|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Auto pull-forward skews retail sales

Big Beautiful Bill = Big Ugly Tax Burden

Carney runs his ship like a banking MD

Big bank CEO has sold $26M

Trump’s nuclear orders send uranium stocks flying

Gold isn’t the only metal up big YTD

HOT OFF THE PRESS

Retail sales skewed by auto pull-forward

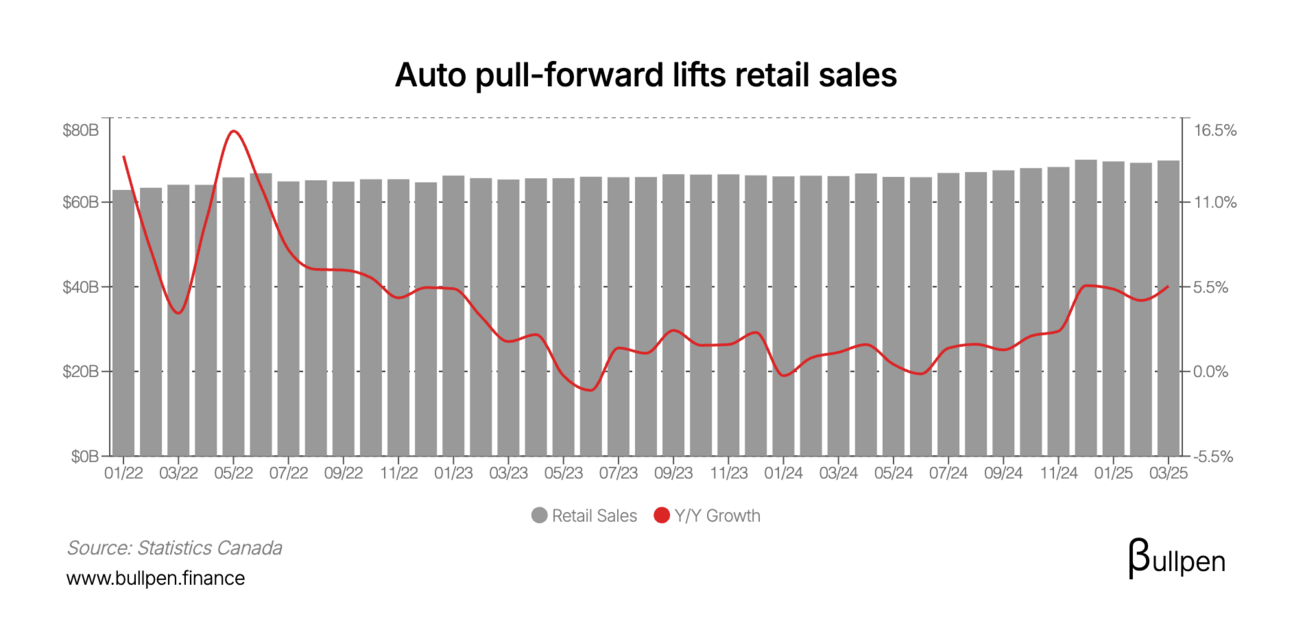

Friday’s retail sales print edged out expectations, rising 0.8% M/M (versus estimates of 0.7%) and up 5.5% compared to last March.

