|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

August GDP disappoints

Budgetary deficit hits $11B

Toromont jumps on solid Q3

Coveo loses 25% on guidance

HOT OFF THE PRESS

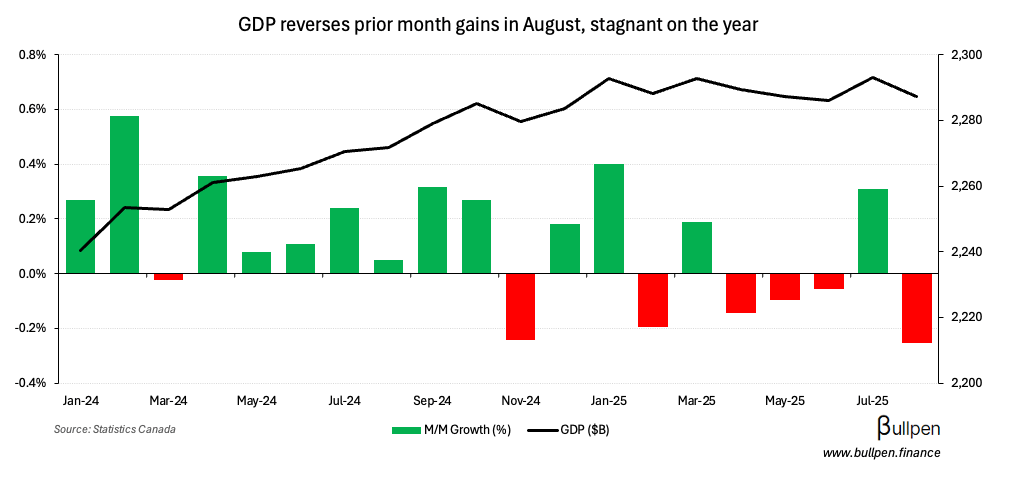

GDP falls short in August

GDP in August missed expectations, falling 0.3% M/M versus estimates for a flat print…

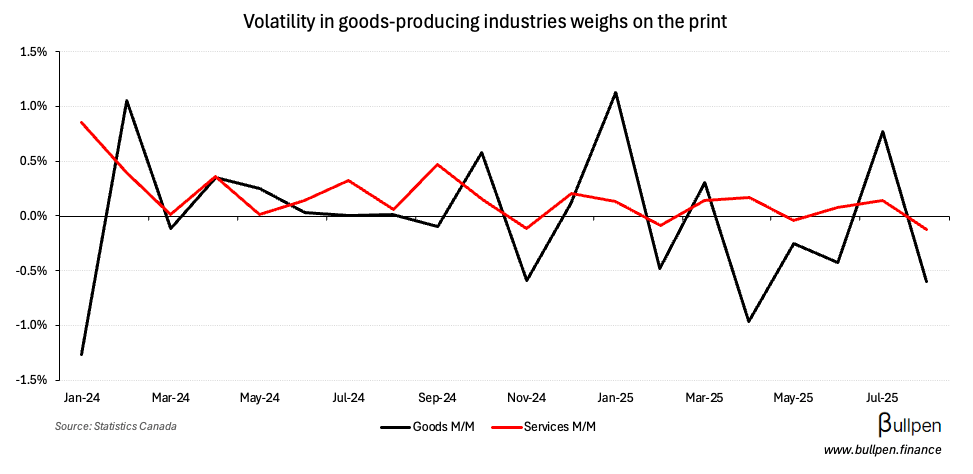

… led by goods-producing industries, which shed 0.6% and pulled down a 0.1% drop in services.

