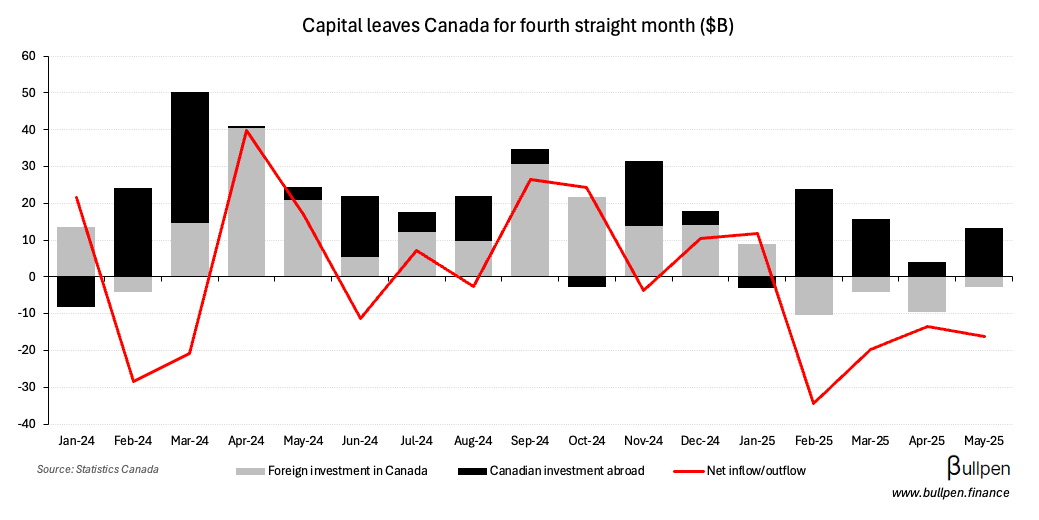

May marked the fourth straight capital outflow from Canada, as investors scooped up $13B of foreign securities and foreign investors dumped $3B of Canadian exposure.

The U.S. market got a Canadian bid after a quiet April, with equities pulling in $14B and corporate bonds adding another $3B at the expense of other foreign investments.

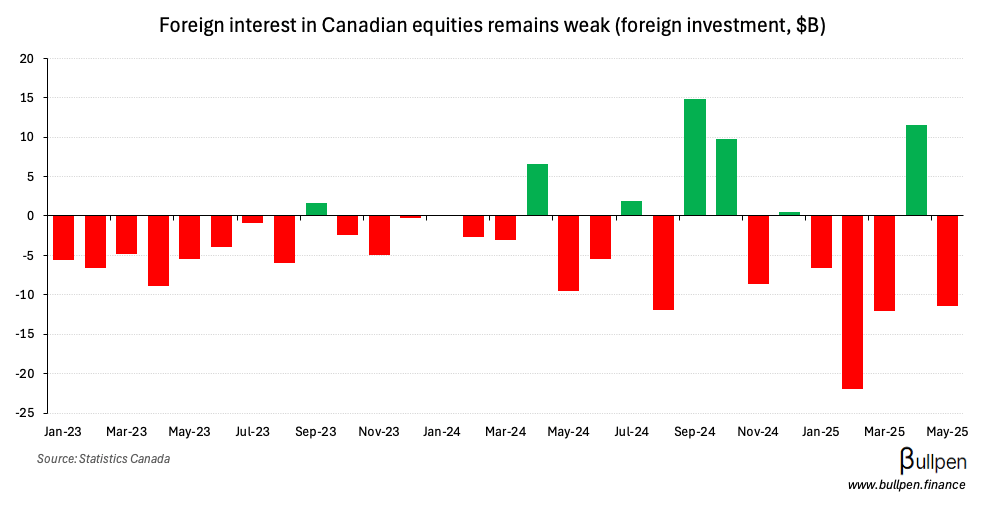

In Canada, the foreign outflow was predominantly equities driven - with $11B of net selling led by energy, mining, and manufacturing…

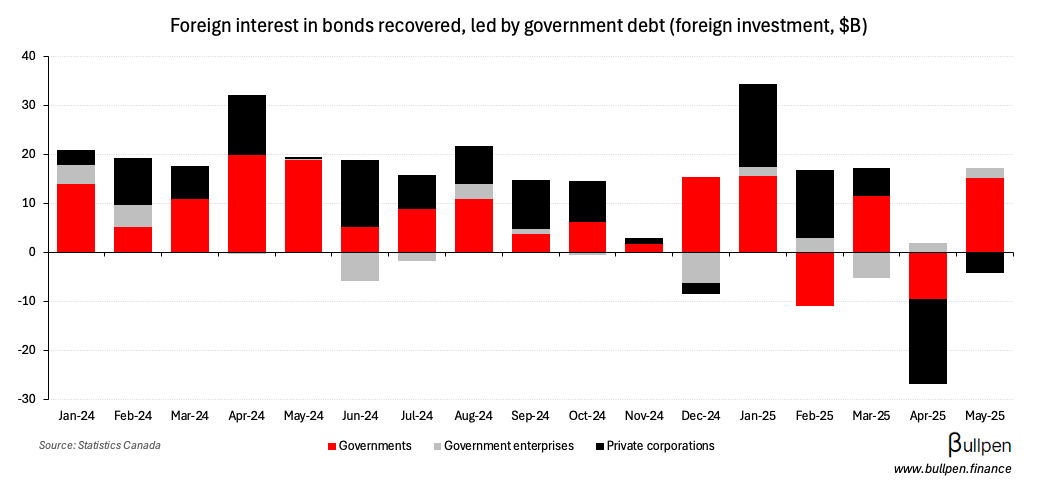

… while foreign demand for Canadian paper returned, with $13B of net buying led by governments, offset slightly by private sector outflows.