|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Carney’s fast-tracked project winners

National net worth inches higher

Barrick lobs Hemlo to Wheaton

D2L runs 13% on Q2 beat

Dynamite blows past estimates

HOT OFF THE PRESS

Construction names run on fast-tracking

Construction companies rallied on the back of Carney’s latest nation building announcement: the first five projects to be reviewed for fast-tracking.

Included in the list are expansions at the Darlington Nuclear Station and Port of Montreal, two projects where Bird, Aecon, and AtkinsRealis are heavily involved.

The latter two have their hands all over the Darlington Nuclear expansion, with Aecon and AtkinsRealis running point on all construction and engineering services, respectively. Bird’s role as an infrastructure provider is smaller, but still material…

… and it will likely play a similar role at the Port of Montreal, thanks to its recent $80M acquisition of FRPD - Canada’s largest marine infra and dredging company. Aecon’s 40% stake in the construction partnership should also result in a windfall.

The stage is set for a Canadian rebuild, with generational tailwinds in nuclear and infrastructure. But as I’ve highlighted recently with both Bird and Aecon, valuations haven’t caught up.

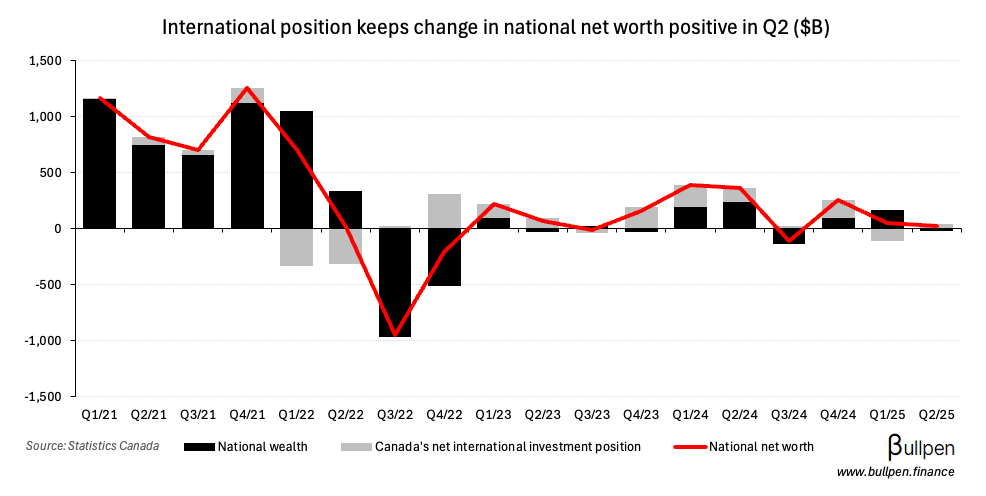

National net worth inches higher

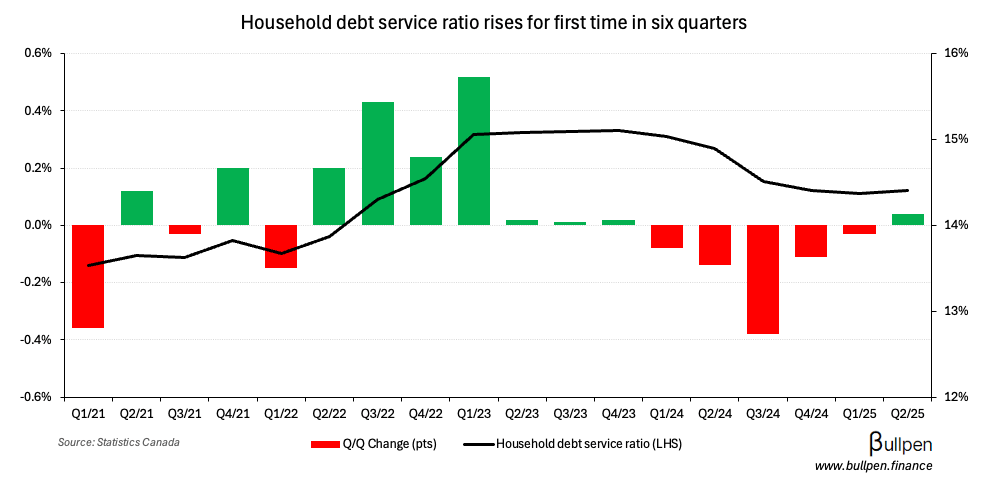

Over the last two days we got a bunch of data on Canada’s financial position, which showed the first rise in the household debt service ratio in six quarters…