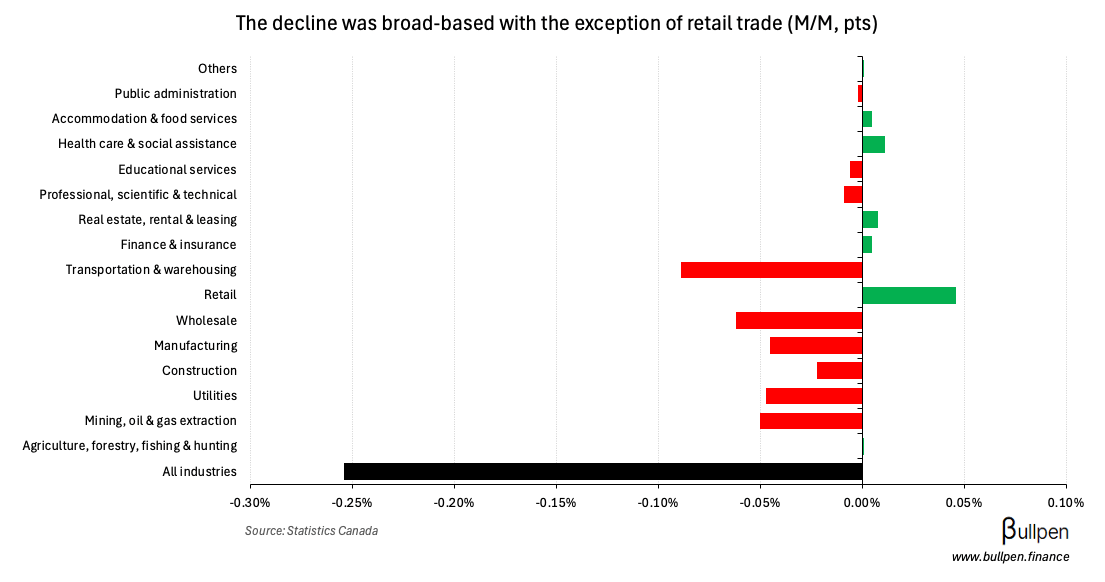

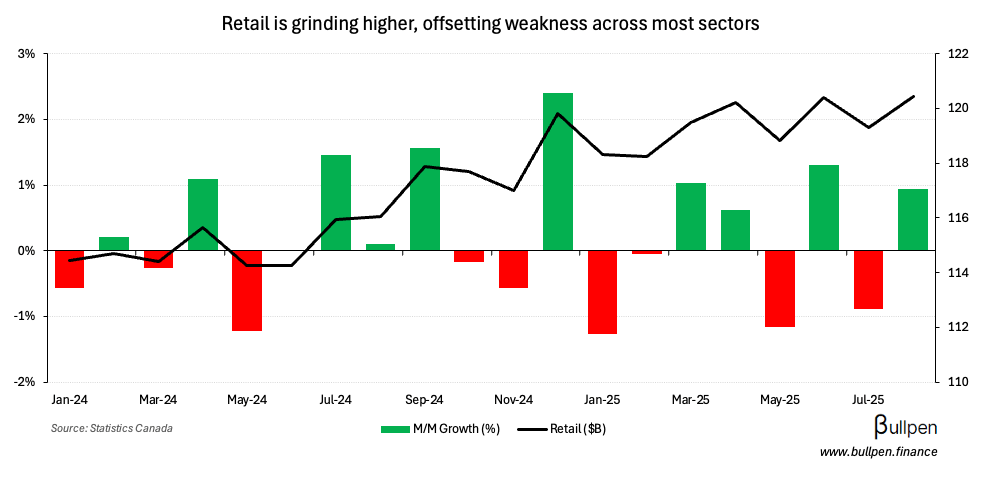

At the sector level, weakness was broad-based with the exception of retail trade…

… which was the lone bright spot in the print, lining up well to last week’s retail sales data.

