|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Breaking down the budget

Coeur bids $7B for New Gold

Ovintiv offers $4B for NuVista

Pet Valu falls 15% on outlook

HOT OFF THE PRESS

Budget breakdown

The much anticipated budget is here and it’s bringing bigger deficits, at $78B this year before scaling down to $57B in 2030.

Carney’s camp has emphasized that the majority of this fiscal hole is linked to its 5-year, $280B capital investment program - led by the major projects, defense spend, and housing programs we’ve all heard of.

Also in that figure are some depreciation incentives, allowing a full write-off of certain equipment, machinery, and CapEx in year one. That should drive fixed capital formation and productivity higher…

… as should a reduction in the size of our public sector, with the government looking to shed 40K federal jobs - part of its $60B cost savings target.

At 500 pages, it’s long - but we’ll follow the key items (like the emissions cap) and keep you in the loop.

Coeur bids $7B for NGD

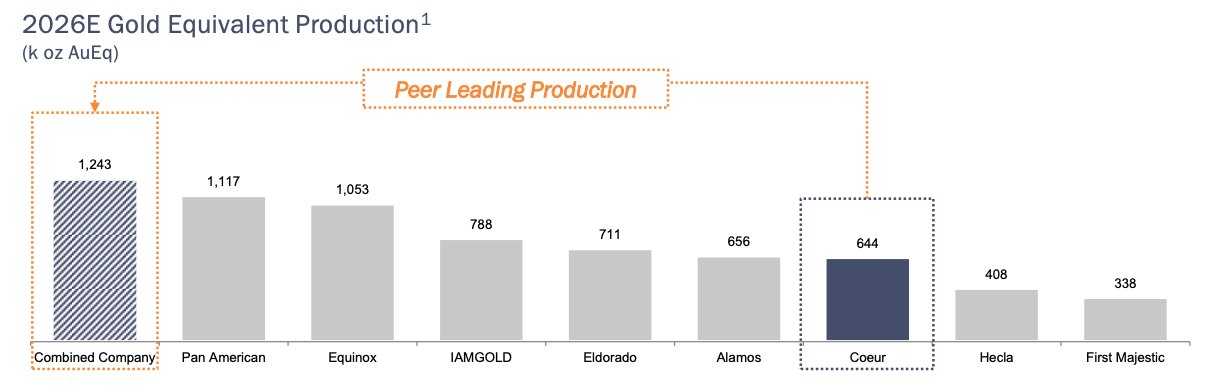

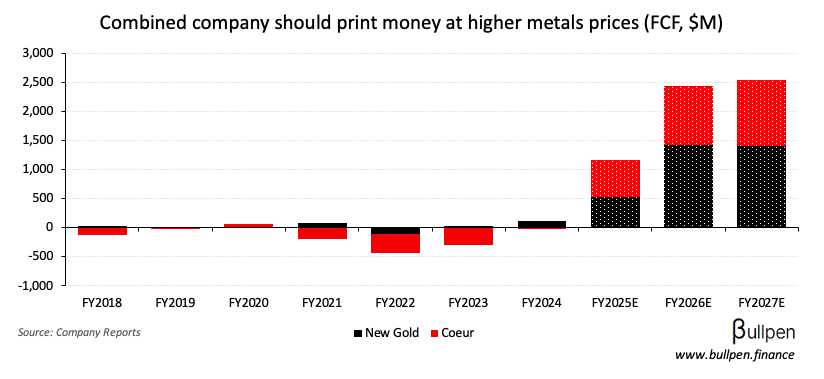

Another Canadian miner is in play, with Coeur (CDE) proposing a $7B all-stock deal for New Gold (NGD) - positioning the combined company as a North American leader in precious metals production…

