|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Unemployment beats on participation

SunOpta jumps 30% on take-private

ARX falls 10% on production issues

Ivey PMI beats, but falls slightly

HOT OFF THE PRESS

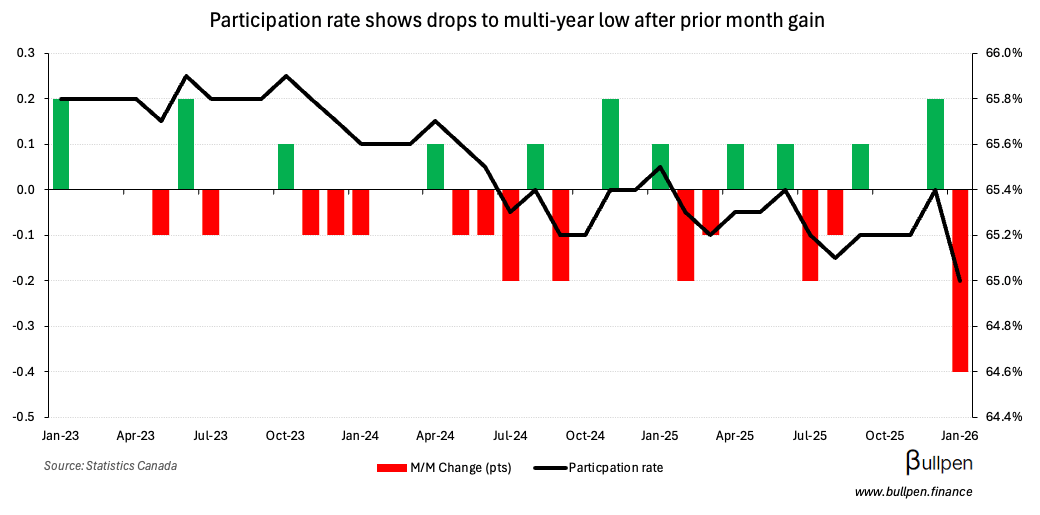

Unemployment beats on weaker participation

The unemployment rate fell to 6.5% in January, better than expectations for the print to stay flat at 6.8%…

… despite a 25K drop in employment, with a second straight month of full-time adds (up 45K) more than offset by part-time losses (down 70K)…

… anchored by manufacturing and educational services at the industry level.

So the real driver wasn’t labour market improvement, but weaker workforce engagement - with the participation rate falling to 65%.

That drawdown should be transitory, with only a small increase in discouraged job seekers - but if vacancies don’t improve…

… unemployment duration could keep grinding higher, encouraging something more structural in nature.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

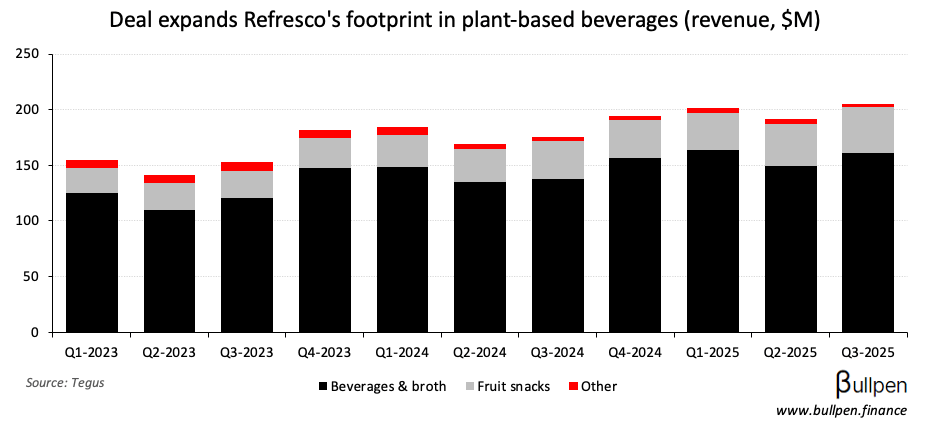

SunOpta (SOY) was up over 30% Friday after announcing it’s being taken private at US$6.50 per share (~$1B) by Refresco, who views the company as a vehicle to add scale in plant-based beverages…

… at a reasonable valuation, with the deal priced at ~11.5x NTM EBITDA - two turns below where the stock has traded historically.

