|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

CPI cools, food inflation accelerates

Equity markets lose $40B YTD

Housing starts keep the momentum

The SPAC king is back

HydroGraph short report kills run

HOT OFF THE PRESS

CPI cools, food inflation accelerates

Headline inflation came up just shy of estimates at 1.7% for July, moving down from June’s 1.9% but holding steady on a core basis.

Continued weakness in gasoline prices led the slowdown, down 16% Y/Y…

… and driving 1.5% deflation in the transportation category, which was an anchor to the print alongside recreation and apparel. Offsetting that weakness was higher inflation in health care, shelter, and food…

… specifically at the grocery store, where a 3.4% jump in prices took a meaningful step up from June’s 2.8% reading.

Equity markets lose $40B of foreign capital

June marked the fifth straight net capital outflow, as investors added $9B of foreign exposure - more than offsetting ~$700M of foreign inflows to Canadian markets.

Canadian investment abroad was largely equities driven, with $5.7B heading south of the border and $2.5B spread across other international equity markets…

… while Canadian equity markets continued to bleed foreign investment, losing $3B in June and over $40B YTD.

Canadian paper still has a bid though, this time carried by a rebound in private debt - with nearly $8B of inflows following >$20B of outflows in the prior two months.

Housing starts keep the momentum going

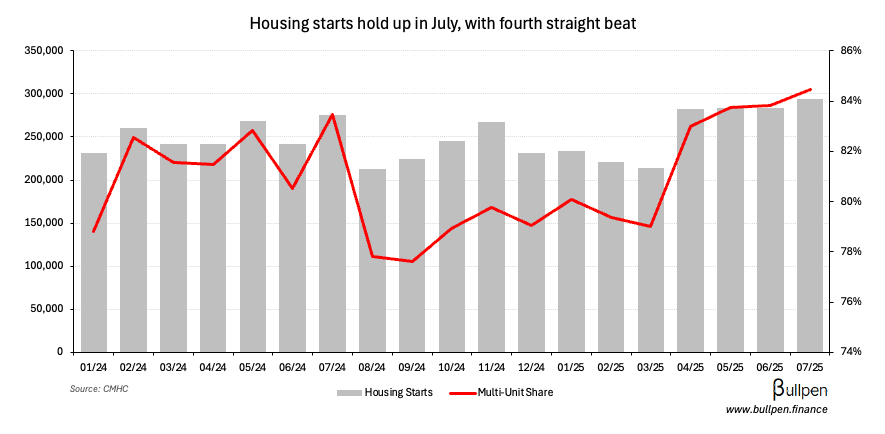

Housing starts posted a fourth straight beat in July, hitting 294K versus estimates of 265K - up nearly 4% M/M after a couple of flat readings previously.

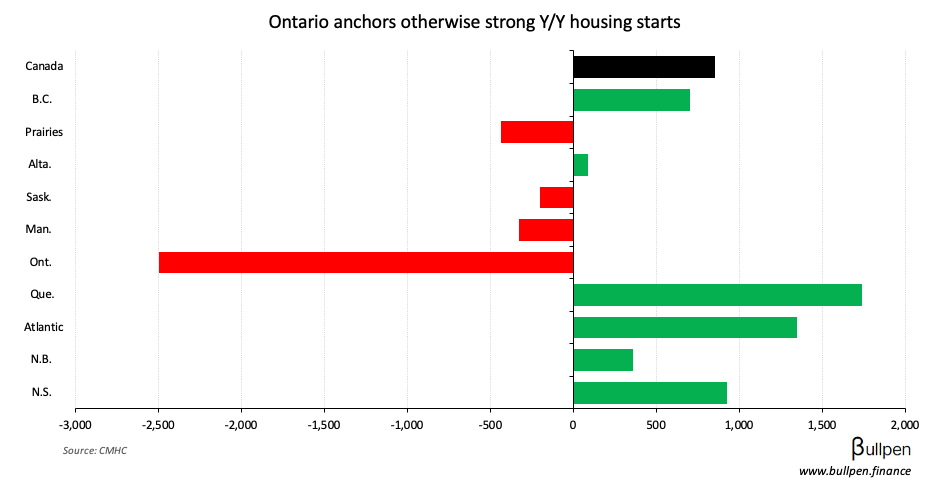

On a Y/Y basis Ontario was the anchor, down nearly 30% while most other provinces showed strong growth.

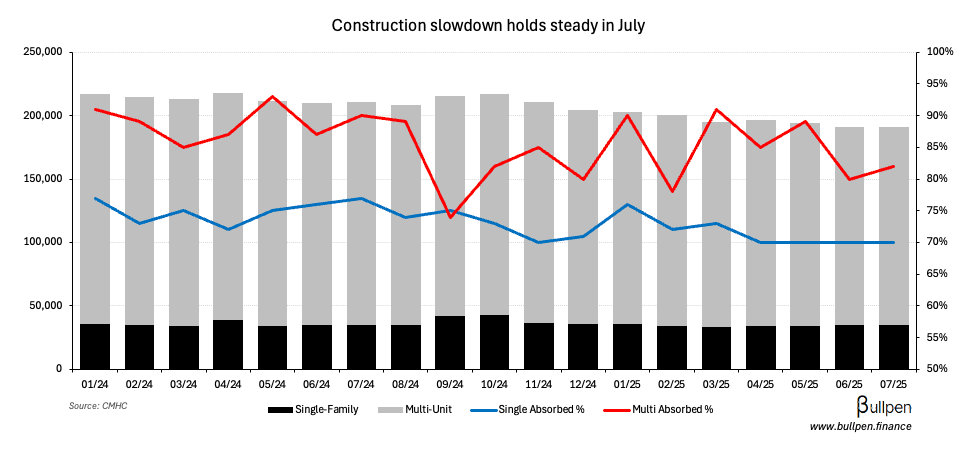

Weakness in multi-unit activity seems to be easing, with construction finding a floor and unit absorption picking up slightly…

