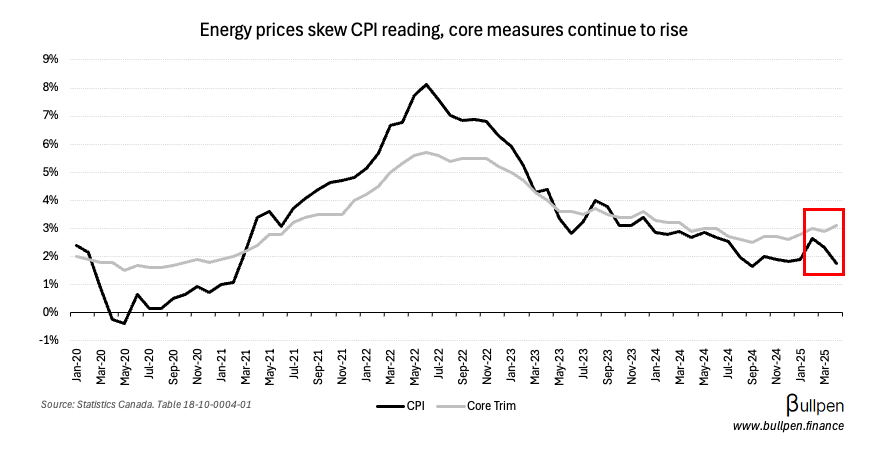

We got CPI for April today which came in at 1.7%, edging out estimates of 1.6% but much lower than March’s 2.3% print. Core CPI continued to climb, though, hitting 3.1% versus last month’s 2.9%.

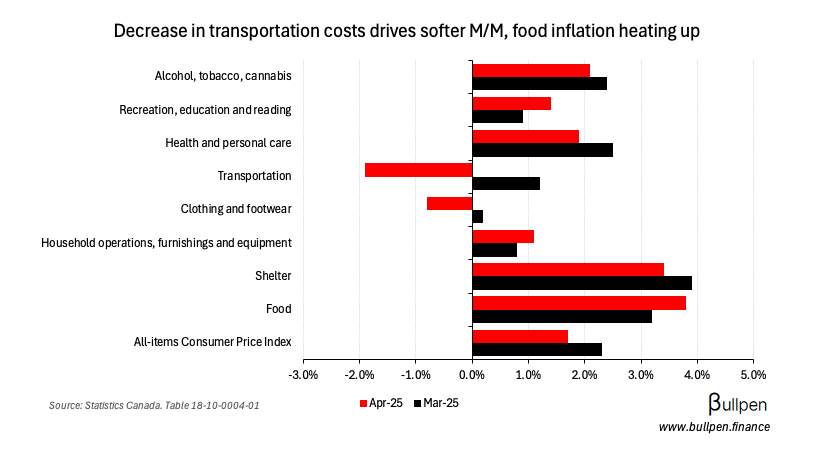

The M/M decline was largely driven by lower transportation costs (17% of the CPI basket), which more than offset continued food inflation post-tax holiday…

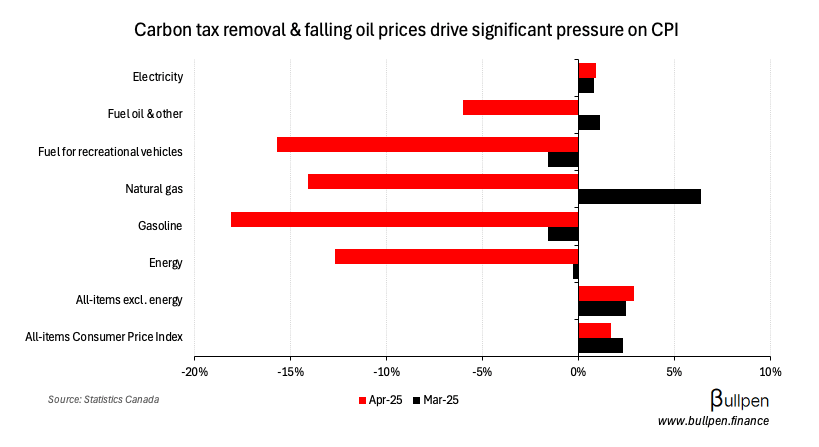

… and was driven by lower fuel costs, which benefited from the removal of the carbon tax and falling oil prices.