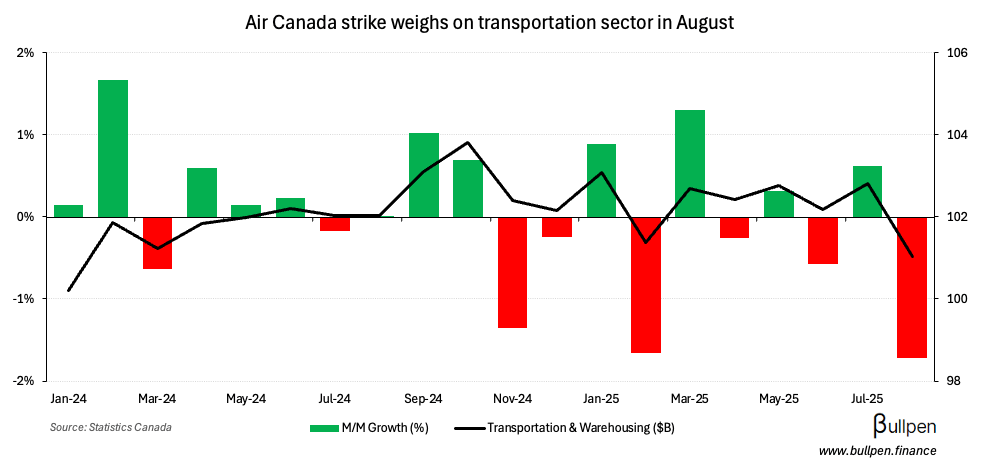

On the negative side, some items were transitory - like the Air Canada strike that weighed down transportation & warehousing activity.

