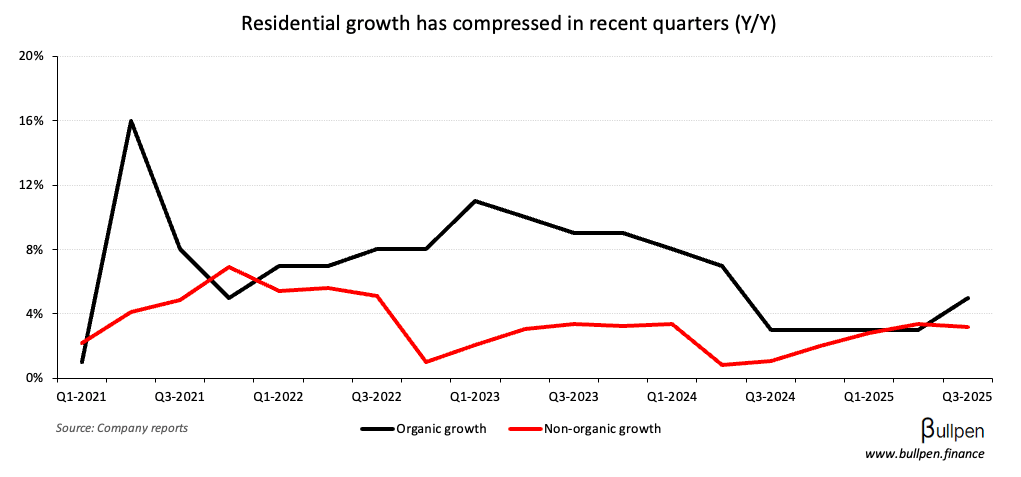

FirstService (FSV) shed 10% on a Q3 that missed small on revenue and beat small on earnings, but the selloff was linked to management’s framing of Q4 - with mid-single digit organic growth in residential…

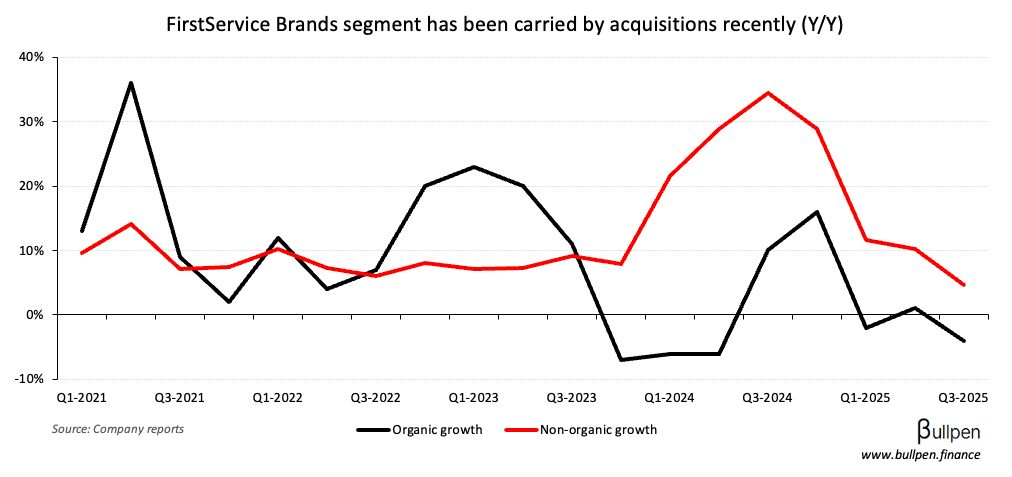

… and material weakness in the organic growth of its restoration (down 20%) and roofing (down 10%) businesses, which have been under pressure through 2025.

With the stock now trading below it’s long-term average valuation…

… investors are waiting for clarity on an end market recovery before giving FSV a bid.

We’re in a good position, and we’ll start to see the growth come back. I just can’t tell you — I can’t give you dates in time. We need more clarity in the marketplace.