|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Retail sales chops sideways

Constellation dives into AI impact

Redemption delays continue

Barrick jumps 10% on PEA

HOT OFF THE PRESS

Retail sales chops sideways

July’s retail sales shaped up largely as expected, falling 0.8% M/M on an identical decrease in volumes. Results were propped up by a 0.2% gain in vehicle sales…

… which was the only positive reading at the industry level, resulting in a miss on core sales which fell 1.2% versus June - led by a 2.5% decline in grocery store sales, as prices at the counter continue to inflate.

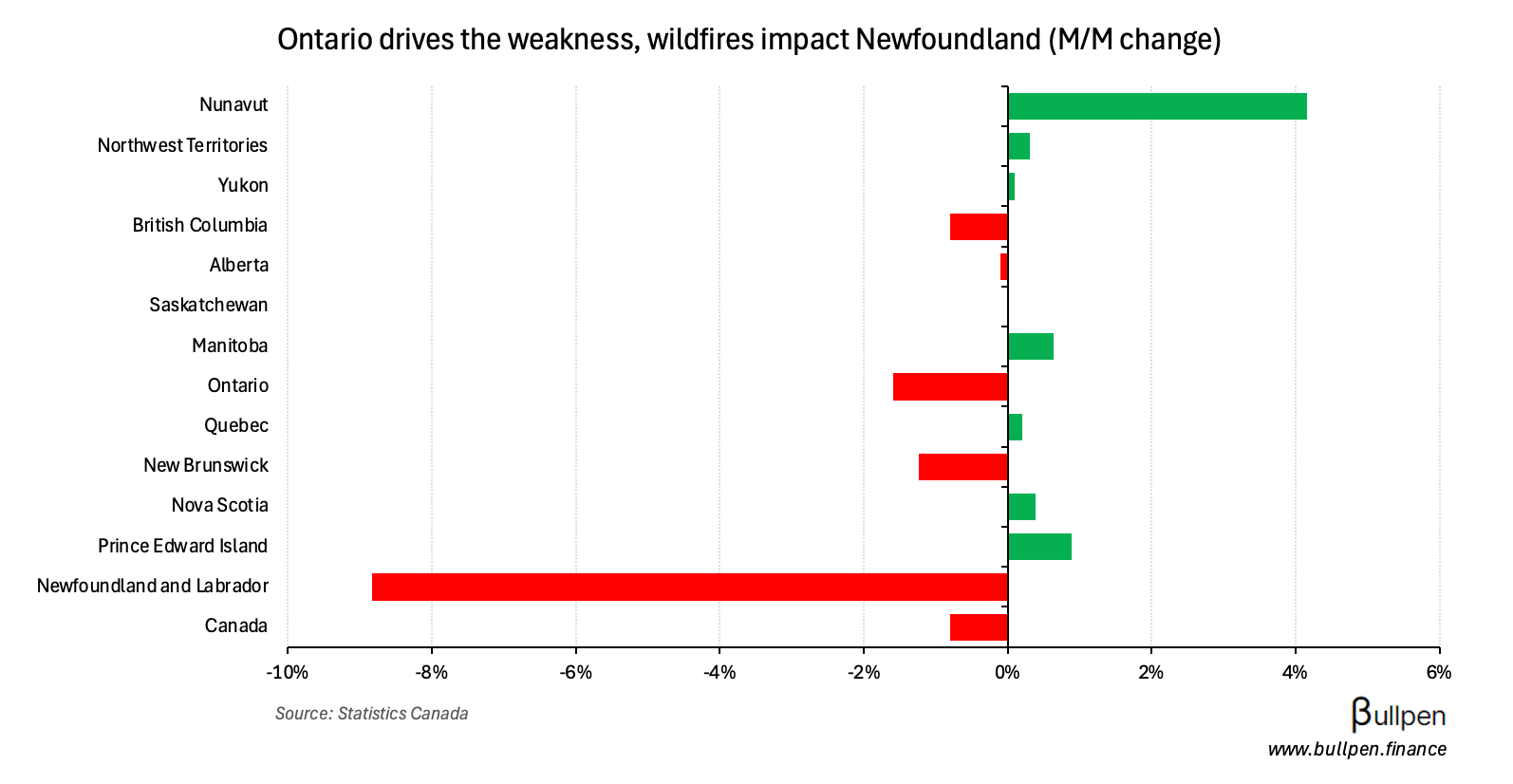

At a regional level, Ontario was the anchor - but Newfoundland and Labrador punched above its weight, losing 9% due to wildfires…

… that got worse in August, with the Kingston fire racking up insured losses of >$70M. Despite that, preliminary estimates for August indicate a 1% bump - as retail sales remains rangebound.