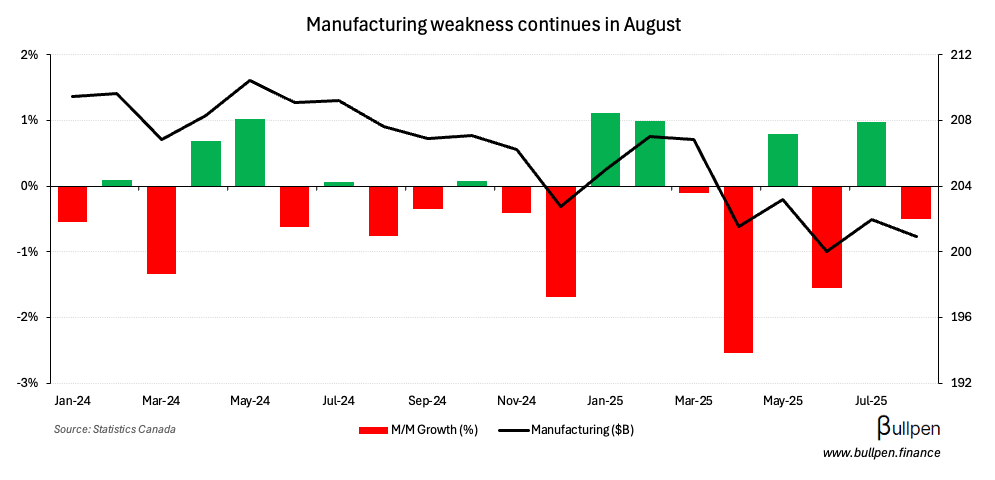

Others were more structural, including the continued slowdown in manufacturing…

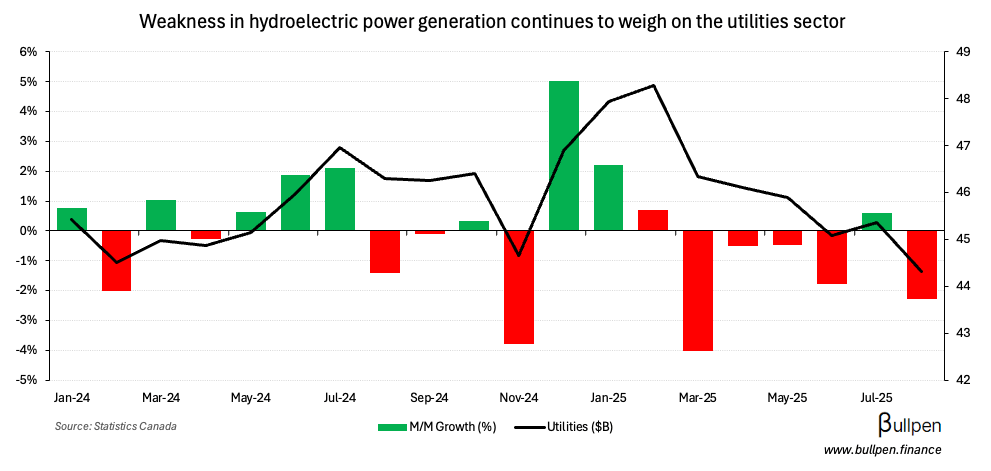

… and in the utilities sector, which has suffered lower hydroelectric power output amid persistently dry conditions.

Some of these categories are expected to turn around in September, with advanced estimates calling for a 0.1% gain.

FUNNY BUSINESS

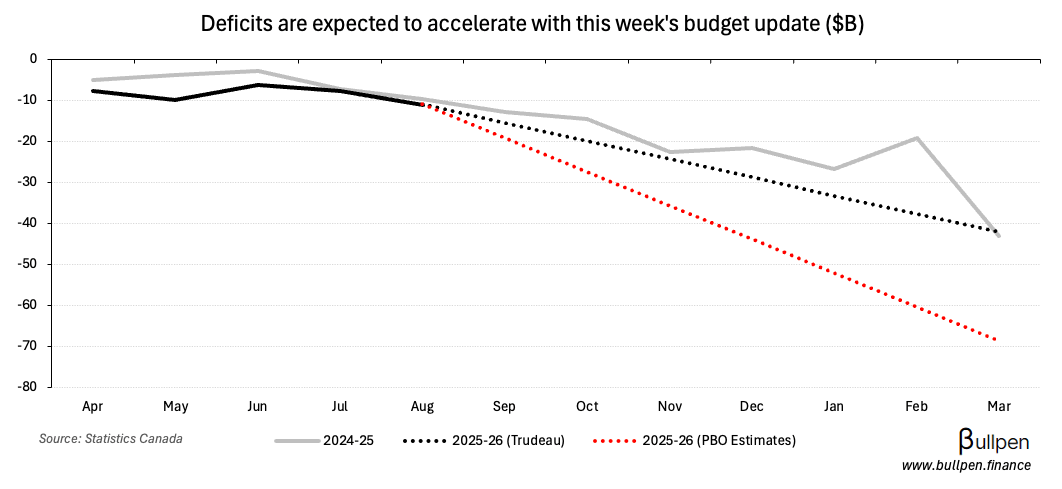

The budgetary deficit was $3.3B in August, expanding Y/Y on higher program expenses…

… led by EI, which is up 16% to date due to weak labour market conditions.

Tariff revenues have moderated the higher spend to some degree, rising $2.5B YTD - or 157%…

… but they’re immaterial in comparison to the coming wave of new spend. With the liberal budget set to be tabled on Tuesday, the question isn’t if the deficit will expand…

… but by how much - with the PBO forecasting an increase to ~$70B and some broker economics teams expecting worse.

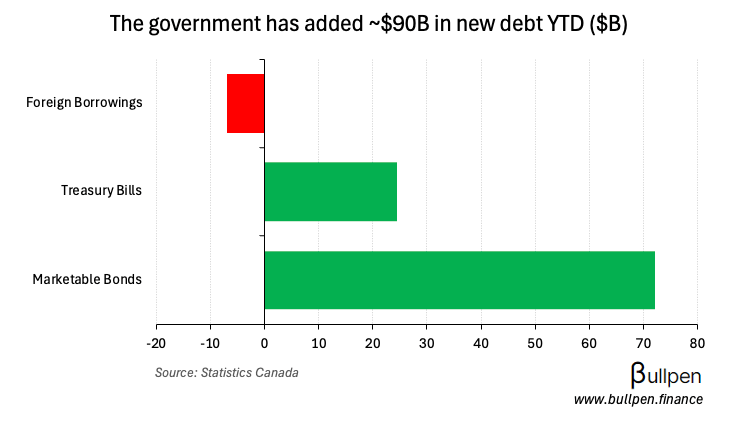

Whatever the new target is, the financing wheels are already in motion - with roughly $90B of new borrowing announced YTD… buckle up.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

