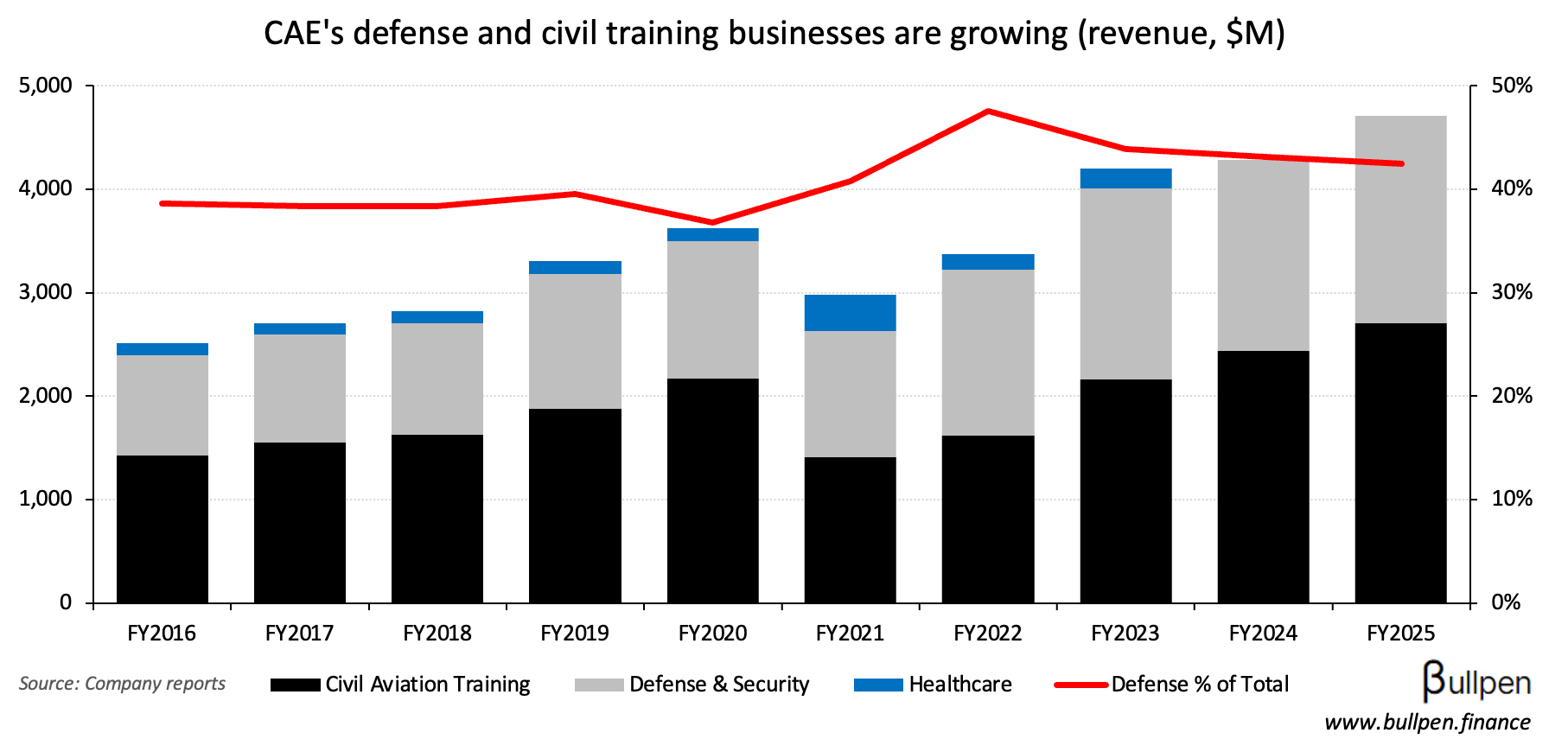

CAE Inc. (CAE) ran 5% Friday following its announced 10-year, $270M contract for Australia’s future air training system. Assuming an even yearly run-rate, the deal only adds 1-2% to defense revenue…

