|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

CPI holds, food inflation jumps

Housing starts up, absorption down

Launching coverage on VersaBank

WSP acquires TRC for $4.5B

HOT OFF THE PRESS

CPI holds, food jumps

Headline inflation of 2.2% came in lighter than expected, holding steady from the October print…

… on a mixed bag of Y/Y changes. On one hand, lower rent costs are weighing on inflation in shelter - while store-bought food re-accelerated to 4.7%…

… the highest reading in nearly two years, driven mainly by fresh fruit costs - a change of tune from the beef-led rise in prices at the counter from months past.

Food wasn’t the only category accelerating, with cellular services rising 12.7% - building on the momentum from October’s 7.7% increase.

Housing starts beat, absorption drops big

Housing starts edged by estimates in November, rising to 254K on a rebound in multi-unit activity.

On a Y/Y basis the print was pretty strong, with the exception of continued weakness in Ontario and BC…

… but that’s not the real story here. While new unit construction continues to inch lower, multi-unit absorption has fallen off a cliff - dropping nearly 20 percentage points over the past two prints.

The amount of pre-construction investments that are deep out of the money is a likely factor, which should drive a continued build in inventories from here.

RESEARCH: VERSABANK

Our coverage of VersaBank (VBNK) is now live. It’s a simple & clean thesis, so I’ll give it to you in three charts. From there, you can grab the full report on our site.

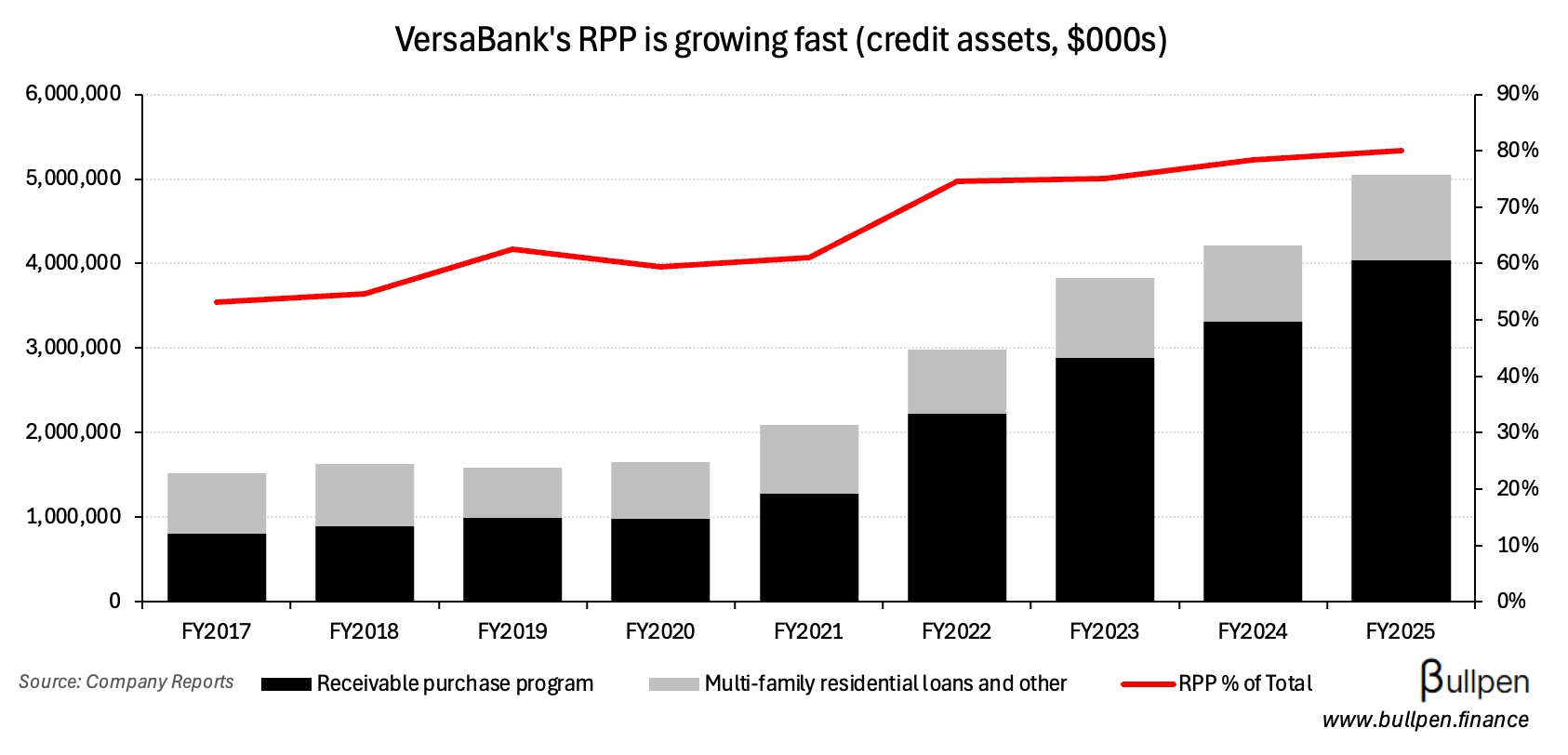

Proven digital banking model: Over decades of operating in Canada, the bank’s core “RPP” model has been refined into a stable margin, low credit risk, high efficiency business (growing >300% in the past five years).