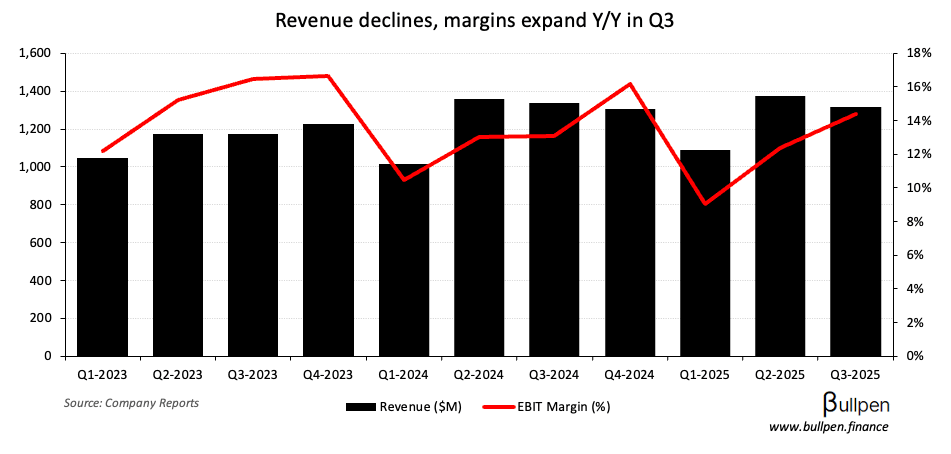

Toromont (TIH) gained 7% on its Q3, which missed on revenue and beat on earnings thanks to strong Y/Y margin expansion.

Bookings were up big in the quarter, gaining 47% Y/Y driven by the company’s recent investment in AVL Manufacturing…

… which should continue, given TIH is another beneficiary of Carney’s nation-building agenda - it’s priced like it too, trading near its peak earnings multiple.