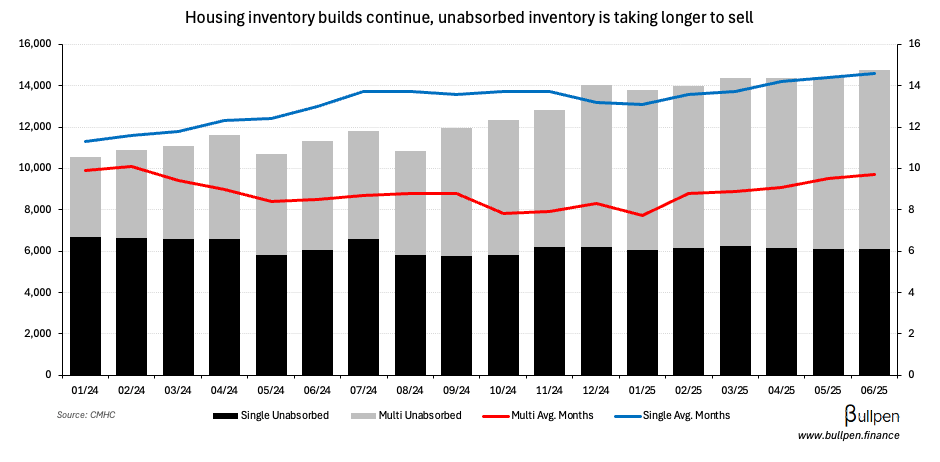

… which will be needed to mop up the excess inventory that continues to build and sit on the market.

FUNNY BUSINESS

In what could end up being a sign of the times, Chamath Palihapitiya AKA The SPAC King is making his return - launching a $250M blank check IPO that explicitly states this in the prospectus:

if they do lose their entire capital, they will embody the adage from President Trump that there can be “no crying in the casino.”

There’s historic precedent to back that fine print, with the majority of his prior deals taking advantage of frothy market conditions and ultimately hosing retail investors.

Let’s see if this time is different or if we’re heading into a repeat of last cycle. If it’s a repeat, don’t say there weren’t signs…

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Craig Parry | Skeena (SKE) | $307K |

| Alan Simpson | StorageVault (SVI) | $609K |

| Philip Witherington | Manulife (MFC) | $459K |

| Brooks Tingle | Manulife (MFC) | $234K |

| Trevor Kneel | Manulife (MFC) | $154K |

| Naveed Irshad | Manulife (MFC) | $192K |

| Rahim Hirji | Manulife (MFC) | $755K |

| Stephanie Fadous | Manulife (MFC) | $103K |

| Holly Johnson | MDA Space (MDA) | $1.9M |

| Michael Greenley | MDA Space (MDA) | $45.4M |

| Richard Patricio | NexGen (NXE) | $1.2M |

| Nolan Watson | Sandstorm (SSL) | $21.0M |

| Daniel Farb | Advantage (AAV) | $943K |

| Alan Hibben | Mattr (MATR) | $381K |

Flagging the MDA Space (MDA) selling, as insiders continue to take chips off the table. The Mattr (MATR) buying is also notable, with Alan (Director) adding nearly $1M of exposure since the company’s ~15% Q2 sell-off.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Shares of HydroGraph Clean Power (HG) lost 24% after a short report highlighted some “interesting” capital allocation decisions for a company framing itself as an innovative technology name.

Besides a brief meeting with this company years ago (still have the graphene!), I’m not up to date on the story and have no dog in the fight…

… but what feels all too familiar is the wildly promotional content that helped fuel HG’s run, including HydroGraph. A Thousand Dollar Stock? and HydroGraph Solved Graphene's Biggest Problem (And It's About to Pay Off Big).

Greed-inducing, substance-lacking content plagues the Canadian small cap space, resulting in a lack of trust that hurts all companies - including quality names. We’ve been working on something to address this issue that I hope to share soon.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 Home Depot (HD) | 4.68 | 4.69 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Corby (CSW) | PM | - |

| 🇺🇸 Salesforce (CRM) | PM | 2.78 |

| 🇺🇸 TJX Companies (TJX) | AM | 1.01 |

| 🇺🇸 Lowe's (LOW) | AM | 4.26 |

| 🇺🇸 Target (TGT) | AM | 2.03 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Inflation Y/Y | 1.7% | 1.8% |

| 🇺🇸 Housing Starts | 1.43M | 1.29M |

| 🇺🇸 Building Permits Prel. | 1.35M | 1.39M |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 New Home Prices | 8:30AM | 0.1% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.