|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

China escalates with 75% tariff

Building permits miss expectations

Gildan to take a $5B swing at Hanes

Insider activity is ramping up

OTEX slides after CEO gets the boot

HOT OFF THE PRESS

China escalates with 75% canola tariff

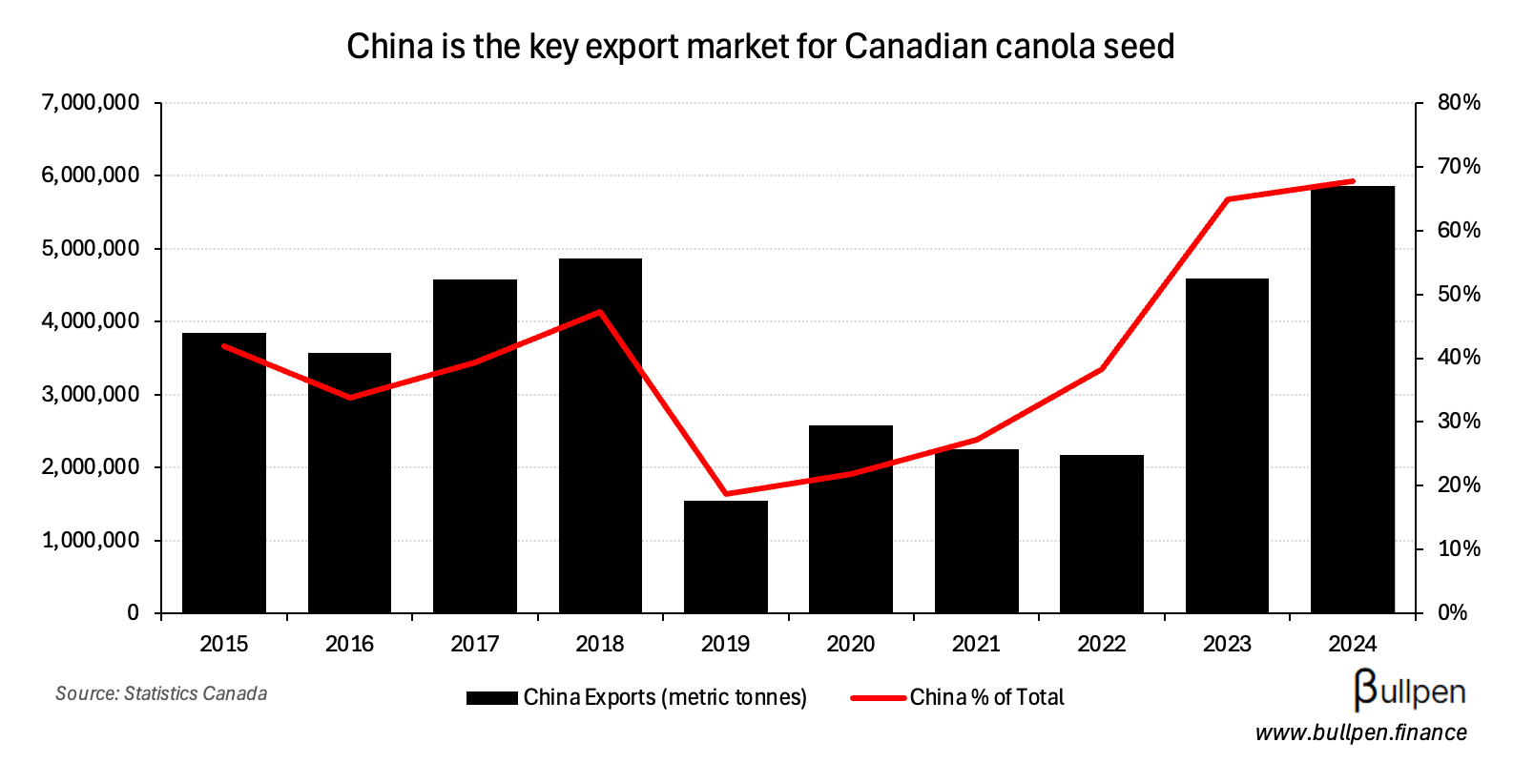

Canola futures fell ~5% on China’s preliminary 75% tariff on Canadian canola seed - a move that targets a $4-5B per year export category that China is the dominant end market for (~70%).

