|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

HOT OFF THE PRESS

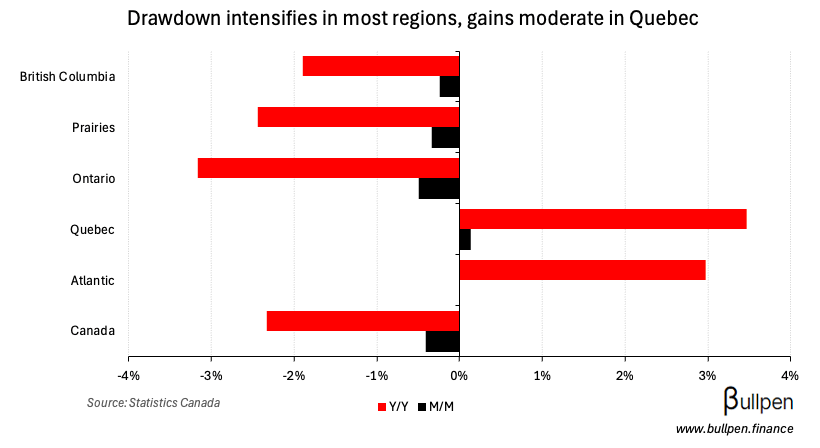

New home prices drop

New home prices fell more than expected in January, shedding 0.4% versus estimates for a 0.1% gain…

… and building on last month’s 0.2% decline, driven by growing price pressure in Ontario, the Prairies, and BC alongside cooling momentum in Quebec.

With unsold inventory building up, a sustained reversal higher isn’t likely in the near-term.

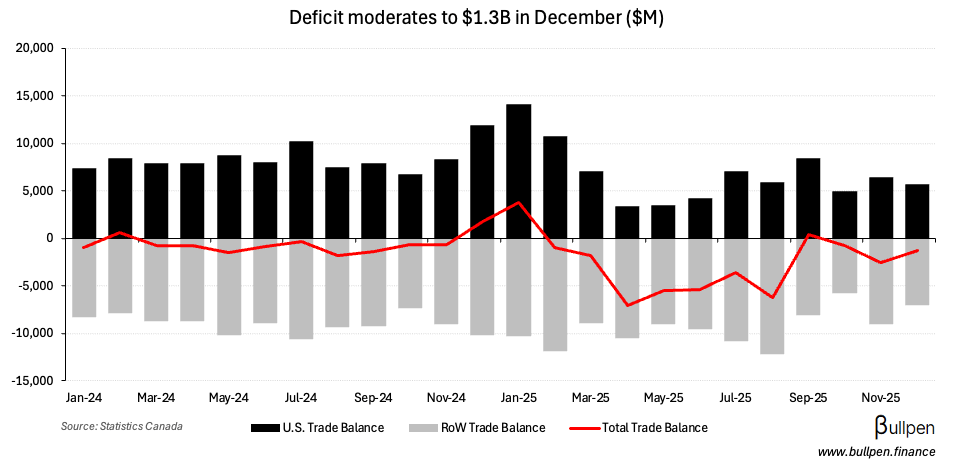

Trade deficit narrows

December’s $1.3B trade deficit was lighter than expected, improving over last month…

… on the back of a 3% gain in exports, led by an 18% increase in metal products and a 26% rise in aircraft deliveries…

… business jets specifically, which drove a record print and make the timing of Trump’s 50% tariff threat (resolving)… interesting.

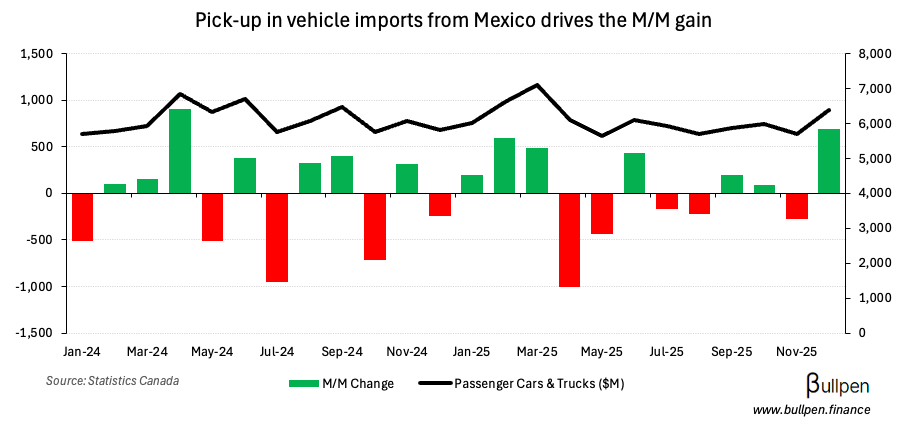

Imports increased to a lesser degree (1%), with a 12% bump in vehicle shipments…

… carrying results, driven by non-U.S. activity (Mexico & the Netherlands).

