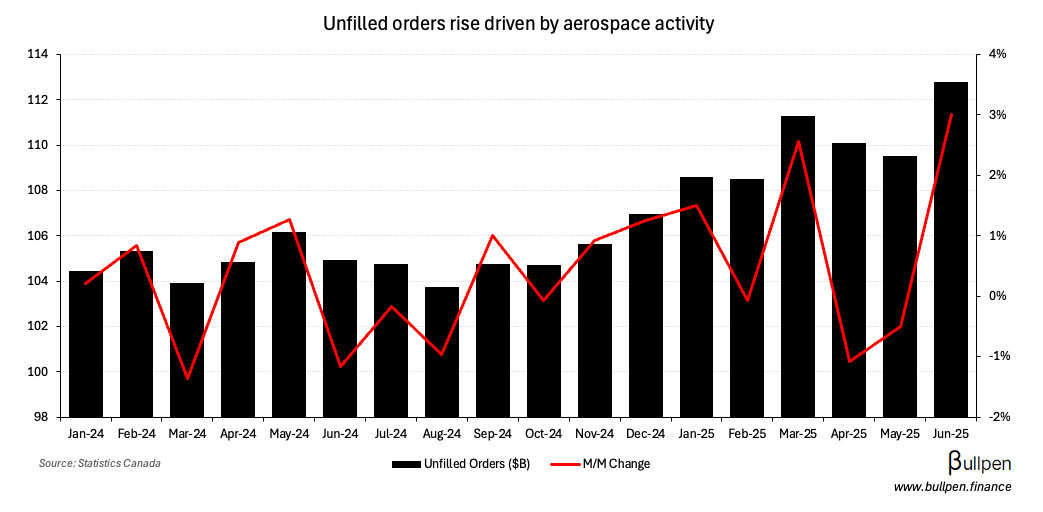

… which in conjunction with higher unfilled orders points to the cooling effect the trade war is having on supply chains.

Despite the disruption, conditions seem to be stabilizing for now - with wholesale sales gaining 0.7% M/M, most of which was volume-driven.

FUNNY BUSINESS

After a couple days of grounded flights and a lot of back and forth, Air Canada (AC) plans to resume operations Monday after striking employees were ordered back to work.

If things go off without a hitch, the only turbulence Air Canada still needs to contend with is the slowdown in its U.S. transborder segment…

… but if the labour dispute drags on, uncertainty could translate into lower passenger load factors - hurting AC’s flight economics… let’s see.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Clive Kinross | Propel (PRL) | $1.5M |

| Gary Edelstein | Propel (PRL) | $430K |

| Clive Johnson | B2Gold (BTO) | $512K |

| Devorah Lithwick | BCE Inc. (BCE) | $207K |

| Scott Parsons | Alamos (AGI) | $542K |

| Daniel Micak | B2Gold (BTO) | $512K |

| Patrick Shea | Waste Connections (WCN) | $942K |

| Alexandre L'Heureux | WSP Global (WSP) | $18.4M |

| Alain Michaud | WSP Global (WSP) | $1.7M |

| Alexandre L'Heureux | WSP Global (WSP) | $18.4M |

| Philippe Fortier | WSP Global (WSP) | $2.0M |

| Alan Simpson | StorageVault (SVI) | $470K |

| Sylvain Aubry | Savaria (SIS) | $279K |

| Patrick Mongeau | Savaria (SIS) | $348K |

| Alexandre Bourassa | Savaria (SIS) | $530K |

| Alan Hibben | Mattr (MATR) | $502K |

| Louis Tetu | CAE Inc. (CAE) | $183K |

| Miles Gregg | Toromont (TIH) | $512K |

| Paul Mascarenas | Neo Materials (NEO) | $183K |

| Russell Girling | Suncor (SU) | $535K |

| Kevin Strain | Sun Life (SLF) | $790K |

| Thomas Murphy | Sun Life (SLF) | $251K |

| Edward Rogers | Rogers (RCI) | $45.8M |

| Peter Marrone | Allied (AAUC) | $854K |

| John Paulson | Bausch (BHC) | $312M |

Bausch Health (BHC) gained 11% Friday on news that Paulson Capital cleared out activist investor Carl Icahn’s full stake, following a drawn out battle for control that weighed on the stock alongside its leverage profile…

… which prompted bankruptcy rumours and a >50% drawdown in 2022 that BHC hasn’t recovered from. With an accounting scandal that pre-dated Icahn’s position leaving a bad taste, the company will need more for a sustainable re-rate.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Bird Construction (BDT) extended it’s post-Q2 fall, down nearly 20% since the print - which came with a continued deceleration in revenue driven by a slowdown in the buildings and industrial segment…

… that management expects to rebound somewhat through the remainder of the year, as uncertainty continues to influence decision making. The sell-off has brought BDT back to its ten-year average EBITDA multiple…

… but the company looks a lot better than it has in the past, with a record backlog supporting a long runway for revenue growth…

… that should come at better economics, with EBITDA margins expanding towards management’s 8% 2027 target.

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales M/M | 0.3% | 0.4% |

| 🇨🇦 Wholesale Sales M/M | 0.7% | 0.7% |

| 🇨🇦 New Vehicle Sales | 177K | - |

| 🇺🇸 Retail Sales M/M | 0.5% | 0.5% |

| 🇺🇸 Export Prices M/M | 0.1% | 0.1% |

| 🇺🇸 Import Prices M/M | 0.4% | 0.0% |

| 🇺🇸 NY Mftg. Index | 11.9 | 0.0 |

| 🇺🇸 Industrial Prod. M/M | -0.1% | 0.0% |

| 🇺🇸 Consumer Sentiment | 59 | 62 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Housing Starts | 8:15AM | 259K |

| 🇨🇦 Foreign Buys | 8:30AM | -4.8B |

| 🇨🇦 Canadian Buys | 8:30AM | - |

| 🇺🇸 NAHB Housing Index | 10:00AM | 33 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.