The escalation rounds out the 100% tariffs placed on canola oil/meal in March, and reinforces the complexity of the trade picture - as Canada looks to China as a potential home for lost U.S. lumber exports.

With the formal investigation by the PRC set to end no later than early 2026, it wouldn’t be surprising to see concessions made on existing tariffs on Chinese goods - we’ll monitor how this one develops and keep you in the know.

Building permits miss expectations

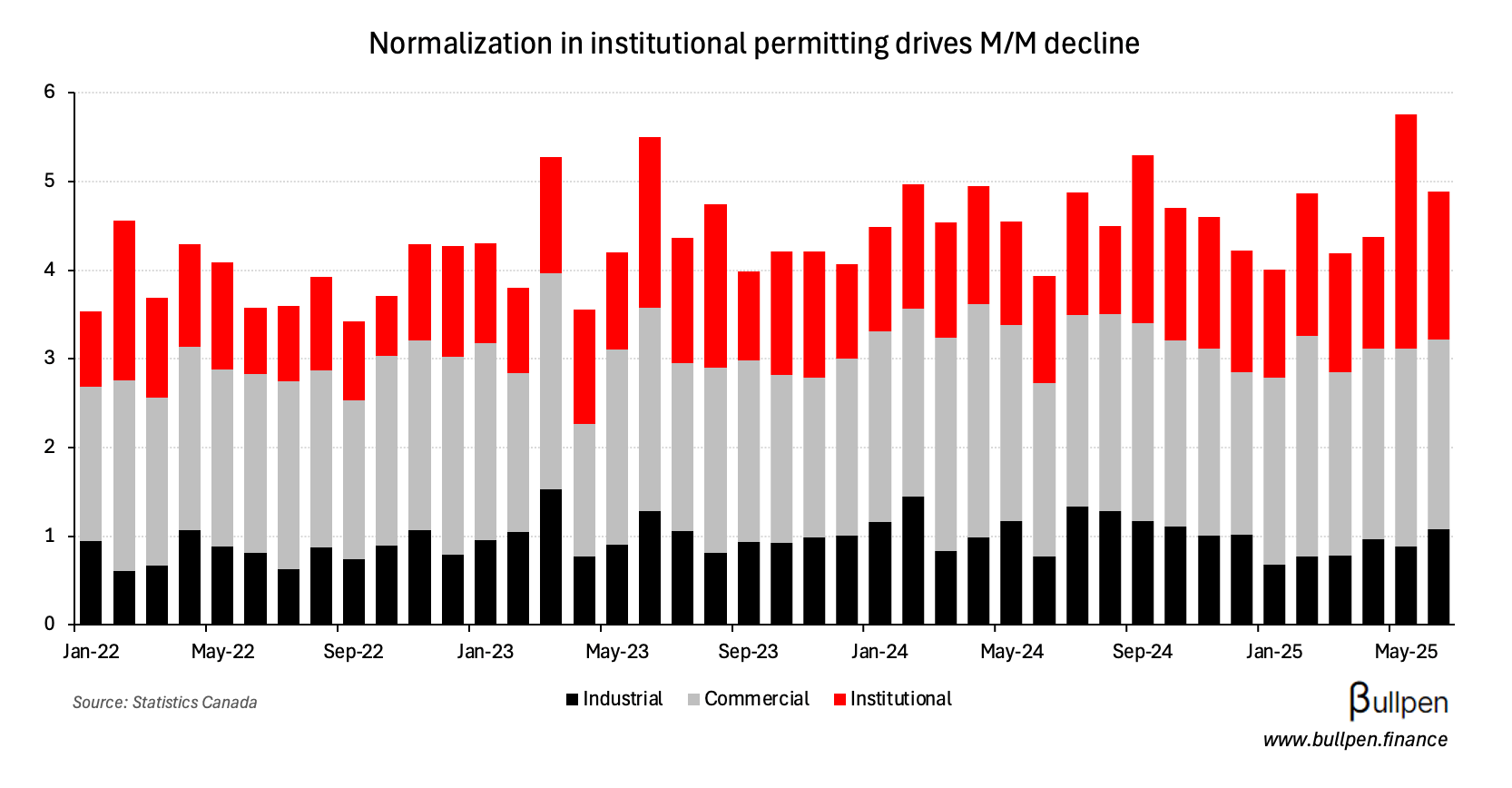

Building permits for June fell to $12B, losing 9% M/M and coming in weaker than analyst expectations for a ~3% decline - mainly driven by institutional activity…

… which returned to normal after a strong May, with a $1.3B decline in Ontario driven by the non-repeat of a hospital project that made for a tough M/M comparison.