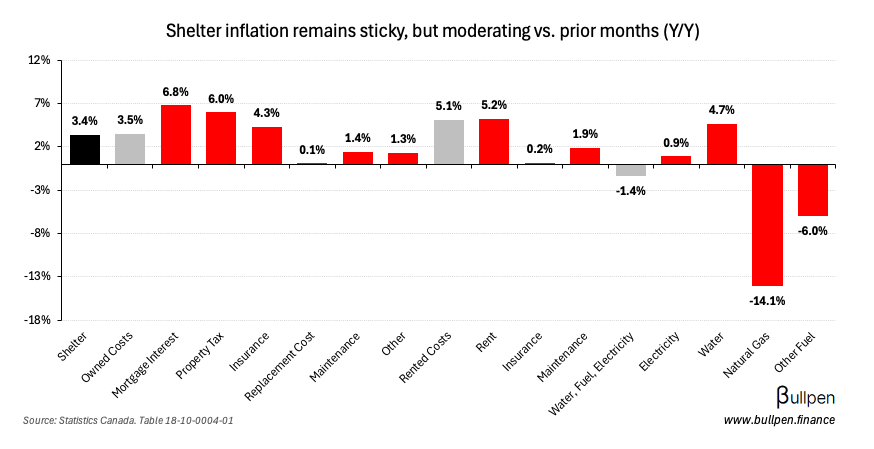

In shelter, lower fuel costs and mortgage interest drove continued moderation on the headline number to 3.4%, though the trend remains largely the same.

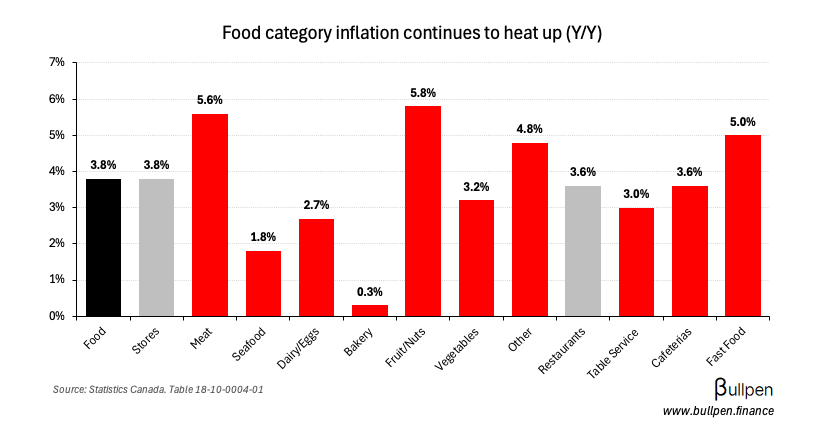

Gains in food inflation were broad-based, with higher meat costs driving in-store inflation and more expensive takeout driving restaurant inflation.

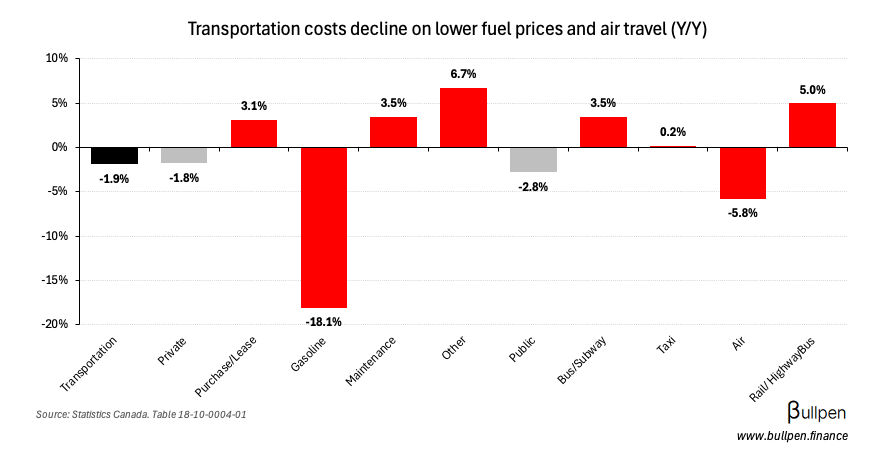

Transportation was a gasoline story, which offset increases in almost all other sub-categories.