|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Gildan’s $4B deal beats expectations

BMO explores $14B portfolio sale

NOA falls 20% on messy Q2

MATR falls 15% on copper tariffs

HOT OFF THE PRESS

Gildan’s $4.4B deal exceeds expectations

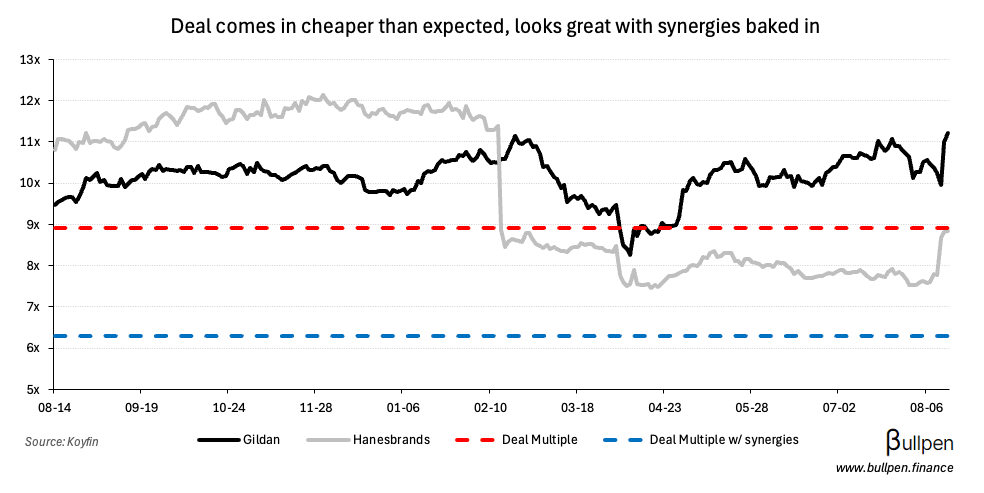

It didn’t take long for the rumour of Gildan’s $5B bid for Hanes to materialize… and better than expected too - with a lower $4.4B price tag representing an 8.9x EBITDA multiple (6.3x post-synergies) that the market rewarded with a 15% bump in shares.

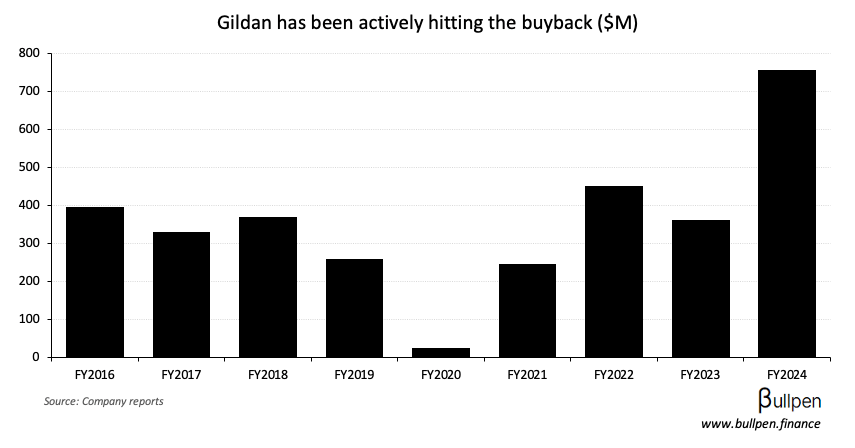

Gildan elected to finance nearly 90% of the equity value with stock - keeping pro-forma leverage at a modest 2.6x, which management expects to get back below 2x shortly with the help of a buyback pause and divestiture of HBI’s Australian unit.