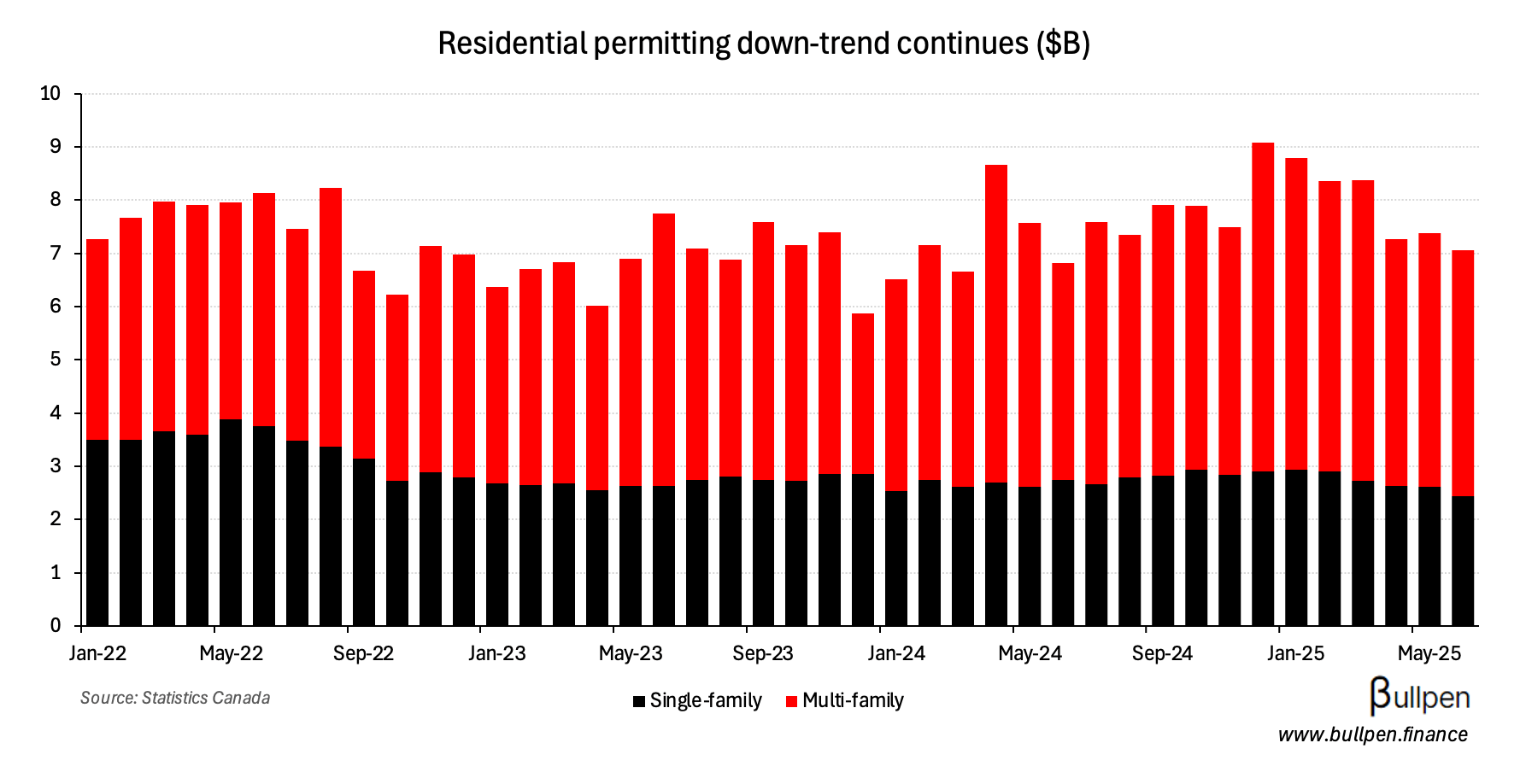

Residential permitting activity contributed to a lesser degree, continuing its downward drift through 2025 - with BC multi-unit activity (down $490M) and Ontario single-family activity (down $90M) weighing on results.

