|

|

||||

|

|

||||

|

|

||||

|

|

If this was forwarded to you, consider joining hundreds of finance professionals who read The Morning Meeting - we’ll make it worth your time!

WHAT'S ON TAP

Retail says go, institutional says slow down

CPI beats, energy costs drive divergence

Strathcona chums the waters with ~$6B takeout bid

Canada Post set to strike again, some companies could be impacted

Westshore rips on analyst upgrade

HOT OFF THE PRESS

Retail says go, institutional says slow down

There’s been some great charts out of the U.S. brokers recently highlighting retail involvement in markets, which eclipsed 30% multiple times in April as DIY investors stepped into market drawdowns aggressively.

This week has been no different, with retail stepping into Monday’s U.S. credit downgrade dip to the tune of $5B, and adding a record $4B in the first three hours of trading yesterday morning.

We’re watching how this develops in conjunction with institutional positioning, which appears to be in stark contrast to retail allocations.

With valuations still elevated, let’s see which group gives first - will institutional capital chase or will retail capital capitulate?

CPI beats, energy costs drive divergence

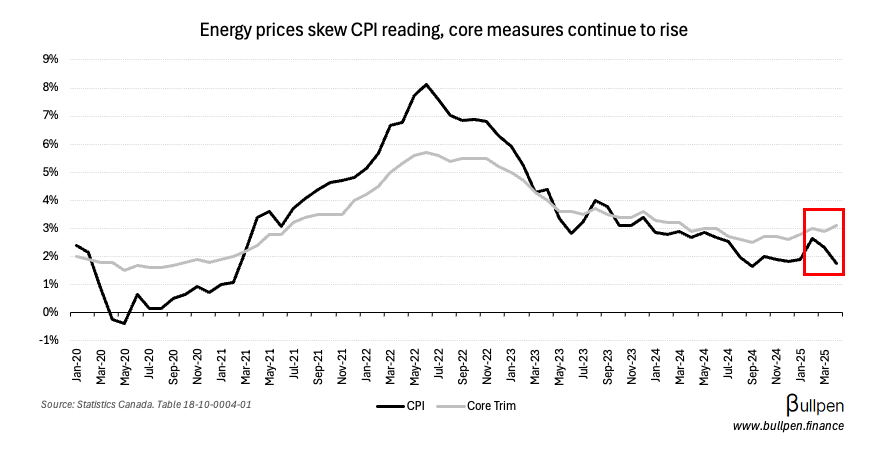

We got CPI for April yesterday which came in at 1.7%, edging out estimates of 1.6% but down 0.6% M/M. Core trimmed-CPI continued to climb though, hitting 3.1% versus 2.9% in March.

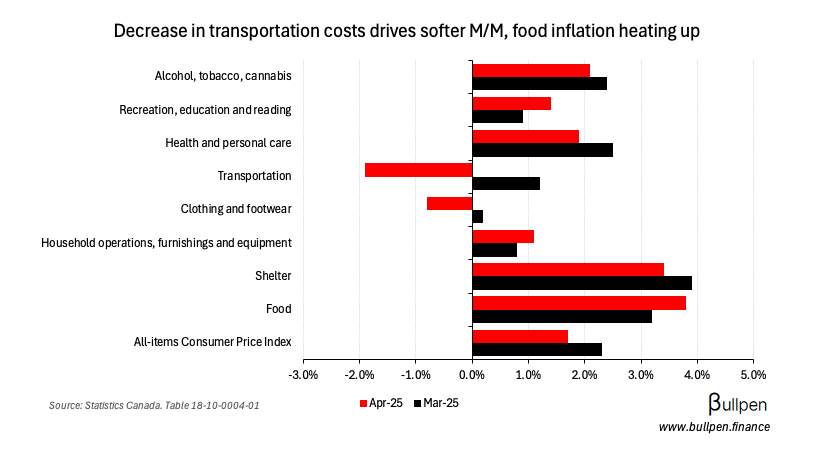

The M/M decline was largely driven by lower transportation costs, which more than offset continued food inflation post-tax holiday…

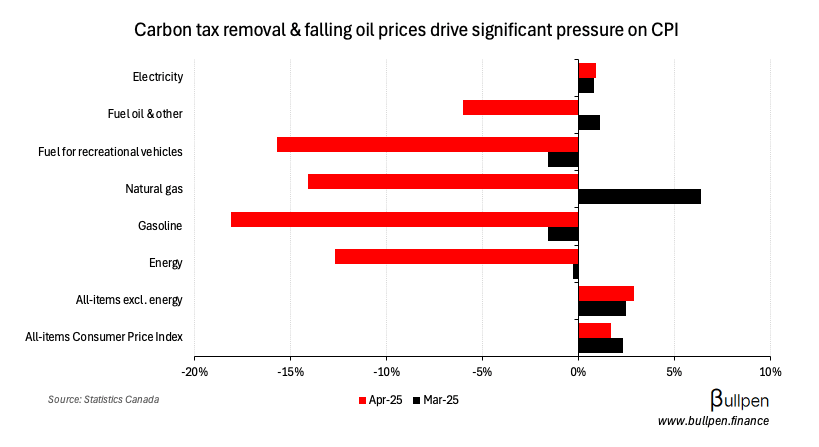

… and was driven by lower fuel costs, owing to the removal of the carbon tax and falling oil prices.