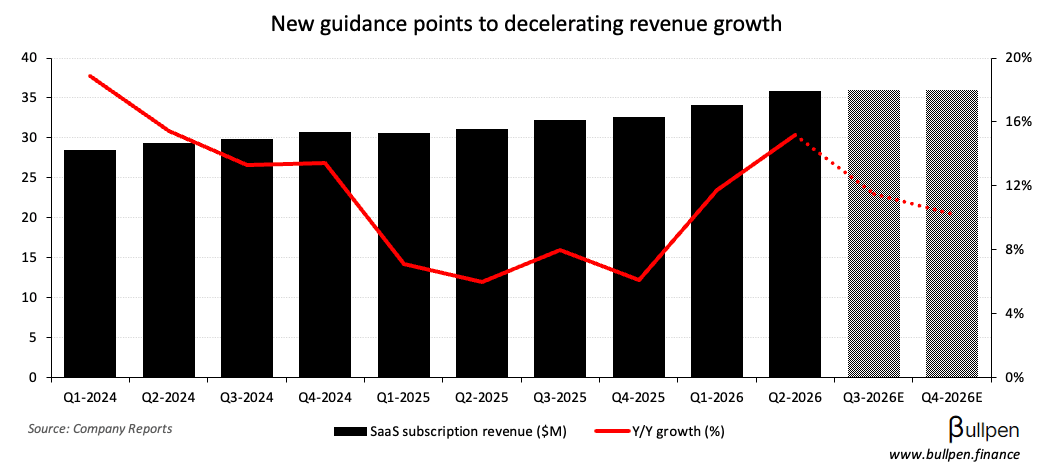

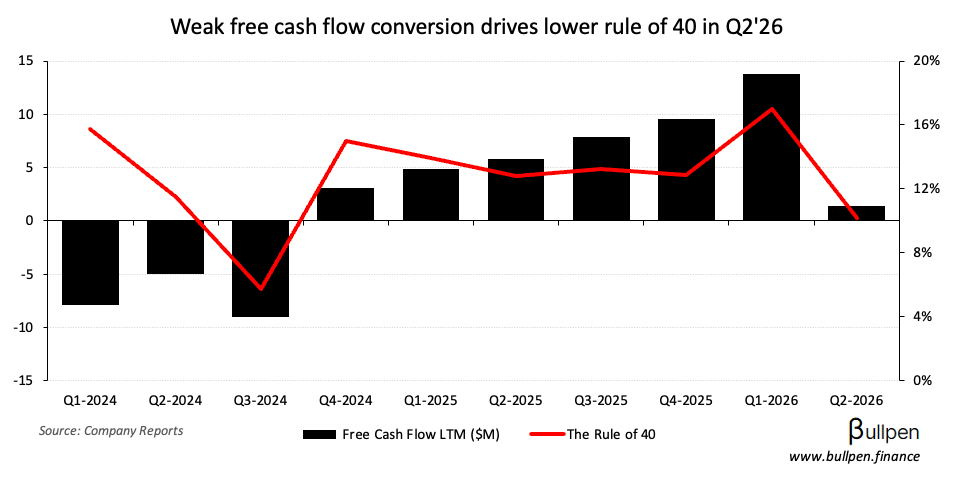

Coveo (CVO) fell 25% on its Q2 print, which inched past estimates but left questions about the future - with management highlighting a revenue loss from renegotiations with Salesforce and changing customer behaviour…

… we observed that additional stakeholder approvals were required as our solutions become more strategic for these customers… we haven’t seen these go to competitors. They simply require more time.

… resulting in the full-year guide tightening around the lower end of the original range.

If growth slows, attention will turn to profitability - leaving a lot of work to do for management to reposition the story.

MDA Space (MDA) continued its slide, now down roughly 20% in the two days since word spread that SpaceX was taking a look at Globalstar.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Eric Sprott | Discovery (DSV) | $6.0M |

| Sergio Martinez | Snowline (SGD) | $3.3M |

| Jon Erickson | Condor (CDR) | $166K |

| Chris Huether | Hammond (HPS-A) | $101K |

| Pierre Chenard | G Mining (GMIN) | $544K |

| Edward Guillet | Waste Con. (WCN) | $1.6M |

| Robert Espey | Parkland (PKI) | $1.0M |

| Thomas Coolen | Trican (TCW) | $531K |

| Stephen Smith | EQB Inc. (EQB) | $7.7M |

| Ross Jennings | Millennial (MLP) | $449K |

Flagging the buying at Trican (TCW), which follows its $230M acquisition of Iron Horse in July. Thomas was the CEO of the target, so it’s good to see him doubling down on recent weakness.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Magna (MG) | 1.33 | 1.25 |

| 🇨🇦 Cenovus (CVE) | 0.77 | 0.75 |

| 🇨🇦 Cdn. National (CNR) | 1.83 | 1.77 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 5N Plus (VNP) | PM | 0.10 |

| 🇨🇦 CareRx (CRRX) | PM | 8.6M |

| 🇨🇦 Gibson (GIB) | PM | 0.29 |

| 🇨🇦 CT REIT (CRT-U) | PM | 114M |

| 🇨🇦 Topaz (TPZ) | PM | 0.07 |

| 🇨🇦 Franco-Nevada (FNV) | PM | 1.38 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | -0.3% | 0.0% |

| 🇺🇸 Chicago PMI | 43.8 | 42.3 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 S&P Mftg. PMI | 10:30AM | 48.2 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.