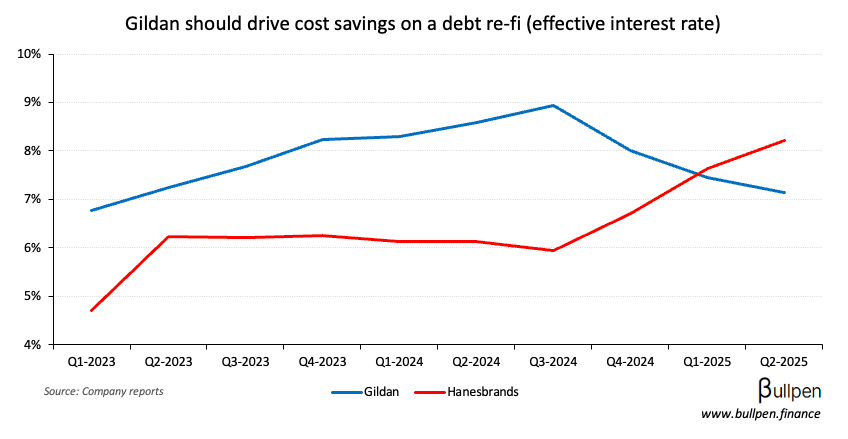

Purchase price: check, financing package: check, strategic rationale: interesting. Cost savings are pegged at ~$200M via higher capacity utilization, overlap in the product mix & manufacturing footprint, and debt refinancing…

… supporting its 3-year guidance for ~20%/yr EPS growth. The combined company is more balanced, both in the products it makes and the path those products take to market…

… but more interesting for the long-term investor is how management frames why this transaction works:

… and contrary to what Hanes has been doing, investing in their brand, Gildan has been investing in low-cost vertically integrated manufacturing… that’s where all of our capital has gone in.

Gildan’s manufacturing expertise is the durable advantage - it’s the heartbeat of retail. If it can digest this deal well, don’t be surprised to see it accretively buy more extremities in the future…

BMO looks to exit transportation finance

The rumour mill is on fire lately - this time it’s BMO in the hot seat, with whispers of a potential $1B sale of its transportation finance division floating around. At ~$14B, the segment is a small portion of its commercial loan book (~4%)…

… but it punches above its weight in terms of credit impact when times are tough, given the cyclicality of the industry.

With credit quality deteriorating in recent quarters…

… and a number of challenges still plaguing the trucking industry, it’s likely BMO wants to leave it in the rearview and focus on something less capital intensive.

FUNNY BUSINESS

Doug Ford is putting his foot down on remote work, mandating 5 days a week in the office starting next year…

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Alain Bergeron | iA Financial (IAG) | $269K |

| Randy MacEwan | Ballard (BLDP) | $1.7M |

| Patrick Mongeau | Savaria (SIS) | $176K |

| Greg Grant | TC Energy (TRP) | $2.0M |

| George Graham | Element (EFN) | $933K |

| Lucille Miller | Tourmaline (TOU) | $287K |

| Daniel Myerson | Foran (FOM) | $142K |

| Pramod Jain | Comp. Modelling (CMG) | $117K |

More buying at Tourmaline (TOU)…

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

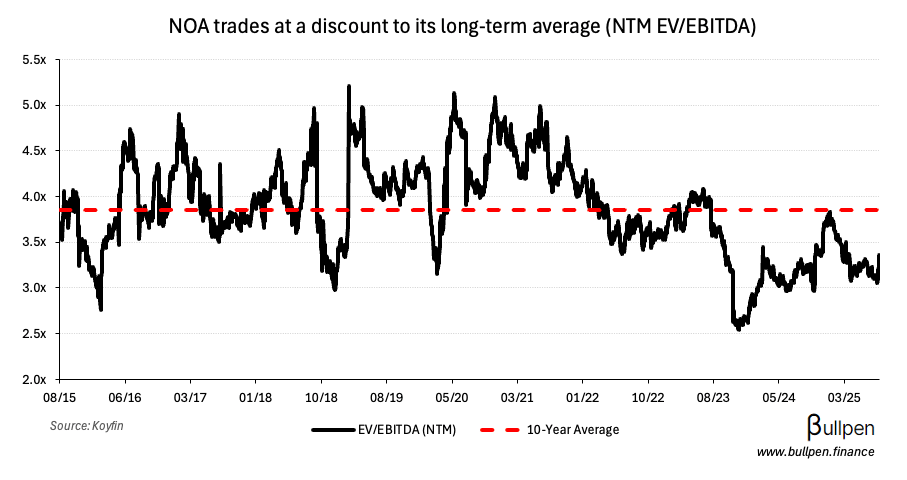

North American Construction (NOA) fell 23% on its Q2, which missed big on margin compression driven in part by the success of its Australian segment, where the volume of new business has outstripped NOA’s capacity to supply it.