The discount stems from margin volatility, with SOY opting to sacrifice near-term profitability to secure additional volumes…

… a trade that private markets are much better at pricing than public markets.

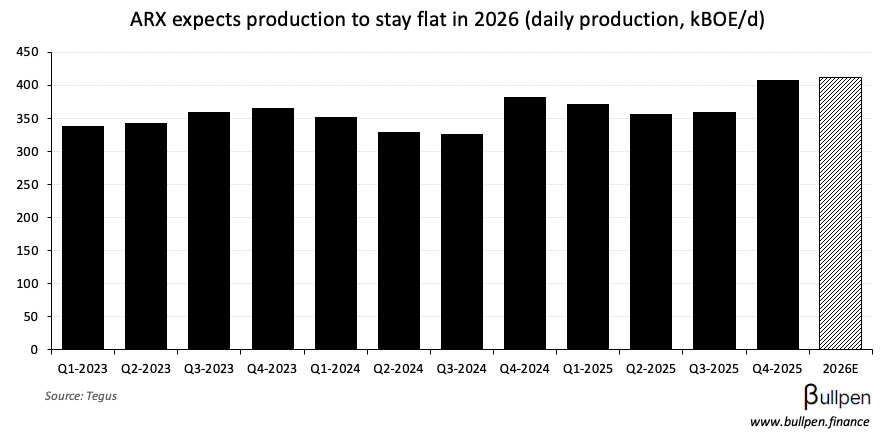

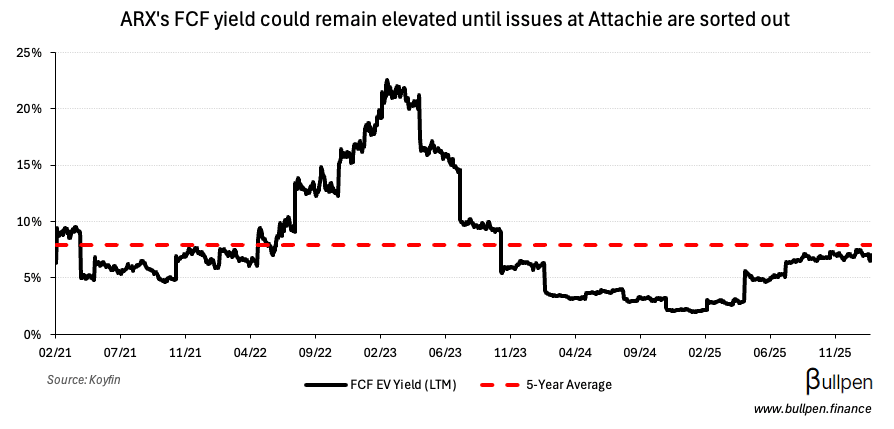

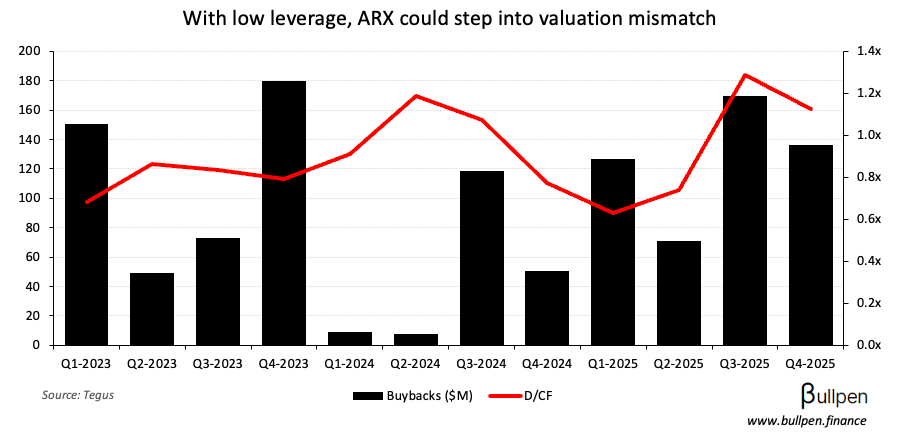

ARC Resources (ARX) shares fell 10% despite reporting a Q4 beat, with management pulling production guidance at Attachie - its flagship growth asset…

… that the company has had trouble ramping up. Given its underperformance, the decision to press pause is the right one…

I realize that sometimes the right business decisions are not necessarily the most popular decisions from a market perspective, but we are here to manage risk while we create long-term value for our shareholders.