ON OUR RADAR

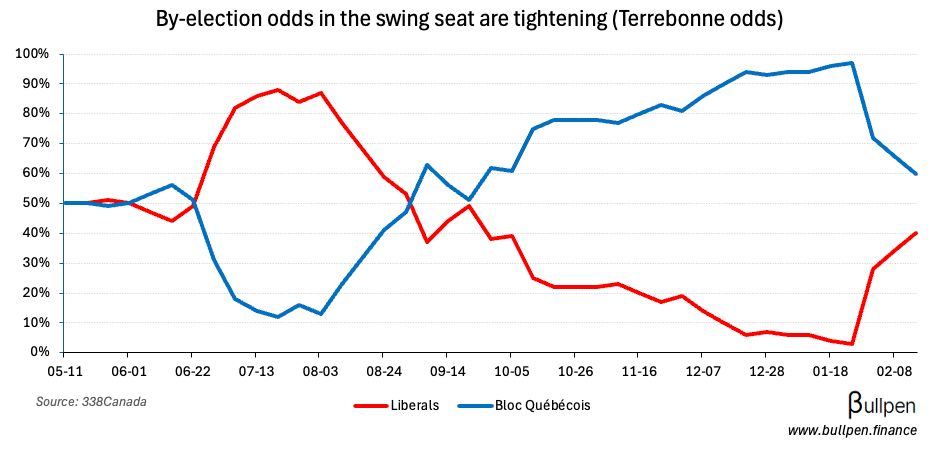

Flagging the third Conservative MP floor crossing, which pushes Carney closer to a majority that would remove friction from the implementation of initiatives like Build Canada Homes, the Alto HSR project, and a new Defence Industrial Strategy.

While his Davos speech sparked speculation that an election could be called, there may be no need - with a by-election in Terrebonne this year…

… that could seal the deal and break the minority government logjam.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

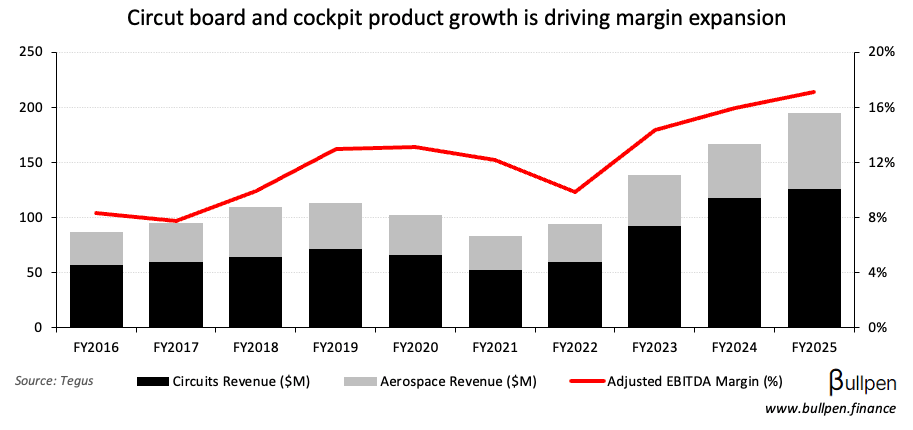

Firan Technology (FTG) added another 7% on its Q4 print, which beat on the top line and missed on EPS. The trajectory remains up and to the right, with management highlighting strong demand…

… across its business jet, aerospace, and defence markets - driving steady margin expansion and backlog growth.

There’s no question about the attractiveness of FTG’s fundamental setup, but with the stock trading above 12x NTM EBITDA (double the long-term average)…

… the next leg higher should be a slow grind relative to the three-year, >500% run in the stock.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Trevor Ebl | TC Energy (TRP) | $343K |

| Eric Jobin | iA Financial (IAG) | $152K |

| Denis Ricard | iA Financial (IAG) | $912K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Canadian Tire (CTC) | 4.47 | 3.80 |

| 🇨🇦 MTY Food (MTY) | 1.88 | 0.83 |

| 🇨🇦 Altus Group (AIF) | 0.67 | 0.58 |

| 🇨🇦 Cenovus (CVE) | 0.49 | 0.38 |

| 🇨🇦 Teck Resources (TECK) | 1.37 | 0.96 |

| 🇨🇦 Sprott (SII) | 1.40 | 0.99 |

| 🇨🇦 Superior (SPB) | 0.27 | 0.25 |

| 🇨🇦 Lundin (LUN) | 0.42 | 0.30 |

| 🇨🇦 Eldorado (ELD) | 0.63 | 0.60 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Hudbay (HBM) | AM | 0.39 |

| 🇨🇦 Onex (ONEX) | AM | - |

| 🇨🇦 Secure Waste (SES) | AM | 0.24 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Trade Balance | -1.3B | -2.1B |

| 🇨🇦 New Home Price M/M | 0.4% | 0.1% |

| 🇺🇸 Trade Balance | -70B | -56B |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Retail Sales M/M | 8:30AM | -0.5% |

| 🇨🇦 PPI M/M | 8:30AM | 0.2% |

| 🇨🇦 Raw Materials M/M | 8:30AM | 0.7% |

Was this forwarded to you? Join 8,000+ investors reading The Morning Meeting by clicking the button below.