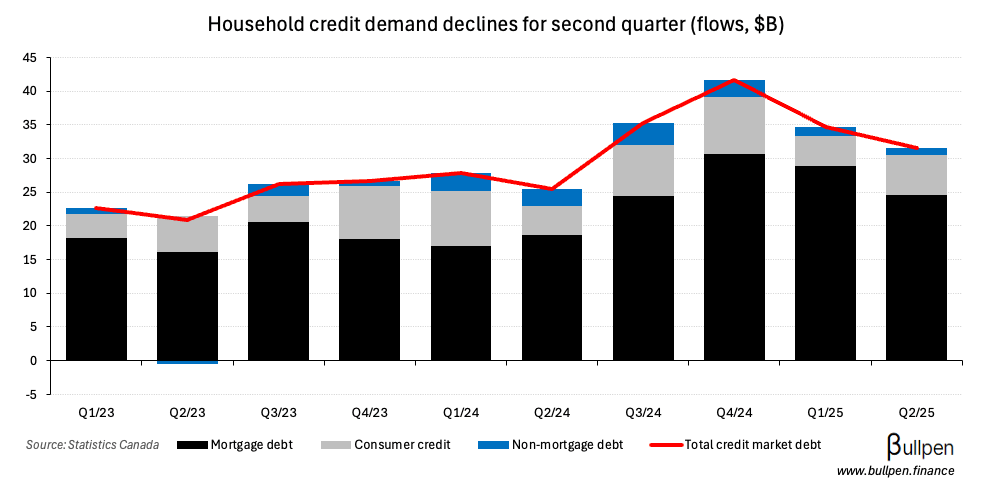

… despite the second sequential drop in household credit demand - as mortgage activity slows.

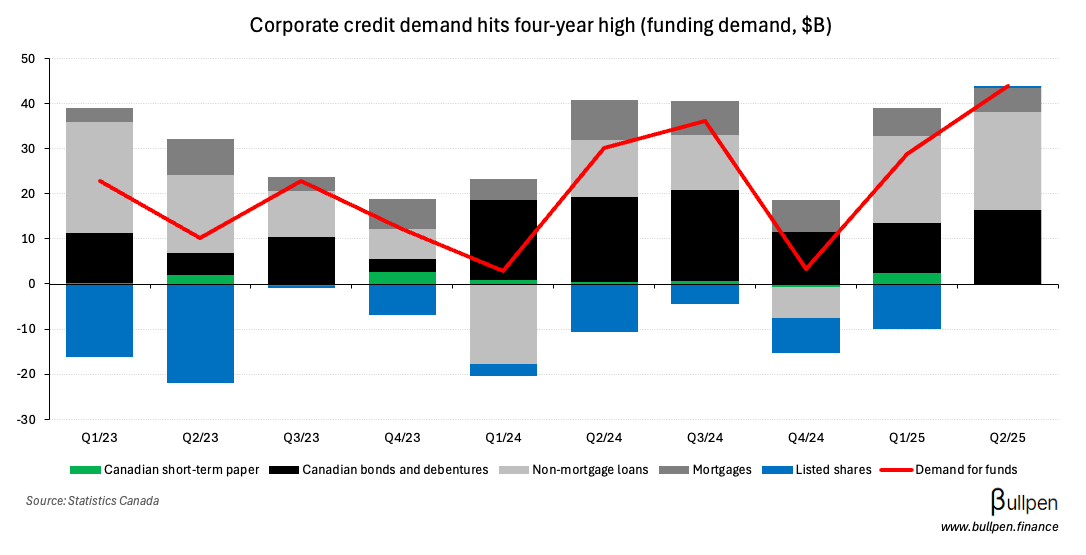

Corporate credit demand remains healthy though, rising for the second straight quarter on increased bond issuance and expanding credit facilities…

… which have been a key funding source for continued expansion south of the border.

It’s this expansion that pushed the national net worth higher in Q2, offsetting a $26B decline in national wealth (non-financial asset value).

FUNNY BUSINESS

Barrick (ABX) announced the sale of its Hemlo gold mine in Ontario for $1.1B, the company’s last Canadian asset - but one that was immaterial to its total production.

Wheaton (WPM) got in on the deal financing, committing up to $400M through an attractive streaming agreement and participating in the equity component to the tune of at least $50M.