… but valuation could be under pressure in the near-term, with this key growth catalyst now in question.

It’s unlikely the discount will open up too wide though, given ARX’s clean balance sheet and willingness to step into the market to buy back stock.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Paolo Bravi | Metro (MRU) | $222K |

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 Philip Morris (PM) | 1.70 | 1.70 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Prairiesky (PSK) | PM | 0.17 |

| 🇺🇸 Apollo (APO) | AM | 2.04 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 6.5% | 6.8% |

| 🇨🇦 Employment Change | -25K | 7K |

| 🇨🇦 Ivey PMI | 50.9 | 49.7 |

| 🇺🇸 Consumer Sentiment | 57.3 | 55.0 |

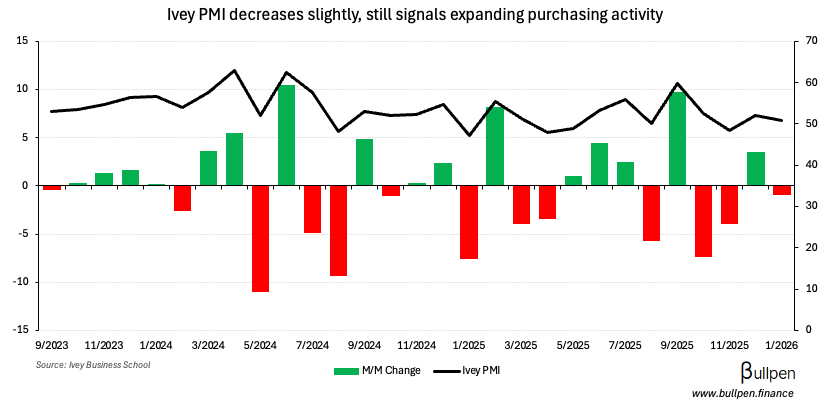

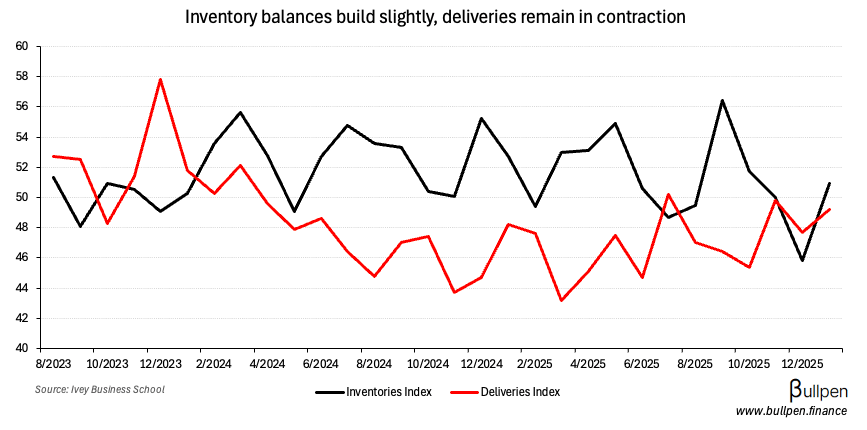

The Ivey PMI came in better than expected at 50.9, indicating purchasing activity expanded relative to last month…

… despite the slight decrease M/M, likely driven by less inventory restocking - as balances built during the month and deliveries stabilized.

The employment index decreased slightly too, tracking to the drop in manufacturing employment in the jobs print above.

Was this forwarded to you? Join 7,000+ investors reading The Morning Meeting by clicking the button below.