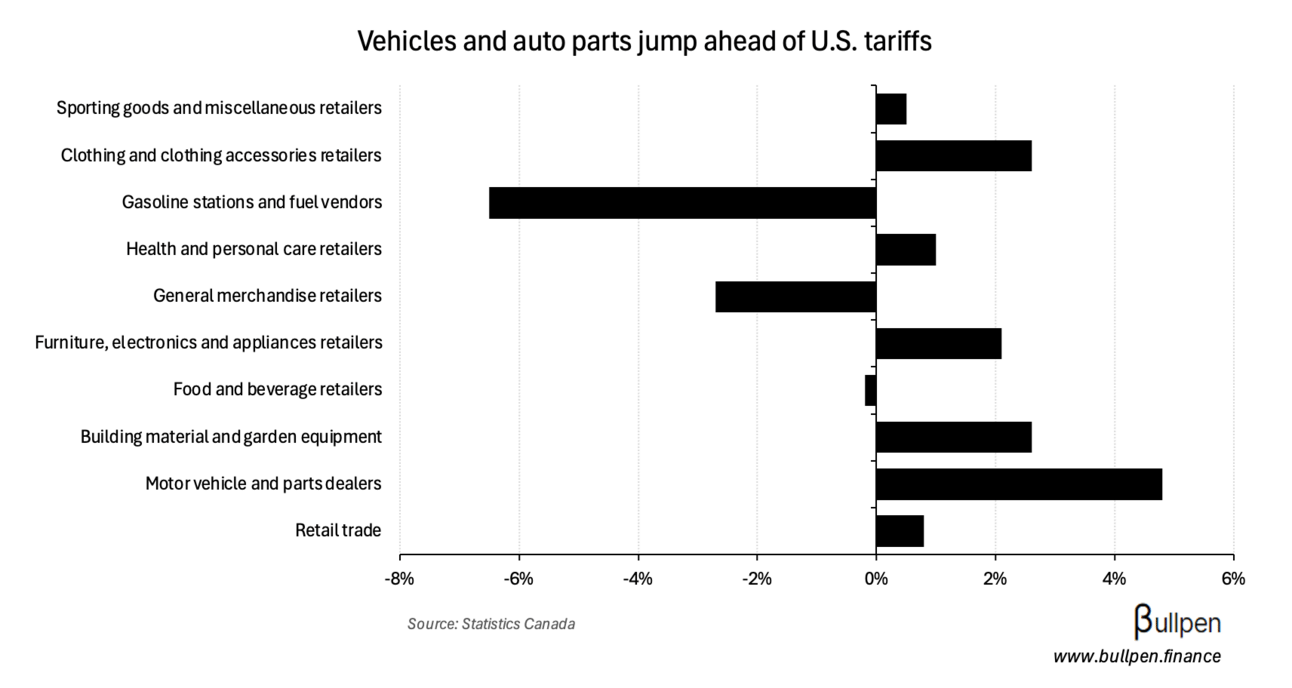

The beat was largely driven by a pull-forward in vehicle sales to get ahead of U.S. tariffs, with the category gaining nearly 5% on February’s number. Excluding auto sales, retail sales fell 0.7% M/M, missing expectations for a flat reading.