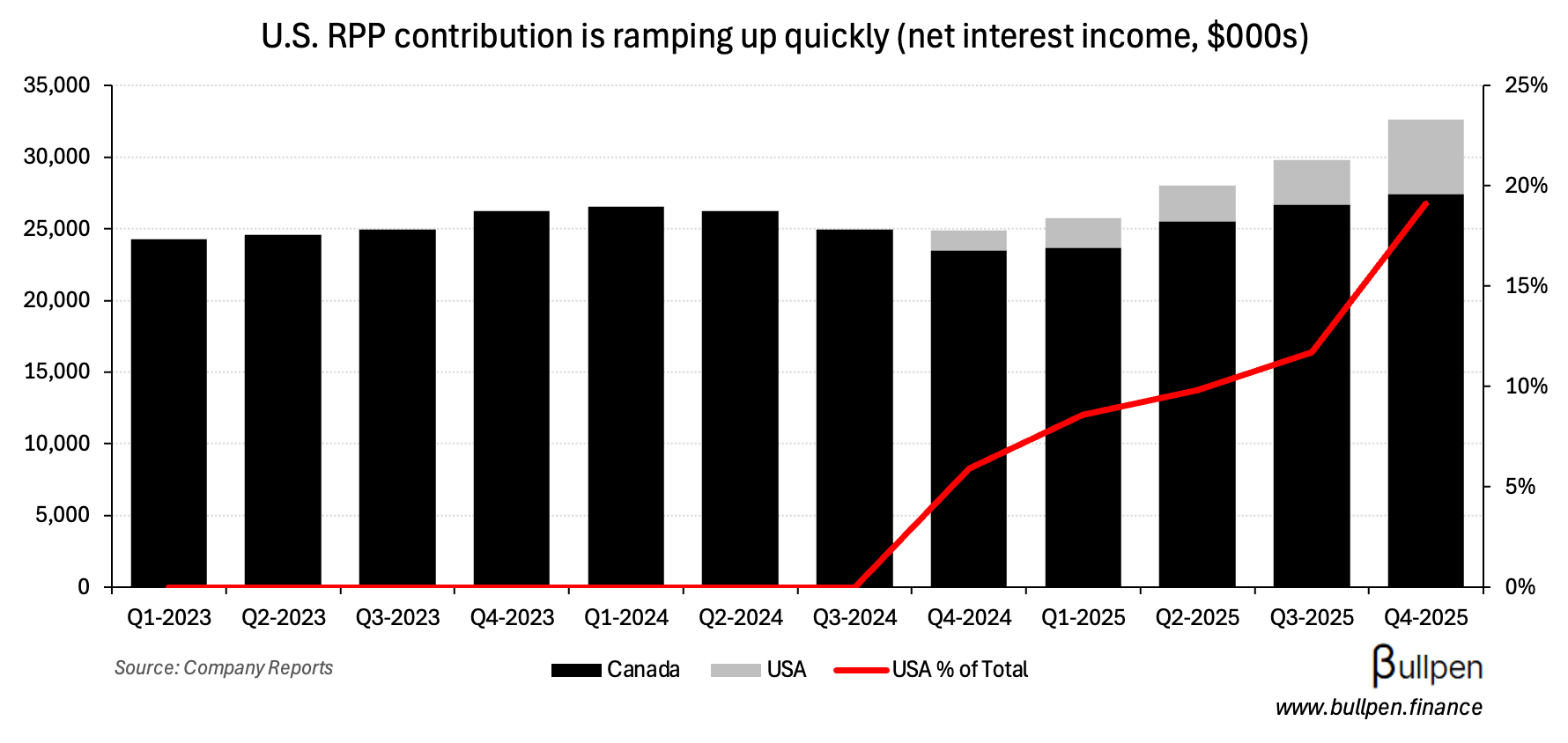

Expanding in the large US market: Through 2025 VersaBank has been expanding south of the border, adding US$300M of assets - with an additional US$1B targeted for 2026. Success here should result in greater operating leverage and higher ROE.