For a breakdown of the most important categories (food, shelter, transportation), check out the full bite: https://www.bullpen.finance/content/123

Strathcona chums the waters with takeout bid

Upon further review, the series of transactions that led to Strathcona’s $5.9B hostile takeover bid for MEG Energy might just be the best we’ve seen this year, and I’m starting to think Adam Waterous (Exec Chair) is a genius.

In the full piece, we break down the strategic rationale of each transaction - and why SCR should benefit regardless of outcome. Check it out!

If the above link doesn’t work, try this: https://www.bullpen.finance/content/124

FUNNY BUSINESS

With last year’s labour disputes still unresolved, it looks like Canada Post is heading for another strike starting this Friday.

If the 32-day strike in 2024 is an indication of what’s coming, here’s a few names that could be impacted:

Company | 2024 Impact |

|---|---|

Transcontinental (TCL-A) | $7 million |

Data Communications Management (DCM) | $3-4 million |

Canadian Tire (CTC-A) | 100 bps of revenue growth, incremental costs |

Pizza Pizza (PZA) | 3.9% drop in sales |

Loblaw (L) | 3.1% drop in SSSG, lower margin/traffic |

Some common themes here… negative impacts would likely be felt by companies that benefit from print/direct mail marketing, or proximity to post office locations.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Ernesto Balarezo | Sierra Metals (SMT) | $3.7M |

| Claudio Cubillas | Sierra Metals (SMT) | $553K |

| Dervla Tomlin | Great-West Life (GWO) | $1.9M |

| Denis Ricard | iA Financial (IAG) | $1.1M |

| Eric Jobin | iA Financial (IAG) | $428K |

| Lori Muratta | South Bow (SOBO) | $371K |

| Colin Robertson | NFI Group (NFI) | $367K |

| Douglas Proven | NFI Group (NFI) | $146K |

| Jonathan McKenzie | Cenovus (CVE) | $925K |

| Riley Frame | Peyto (PEY) | $360K |

| Michael Rees | Peyto (PEY) | $324K |

| Crissy Rafoss | Peyto (PEY) | $340K |

| Gil Borok | Colliers (CIGI) | $2.5M |

| Mark Eaton | K92 Mining (KNT) | $656K |

| Michael Godin | CGI (GIB-A) | $113K |

| James Maclean | Baytex (BTE) | $100K |

| Ryan Paulgaard | NuVista (NVA) | $401K |

| James Jeter | RB Global (RBA) | $213K |

| Randy Reichert | Skeena (SKE) | $298K |

Flagging the Cenovus (CVE) buy here, whose name is in the hat for the potential to submit a competing bid for MEG Energy.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Westshore Terminals (WTE) was upgraded by RBC, who believes the Alberta regulator’s approval of the Grassy Mountain coal project isn’t priced in, and that there’s a margin of safety if it doesn’t ultimately go through as well as other catalysts, like the company’s potash handling facility in BC that’s expected to come online next year.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Nexgen (NXE) | -0.07 | -0.05 |

| 🇨🇦 Coveo (CVO) | 0.00 | 0.01 |

| 🇺🇸 Home Depot (HD) | 3.45 | 3.59 |

| 🇺🇸 Palo Alto (PANW) | 0.80 | 0.77 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Canada Goose (GOOS) | AM | 0.23 |

| 🇨🇦 Velan (VLN) | PM | - |

| 🇨🇦 Zedcor (ZDC) | PM | 3.8M |

| 🇺🇸 TJX Co. (TJX) | AM | 0.91 |

| 🇺🇸 Lowe's (LOW) | AM | 2.88 |

| 🇺🇸 Target (TGT) | AM | 1.65 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Inflation Y/Y | 1.7% | 1.6% |

| 🇨🇦 Core Inflation Y/Y | 2.5% | - |

| 🇨🇦 Inflation M/M | -0.1% | -0.2% |

| 🇨🇦 Core Inflation M/M | 0.5% | 0.2% |

| 🇨🇦 CPI Median Y/Y | 3.2% | 2.9% |

| 🇨🇦 CPI Trim Y/Y | 3.1% | 2.9% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Home Price Index M/M | 8:30AM | 0.1% |

| 🇨🇦 Home Price Index Y/Y | 8:30AM | - |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|