H&R REIT stuck to its word, executing $1.5B of asset sales across the retail and office portfolio. Once closed, residential and industrial exposure will climb above 80% of fair value…

… which has more headroom still, with negotiations underway on two more Canadian office properties and management indicating its desire to accelerate its resi/industrial transformation (will be needed to reach its $2.6B target).

H&R plans to wipe out debt with the $1.1B in cash proceeds post-close, bringing leverage down to 8.7x - below its target ceiling of 9x…

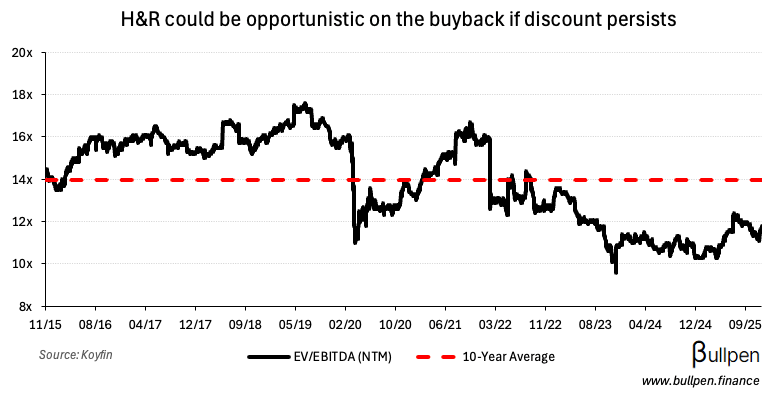

… which gives it some room for share repurchases, with the company applying for a $200M NCIB in the near future.