Gildan to take a $5B swing at Hanes

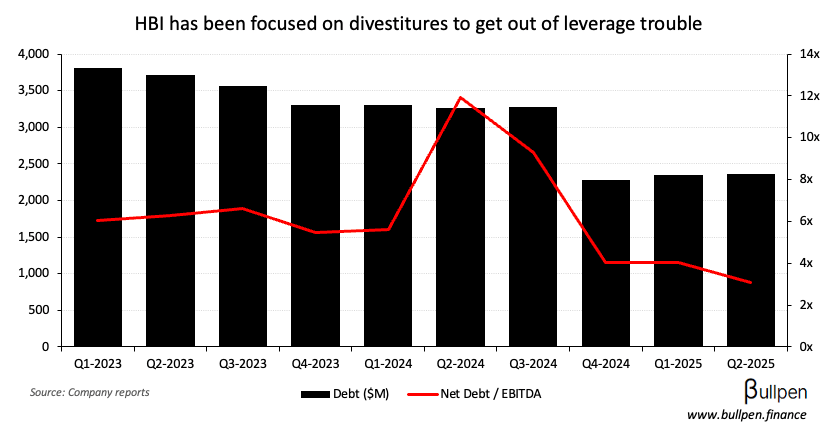

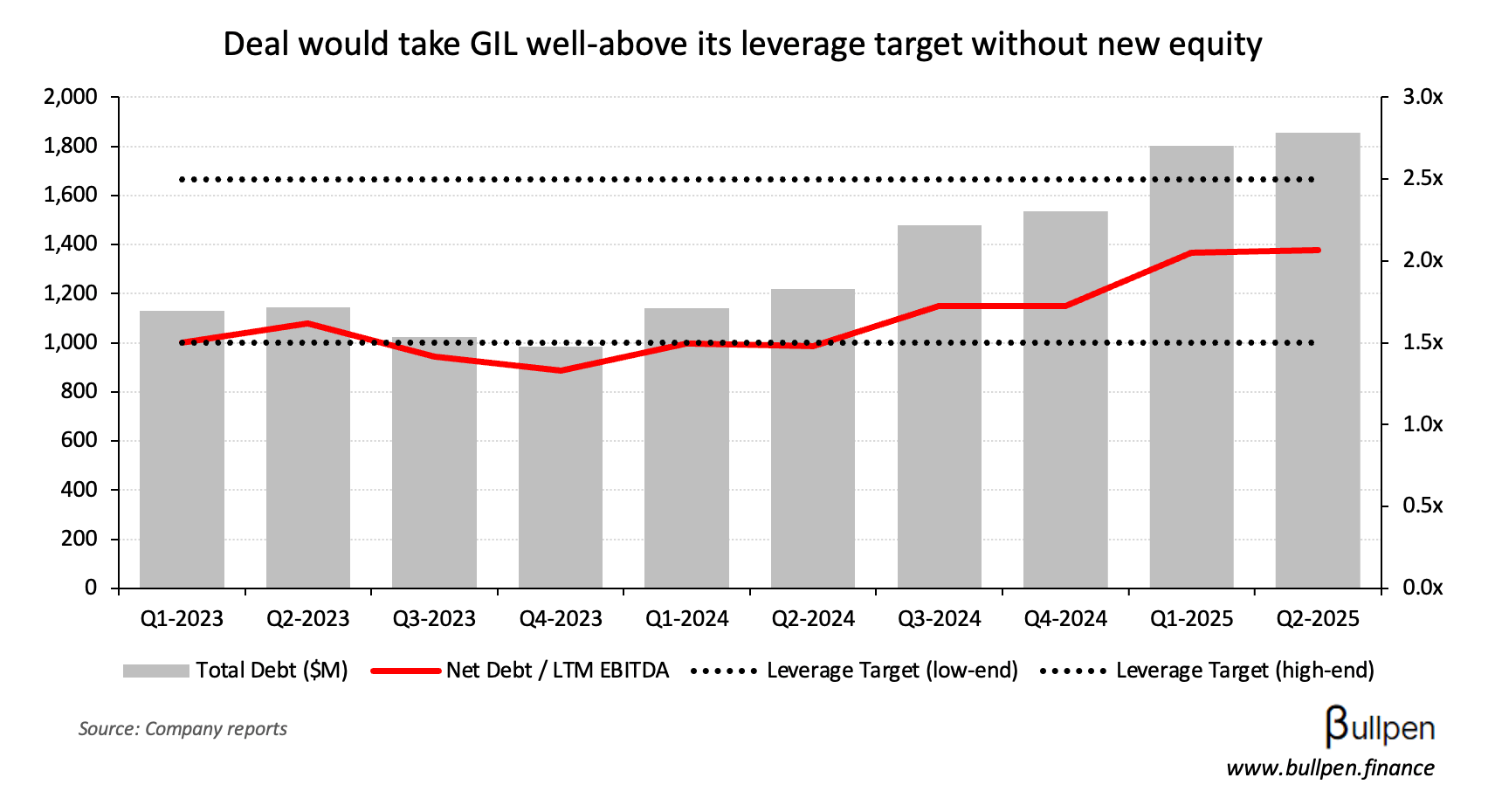

A rumour broke yesterday that Gildan (GIL) is circling Hanesbrands (HBI) in what would be an opportunistic $5B bid - representing a mid-9s EV/EBITDA multiple, passing the quick and dirty accretion check.

While straying from its focus on organic growth, there’s an obvious strategic rationale for the deal. GIL should be able to drive margin expansion at HBI, and could unlock additional growth from its existing retail distribution.

The timing works too, as an offer would come at a point where HBI has turned inwards, sacrificing growth and selling off assets to reduce its debt load as it manages through tariff impacts.

The catch? Financing. Gildan’s currently within its leverage target range and with cash on hand, would have roughly $400M to spend before breaching the top end. Either leverage is going higher, or Gildan will issue equity… or both.

FUNNY BUSINESS

Almost there…

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Kelly Hepher | IGM Financial (IGM) | $175K |

| Claude Genereux | Power Corp. (POW) | $1.7M |

| Kelly Hepher | Kinross (K) | $260K |

| Bruno Lemelin | Kinross (K) | $416K |

| Alan Simpson | StorageVault (SVI) | $247K |

| John Risley | MDA Space (MDA) | $21.9M |

| Sam Kolias | Boardwalk (BEI-U) | $9.5M |

| Chris Scherman | Pembina (PPL) | $3.0M |

| Cameron Goldade | Pembina (PPL) | $296K |

| Andy Mah | Pembina (PPL) | $245K |

| Eva Bishop | Pembina (PPL) | $497K |

| Mike Rose | Tourmaline (TOU) | $1.8M |

| Carl Colizza | Saputo (SAP) | $211K |

| Colin Robertson | NFI Group (NFI) | $386K |

Mike Rose of Tourmaline (TOU) is putting another big one on the board, following the $6.9M buy last week I flagged in Monday’s Morning Meeting.

The big selling at MDA Space (MDA) and Boardwalk (BEI-U) is also notable. For MDA, John Risley (Director) has been selling this year - but this size is a material step up. For Boardwalk, the selling from Sam (CEO) is the first on record.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