The weak quarter prompted a pretty heavy downward revision to guidance, so the stock could be stuck for a while - despite trading at levels that have historically been attractive entry points.

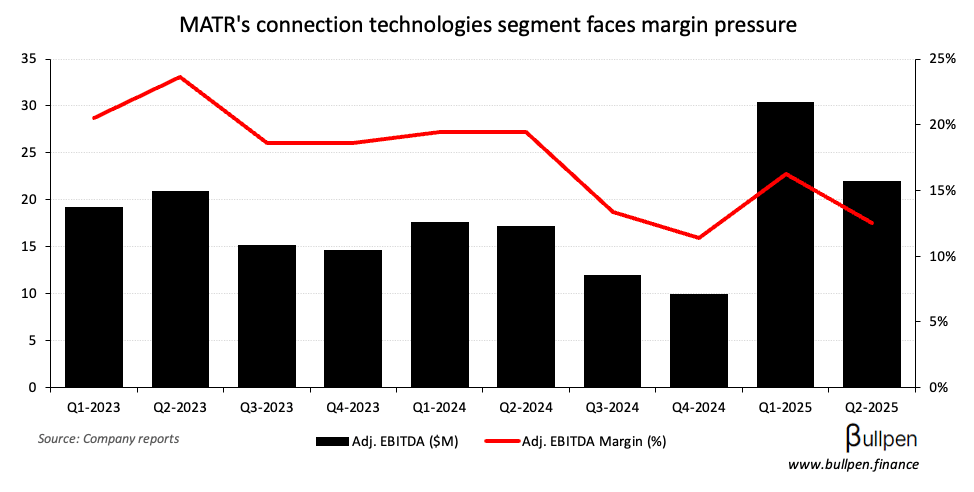

Mattr (MATR) shed 16% on a Q2 miss, with guidance for a weaker Q3 on tariff impacts that should add ~5% to its copper cost base of $100-130M per year - pressuring margins in its wire & cable business…

… and its end market demand, with a cautious outlook for customers like distributors - who can draw on existing inventory while the trade situation plays out.

… we anticipate some degree of noncritical order slowing or deferral during the second half of 2025 as supply chains rebalance.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Bragg (BRAG) | 3.5M | 4.2M |

| 🇨🇦 First Majestic (AG) | 0.06 | 0.07 |

| 🇨🇦 WELL Health (WELL) | 0.10 | 0.09 |

| 🇨🇦 Auto Properties (APR-U) | 19.3M | 19.5M |

| 🇨🇦 G Mining (GMIN) | 0.22 | 0.36 |

| 🇺🇸 Applied Materials (AMAT) | 2.48 | 2.36 |

| 🇺🇸 Deere & Co (DE) | 4.75 | 4.55 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 PPI M/M | 0.9% | 0.2% |

| 🇺🇸 Jobless Claims | 224K | 228K |

| 🇺🇸 Continuing Claims | 1,953K | 1,960K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales M/M | 8:30AM | 0.4% |

| 🇨🇦 New Vehicle Sales | 8:30AM | - |

| 🇨🇦 Wholesale Sales M/M | 8:30AM | 0.7% |

| 🇺🇸 Retail Sales M/M | 8:30AM | 0.5% |

| 🇺🇸 Export Prices M/M | 8:30AM | 0.1% |

| 🇺🇸 Import Prices M/M | 8:30AM | 0.0% |

| 🇺🇸 NY Mftg. Index | 8:30AM | 0.0 |

| 🇺🇸 Industrial Prod. M/M | 9:15AM | 0.0% |

| 🇺🇸 Capacity Utilization | 9:15AM | 77.5% |

| 🇺🇸 Mftg. Prod. M/M | 9:15AM | -0.1% |

| 🇺🇸 Consumer Sentiment | 10:00AM | 62 |

| 🇺🇸 Business Inv. M/M | 10:00AM | 0.2% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.