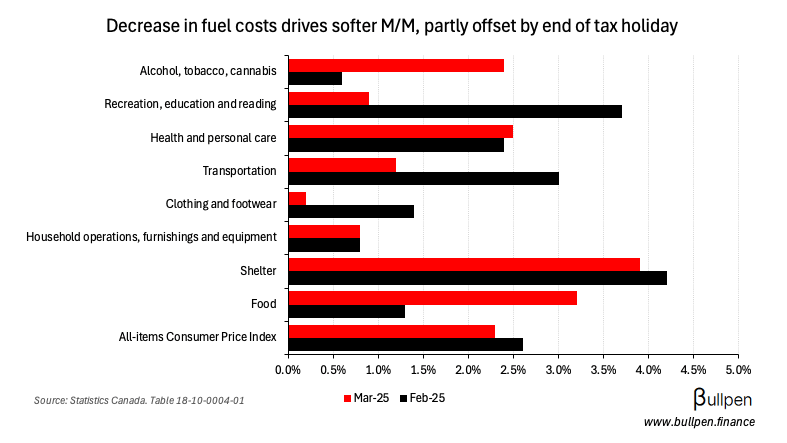

We got CPI for March today, which came in at 2.3% versus estimates of 2.6% (and February’s 2.6% reading).

The softer print was driven by the transportation category, which offset inflation in food.

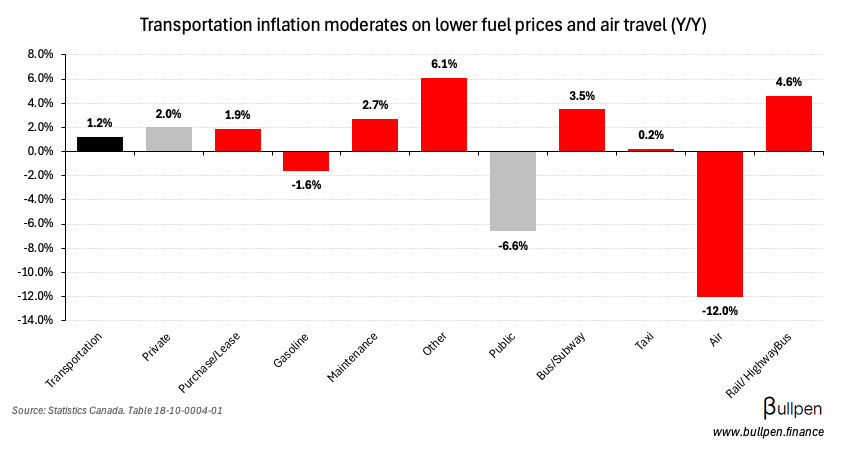

Fuel costs were the big driver of the lower inflation reading in transportation, though airfares saw a notable decline as well, likely owing to the weak demand we wrote about previously.

Restaurants were the big story in food inflation, reversing course from deflation over the prior 2 months on the back of the tax holiday roll-off.

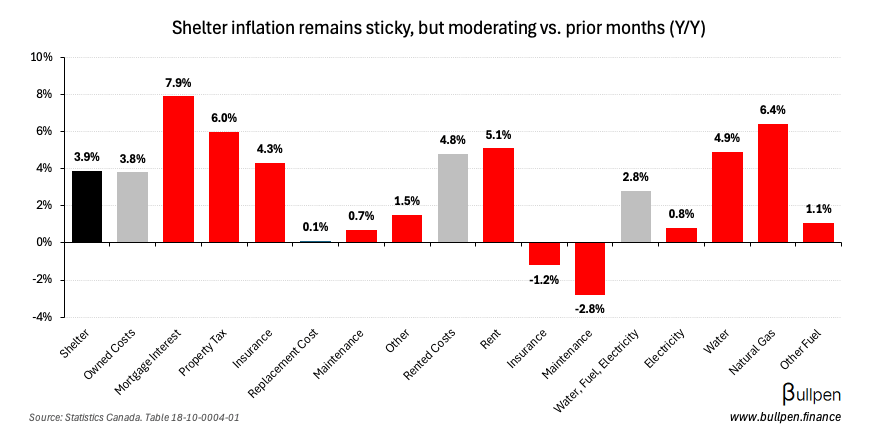

Shelter remains a core driver of inflation Y/Y, though most categories across both owned and rented costs continue to moderate versus previous months.

With crude oil prices dropping ~15% so far in April, fuel cost deflation should remain an opposing force to food inflation in next month’s reading.