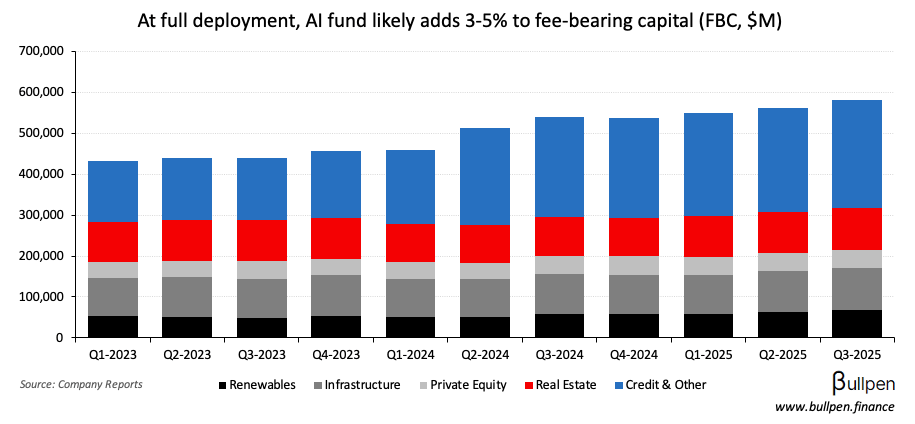

Brookfield (BAM) launched its $100B AI Infrastructure program Wednesday, backed by a dedicated fund it hopes to raise $10B for (see recent $5B Bloom deal). While the headline number is big, BAM is bigger…

... at $580B of fee-bearing capital. With project level debt financing ~70% of most deals, that leaves ~$30B of new equity capital managed in BAM’s infra strategy. Assuming the co-invest portion of that negotiates a 50% haircut on fees…

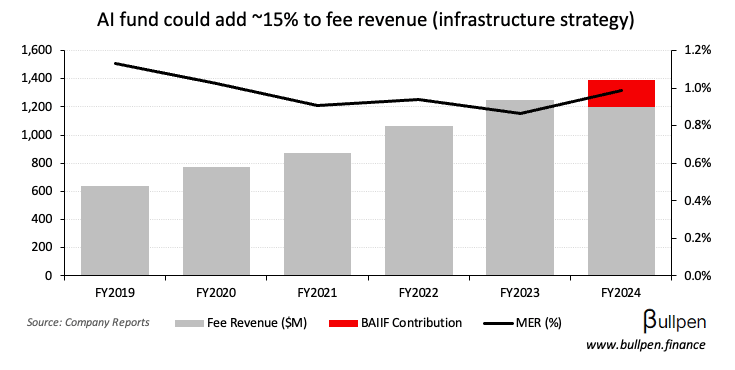

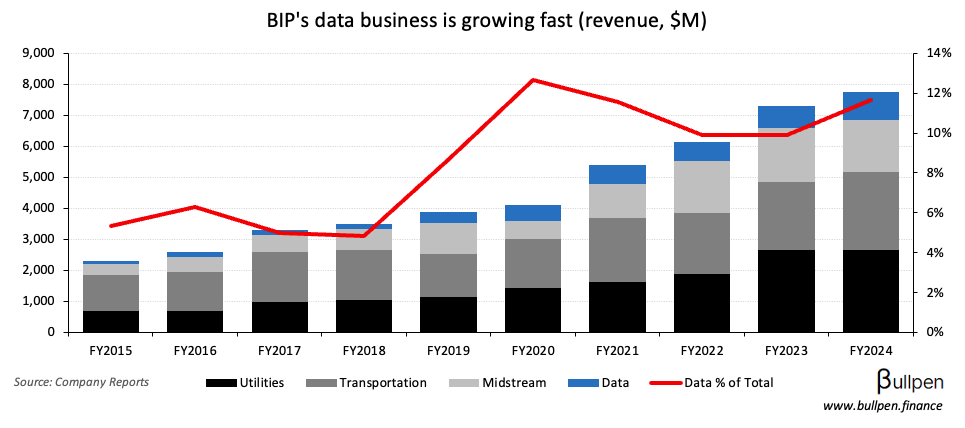

… you’re looking at a $190M bump to fee-based revenue once fully deployed, 15% of what the infra strategy currently generates (4% of total fee revenue). Not huge, but other Brookfield entities will likely get involved, BIP on the data side…

… BEP on the renewable power and nuclear side. Ironically, that would increase the amount of fees paid back to BN/BAM through a separate agreement - a story for another time…