Barrick gets to focus on its core operations, Wheaton gets an attractive gold stream, and the Hemlo mine stays in Canadian hands - everybody wins.

ON OUR RADAR

Want to highlight the Australian government’s signing of a $1.1B deal with Anduril for its “Ghost Shark” autonomous undersea vehicles (unreal name). Kraken Robotics (PNG) supplies the batteries for these units, and is up >20% on the news.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

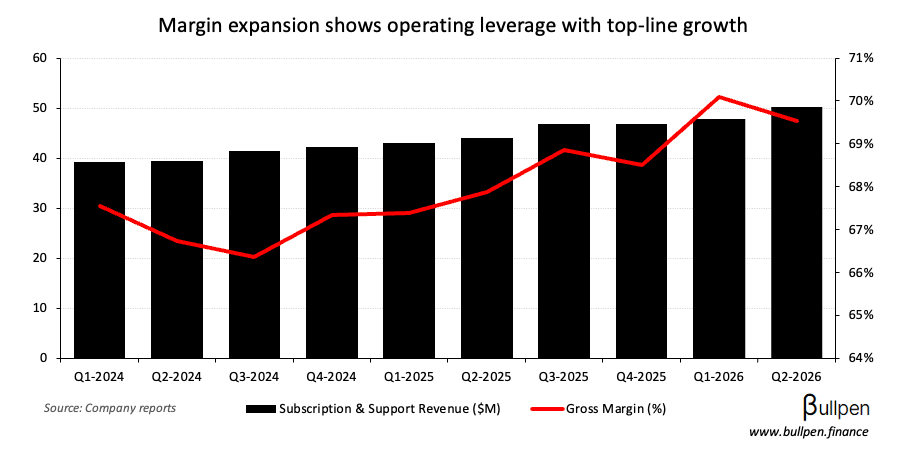

D2L Inc. (DTOL) jumped 13% on its Q2, which beat on better subscription revenue and margins - prompting a small guidance bump in the subscription segment.

Supporting the new full-year target is continued international expansion, which management reiterated as a key growth lever into the future.

… we certainly continue to be very confident in that business driver growing very well and continue to view it in that 15-plus range.

Groupe Dynamite (GRGD) is up 27% since crushing Q2 results, with accelerating same-store sales growth and ecommerce revenue…

… helping to offset some tariff-related headwinds - driving higher margins and an increased guide for 2025…

… with management calling for 18% same-store growth (was 8%) and 33% EBITDA margins (was 31%) at the midpoint. Analyst estimates tracked higher in response, adding 10% and compressing what is quickly becoming a pretty rich valuation.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Sandip Rana | Franco-Nevada (FNV) | $1.6M |

| Barton Demosky | Bombardier (BBD) | $755K |

| Eve Laurier | Bombardier (BBD) | $638K |

| Mike Cuddy | Toromont (TIH) | $1.1M |

| David Malinauskas | Toromont (TIH) | $877K |

| Kristopher Smith | Suncor (SU) | $23.0M |

| David Oldreive | Suncor (SU) | $261K |

| Sebastian Rubio | CCL Ind. (CCL) | $721K |

| Darryl White | BMO (BMO) | $4.7M |

| Mark Zurel | Major Drilling (MDI) | $392K |

| Terry Anderson | ARC Resources (ARX) | $119K |

| Harold Kvisle | ARC Resources (ARX) | $120K |

| Kristen Bibby | ARC Resources (ARX) | $241K |

| David Schummer | Equinox (EQX) | $100K |

| Ohad Epschtein | Anaergia (ANRG) | $364K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Empire (EMP-A) | 0.91 | 0.88 |

| 🇨🇦 ADF Group (DRX) | 3.7M | 10.0M |

| 🇨🇦 Blackline (BLN) | -0.02 | -0.01 |

| 🇨🇦 Transat (TRZ) | -0.12 | -0.17 |

| 🇺🇸 Adobe (ADBE) | 5.31 | 5.18 |

| 🇺🇸 Kroger (KR) | 1.04 | 1.00 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 Inflation Y/Y | 2.9% | 2.9% |

| 🇺🇸 Core Inflation Y/Y | 3.1% | 3.1% |

| 🇺🇸 Jobless Claims | 263K | 235K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | 8:30AM | 4.0% |

| 🇨🇦 Capacity Utilization | 8:30AM | 78.8% |

| 🇺🇸 Cons. Sentiment Prel. | 10:00AM | 58 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.