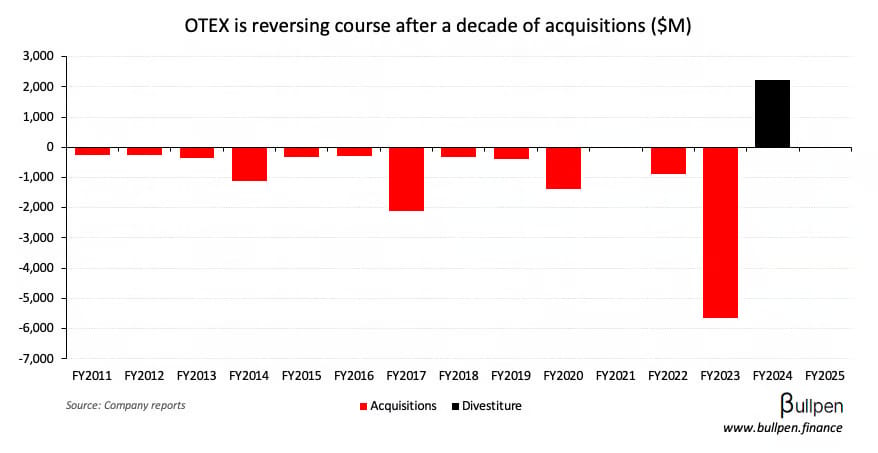

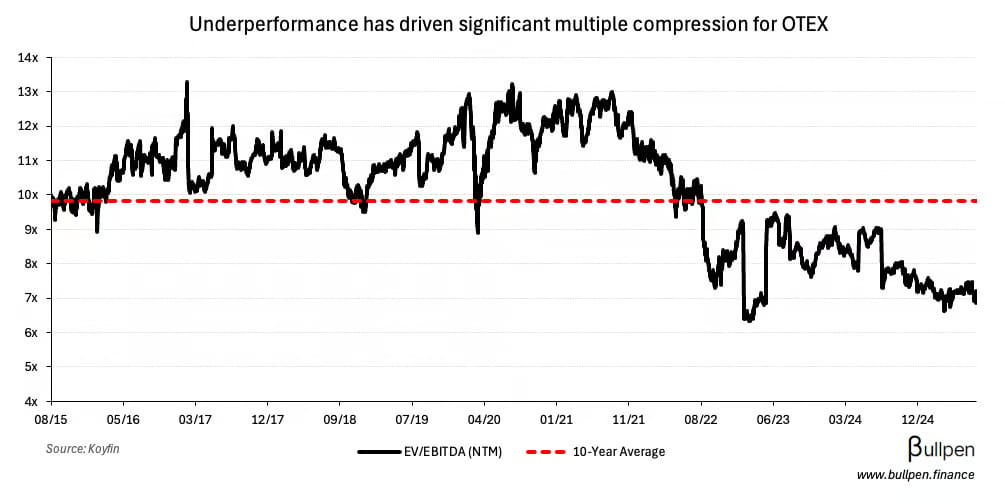

OpenText (OTEX) continued its slide, down ~5% since giving the CEO the boot on Monday - as the company looks to transition away from acquisition fueled growth…

… towards a leaner, more sustainable model centered around its cloud unit.

With the search now on for both the CEO and CFO seat after Chadwick Westlake took the helm at EQB, the market is pricing OTEX as a “show me” story.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Rogers Sugar (RSI) | 0.13 | 0.11 |

| 🇨🇦 Neo Materials (NEO) | 0.18 | 0.11 |

| 🇨🇦 Cineplex (CGX) | -0.04 | 0.06 |

| 🇨🇦 Martinrea (MRE) | 0.66 | 0.48 |

| 🇨🇦 CAE Inc. (CAE) | 0.21 | 0.20 |

| 🇨🇦 Superior Plus (SPB) | -0.34 | -0.03 |

| 🇨🇦 Peyto (PEY) | 0.43 | 0.47 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Hydro One (H) | AM | 0.52 |

| 🇨🇦 Calian (CGY) | AM | 1.17 |

| 🇨🇦 KP Tissue (KPT) | AM | 0.12 |

| 🇨🇦 Metro (MRU) | AM | 1.53 |

| 🇨🇦 Alithya (ALYA) | AM | 0.07 |

| 🇨🇦 Boyd Group (BYD) | AM | 0.58 |

| 🇨🇦 Hudbay (HBM) | AM | 0.10 |

| 🇨🇦 Linamar (LNR) | PM | 2.75 |

| 🇨🇦 Electrovaya (ELVA) | PM | 0.04 |

| 🇨🇦 AutoCanada (ACQ) | PM | 0.46 |

| 🇨🇦 CCL Ind. (CCL-B) | PM | 1.14 |

| 🇨🇦 DRI Health (DHT-U) | PM | 0.48 |

| 🇨🇦 Pollard (PBL) | PM | 0.47 |

| 🇨🇦 Mattr (MATR) | PM | 0.14 |

| 🇨🇦 K-Bro Linen (KBL) | PM | 21.5M |

| 🇨🇦 N.A. Construction (NOA) | PM | 0.72 |

| 🇨🇦 Stantec (STN) | PM | 1.36 |

| 🇨🇦 Northland (NPI) | PM | 0.08 |

| 🇨🇦 Bird (BDT) | PM | 0.50 |

| 🇨🇦 Equinox (EQX) | PM | 0.02 |

| 🇨🇦 Sagicor (SFC) | PM | 0.26 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | -9.0% | -3.4% |

| 🇺🇸 Inflation M/M | 0.2% | 0.2% |

| 🇺🇸 Inflation Y/Y | 2.7% | 2.8% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.