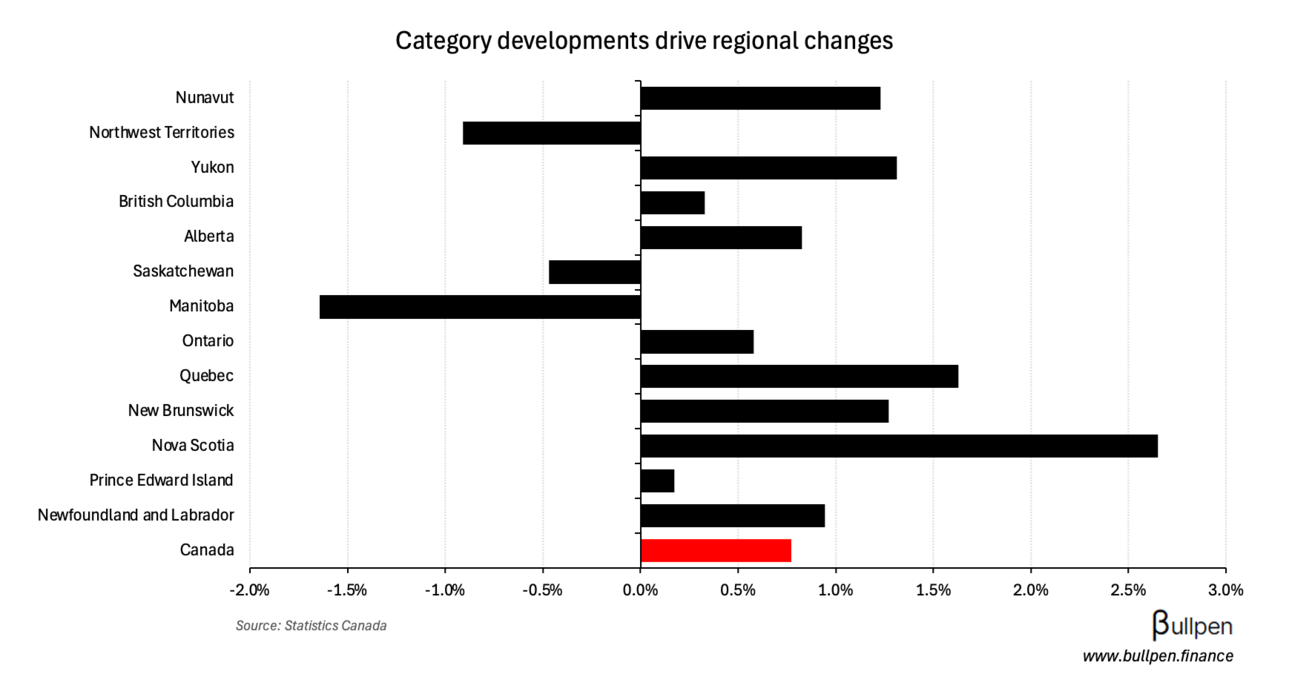

The main category drivers influenced regional results, with auto-heavy provinces like Quebec outperforming fuel-reliant provinces like Manitoba.

The front-running effect looks set to continue in the near-term, with preliminary numbers suggesting a 0.5% monthly bump to retail sales for April.

Big beautiful bill, big ugly tax burden

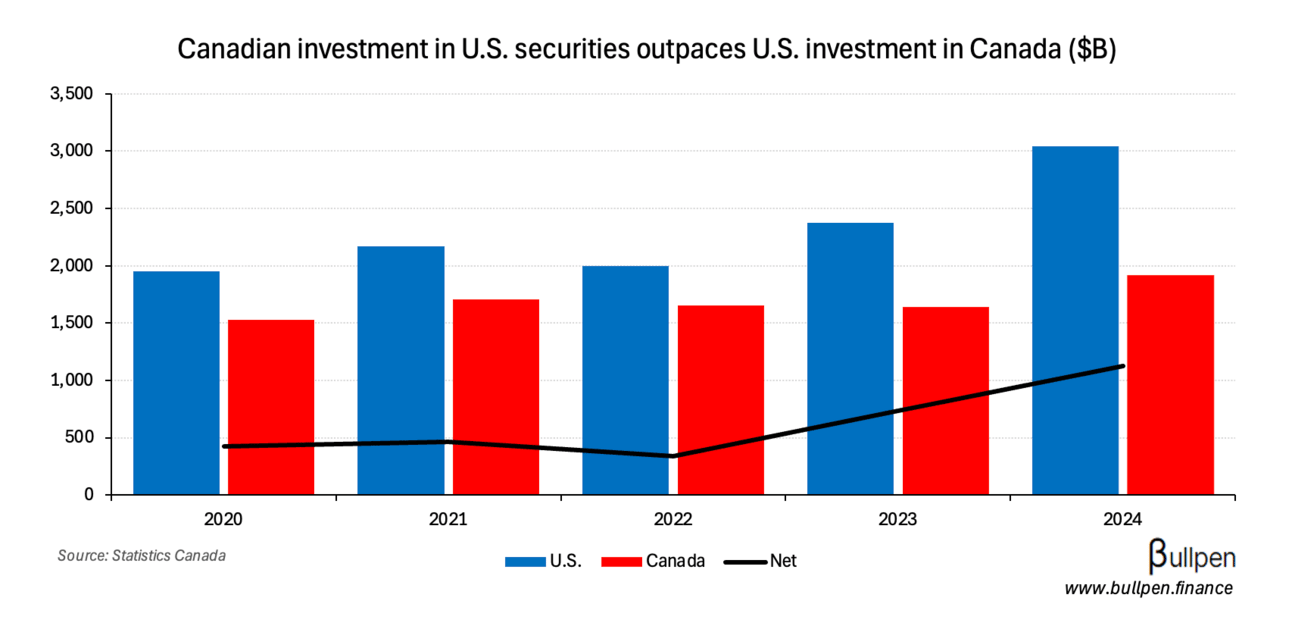

In February, we highlighted the Digital Services Tax (DST) as an area Trump would likely press on with future policy action. His proposed “One Big Beautiful Bill Act” (OBBA) does just that, saddling Canadian investors and corporates with huge tax hikes.

On the investor side, a jump from a 15% withholding tax on U.S. dividends to 50% (5% per year) could stick Canadians with an $80B bill over 7 years.