Constellation to dive into AI impact

“Software Jesus” Mark Leonard is diving into the impact of AI on an investor call this morning at 9AM. In January I covered the DeepSeek situation, picking Constellation as a potential winner - but it hasn’t been smooth sailing for the serial acquirer this year…

… given they haven’t been as active on M&A as they’d like to be…

… a theme that’s likely to be magnified by AI, as private equity raises capital to future-proof legacy software - pushing up the price for a finite set of targets.

Very difficult for us to compete with private equity for some of the large ones. And just generally, it’s just a difficult market out there. For us, some of the prices have really gone up dramatically.

On the positive side, CSU’s hyper-niche VMS approach entrenches it deeply in customer workflows - turning the competitive threat of AI into an opportunity to streamline operations.

With the stock testing it’s long-term average valuation, the event could offer clues about where Canada’s favourite software conglomerate trades next… let’s see.

FUNNY BUSINESS

Nicola Wealth warned investors of delayed redemptions in two funds, following the lead of Centurion and Trez Capital in recent months - as investors look to raise cash from private real estate holdings.

Contagion or not, it reiterates that there’s no free lunch - everything is a trade. Micro-cap multi-bagger? Blow up risk. Large-cap dividend name? Low growth. Private real estate cash flow? Hope you’re not thirsty…

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Barrick (ABX) rose 10% on Friday, extending gains from its $1.1B Hemlo sale…

… with a new PEA on its Fourmile gold mine highlighting the generational potential of the asset. Management expects its current drilling program to double the resource by year-end, while retaining exploration upside…

… at high grades, underpinning Barrick’s $700/oz AISC estimate over the >25 year life of the mine. At current gold prices, that’s english for “printing money”.

Orla Mining (OLA) fell 5% on news that Newmont was selling its stake in the company, less than two weeks after Agnico closed out its position. Not a great look given Orla’s recent production challenges.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Thomas Uhr | BRP Inc. (DOO) | $387K |

| Jamie Porteous | Cargojet (CJT) | $300K |

| Richard Fortin | Couche-Tard (ATD) | $45.3M |

| Gregory Nakonechny | Leon's (LNF) | $687K |

| Mary Vitale | Dynamite (GRGD) | $748K |

| Sarah Brami | Dynamite (GRGD) | $2.2M |

| Christian Roy | Dynamite (GRGD) | $1.7M |

| Asha Hotchandani | Lightspeed (LSPD) | $339K |

| Lee Curran | Peyto (PEY) | $480K |

| Robert Hemmings | Colliers (CIGI) | $16.5M |

| Barton Demosky | Bombardier (BBD) | $445K |

| Stuart Lang | CCL Ind. (CCL) | $2.1M |

| Vijaya Srinivasen | CGI (GIB) | $342K |

| Ralf Bauer | CGI (GIB) | $256K |

| Celine Boston | PSI (PSI) | $134K |

| Robert Rotzinger | Taseko (TKO) | $523K |

| Poupak Bahamin | Barrick (ABX) | $251K |

| Grant Beringer | Barrick (ABX) | $1.1M |

| Joel Holliday | Barrick (ABX) | $398K |

| Joel Holliday | Barrick (ABX) | $398K |

| Scott Stauth | Cdn. Natural (CNQ) | $2.2M |

| Kara Slemko | Cdn. Natural (CNQ) | $364K |

| Nadeem Velani | CPKC (CP) | $12.9M |

| Shawn Beber | CIBC (CM) | $2.1M |

| Eric Boyko | Couche-Tard (ATD) | $145K |

| Michael Rees | Peyto (PEY) | $123K |

| Sean Black | Happy Belly (HBFG) | $148K |

| Larissa Conrad | Vermilion (VET) | $260K |

Flagging the selling at Dynamite (GRGD), which is the first on record and comes on the back of a huge run after Q2 results that pushed valuation meaningfully higher.

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Retail Sales M/M | -0.8% | -0.8% |

| 🇨🇦 Retail Sales Ex-Autos | -1.2% | -0.7% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 PPI M/M | 8:30AM | 0.9% |

| 🇨🇦 Raw Materials M/M | 8:30AM | 1.2% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.