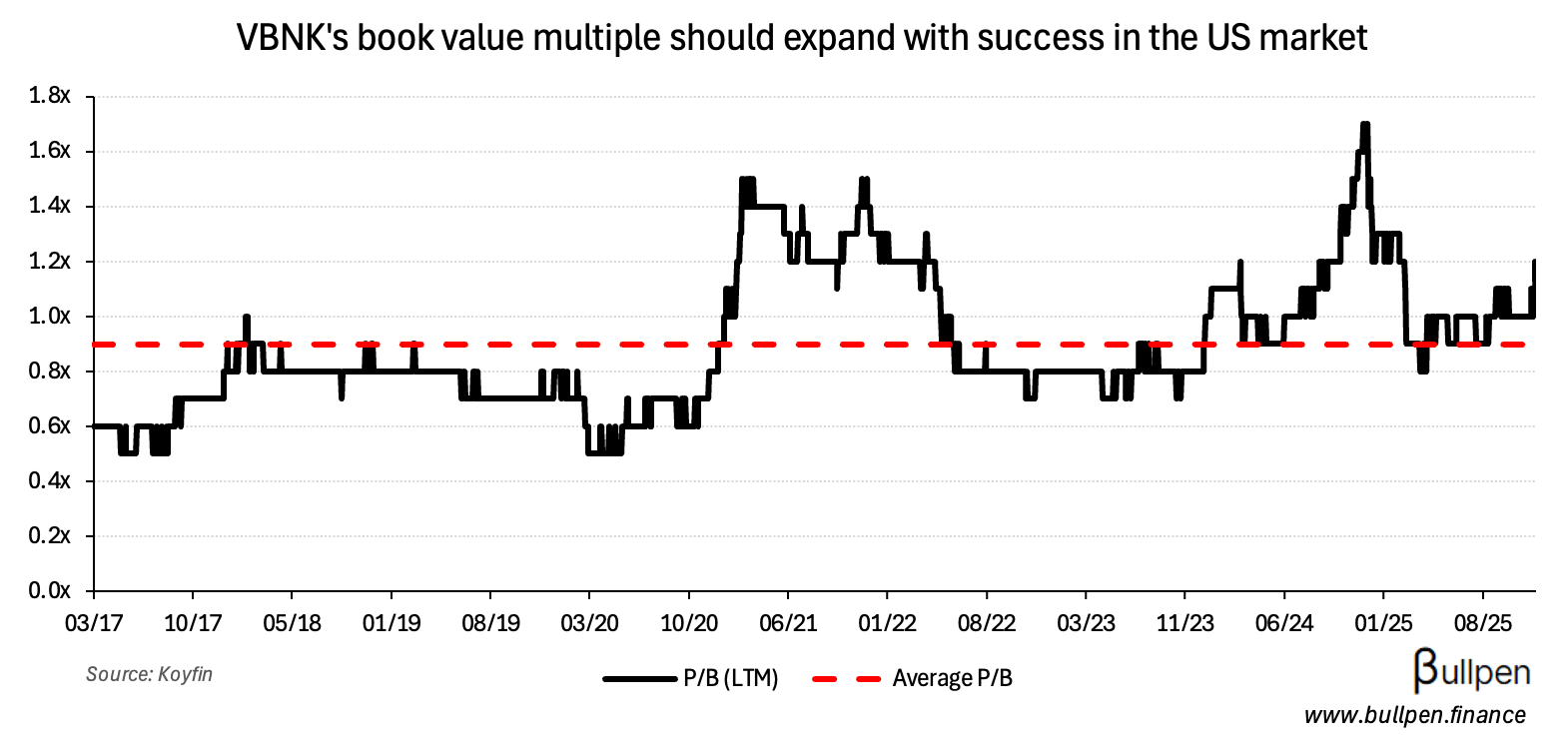

Trading near book value: This US expansion should translate to higher growth in book value per share and a higher multiple on that growth. Combined, these two levers for investment returns make the upside case for VBNK compelling.

Bottom line: this is a story you should be following. Our initiation report will get you up the curve and our ongoing research coverage will keep you there - use the button below to get it in your inbox:

If the button doesn’t work, try this: https://www.bullpen.finance/versabank

ON OUR RADAR

Flagging WSP Global’s splashy $4.5B deal for TRC, a price tag that translates to 12.5× 2026 EBITDA after synergies. The transaction math works from day one…

… and should improve to high-single-digit accretion after TRC is fully integrated. More than anything, this is a land grab - building on WSP’s $2.4B Power Engineers deal to grow the U.S. power business…

… and accelerate its push into the private sector, given over 80% of TRC’s business is done with non-government entities.

With management targeting sub-2x leverage a year after closing, WSP could soon build on its $5B of committed capital in 2025…

… especially if the equity markets stay supportive, with $850M of this one funded through share issuance.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

NFI Group (NFI) gained 12% following its battery recall agreement with XALT, which should result in a 75-80% recovery on the $229M provision it took last quarter for a full battery replacement on 700 vehicles.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Grant Fagerheim | Whitecap (WCP) | $112K |

| Guillaume Cloutier | TerraVest (TVK) | $124K |

| Rahim Suleman | Neo Materials (NEO) | $199K |

| Shaina Morihira | Freehold (FRU) | $275K |

| Ross Jennings | Millennial (MLP) | $345K |

EARNINGS

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Transat A.T. (TRZ) | PM | 0.21 |

| 🇺🇸 Micron (MU) | PM | 3.94 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 Non Farm Payrolls | 64K | 50K |

| 🇺🇸 Unemployment Rate | 4.6% | 4.4% |

| 🇺🇸 Retail Sales M/M | 0.0% | 0.1% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Foreign Security Buys | 9:30AM | 21.8B |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.