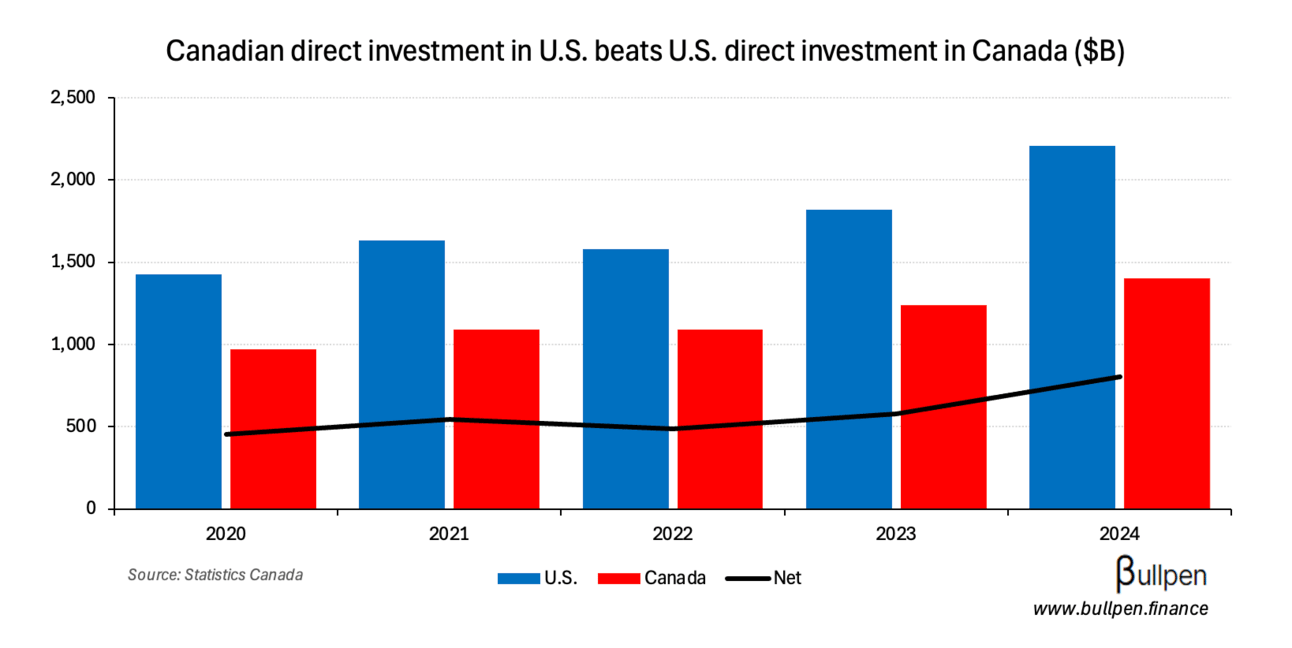

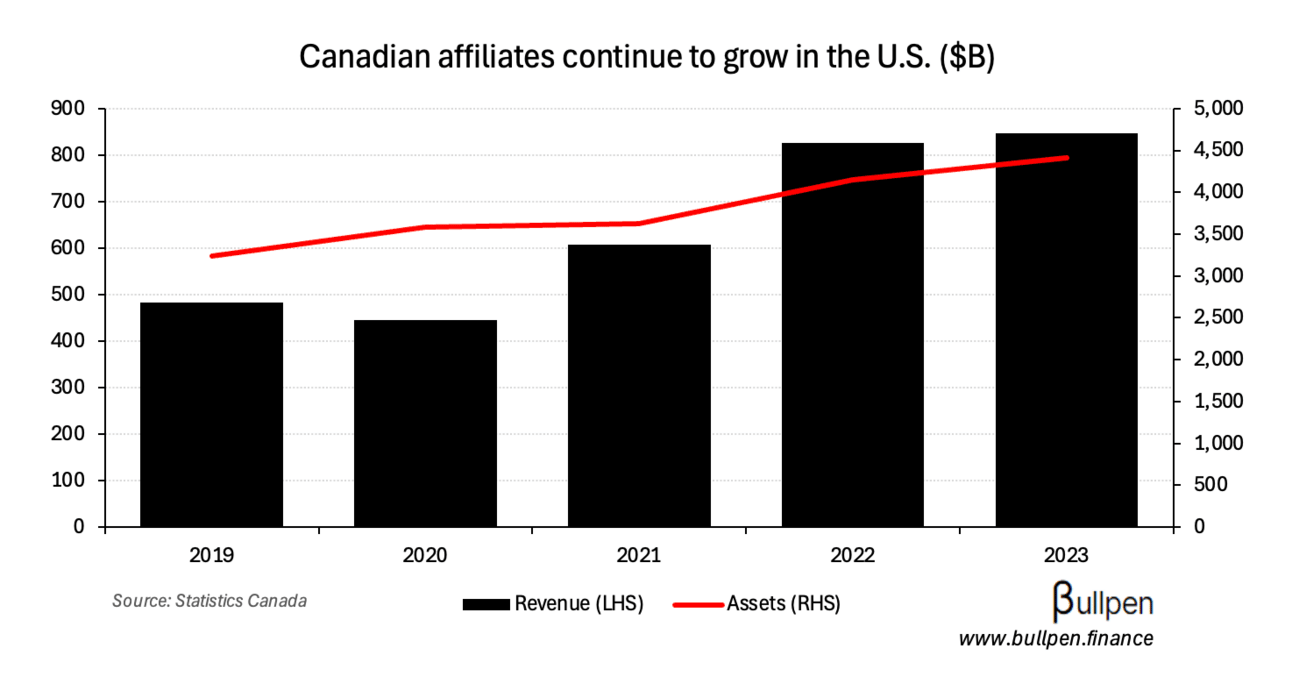

Similarly, Canadian corporations would face the same 5% annual bump - up to 50% - on dividends from U.S. subsidiaries. The U.S. subs have been getting increased investment dollars from the Canadian parents…

… resulting in increased contributions to financial performance - a tough spot to be.

The bill, set to pass by July 4th if Carney doesn’t walk back measures the U.S. deems unfair, would have massive implications for capital flows - a topic we’re going to dig into more this week.

FUNNY BUSINESS

The National Post was out with a piece on Carney’s leadership style post-election, highlighting a stark contrast to Trudeau’s “kumbaya” approach. While in some places the piece was critical of Carney’s all-business style…

But the prime minister is already bearing the signs of a potential micromanager, wanting to review or rework documents or communications products that should be well below the purview of a prime minister.