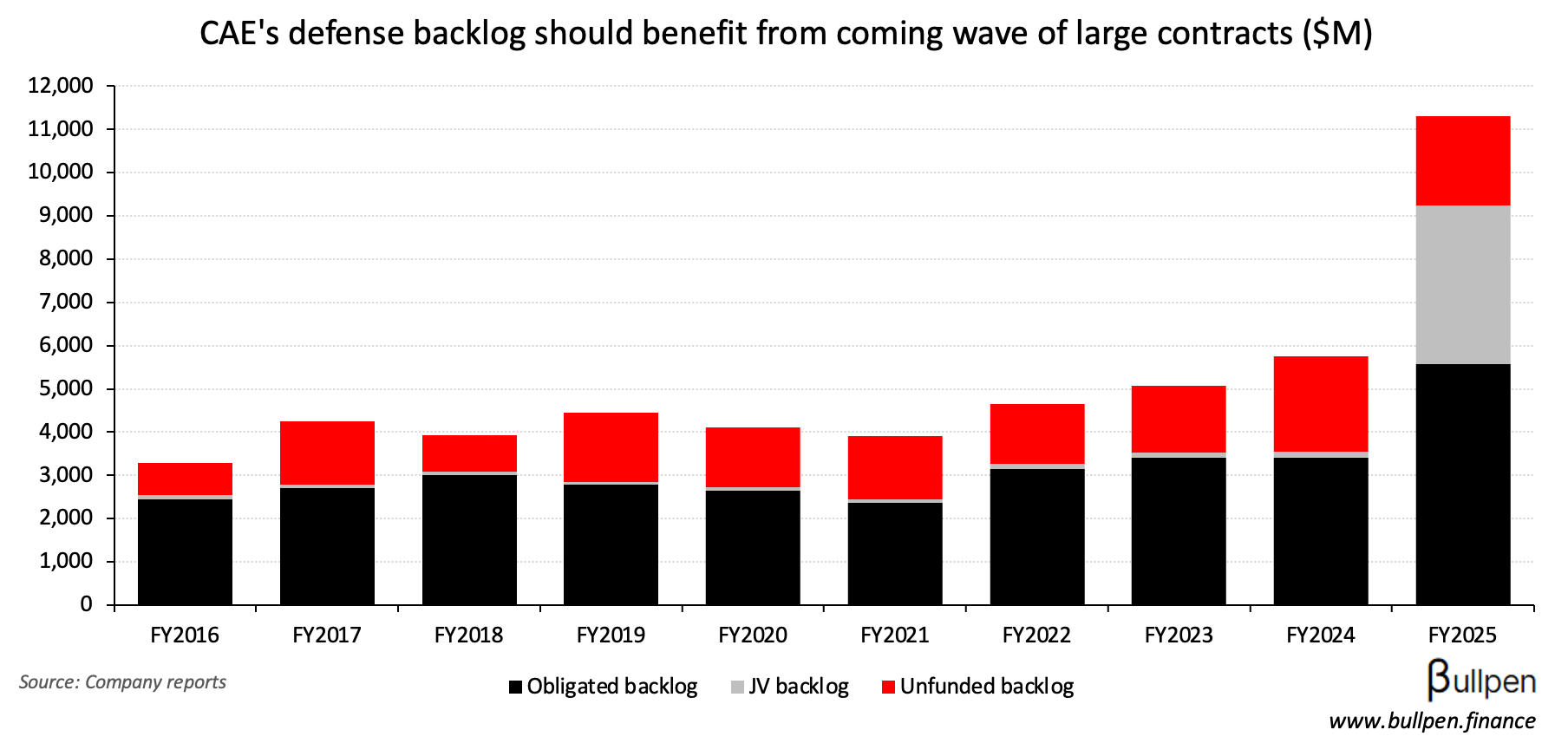

… but more importantly, it reinforces the multi-year setup for defense spending globally and builds on earlier large contract success in Canada. With the backlog sitting at $11B…