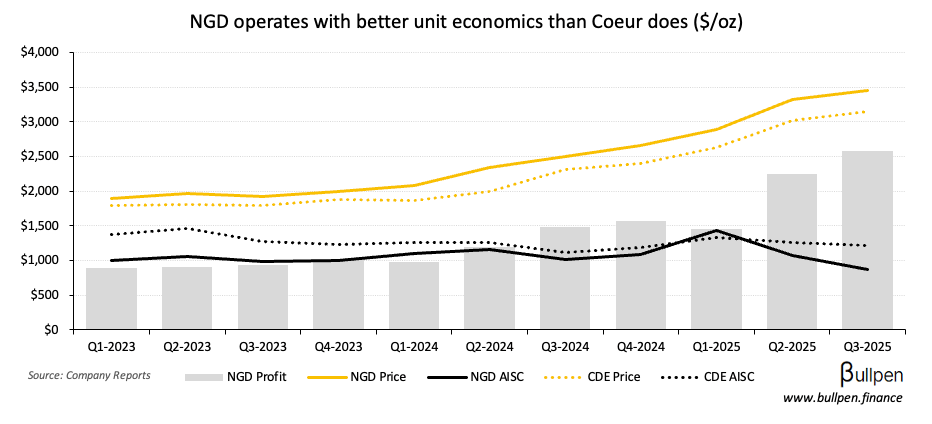

… and one with better economics, given NGD’s low cost production profile and leverage to gold prices.

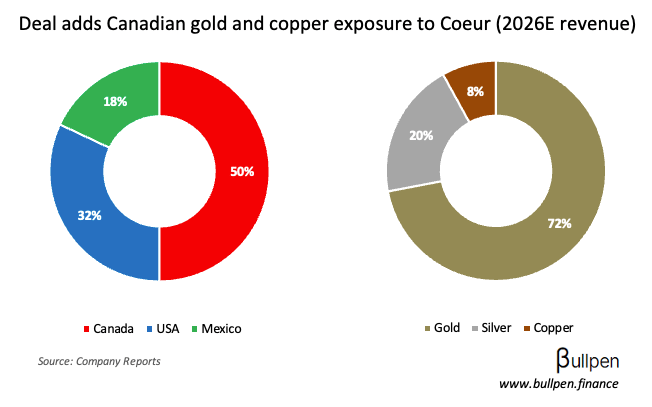

Coeur also gets some copper exposure in the deal, which could be a regulatory hurdle if the $75B Teck/Anglo merger is any indication…

… but management appears committed, indicating it will pursue a TSX listing and ramp up investment in the acquired assets. There’s a lot of cash waiting on the other side of an Investment Canada approval…

… which could drive a re-rate, given the better trading liquidity and index inclusion opportunities that come with being an American company.

FUNNY BUSINESS

Rumours of another Canadian energy takeout after Paramount (POU) sold a 9.5% stake in NuVista (NVA) were proven true, with Ovintiv (OVV) revealed as the buyer - announcing a $3.8B bid that would expand its Montney presence…

… by 100 mBOE/d. Post-close, OVV will look to get rid of its exposure to the Anadarko basin (also ~100 mBOE/d) - which should keep its production profile flat...

… and bring its net debt position below $4B, opening the door for a ramp in buybacks. Since highlighting M&A could follow weak oil prices we’ve seen MEG, STEP, TCW, KEC, and NVA transact…

… let’s see who’s next.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

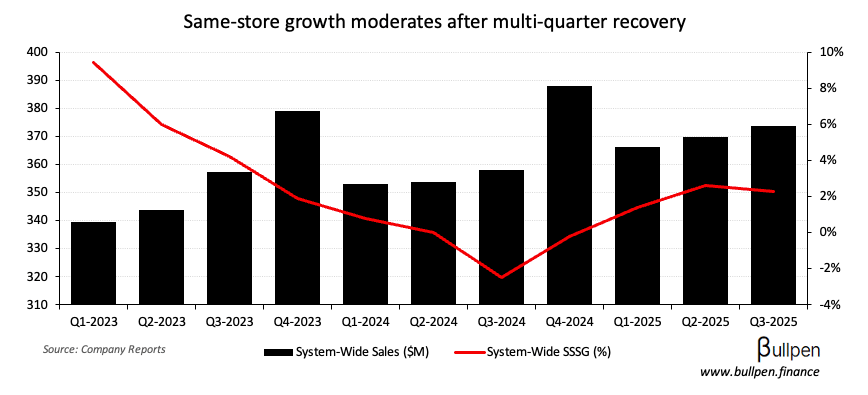

Pet Valu (PET) lost 16% after reporting a Q3 miss, driven by a slowdown in same-store sales growth…

… which prompted the company to tighten its full-year guide towards the bottom half of its previous targets ($1.18B of revenue, ~$260M of EBITDA).

The 2026 outlook was the nail in the coffin, with management’s skepticism around an industry recovery likely to drive downward estimates revisions…

… we think industry growth will remain below its long-term mid-single-digit run rate through next year.