… we think the attitude shift could be a breath of fresh air in what has historically been a slow moving Liberal party. Plus, we’re getting a kick out of imagining Carney giving the juniors the MD treatment.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Rakesh Aerath | CGI Inc. (GIB) | $152K |

| Brian Rosen | Colliers Int. (CIGI) | $302K |

| J.P. Lachance | Peyto (PEY) | $272K |

| Michael Collens | Peyto (PEY) | $194K |

| Troy Tally | TC Energy (TRP) | $123K |

| David McKay | Royal Bank (RY) | $3.5M |

| Robert Orr | Power Corp. (POW) | $24.2M |

| Jeffrey Leger | Loblaw (L) | $495K |

| Richard Dufresne | George Weston (GW) | $2.7M |

| Shelley Brown | Stantec (STN) | $134K |

Flagging big insider selling out of the financials, specifically Dave McKay. The Royal Bank (RY) CEO has sold $26M in stock over the past year, significantly more than the $5M he sold in 2023.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

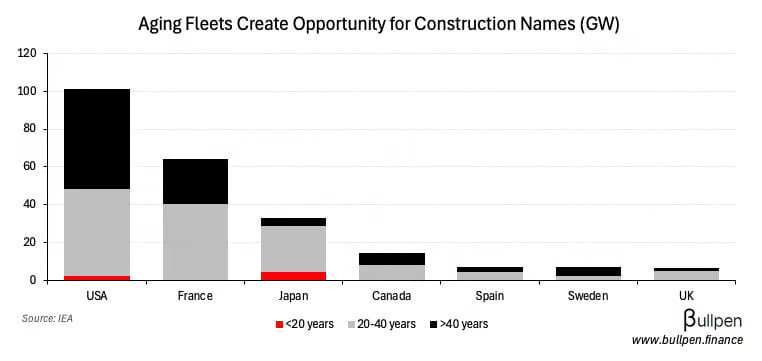

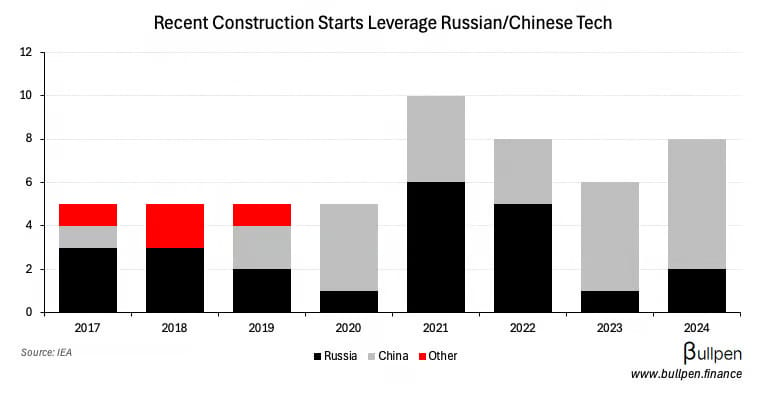

Uranium names ran hot on Friday on the back of Trump’s executive orders to accelerate nuclear development. The miners jumped most, given increased capacity means increased uranium demand in an already tight market, as highlighted in our initial look at the nuclear value chain.