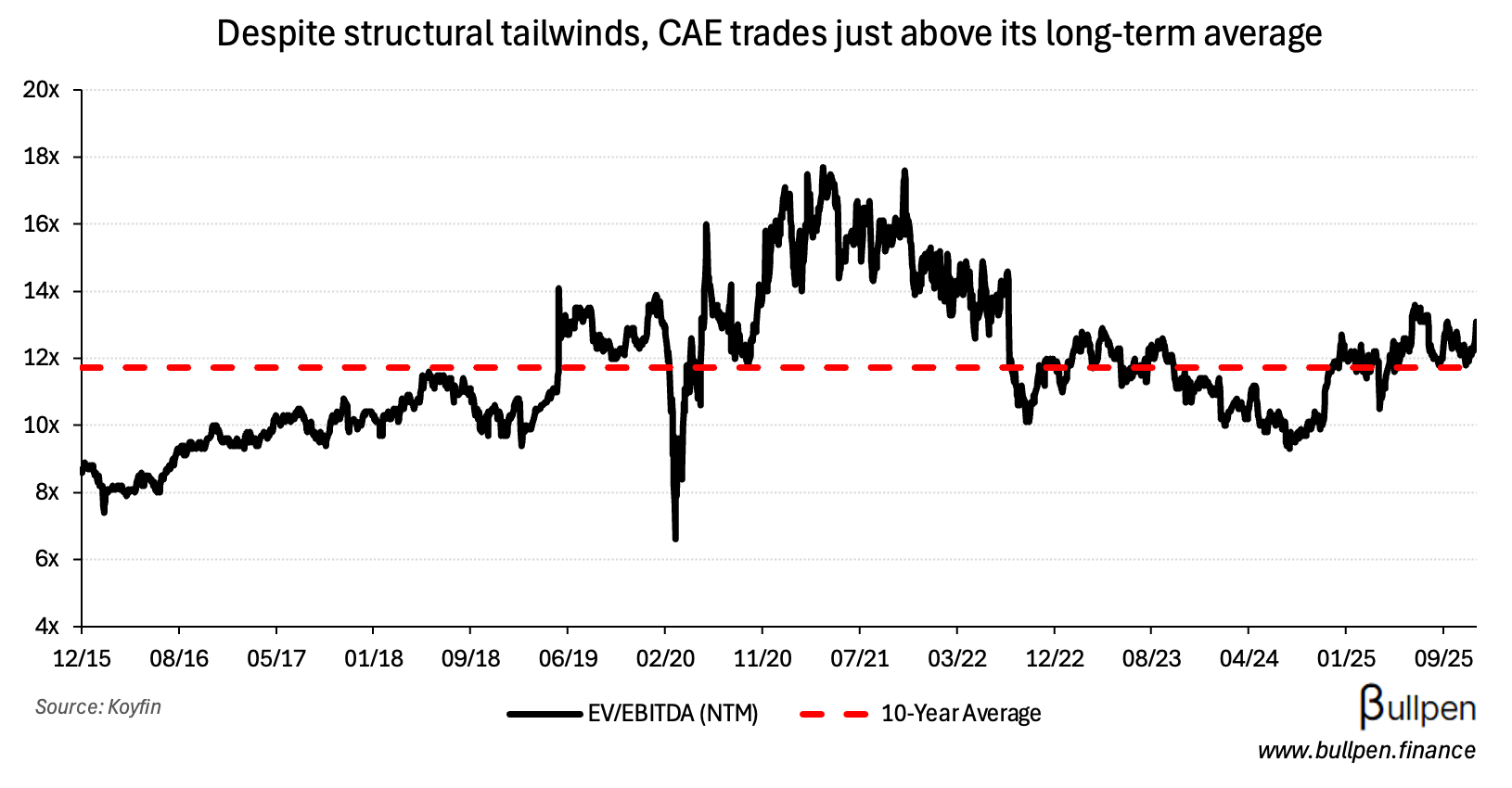

… and the new CEO likely to drive U.S. growth, CAE’s revenue runway is long - justifying a premium over its long-term average valuation.