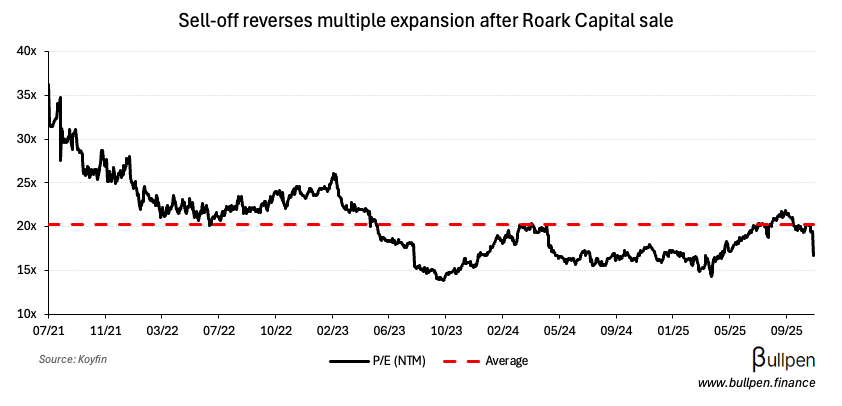

… and keep investors sidelined until they have line of sight to a rebound. With shares giving back gains following Roark Capital’s exit in June, this one could chop sideways for a while.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Guy Grenier | Richelieu (RCH) | $305K |

| Thomas Coolen | Trican (TCW) | $531K |

| Debra Kelly-Ennis | TFI Int. (TFII) | $150K |

| Rene Amirault | Secure (SES) | $497K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Fortis (FTS) | 0.87 | 0.85 |

| 🇨🇦 Pet Valu (PET) | 0.40 | 0.40 |

| 🇨🇦 Thomson (TRI) | 0.85 | 0.83 |

| 🇨🇦 Colliers (CIGI) | 1.64 | 1.57 |

| 🇨🇦 Kinross (K) | 0.44 | 0.39 |

| 🇨🇦 Shopify (SHOP) | 0.34 | 0.34 |

| 🇨🇦 Dexterra (DXT) | 0.19 | 0.19 |

| 🇨🇦 Cargojet (CJT) | 0.58 | 0.91 |

| 🇨🇦 Air Canada (AC) | 0.75 | 0.79 |

| 🇨🇦 Propel (PRL) | 0.49 | 0.45 |

| 🇨🇦 iA Financial (IAG) | 3.47 | 3.34 |

| 🇨🇦 Ovintiv (OVV) | 1.03 | 0.96 |

| 🇨🇦 Andrew Peller (ADW) | 0.19 | 0.14 |

| 🇨🇦 Intact (IFC) | 4.46 | 4.21 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Maple Leaf (MFI) | AM | 0.39 |

| 🇨🇦 ATS Corp. (ATS) | AM | 0.43 |

| 🇨🇦 Brookfield Ren. (BEP) | AM | 642M |

| 🇨🇦 CGI (GIB-A) | AM | 2.09 |

| 🇨🇦 Suncor (SU) | AM | 1.14 |

| 🇨🇦 Stella-Jones (SJ) | AM | 1.56 |

| 🇨🇦 WSP Global (WSP) | PM | 2.65 |

| 🇨🇦 Great-West (GWO) | PM | 1.22 |

| 🇨🇦 GFL Env. (GFL) | PM | 0.26 |

| 🇨🇦 Savaria (SIS) | PM | 0.29 |

| 🇨🇦 Kinaxis (KXS) | PM | 0.85 |

| 🇨🇦 Open Text (OTEX) | PM | 0.99 |

| 🇨🇦 Russel (RUS) | PM | 0.64 |

| 🇨🇦 Badger (BDGI) | PM | 1.22 |

| 🇨🇦 Sun Life (SLF) | PM | 1.83 |

| 🇨🇦 High Liner (HLF) | PM | 0.30 |

| 🇨🇦 Lundin (LUN) | PM | 0.15 |

| 🇨🇦 goeasy (GSY) | PM | 4.63 |

| 🇨🇦 Nutrien (NTR) | PM | 0.96 |

ECONOMIC DATA

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 S&P Composite PMI | 10:30AM | - |

| 🇨🇦 S&P Services PMI | 10:30AM | - |

| 🇺🇸 ADP Employment Change | 9:15AM | 25K |

| 🇺🇸 ISM Services PMI | 11:00AM | 50.8 |

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.