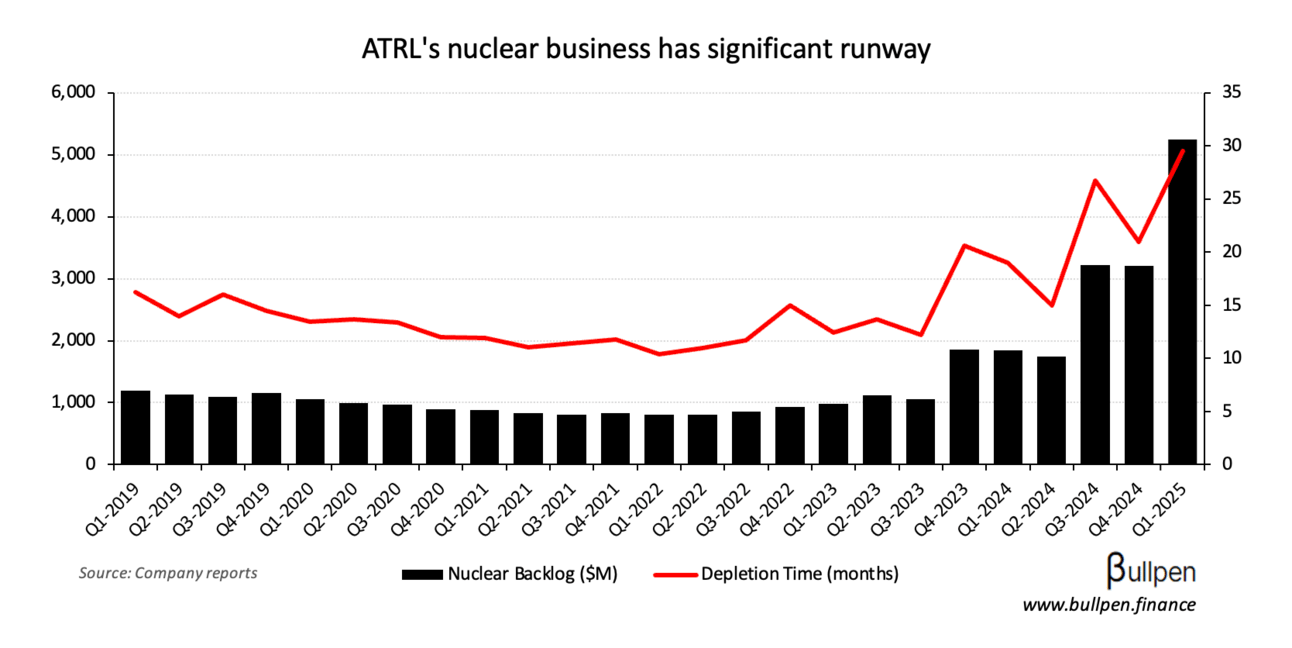

The capacity buildout should come in addition to a huge refurb cycle…

… which has driven massive growth in the backlog of construction & engineering firms like AtkinsRealis (ATRL, up 4% on Friday).

But more interesting is how supply chains will reorient around the changing geopolitical landscape, given the industry’s reliance on “unfriendly” tech.

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Sucro (SUGR) | 0.50 | - |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Retail Sales Ex Auto | -0.7% | 0.0% |

| 🇨🇦 Retail Sales M/M | 0.8% | 0.7% |

| 🇨🇦 Retail Sales Prel. | 0.5% | - |

| 🇨🇦 Retail Sales Y/Y | 5.6% | - |

| 🇺🇸 Building Permits | 1.42M | 1.41M |

| 🇺🇸 New Home Sales | 0.74M | 0.69M |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales M/M | 8:30AM | - |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

While gold is getting all the attention copper is having a hell of a year, thanks to China’s insatiable appetite as it continues to industrialize.

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.